Creating a clear and concise installment receipt is a key part of any transaction involving payment plans. It ensures both parties understand the terms of the agreement, offering peace of mind for both buyer and seller. A well-designed template simplifies this process, ensuring that all necessary information is clearly outlined.

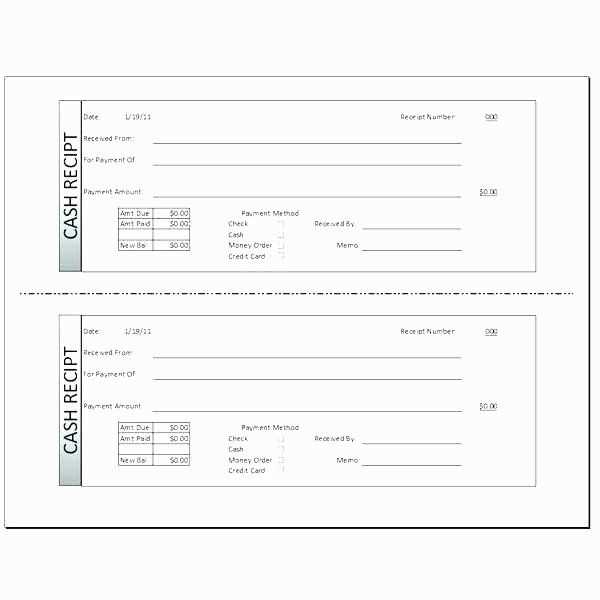

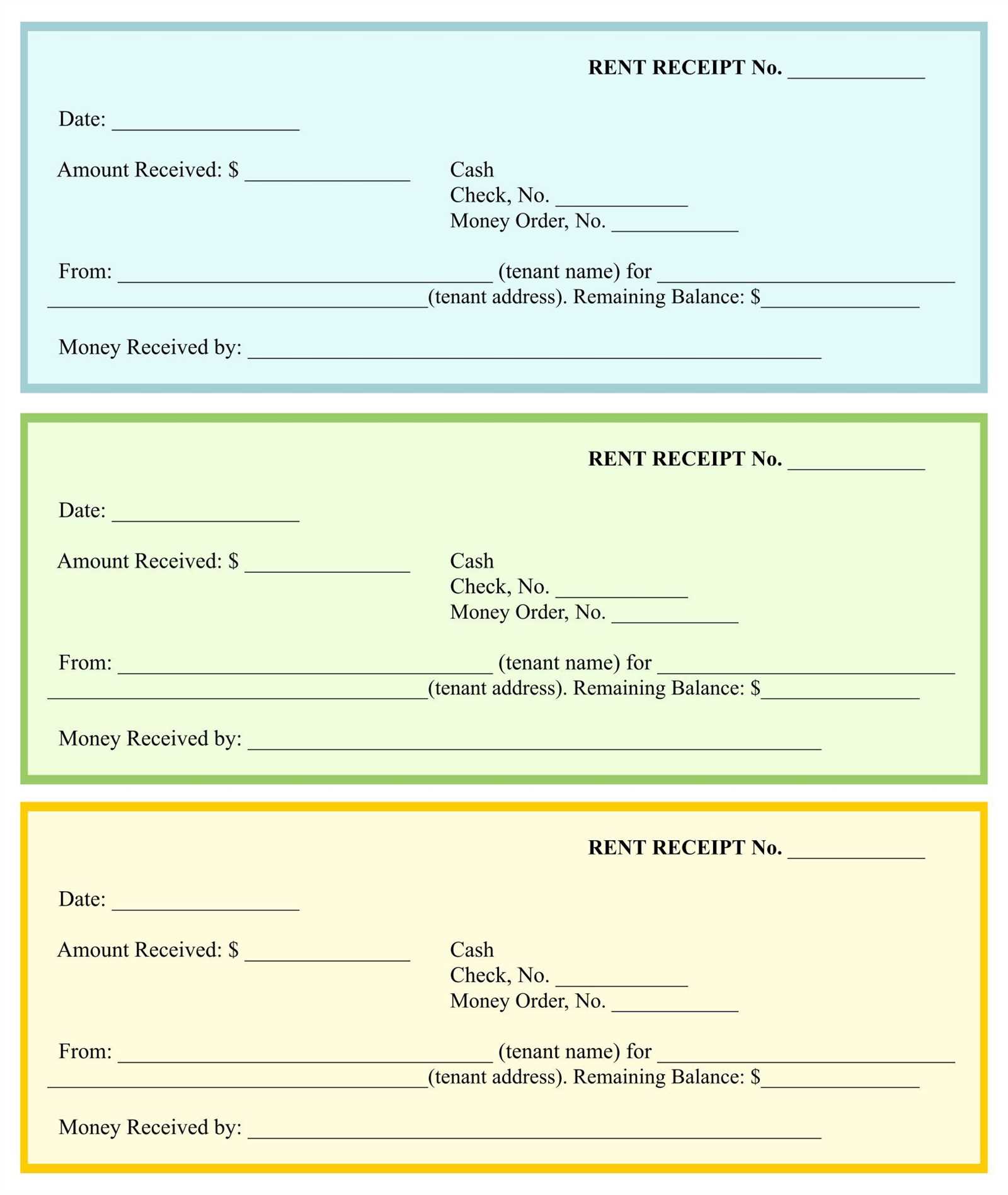

To make your installment receipts effective, include details such as the total amount owed, the amount paid, the remaining balance, and the due date for subsequent payments. Additionally, incorporating a unique receipt number, the payment method, and both parties’ contact information will enhance clarity and ensure accountability.

When designing your template, focus on simplicity and readability. Organize the sections logically, and use clear headings like Payment Details and Outstanding Balance. This structure helps recipients quickly locate the information they need. Whether you’re a business owner or an individual creating a personal receipt, a well-crafted template helps prevent misunderstandings and keeps everyone on the same page.

Here are the corrected lines:

Ensure that your installment receipt template includes accurate fields for each payment installment. Double-check the layout for clarity and consistency.

Key Fields to Include:

- Receipt Number: A unique identifier for the transaction.

- Installment Number: Specify which installment the receipt corresponds to.

- Payment Date: Indicate when the installment payment was made.

- Amount Paid: Clearly state the payment amount.

- Remaining Balance: Show how much is left to be paid after this installment.

- Payment Method: Specify the method used for payment (e.g., credit card, bank transfer).

- Due Date: Note the due date for the next payment.

Additional Tips:

- Ensure all amounts are in the correct currency and format for easy understanding.

- Provide clear contact details for the payer to reach out in case of any discrepancies.

- Use a professional, clean font to enhance readability.

Following these recommendations ensures that the installment receipt is both clear and professional, making it easier for both parties to track payments accurately.

- Installment Receipt Template Guide

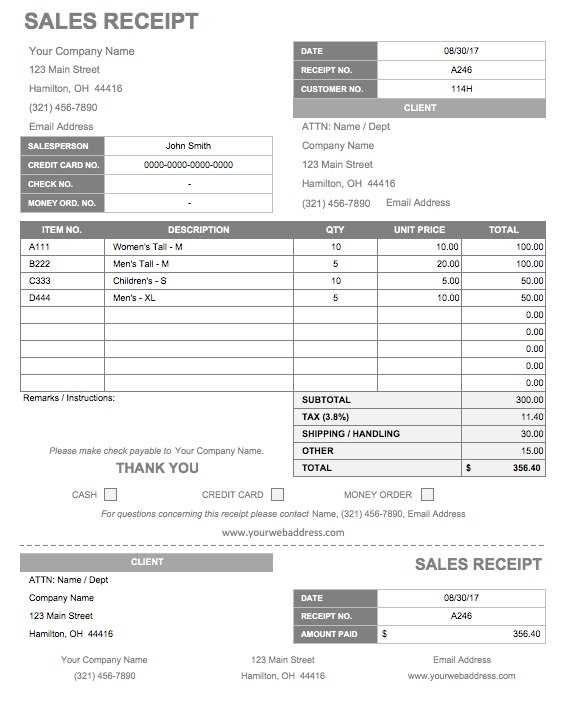

To create a clear and professional installment receipt, follow these key points. The document should include the buyer’s name, the seller’s details, and a clear breakdown of the payment terms. Each installment amount, due date, and total owed must be specified. Always indicate the payment method and note whether it’s a cash, check, or online transaction. Keep the receipt simple but detailed enough to avoid any misunderstandings between parties.

Start with the basic information: Include the transaction date and the specific installment number (e.g., first, second, etc.). Then, list the amount of the installment, the total amount due, and the remaining balance after the current payment. For accuracy, include a reference number or contract number tied to the agreement to make the receipt easily traceable in the future.

Make sure the receipt clearly states that the payment is part of an installment plan. This eliminates confusion and sets clear expectations on how future payments will be handled. It’s also helpful to provide contact information for any questions or follow-up. Once the buyer has made the payment, both parties should sign and date the receipt, which confirms that the transaction has been completed as agreed.

Including terms like late fees, if applicable, ensures that both parties understand the consequences of missed payments. This is particularly important for longer-term agreements. Finally, keep a copy of each receipt for your records to avoid future disputes.

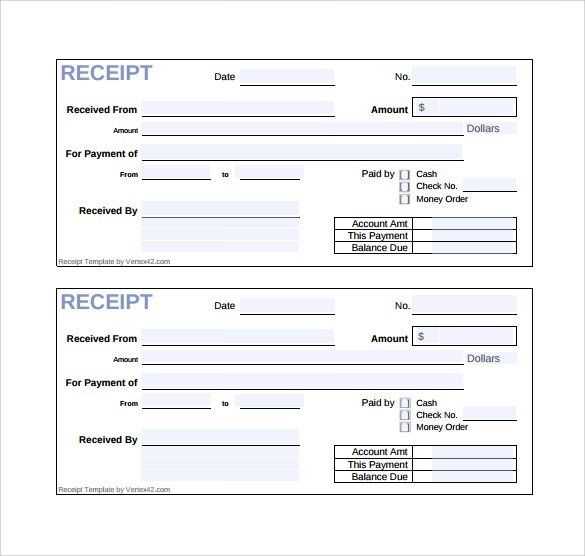

To create an installment receipt, first ensure you have the following key details: the buyer’s name, the payment schedule, the amount due, and the installment number (e.g., first, second, third payment). Use a clear format that separates the payment terms, balance remaining, and payment due date.

Start with your business name, contact details, and the date of the transaction at the top of the receipt. Include a reference number to track the transaction easily. This helps in case of any future inquiries or issues.

Include a description of the product or service provided, as well as the total price. Specify how much has been paid and how much is left. Each installment should be clearly marked with the amount, date, and remaining balance after payment.

Make sure the due date for the next installment is easily visible. This helps keep both you and your client organized and ensures payments are made on time. Add a section for the client’s signature to confirm receipt of the installment, if applicable.

Finally, provide a space for your signature or stamp, confirming the receipt of the payment. This adds a level of formality and security to the transaction.

Make sure to include the following details for a clear and precise installment receipt:

1. Payment Amount – Clearly state the amount being paid for the current installment. This ensures both parties know the exact sum being settled.

2. Date of Payment – Record the exact date on which the installment was made. This helps track payment history and maintain transparency.

3. Total Purchase Amount – Mention the total price of the product or service to clarify how much is due in total, allowing for easier reference in the future.

4. Remaining Balance – Specify how much is left to be paid. This allows both parties to quickly understand the outstanding amount and avoid confusion.

5. Payment Method – Indicate how the payment was made, whether by cash, bank transfer, credit card, or other methods. This detail adds clarity on the transaction process.

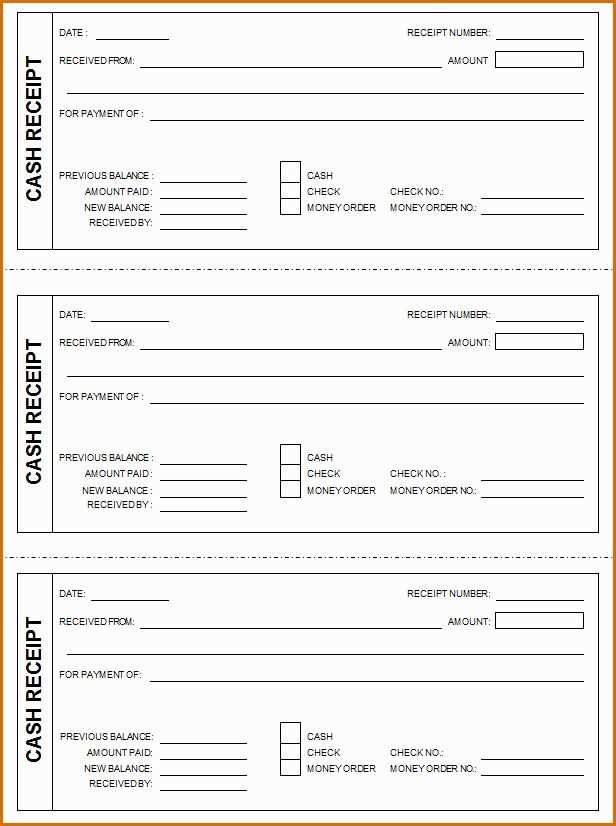

6. Installment Schedule – Include the frequency and dates of future payments, such as monthly or quarterly, so there’s no ambiguity about the remaining installment plan.

7. Reference Number – Add a unique reference number for tracking purposes. This makes it easier to locate specific transactions in case of any future queries.

8. Parties Involved – List the buyer’s and seller’s names, along with their contact information if necessary. This confirms the identities of the individuals involved in the transaction.

9. Description of the Item or Service – Include a brief description of the product or service being paid for. This provides context for the payment and helps prevent misunderstandings.

10. Terms and Conditions – If applicable, include any relevant terms, such as interest rates or late fees. This ensures both parties are aware of the agreed-upon conditions.

Customize your receipt by clearly breaking down payment schedules and amounts. For installment-based plans, highlight the following: total purchase amount, installment amount, frequency (weekly, monthly, etc.), and the number of installments. Ensure each installment is clearly labeled with dates and amounts, so the customer can track payments easily.

Highlight Payment Dates and Amounts

For each installment, display the due date and payment amount in a well-structured table or list. This helps customers know exactly when and how much they owe. If there are different payment amounts per installment, make sure to specify this clearly. This approach minimizes confusion and enhances transparency.

Include Remaining Balance

To provide clarity, always show the remaining balance after each payment is made. Update the total balance section as payments are received. This feature ensures your customer stays informed about their progress and the outstanding amount.

Create a clear and concise installment receipt template to ensure both parties are well-informed. Start with a brief statement at the top that specifies the transaction details, such as the total amount, installment plan, and payment schedule. Be sure to include:

- Payment Breakdown: List the amount of each installment and the due date for each. Make sure to indicate any interest or fees if applicable.

- Payee and Payer Information: Include the names and contact details of both the payer and payee to avoid confusion.

- Signature Section: Provide a space for both parties to sign and date the receipt, confirming agreement to the terms outlined.

- Payment Method: Specify the method of payment, whether cash, check, bank transfer, etc., and include relevant transaction details.

- Late Payment Penalties: Mention any penalties or actions in case of delayed payments, ensuring both parties understand their obligations.

This structure ensures clarity and prevents misunderstandings. Make sure each installment receipt is uniquely tailored to the agreement, maintaining professionalism and transparency in all aspects of the transaction.