For landlords in Australia, using a rental receipt template can streamline record-keeping and enhance transparency. A simple yet clear template provides renters with a professional acknowledgment of their payments. It’s crucial that the receipt includes the rental property’s details, payment amount, due date, and the payment method. This helps both parties stay organized and avoid any potential disputes regarding rent payments.

The template should also include the tenant’s name, the rental period, and the landlord’s contact information. By maintaining a consistent format, you create a paper trail for all transactions, which can be helpful during audits or when resolving payment disputes. This small step can save both time and stress in the long run.

Ensure clarity and accuracy in each section. Avoid vague language and always double-check payment details. If you’re unsure about any legal requirements related to rental receipts, consulting with a local expert can offer peace of mind and ensure that your documents meet all necessary standards. A well-designed template minimizes errors and reinforces the professional relationship between landlord and tenant.

Here’s the revised version with reduced repetition:

Ensure that your rental receipt includes all required details to meet legal and financial standards in Australia. Start with the rental property’s name and address, followed by the tenant’s name and rental period. Clear itemization of charges helps both parties understand the transaction. Include the total amount paid, including any deposits or fees.

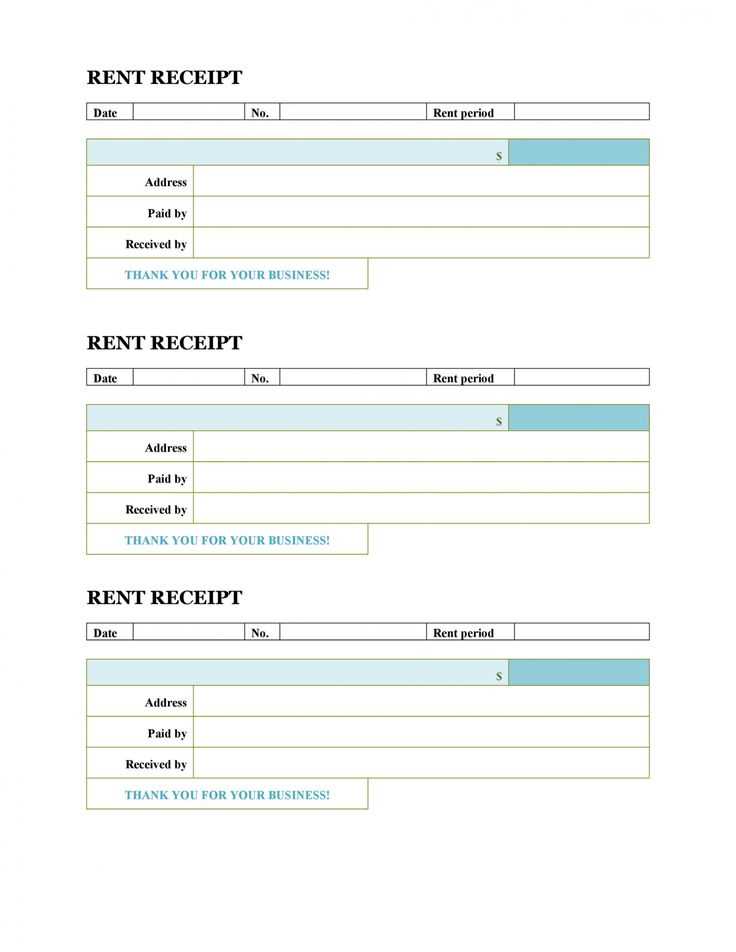

Key Elements of a Rental Receipt

- Rental Amount: List the exact amount of rent paid for the specified period.

- Payment Method: Indicate the method of payment, whether it’s cash, bank transfer, or other means.

- Receipt Number: Provide a unique receipt number for tracking and reference.

- Landlord’s Details: Include the name, address, and contact information of the landlord or property manager.

- Signature: Both parties should sign the receipt to confirm the transaction.

Common Mistakes to Avoid

- Not specifying the rental period clearly, which may lead to confusion.

- Leaving out payment details, such as method and transaction reference.

- Failing to provide a receipt number for future reference.

Including these elements ensures the receipt is not only complete but also legally compliant. It will make future reference easier for both parties, and avoid disputes or misunderstandings.

- Rental Receipt Template in Australia

In Australia, a rental receipt template must include key details to ensure clarity and compliance. Ensure you provide the following information:

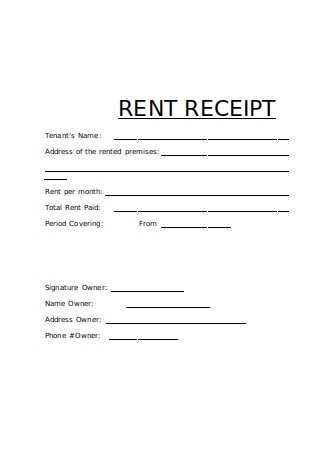

Details to Include

- Tenant’s name – The full name of the person making the payment.

- Landlord’s details – The name and contact information of the property owner or managing agent.

- Rental period – Clearly state the start and end dates of the rental period covered by the payment.

- Amount paid – The total sum paid for the rental, and if applicable, any discounts or extra fees.

- Payment method – Specify whether the payment was made by cash, cheque, bank transfer, or another method.

- Receipt number – This ensures traceability and helps in record keeping.

Why a Template Helps

Using a rental receipt template can help streamline the process for both tenants and landlords. It ensures that all required information is documented correctly and minimizes confusion. Additionally, keeping a copy of each receipt can serve as proof of payment in case of disputes. You can easily find customizable templates online or create your own, based on these essential details.

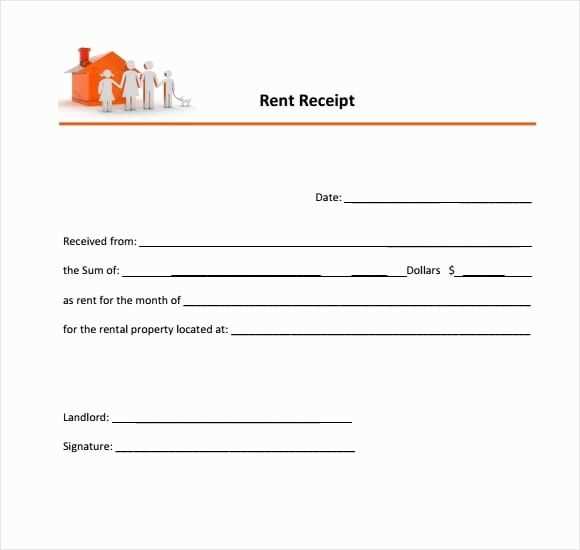

Start by including the tenant’s full name and the rental property address. Clearly state the rental period, including the dates covered by the payment. Provide the exact amount paid and any additional charges, such as late fees or maintenance costs, if applicable.

Include Payment Details

Specify the payment method, such as bank transfer, cash, or cheque. Note the date the payment was made and confirm that it has been received. This ensures clarity for both parties and helps with future record-keeping.

Record and Store Receipts

Use a unique receipt number for each payment to help track transactions. Retain a copy of the receipt for your own records and provide one to the tenant. This documentation is useful for both parties, especially in case of any future disputes or references for tax purposes.

Adapt your receipts to fit different tenancy arrangements by including key details relevant to each type. For residential leases, include tenant information, rental period, and the rental amount. For commercial leases, make sure to note the premises address, lease type, and any additional charges like maintenance fees or outgoings.

Ensure that the receipt clearly states the payment date and whether the payment was made in full or as part of an installment plan. It’s helpful to reference the lease agreement in the receipt for transparency, including the due date and any penalties for late payments.

For short-term rentals, provide clear details of the rental period, the accommodation’s address, and any refundable deposits. In cases of periodic tenancies, specify if the payment is for a specific period or an ongoing arrangement. Customizing each receipt to match the tenancy type will ensure clarity for both landlords and tenants.

In Australia, issuing receipts for rental transactions is governed by specific legal requirements. Businesses must ensure their receipts meet the Australian Consumer Law (ACL) standards, which are designed to protect both consumers and businesses in commercial transactions.

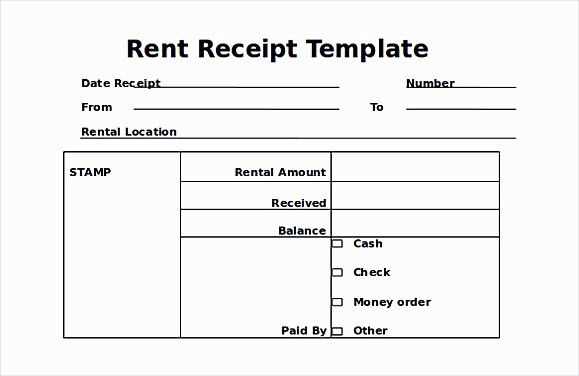

Inclusion of Key Details

Receipts must include certain details to comply with the law. This includes the business name, Australian Business Number (ABN), date of the transaction, the amount paid, a description of goods or services, and the payment method. These details ensure clarity and transparency, allowing both parties to track the transaction accurately.

GST Considerations

If the rental business is registered for Goods and Services Tax (GST), the receipt must specify whether GST was included in the price. GST should be clearly shown as a separate line item on the receipt. Failure to do so can result in confusion for both businesses and customers.

Electronic Receipts

Electronic receipts are legally acceptable in Australia, as long as they contain the same information as paper receipts. Businesses offering electronic receipts should ensure they are accessible and legible to the recipient.

Record-Keeping Requirements

Businesses are required to keep records of receipts for at least five years, as per the Australian Taxation Office (ATO) regulations. This is important for tax and auditing purposes, especially for businesses that deal with GST or other taxes. Digital records must be backed up and easily retrievable when needed.

| Required Information | Description |

|---|---|

| Business Name & ABN | Identify the business issuing the receipt |

| Date of Transaction | Clear record of when the transaction took place |

| Amount Paid | Exact amount paid, including GST if applicable |

| Payment Method | Method of payment (e.g., credit card, cash) |

| Description of Goods/Services | Brief description of the rental or service provided |

To create a rental receipt template in Australia, ensure the following details are included:

- Tenant’s Name and Address: Clearly mention the tenant’s full name and their rental address.

- Rental Property Details: Include the property’s address and the period covered by the payment.

- Payment Information: Specify the rental amount, payment method, and due date.

- Landlord’s Information: List the landlord’s name, contact details, and any relevant ABN (Australian Business Number) if applicable.

- Payment Date: Record the exact date the payment was received.

- Receipt Number: Assign a unique number for tracking purposes.

This template should be clear and concise, ensuring both tenant and landlord have a mutual understanding of the transaction.