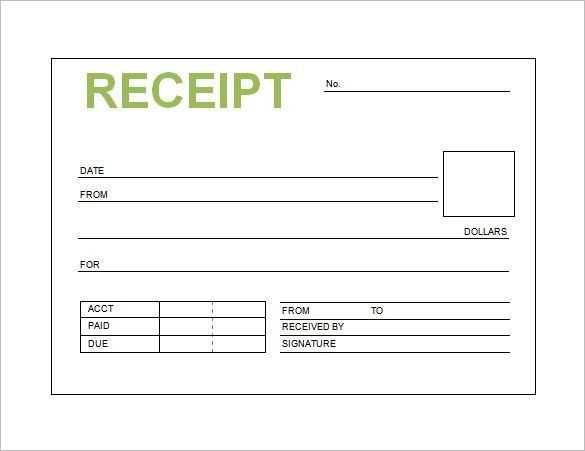

To streamline your tire shop operations, use a clear and simple sales receipt template. A well-structured receipt not only helps with record-keeping but also improves customer satisfaction by providing all the necessary transaction details in one document. Key sections should include the date, customer information, tire specifications, quantity, price, and total cost.

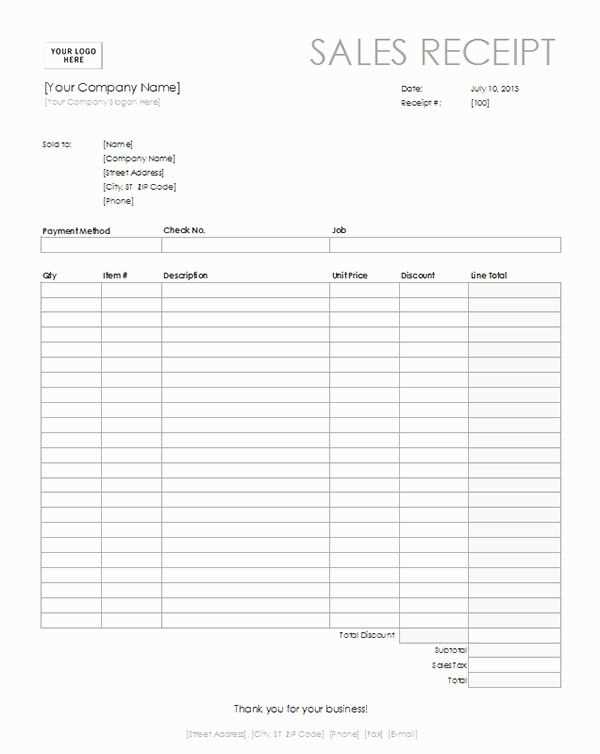

Customize the template to reflect your shop’s branding. Include your shop’s name, contact information, and any relevant terms or conditions regarding returns, warranties, and services. This ensures transparency and builds trust with customers. For better clarity, break down the charges–such as individual tire prices, installation fees, taxes, and discounts.

Lastly, ensure the template is easy to fill out on both physical and digital formats. This allows for smooth transactions, whether your shop is using point-of-sale systems or paper-based methods. Keep the design simple yet informative to avoid clutter, while making sure every section is legible and straightforward for both you and your customers.

Customizing Fields for Tire Sales Transactions

Tailor the fields on your sales receipt template to match the specifics of tire transactions. Include details such as tire brand, tire size, and tire type for clear identification. This makes it easier to track inventory and provide accurate service to customers.

For better clarity, add fields for quantity, unit price, and total cost. These will help both the customer and your team verify the purchase and simplify the checkout process. Additionally, having a field for serial numbers or vehicle model can help associate the tires with a particular vehicle, streamlining future sales or warranty claims.

Customize tax and discount fields to reflect your pricing structure. Offering discounts on multiple tire purchases or special taxes can be easily accommodated through these customizable sections. Always make sure to include a transaction ID and date for accurate record-keeping and auditing purposes.

By adjusting your sales receipt to reflect these specific fields, you ensure a smoother transaction and enhance customer experience.

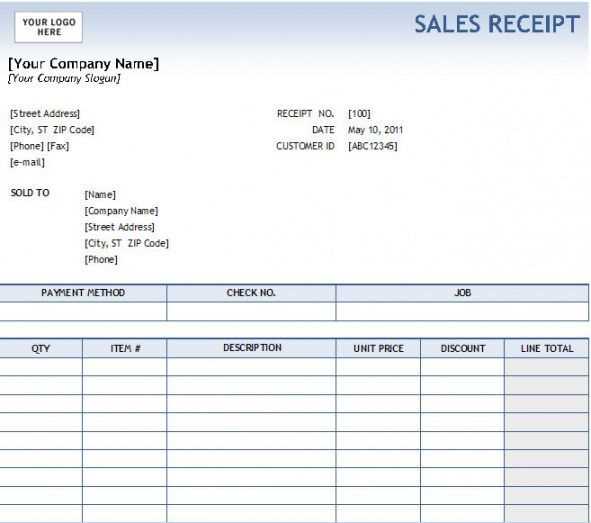

Incorporating Discounts and Tax Calculations

Apply discounts and tax calculations directly on the sales receipt template for transparency and accuracy. Ensure the discount is calculated before tax to avoid errors in the final total.

- Discount Placement: List the discount as a separate line item before taxes are applied. For example, “10% off tires” can be shown clearly, followed by the discounted price.

- Tax Calculation: Calculate taxes on the subtotal after the discount. This ensures that the customer pays the correct amount of tax based on the reduced price.

- Tax Rate: Include the specific tax rate applicable to the sale, e.g., “Sales Tax (8%)”. This gives clarity on the tax portion of the total amount.

- Final Total: Show the final amount after tax and discount are applied, clearly labeled as “Total Due”.

Ensure that both the discount and tax sections are easily identifiable and readable. Providing a breakdown of these figures helps customers understand the charges and boosts the trustworthiness of your business.

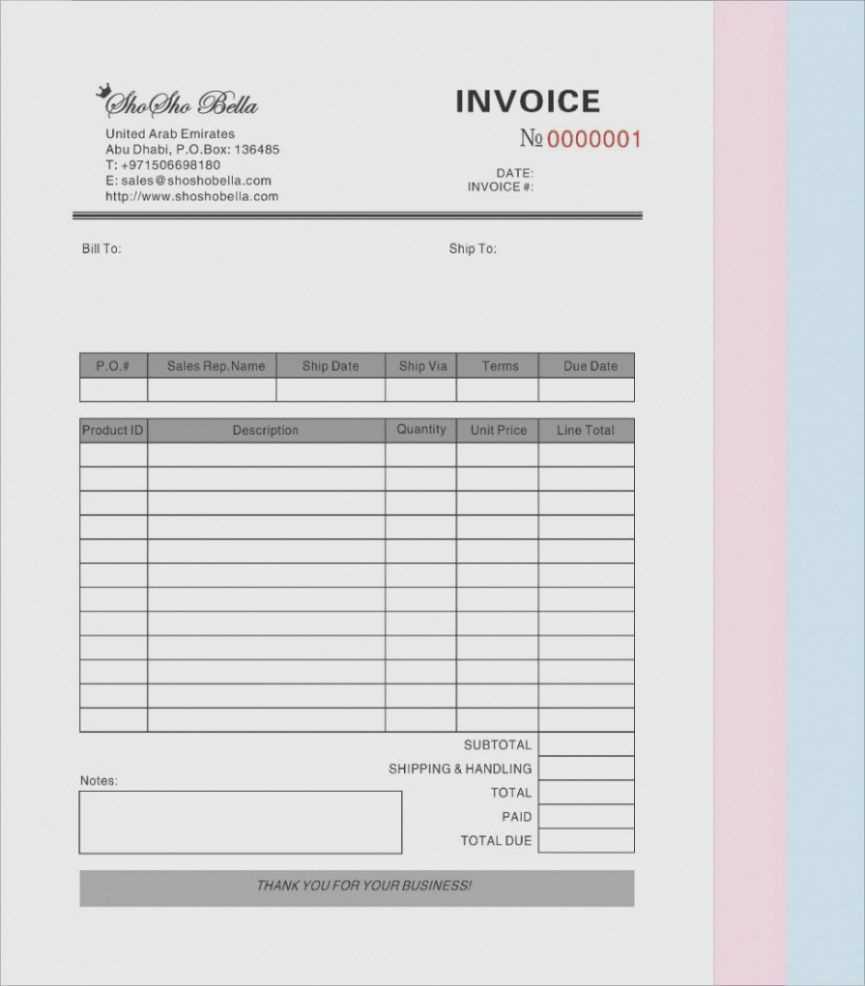

Integrating Payment Methods and Transaction IDs

Integrate multiple payment methods into your tire shop sales receipt template to offer customers various options for transactions. Include clear identifiers for each method, such as credit card, PayPal, or bank transfer, to keep track of payment types efficiently.

Linking Transaction IDs with Payments

Each transaction should have a unique transaction ID linked to the payment method used. This ID serves as a reference for both the shop and the customer. Ensure the ID is easily accessible on the receipt for future inquiries or refunds.

Tracking Payments for Accountability

Store transaction IDs in your database to maintain accurate records. Cross-check them with payment gateways to ensure that payments match the sales made. This process reduces errors and helps manage refunds or disputes smoothly.