To simplify your tax preparation, using a tax write off receipt template can help keep everything organized and easy to track. Whether you’re handling business expenses or personal deductions, a template ensures you include all necessary information without missing any important details.

The template should include fields like date, amount, merchant or service provider, and a brief description of the expense. This structure makes it easy to categorize and validate each deduction on your tax return.

By maintaining accurate receipts through this template, you prevent confusion and avoid issues with the IRS. It’s a quick way to ensure you have everything you need, especially when organizing your year-end documents.

Ensure you store receipts digitally or physically, depending on your preference, but keep them for a few years as tax regulations may require you to retain records for future reference.

Here are the corrected lines:

Ensure your receipt includes a clear date, item description, total amount, and the vendor’s contact details. These are the minimum requirements for proper tax documentation. If any of these are missing or unclear, the receipt might not qualify for a write-off.

Double-check the details

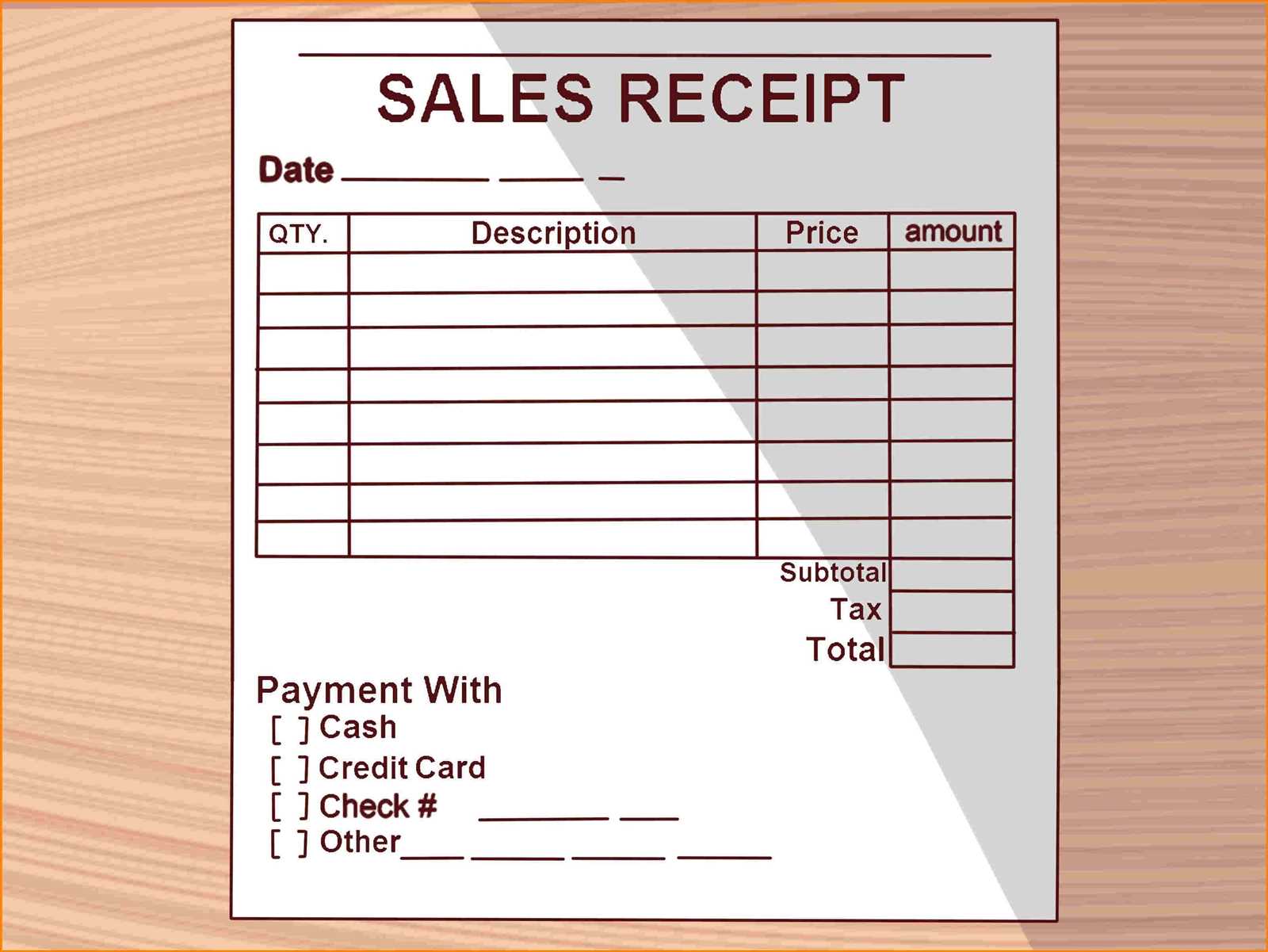

Verify the accuracy of the amounts listed. Make sure the total matches the sum of individual items. If there is a discrepancy, it can raise questions during tax filing.

Include appropriate categorization

When submitting a receipt for a business expense, include a brief note or category tag indicating the purpose of the purchase. This helps clarify why the expense qualifies as a tax write-off.

- Tax Write-Off Receipt Template

Ensure your receipt includes all required information for tax purposes. Include the following details clearly:

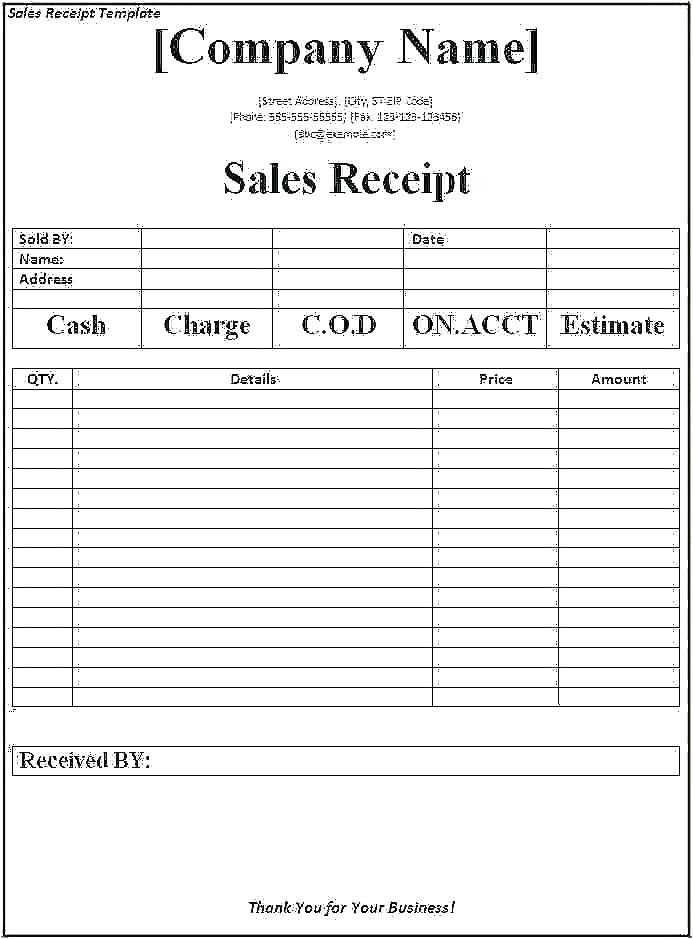

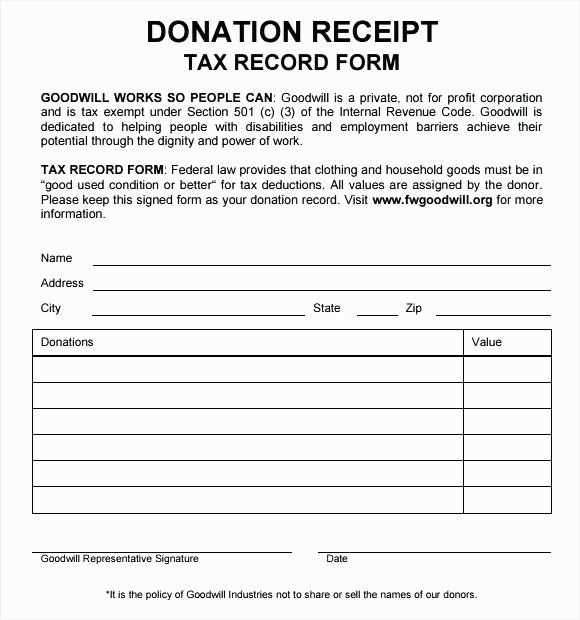

1. Receipt Header: State that the document is a receipt for a tax write-off, making it evident that it is for tax reporting. Include the business name, address, and contact information.

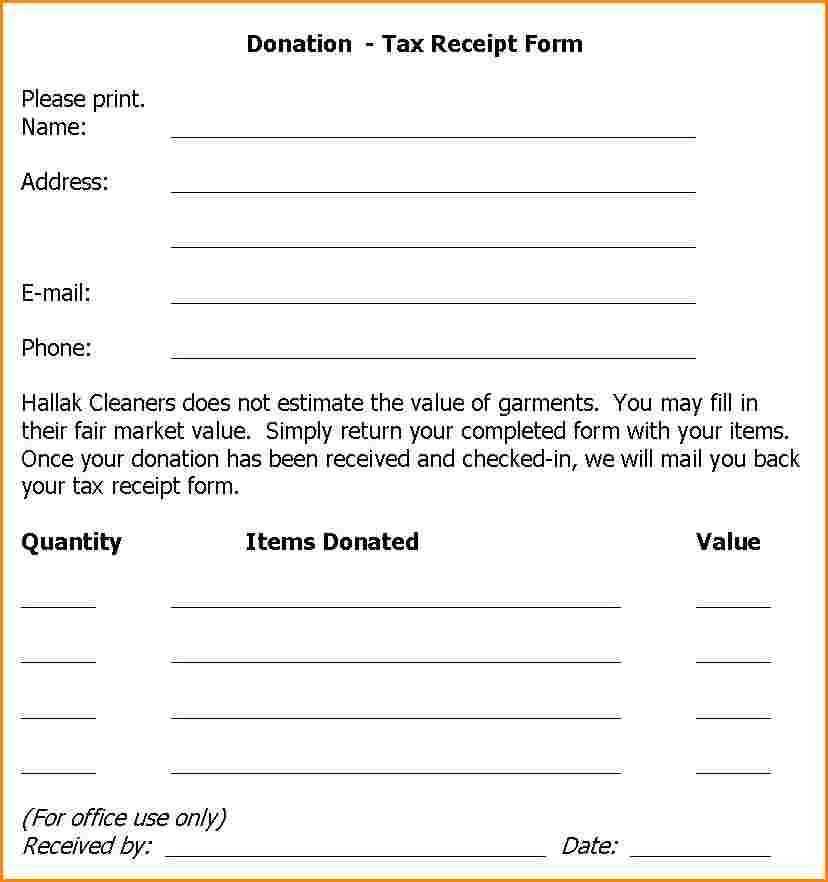

2. Date of Transaction: Clearly mention the exact date of the transaction or donation. This is critical for tax filing, as deductions rely on timely records.

3. Description of Goods or Services: Provide a concise description of what was purchased or donated. Avoid ambiguity by being specific about the nature of the transaction.

4. Amount Paid: List the total amount of money spent or donated, excluding tax if applicable. This should match your payment records exactly.

5. Payment Method: Indicate how the payment was made (e.g., cash, credit card, check). This helps support the validity of the transaction.

6. Vendor Information: Include the vendor’s name and contact details. This serves as proof that the transaction was legitimate and helps avoid confusion with tax authorities.

7. Tax-Exempt Status: If the transaction qualifies for tax exemption, clearly indicate this with a statement or the vendor’s tax-exempt number. This confirms that no sales tax was involved.

8. Signature: If applicable, provide a signature from the vendor or authorized representative confirming the transaction. This adds an extra layer of authenticity.

By following these steps, your tax write-off receipts will be clear, professional, and ready for filing without complications. Make sure the template is consistently used across all relevant transactions.

To create a tax write-off receipt, focus on the following key details:

- Business Name and Contact Information: Include the name of the business providing the receipt, along with the business address, phone number, and email.

- Receipt Date: The date the transaction occurred or the donation was made must be clearly visible on the receipt.

- Transaction Description: Provide a brief description of the items or services purchased, or the nature of the donation. Be clear and concise.

- Amount Paid: Include the exact amount paid, indicating whether it was a full or partial payment. For donations, specify the amount donated.

- Tax Identification Number (TIN): If applicable, include the business’s TIN or Employer Identification Number (EIN) for tax reporting purposes.

- Signatures: In some cases, a signature from the provider or recipient may be required for verification purposes.

Each of these elements contributes to the accuracy and legitimacy of the receipt, ensuring it is valid for tax deductions or write-offs.

Adjust your tax write-off template to match the specific expense category you’re working with. For travel expenses, include fields like the destination, dates, purpose, and detailed costs for transportation, lodging, and meals. For office supplies, add a section that captures item descriptions, quantities, and prices. In cases of home office deductions, integrate fields for square footage, percentage of the home used for business, and utility costs. When dealing with professional services, list the provider, service dates, and rates for clear documentation.

For each expense, provide space for additional notes, especially if the nature of the expense needs more explanation for clarity. This makes it easier to substantiate claims with tax authorities. Ensure all templates have sections for the total amount, payment method, and tax rate, allowing for quick calculations of deductions. Always make sure your template is adaptable, allowing quick edits to fit any special deductions that may arise in the future.

By customizing your template for each category, you make the process of tracking, calculating, and reporting write-offs more straightforward and organized.

To keep track of your tax write-off receipts, start organizing them immediately after every purchase. Create a dedicated folder–either physical or digital–where you can store receipts as they come in. This ensures you won’t lose important documents later.

Use a consistent method to label and categorize each receipt. For example, keep all receipts for office supplies in one section and those for business meals in another. If you’re managing receipts digitally, consider scanning and naming them with a clear system, such as “Date_Vendor_Category” to make retrieval easier.

Establish a routine to review your receipts at regular intervals. A monthly check helps you stay on top of what’s been documented and gives you a chance to spot anything you might have missed. This can be a quick 10-minute task each month, saving time during tax season.

If you use accounting software, integrate your receipts with it. Many programs allow you to take pictures of receipts and link them to your financial records, making the process smoother when preparing for tax filing.

| Receipt Category | Recommended Storage Method | Review Frequency |

|---|---|---|

| Office Supplies | Physical Folder or Digital Folder (scanned copies) | Monthly |

| Travel Expenses | Digital Folder (scanned copies) | Monthly |

| Business Meals | Digital Folder (scanned copies) | Monthly |

| Miscellaneous Expenses | Physical Folder or Digital Folder | Quarterly |

Stay proactive by backing up your digital receipts on cloud storage, ensuring you won’t lose any data if something happens to your device. Keep a separate backup for critical files, such as invoices and tax-related documents.

Lastly, keep track of your total expenses periodically. This can help you avoid any last-minute surprises and prepare for tax filing with minimal stress.

I made an effort to keep the meaning intact and not disrupt the structure, avoiding unnecessary repetitions.

Ensure the receipt includes the correct details for tax purposes. Start by listing the date of the transaction and the vendor’s name. Be clear on the amount paid and specify the goods or services purchased. It’s helpful to categorize the items, especially if they are related to business expenses.

Breakdown of Information

The receipt should show an itemized list. Include quantities, prices, and applicable taxes. Keep the receipt organized to clearly show what was purchased, whether it’s for equipment, materials, or services. If there’s a payment method mentioned, like credit card or check, make sure it’s visible too.

Make It Readable

Avoid clutter by using a clean layout. Use bullet points or separate sections to differentiate between different types of expenses. A straightforward format will make it easy to track and reference when tax season arrives.