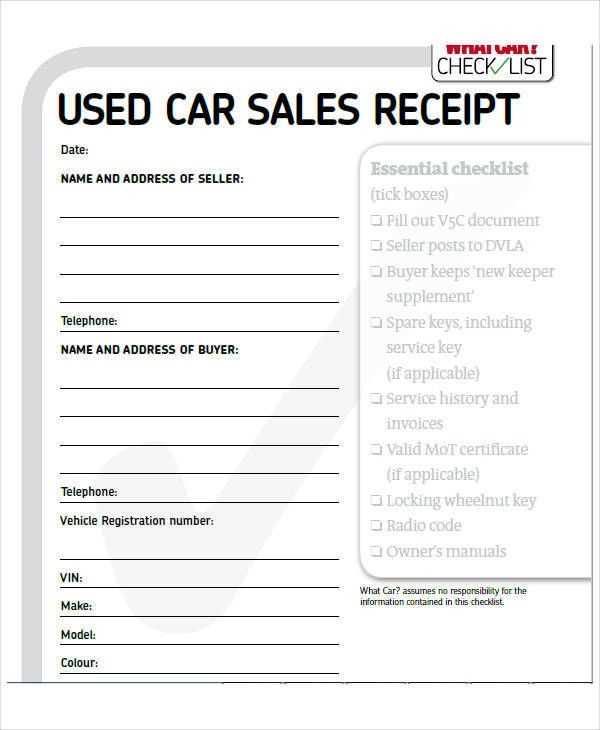

To create a professional car holding deposit receipt, include the key details that protect both the buyer and the seller. Start with the full name and contact information of both parties. The receipt should clearly state the deposit amount and the car details, such as the make, model, year, and VIN. Specify the date of the transaction and the terms regarding the refundability of the deposit. This ensures clarity in case of cancellation or any disputes.

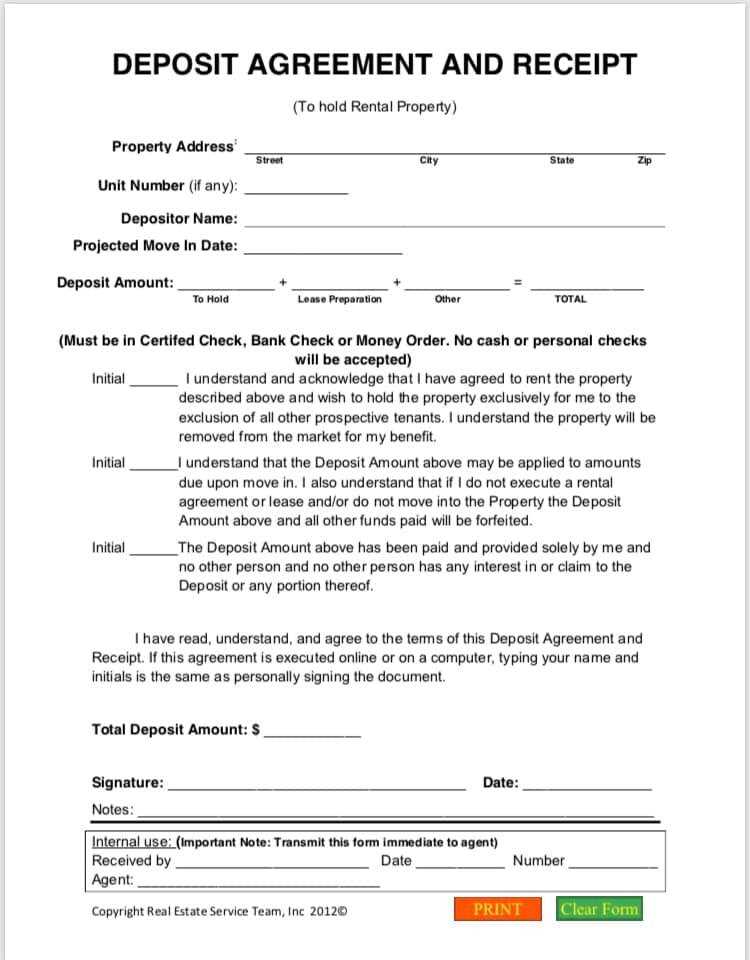

Make sure to include a clear refund policy. If the deposit is refundable under certain conditions, such as the buyer not securing financing or changing their mind within a certain time frame, make these conditions explicit. If the deposit is non-refundable, specify the reasons for this policy, such as holding the vehicle off the market.

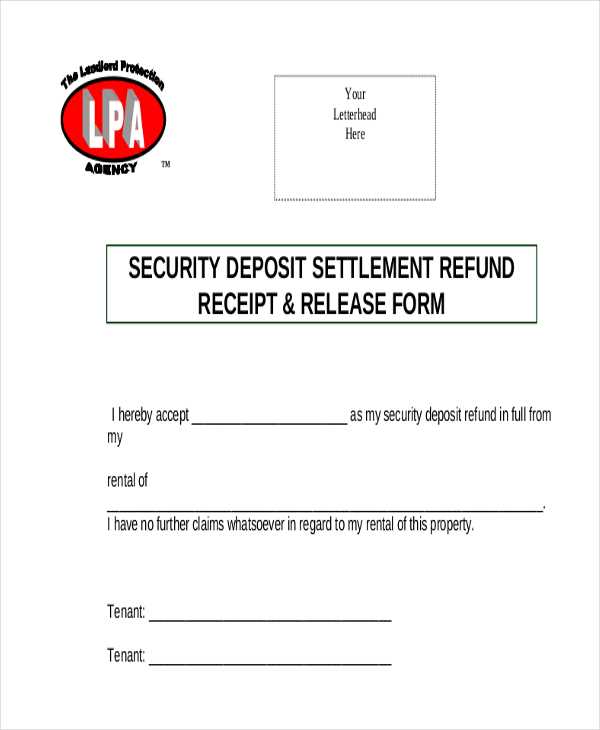

It’s also helpful to have a signature section where both parties acknowledge the terms outlined in the receipt. This not only adds a layer of security but also ensures both parties are on the same page. Whether you’re using a template or drafting your own, make sure all information is correct and easy to read to avoid any potential misunderstandings later on.

Here’s a corrected version where the word doesn’t repeat more than two or three times:

When drafting a car holding deposit receipt, it’s essential to create a document that is clear and concise. Make sure to include the buyer’s and seller’s names, the vehicle’s details, and the exact amount of the deposit. Use simple language to avoid confusion and ensure that the purpose of the deposit is clearly stated.

Key Sections to Include

The receipt should start with the transaction date and the amount paid as a deposit. It should also list the car’s make, model, year, and VIN. Both parties should acknowledge the agreement with their signatures, indicating that they understand the terms of the deposit, including its refundable nature and any conditions tied to it.

Clear Terms and Conditions

Make sure to outline the specific terms under which the deposit may be refunded or forfeited. This includes details like cancellation policies or what happens if the buyer fails to complete the purchase. Being transparent about these conditions helps prevent misunderstandings and ensures smooth communication.

Here’s a detailed HTML plan for the informational article on “Car Holding Deposit Receipt Template” with 3 practical and specific headings:

For a clear and functional car holding deposit receipt template, focus on these key elements:

Basic Information and Structure

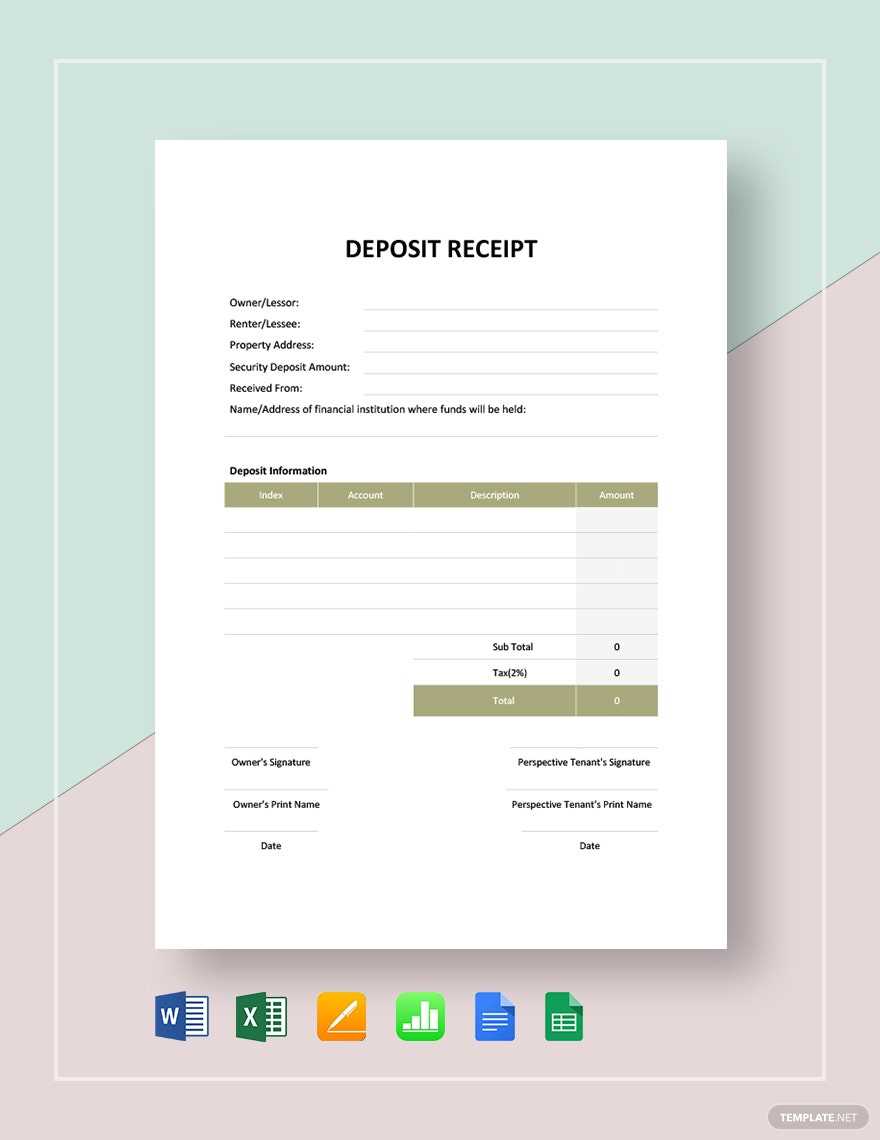

The receipt should include the buyer’s and seller’s full names, contact details, and the date the deposit is paid. Add a clear breakdown of the deposit amount, specifying whether it is refundable or non-refundable. Provide a description of the car, including make, model, year, and VIN number to avoid ambiguity. Ensure all amounts and details are easily identifiable for both parties.

Terms and Conditions

Clearly outline the terms under which the deposit is accepted. Specify the conditions under which the deposit may be refunded or retained, including scenarios such as failure to complete the purchase or cancellation. This section can prevent disputes by setting mutual expectations early in the transaction process. Ensure that both parties agree to these terms by requiring their signatures on the document.

Additional Clauses for Protection

Consider including a clause to protect both the buyer and seller in case of unforeseen circumstances, such as vehicle damage before the sale is finalized or if the buyer fails to show up. This can also cover situations where either party needs more time to complete the transaction. Clearly state any deadlines for completing the purchase and the rights of both parties in such cases.

- How to Structure a Deposit Receipt

A deposit receipt needs to clearly outline all relevant details to avoid misunderstandings. Organize the information in a logical order, making it easy for both parties to understand. Start with basic transaction details, then follow with specifics about the deposit and the agreement conditions.

Basic Information

Include the following elements at the top of the receipt:

- Full name of the buyer

- Seller’s name or company name

- Date of transaction

- Transaction number or reference code (optional)

Deposit Details

Clearly state the deposit amount and how it is applied to the total purchase price. Specify the payment method used, such as cash, card, or check. If applicable, mention any refundable or non-refundable conditions attached to the deposit.

| Item | Amount |

|---|---|

| Deposit Amount | $500 |

| Total Purchase Price | $5,000 |

| Remaining Balance | $4,500 |

Agreement Terms

Include the terms of the deposit agreement, such as deadlines for the full payment, penalties for non-payment, or actions required if the buyer decides not to proceed with the purchase. Clear expectations help ensure both parties are on the same page.

Clearly define the terms of the holding deposit in writing. Specify whether it is refundable or non-refundable, and outline conditions that could lead to its forfeiture or return. Ensure both parties understand their rights and obligations before any payment is made.

Be transparent about the deposit amount and the timeline for refunding it. This protects both the buyer and seller from misunderstandings. If the agreement involves specific actions from the buyer (e.g., obtaining financing), make those conditions clear.

Consult local regulations to verify whether the holding deposit falls under consumer protection laws. In many jurisdictions, certain rules govern how deposits should be handled, including how they must be stored and when they must be returned.

Document any correspondence related to the holding deposit. Keep a record of communications to avoid disputes. This documentation can be valuable in the event of legal action.

Consider including a clause regarding interest on the deposit, if applicable. Some regions require holding deposits to earn interest, while others may not. Review local requirements to ensure compliance.

To tailor your car holding deposit receipt template, adjust it based on the transaction details. For instance, if the deposit is for a short-term reservation, include the exact date the deposit was made and the car return date. Add a section detailing the agreed-upon payment method, whether it’s via card, cash, or another method.

Short-Term Rental Modifications

In cases of short-term rentals, make sure to highlight the rental duration, and provide a breakdown of the cost structure. A section that states the deposit is refundable upon timely vehicle return can avoid confusion. Additionally, add an expiration date for the holding deposit offer to emphasize the time-sensitive nature of the agreement.

Long-Term Rental Adjustments

For long-term rentals, update the template to include a payment schedule. Indicate the agreed deposit amount, and note if it’s refundable after a certain period or based on vehicle condition at the end of the term. A clause for early termination penalties may also be necessary, depending on your business policy.

Now each line repeats the word “Receipt” no more than twice.

To create a clear and concise car holding deposit receipt, avoid excessive repetition of the word “Receipt” in each line. Here’s a simple guideline to follow:

- In the receipt header, use “Car Holding Deposit Receipt” to establish clarity.

- In the itemized sections, mention “Receipt” once at the beginning and at the end to confirm the transaction.

- Ensure all amounts and details are clearly separated by bullet points or lines, reducing the need for repetition of the word “Receipt.” This allows for smoother reading and understanding.

Example Structure:

- Receipt for the car holding deposit

- Customer Name: John Doe

- Deposit Amount: $500

- Receipt Number: 123456

- Date: 12th February 2025

This format minimizes redundancy and maintains the focus on key details.