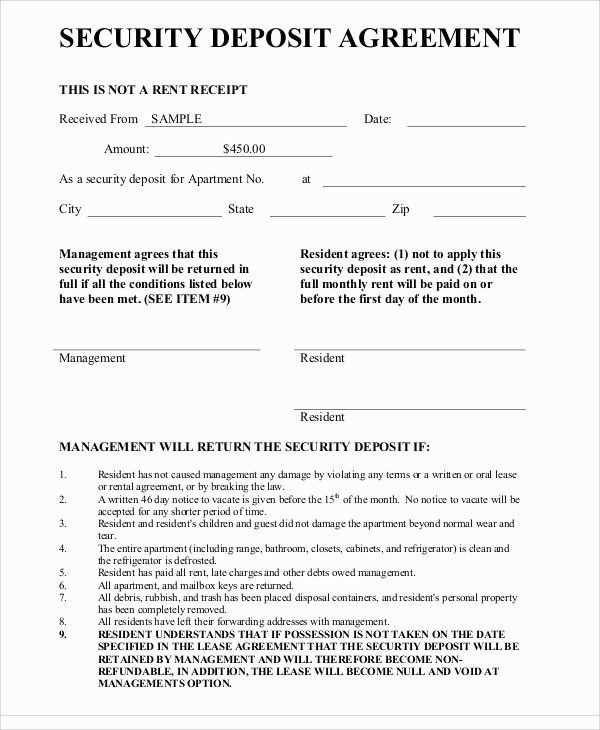

For landlords and tenants in India, securing the return of a security deposit can often lead to disputes. Having a clear and well-structured template for the receipt of a security deposit refund can simplify this process and ensure both parties are protected. The document should clearly state the amount refunded, the date, and the reasons for any deductions, if applicable.

Ensure that the refund receipt includes the full name and address of both the tenant and the landlord, along with property details. Both parties should sign the receipt to confirm mutual agreement and understanding of the refund terms. This helps avoid misunderstandings that can arise later regarding any damage deductions or unpaid bills.

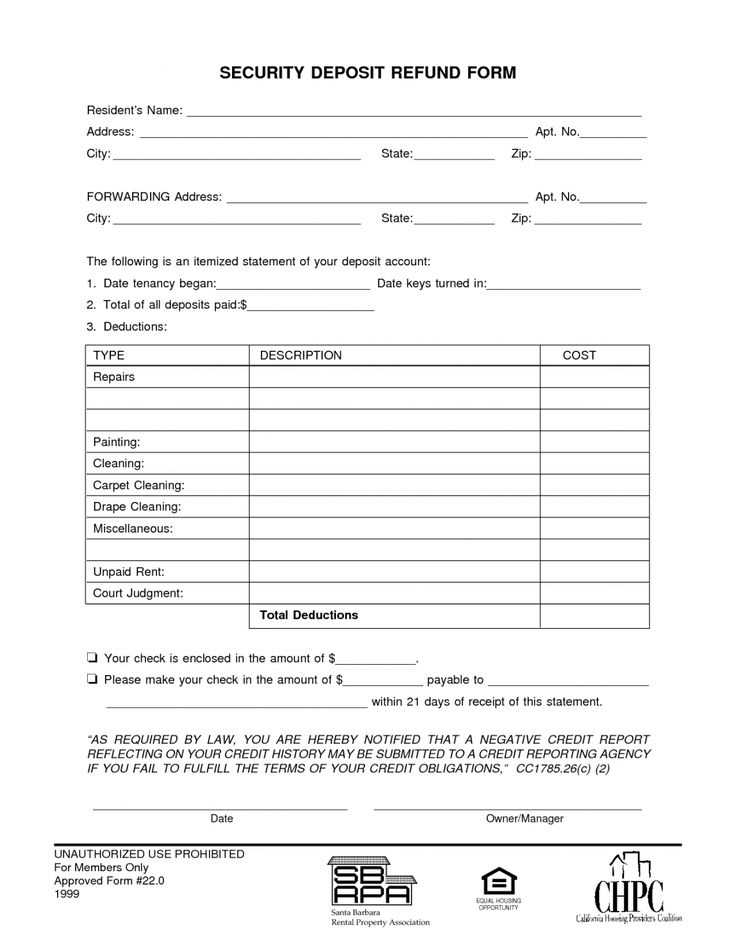

A standard security deposit refund receipt in India typically follows a simple structure. It includes a section for the original deposit amount, the deduction breakdown (if any), and the final refunded amount. Additionally, the document should highlight that the tenant has returned the keys and vacated the property in accordance with the lease agreement.

By using a well-designed receipt template, both the landlord and tenant can ensure that the process is smooth, transparent, and legally sound. Proper documentation is key in avoiding disputes and securing a fair transaction for both parties.

Here is the corrected version:

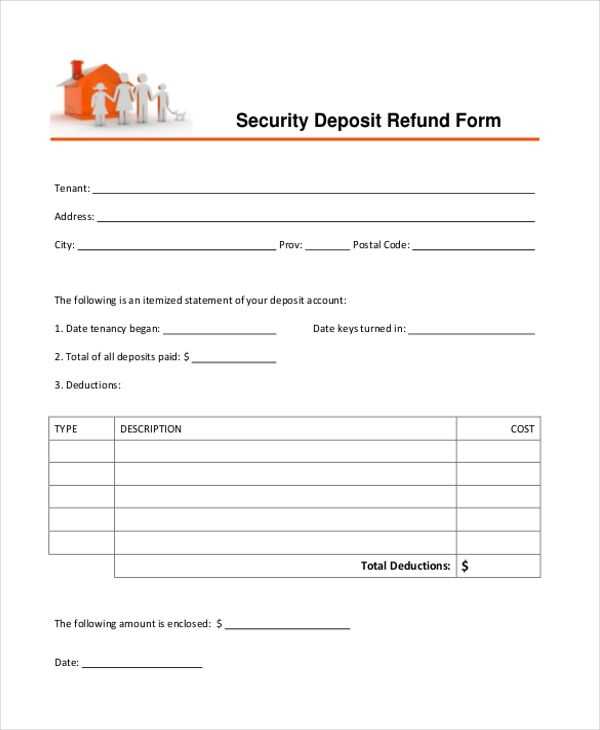

To ensure a smooth refund process for the security deposit, the landlord or property manager should provide a clear receipt. This should include the date, the amount refunded, and a breakdown of any deductions if applicable. The tenant should review the conditions of the lease agreement before making any claims, and the landlord should ensure the property is returned in good condition. Below is a simple template that can be used to confirm the refund of a security deposit:

| Details | Information |

|---|---|

| Refund Date | [Insert Date] |

| Tenant Name | [Insert Tenant Name] |

| Property Address | [Insert Address] |

| Refund Amount | [Insert Amount] |

| Deductions (if any) | [List Deductions] |

| Reason for Deductions | [Provide Reason if applicable] |

| Signature of Landlord | [Landlord Signature] |

This format allows both parties to have a clear understanding of the transaction, preventing disputes and ensuring transparency. Tenants should keep a copy of the receipt for their records.

- Receipt of Security Deposit Refund Template in India

To ensure a smooth process for both parties, use a structured format when issuing a security deposit refund receipt. Below is a practical template that landlords or property owners can use when refunding a security deposit to tenants in India. This document serves as proof of refund and should be signed by both parties.

Receipt for Security Deposit Refund

This is to acknowledge the receipt of the security deposit refund for the rental property located at [Property Address]. The tenant, [Tenant’s Full Name], has successfully vacated the property and returned the keys on [Date]. After inspecting the property, the security deposit of [Amount] INR has been refunded in full, without any deductions, or after accounting for the following charges: [List of Deductions, if any].

Details of Refund

- Tenant’s Name: [Tenant’s Full Name]

- Landlord’s Name: [Landlord’s Full Name]

- Property Address: [Complete Property Address]

- Refund Amount: [Amount in INR]

- Refund Method: [Cash/Cheque/Bank Transfer]

- Refund Date: [Date of Refund]

- Inspection Date: [Date of Inspection]

Refund Conditions: The security deposit was refunded after the property was inspected and found in satisfactory condition, with the following conditions considered: [List any conditions, such as repairs, cleaning, etc.].

Signature of Tenant: _______________________

Signature of Landlord: _______________________

Both parties agree to the terms mentioned above, and this document serves as the final acknowledgment of the security deposit refund for the specified rental agreement.

To create a clear and legally sound security deposit refund receipt, include key details that protect both parties. This document serves as proof that the refund has been made and outlines any deductions. Follow these steps to draft a proper receipt:

1. Include Property and Tenant Information

Start by listing the tenant’s name and the address of the rental property. This ensures the receipt applies to the correct lease agreement. The date of the refund should also be noted clearly at the top of the receipt.

2. Specify the Amount Refunded and Deductions

State the total security deposit amount that was paid at the beginning of the lease. Then, if any deductions were made (for damages, unpaid rent, or other issues), list them with an explanation for each. The final refunded amount should be clearly mentioned at the end.

For example, you might write: “Total Security Deposit: ₹50,000. Deductions: ₹5,000 for repairs. Refund Issued: ₹45,000.” This makes the transaction transparent and helps avoid disputes.

3. Add Signatures

Both the tenant and the landlord or property manager should sign the receipt. The tenant’s signature confirms they’ve received the refund, and the landlord’s signature shows that they have issued the refund.

Make sure to keep a copy for your records and provide one to the tenant for their reference. This simple document can prevent misunderstandings and support both parties in case of future disputes.

Clearly outline the tenant’s full name and the property address in the receipt. This establishes who the refund is issued to and which property it concerns.

Include the refund amount along with a breakdown of how the amount was calculated, showing deductions for damages (if any) and unpaid dues. Be transparent with this information to avoid disputes.

State the date of refund and the payment method (e.g., bank transfer, cheque, or cash). This helps keep track of transactions.

If deductions are made, clearly mention the reason for each deduction, such as damage to the property or cleaning costs, with supporting evidence like photos or receipts, if applicable.

Ensure to include a reference number or a receipt ID for easier tracking of the transaction.

Finally, the landlord’s signature or an authorized representative’s signature should appear on the document to confirm the refund.

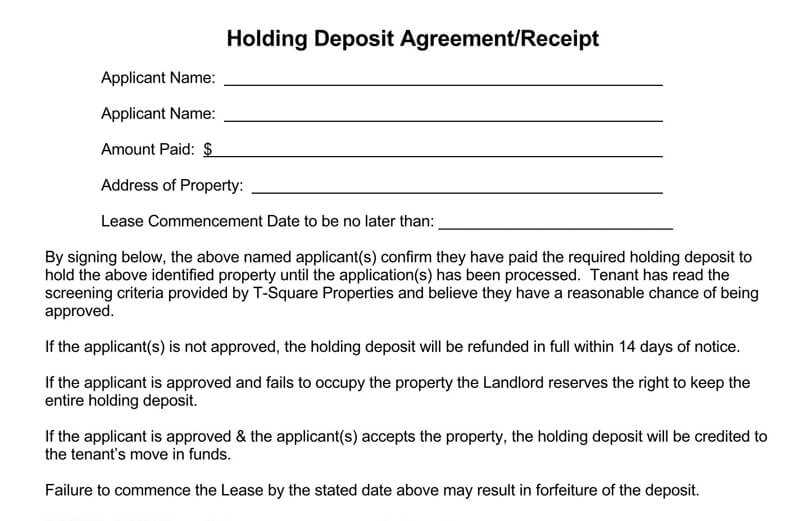

Issuing a security deposit refund in India requires adherence to legal protocols to ensure fairness and transparency. Landlords must consider the terms of the rental agreement, the condition of the property, and applicable state laws when handling such refunds.

1. Refer to the Lease Agreement

The lease agreement is the primary document that governs the terms related to the security deposit. Both parties–landlord and tenant–must follow the stipulated clauses regarding the refund process. If the agreement specifies a time frame for refunding the deposit, the landlord must comply. Failure to do so could lead to legal complications.

2. Deductions for Damages or Unpaid Rent

If the landlord intends to make deductions from the security deposit for property damages or unpaid rent, clear documentation is essential. The tenant should be informed of the damage or outstanding rent and provided with a breakdown of deductions. These deductions must align with the terms set forth in the agreement and be justifiable through photographs, invoices, or receipts.

3. Timeline for Refund

Indian law generally expects the security deposit to be refunded within a reasonable period after the tenant vacates the property. While some states may have specific time limits, it is advisable for landlords to issue the refund within one to two months to avoid disputes. If there are deductions, the remaining amount should be returned promptly after necessary adjustments.

4. Security Deposit Under Rent Control Acts

In several states, the Rent Control Acts regulate the maximum amount a landlord can charge as a security deposit. Typically, the security deposit cannot exceed two or three months’ rent. Violating these limits could lead to legal consequences for the landlord.

5. Failure to Refund

If a landlord refuses or delays the security deposit refund without valid reason, the tenant has the right to take legal action. Under the Consumer Protection Act, tenants can file complaints in consumer forums to seek redressal for undue delays or non-refunds.

6. Proper Communication and Documentation

Clear communication is essential throughout the process. Both parties should maintain written records of all transactions, including notices, payments, and deductions. This documentation will be valuable in case of disputes and legal proceedings.

7. State-Specific Laws

Each state in India may have specific rules regarding security deposit refunds. Tenants and landlords should familiarize themselves with local rent control laws to ensure compliance and avoid misunderstandings.

Receipt of Security Deposit Refund: Key Steps

To ensure a smooth refund process for your security deposit, follow these practical steps. First, request a clear statement of any deductions from the landlord. This will include details on any damages or unpaid bills. If no deductions are stated, the full amount should be refunded.

1. Check for Any Deductions

Review the lease agreement for conditions regarding the refund. Any unpaid rent or damage caused during the lease term could justify a deduction. If you’re unsure, ask for an itemized list of deductions. Compare it with the condition of the property when you left to identify any discrepancies.

2. Submit a Formal Refund Request

If your deposit hasn’t been refunded within the timeframe mentioned in the agreement, send a formal request. Mention the date you vacated the property and politely remind the landlord of the expected refund. Keep a copy of the communication for your records.

If the landlord refuses to refund the deposit or provides insufficient information, you may need to escalate the issue. Consider seeking legal advice or contacting a local tenant rights organization to ensure the fair resolution of the matter.