Using a receipt template designed for bank tellers simplifies record-keeping and ensures accuracy. Choose a format that clearly outlines transaction details like date, time, amount, account number, and teller’s ID. This helps both customers and bank staff track payments or deposits with ease.

Templates should feature a clear structure. A standard format often includes fields for transaction type (deposit, withdrawal, transfer), account balance after the transaction, and payment method. Including contact details of the branch or bank is also beneficial for customer reference.

Customize the template to meet your bank’s specific needs. For instance, some institutions may require a barcode for faster processing, while others might include additional security measures like transaction IDs. Streamlining the design keeps information legible and reduces the risk of errors during the banking process.

Adapt the template for different transaction types, ensuring consistency across all printed receipts. This can save time and reduce confusion when staff members switch between various types of banking transactions. Make sure that each section of the template is intuitive and straightforward for both tellers and customers.

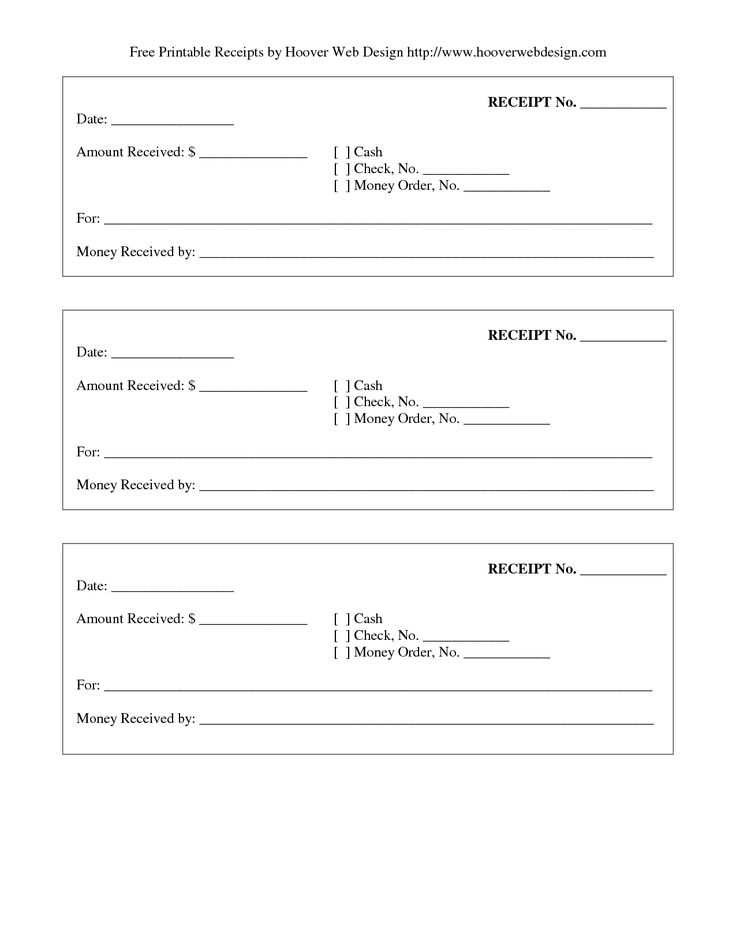

Templates for Bank Tellers Receipts

Bank teller receipts must be clear, accurate, and follow a standard format. Use these templates to streamline transactions, reduce errors, and maintain a professional appearance for your bank’s services.

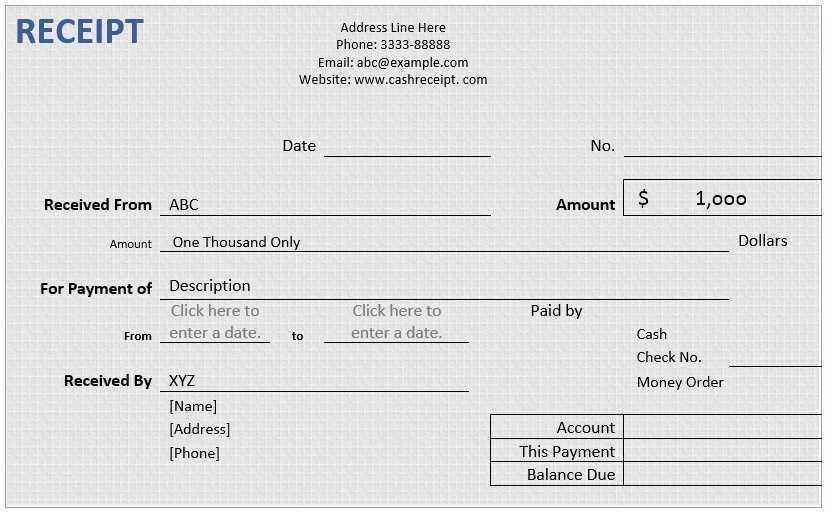

Basic Receipt Template

Date: [Insert Date]

Transaction ID: [Insert Transaction ID]

Branch Location: [Insert Branch Name/Location]

Customer Name: [Insert Customer Name]

Amount: [Insert Amount]

Deposit/Withdrawal: [Deposit/Withdrawal]

Account Number: [Insert Account Number]

Signature: ______________________

Deposit Receipt Template

Date: [Insert Date]

Transaction ID: [Insert Transaction ID]

Branch Location: [Insert Branch Name/Location]

Customer Name: [Insert Customer Name]

Amount Deposited: [Insert Amount]

Account Number: [Insert Account Number]

Deposit Method: [Cash/Cheque/Transfer]

Signature: ______________________

How to Create a Template for Bank Deposit Receipts

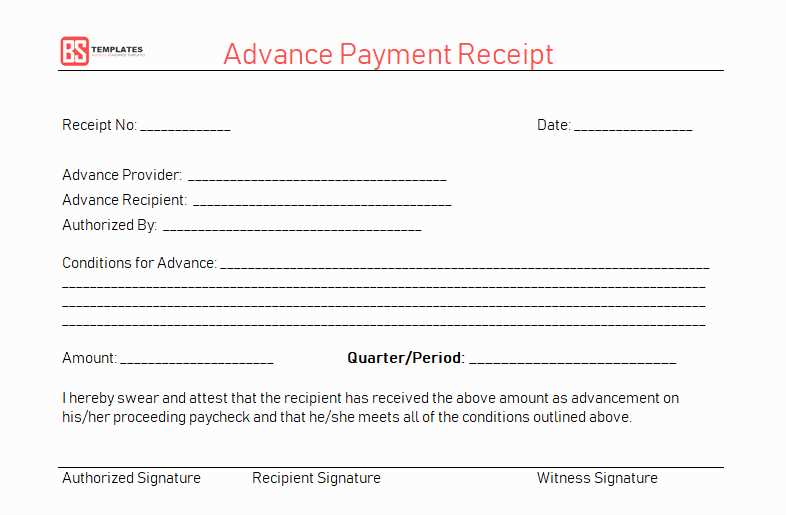

Design a bank deposit receipt template by including the necessary fields for transaction details. Start with the date and time of the deposit. Include the depositor’s name, account number, and contact information. Clearly show the deposit amount in both figures and words to prevent errors. Specify the type of deposit–cash, check, or transfer–along with the relevant details, like check numbers or bank details for transfers.

Provide a unique transaction or receipt number for tracking purposes. Include a section for bank teller initials to confirm processing. Add space for additional notes or special instructions if needed. Finally, include the bank’s name, branch, and contact details at the bottom, along with any legal disclaimers or policies related to deposits.

Ensure the layout is clear and organized, with enough spacing to keep information legible. The font should be easy to read, and the design should be simple to avoid confusion. Keep the template flexible for future adjustments, such as changing legal requirements or updating transaction fields.

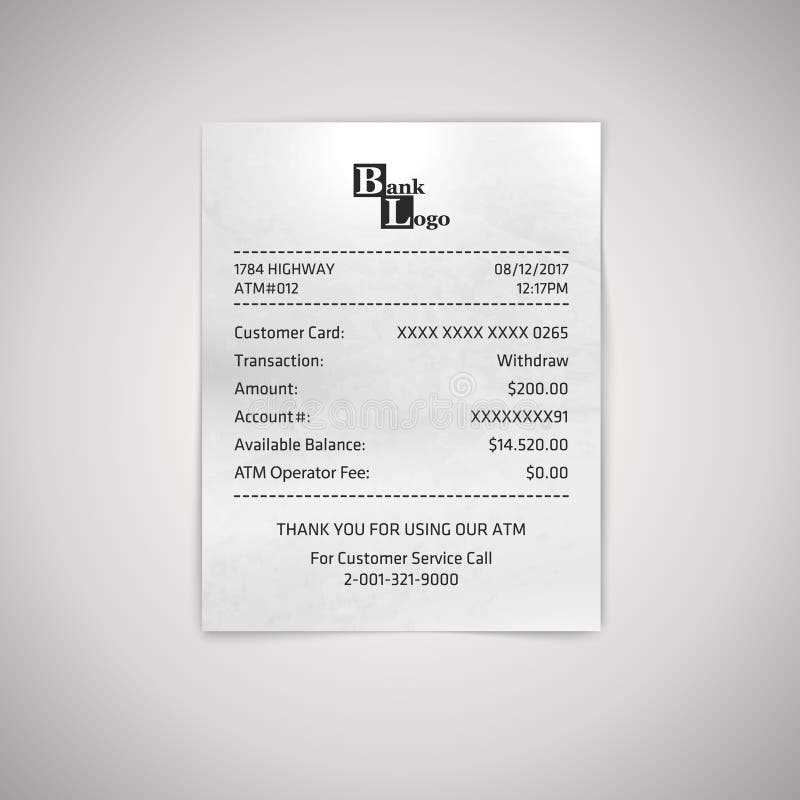

Key Elements to Include in a Withdrawal Receipt Template

Include the transaction date and time for easy tracking. This helps to identify when the withdrawal took place.

Clearly state the account number or account holder’s name. This links the receipt to the correct customer or account.

List the amount withdrawn in both numeric and written form. This avoids confusion and ensures clarity.

Include the teller’s ID or name for accountability. This allows the customer to identify who processed the transaction.

Provide a transaction reference number. It serves as a unique identifier for the withdrawal and can be used for future inquiries or disputes.

State the remaining balance in the account, if applicable. This keeps the customer informed of their updated balance after the withdrawal.

Specify the type of transaction, such as cash withdrawal or transfer. This clarifies the nature of the withdrawal.

Ensure the bank’s name and logo are visible. This confirms the legitimacy of the transaction and provides a professional appearance.

Include a clear statement of the withdrawal method, such as teller-assisted or ATM. This offers transparency regarding how the funds were accessed.

Customizing Receipt Templates for Different Banking Transactions

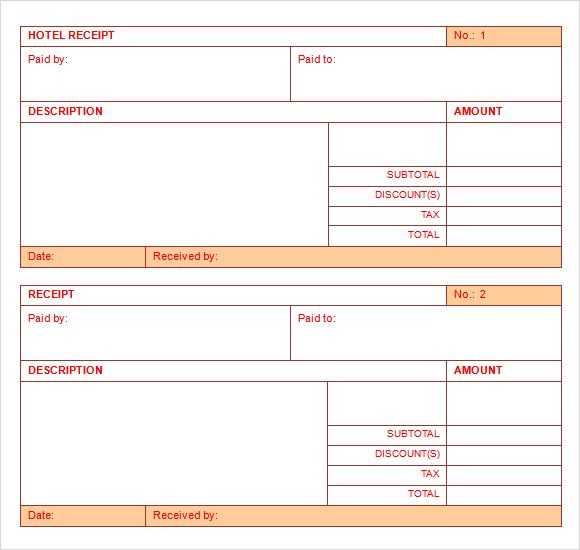

Customize receipt templates to match the specifics of various banking transactions. Adjust the template layout and content to accommodate details relevant to each transaction type, such as deposits, withdrawals, or transfers.

Adjusting for Deposit Transactions

For deposit receipts, include the following elements:

- Deposit amount

- Deposit method (e.g., cash, cheque, or direct deposit)

- Account number

- Transaction reference number

- Branch or ATM location (if applicable)

Ensure the deposit method is clearly indicated to avoid confusion, especially when multiple methods are available.

Adjusting for Withdrawal Transactions

Withdrawal receipts should highlight:

- Withdrawal amount

- Account number

- ATM or branch location

- Transaction date and time

- Transaction reference number

For ATM withdrawals, you may also include the machine ID or the bank’s contact details in case of issues.

Customizing for Fund Transfers

Fund transfer receipts need additional information to clarify the transaction:

- Sender’s and recipient’s account numbers

- Transfer amount

- Currency type

- Transaction fee (if applicable)

- Transfer reference number

Ensure clear presentation of any fees and exchange rates if dealing with international transfers.

Each transaction type requires specific details to help both the customer and bank staff identify the transaction and resolve potential issues swiftly. Adjust receipt templates to reflect these details accurately.