Creating a receipt for a deposit is a simple process that requires clear information. Start by including the date of the transaction, the names of both the payer and the payee, and the amount deposited. This ensures transparency and can serve as proof in case of future disputes.

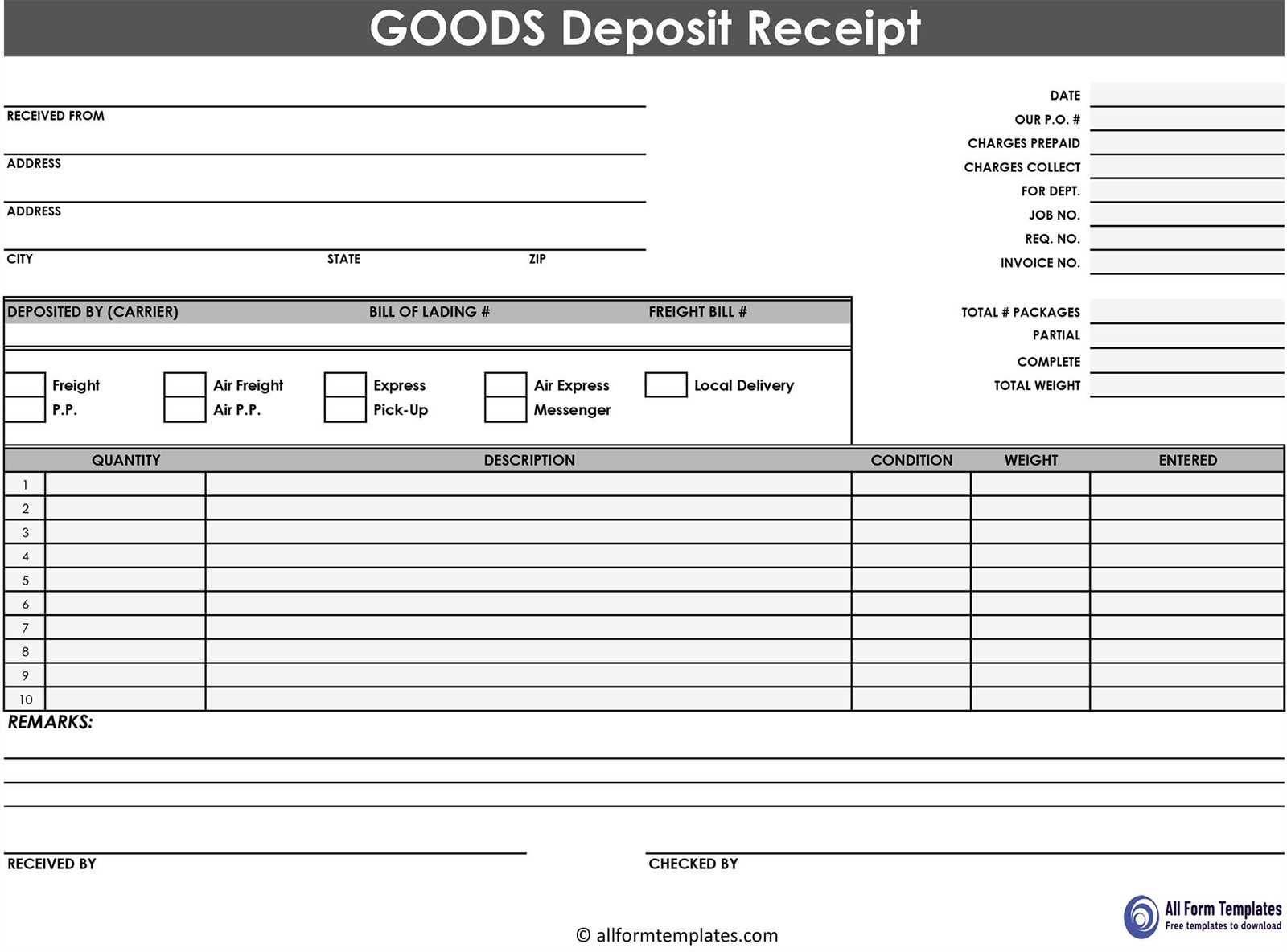

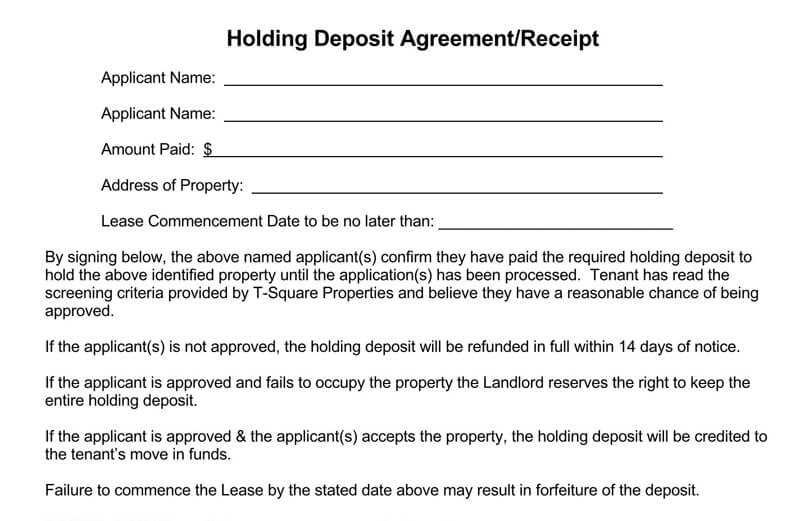

Specify the purpose of the deposit–whether it’s for a service, product, or rental agreement. This step eliminates any confusion about why the money was transferred. If the deposit is part of an installment plan, outline the terms of the agreement, such as total amount and payment schedule, to ensure mutual understanding.

Include a unique reference number on the receipt. This helps track the deposit in case you need to refer back to it later. The number can be part of your business’s internal tracking system or a simple sequence that makes each receipt identifiable.

Finally, ensure the receipt is signed by both parties involved, or at least by the receiver of the deposit. A signed document carries more weight legally and confirms that the transaction was completed as agreed.

Here’s the corrected version:

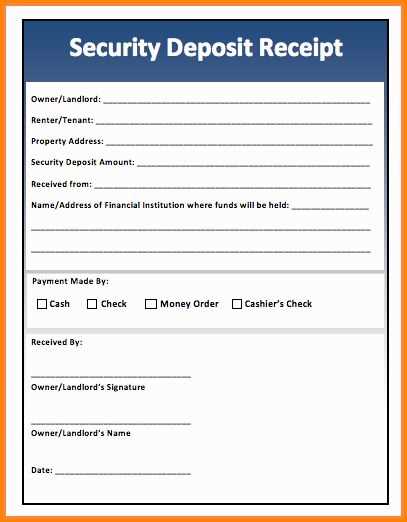

The deposit receipt template should be clear and concise. Use the proper format, including necessary fields such as date, deposit amount, payer’s name, and the transaction reference number. Ensure all fields are correctly aligned, and use a consistent style for dates and figures.

Key Elements

Include the deposit amount in both numerical and written form. This avoids any potential discrepancies or confusion. Make sure to clearly identify the account or service the deposit applies to.

Additional Tips

To avoid errors, double-check the reference number and payer’s details before finalizing the receipt. For transparency, consider including both the method of payment and the transaction’s date in the receipt.

- Template for Receipt of Deposit

Use a clear and simple format when creating a receipt for a deposit. Start with the basic information such as the date of the deposit, the amount received, and the method of payment (cash, check, etc.). The name of the person or company making the deposit should be included, along with the name of the recipient.

Include a statement confirming the purpose of the deposit. This can specify if it’s for a particular service, product, or any other agreed-upon reason. Also, include a unique reference number to help track the transaction in case of disputes.

Make sure to include the terms of any agreements, such as whether the deposit is refundable and under what conditions. For example, specify if the deposit is part of a larger agreement or contract and outline any deadlines or responsibilities attached to it.

Finally, both parties should sign the document to confirm the deposit has been received and agreed upon. This adds a layer of legitimacy and accountability to the transaction.

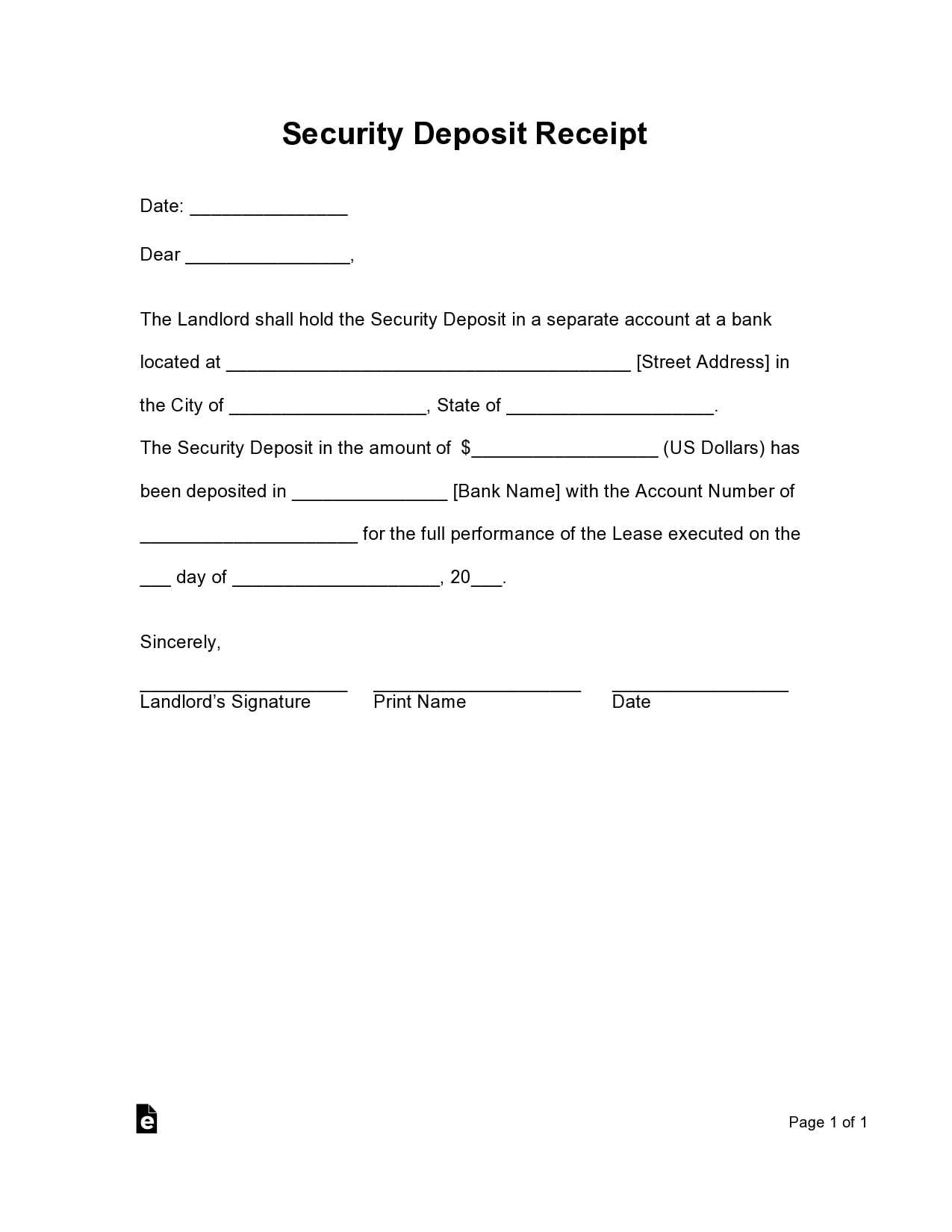

To draft a deposit confirmation template, include clear and accurate information that ensures both parties understand the details of the transaction. Start with a brief header stating the purpose of the document, such as “Deposit Confirmation” or “Confirmation of Deposit.” Include the following elements:

Key Information to Include

| Detail | Description |

|---|---|

| Transaction Date | Specify the exact date when the deposit was made. |

| Depositor’s Name | List the full name of the person or entity making the deposit. |

| Amount Deposited | Clearly state the exact amount of the deposit, including currency. |

| Deposit Method | Note the method used for the deposit (e.g., bank transfer, cash, check). |

| Account Details | If applicable, provide the account information where the deposit was made (e.g., account number, account holder name). |

| Confirmation Number | Include a unique confirmation or reference number for tracking purposes. |

Finalizing the Template

Conclude with a statement of confirmation, such as “This document serves as confirmation of the deposit made on [date].” Ensure that both parties sign the document, either physically or digitally, for verification. Always keep a copy for your records and ensure the recipient also retains a copy for their own documentation.

Deposit receipts serve as a confirmation of funds deposited with a financial institution or business entity. It’s important to ensure the legal aspects governing these receipts are clear to avoid disputes and safeguard all parties involved.

- Legal Binding Nature: A deposit receipt is a legally binding document that establishes the terms and conditions of the deposit. It should detail the amount, the purpose of the deposit, and any obligations or rights associated with it.

- Ownership and Transferability: The deposit receipt should specify whether the deposit is transferable or non-transferable. If transferable, the legal process for such transfer should be outlined, including any documentation or formalities required for the transfer of ownership.

- Interest and Return Terms: If applicable, the deposit receipt must clearly state the interest rate and the terms under which any returns on the deposit will be provided. This ensures both the depositor and the institution have aligned expectations regarding the deposit’s growth.

- Default and Penalties: It’s critical to include provisions for what happens in the event of default or non-compliance with the terms. This includes any penalties, forfeitures, or legal actions that may be taken against the depositor or institution.

- Regulatory Compliance: Ensure that the deposit receipt complies with all relevant local, national, and international regulations governing financial transactions, including anti-money laundering (AML) and know your customer (KYC) laws.

When drafting or reviewing a deposit receipt, consider these aspects carefully to prevent misunderstandings and ensure legal clarity. Consult a legal expert if necessary to confirm compliance with all applicable laws and regulations.

Double-check the accuracy of deposit amounts. Small mistakes can create confusion and may lead to disputes. Always confirm the exact sum before issuing the confirmation letter.

Ensure the correct date is included. The absence of a precise date can cause uncertainty about when the transaction occurred, which may affect future references.

Do not forget to include the transaction method. Whether it’s a bank transfer, cheque, or cash, specifying how the deposit was made provides transparency.

Keep the deposit reference number clear and visible. Missing or unclear reference numbers can make it difficult for recipients to track the payment and verify its authenticity.

Avoid vague language. The confirmation should state exactly what the deposit is for, leaving no room for misinterpretation.

Be mindful of not including unnecessary personal information. Limit details to what is necessary for the confirmation, respecting privacy and confidentiality.

Lastly, do not delay sending the confirmation. Ensure it is issued soon after the deposit to maintain trust and ensure smooth communication.

Thus, the text became more diverse while preserving the original meaning.

To enhance the clarity and readability of the template receipt of deposit, focus on eliminating redundancy and providing clear details about the terms. Clearly outline the deposit amount, payment method, and any associated fees. This ensures transparency and avoids misunderstandings between the parties involved. Include a section that specifies the deposit’s refundable conditions and any applicable deadlines for withdrawal. This will help maintain trust and protect both parties in case of disputes. Finally, ensure that the document is formatted neatly, with sufficient space between sections for easy reading.