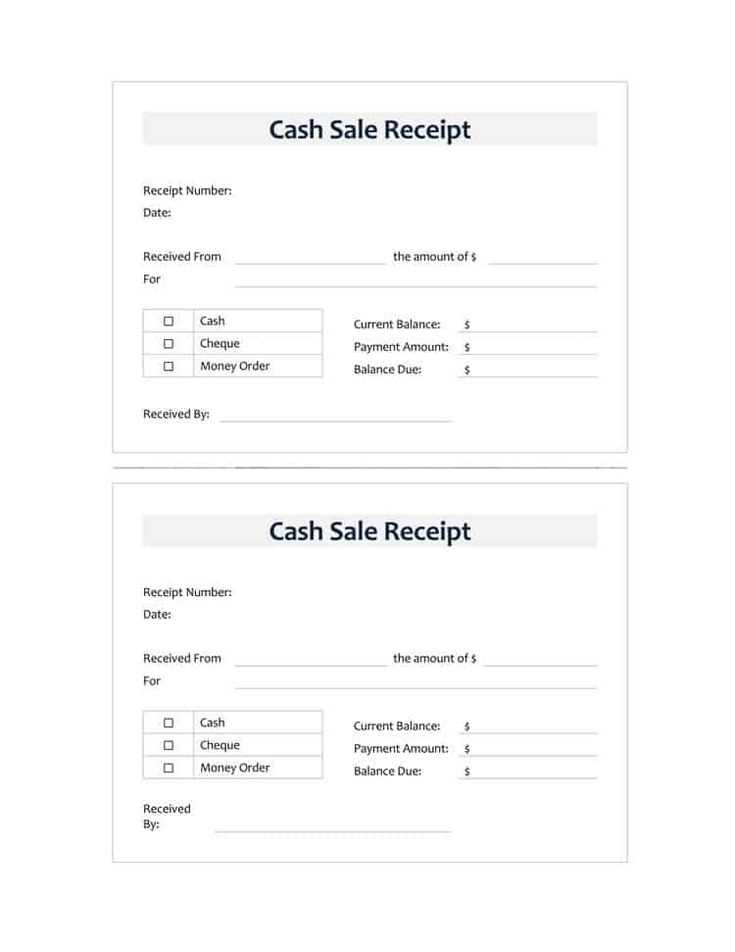

To create a cash receipt that’s clear and easy to understand, focus on structuring it with the right details. The format should include the date of the transaction, a unique receipt number, the name of the payer, and a breakdown of the payment amount. Make sure to specify whether the payment was for goods, services, or a combination of both.

A well-structured receipt also includes clear contact information for both the payer and the payee. This should cover addresses, phone numbers, and email addresses where necessary. If applicable, include any tax-related details such as VAT or sales tax, as well as the total amount after taxes have been applied.

Ensure your template has space for a signature or an acknowledgment that both parties agree to the terms. This helps in confirming the transaction, especially for larger sums or recurring payments. Adding a footer with business details, such as your registration number or business hours, can also be useful for future reference.

By organizing your receipt with these elements, you’ll keep your documentation professional and transparent, reducing the chance of confusion or disputes down the line.

Here are the corrected lines:

Ensure the following adjustments are made for clarity and consistency in your cash receipt format:

- Recipient Name: Use a clear field for the recipient’s name. This prevents ambiguity and ensures accurate record-keeping.

- Date of Transaction: Display the transaction date in a consistent format (e.g., MM/DD/YYYY) to avoid confusion across different systems.

- Amount Paid: Clearly list the exact amount, followed by the payment method (cash, card, etc.), ensuring both are easily distinguishable.

- Receipt Number: Include a unique receipt number for each transaction to improve tracking and reconciliation.

- Tax Information: Add a breakdown of taxes if applicable. This should include the tax rate and the total amount of tax collected.

Example Format:

- Recipient: John Doe

- Date: 02/12/2025

- Amount Paid: $150.00 (Cash)

- Receipt Number: 123456

- Tax: 7% Sales Tax – $10.50

These adjustments will help create a standardized, user-friendly receipt format that’s easy to follow and process.

- Cash Receipt Format Template

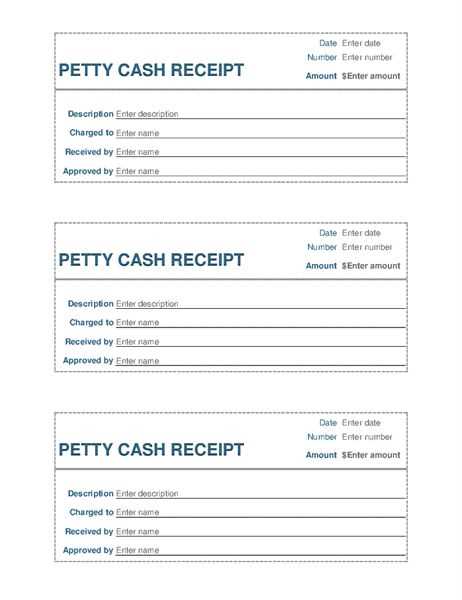

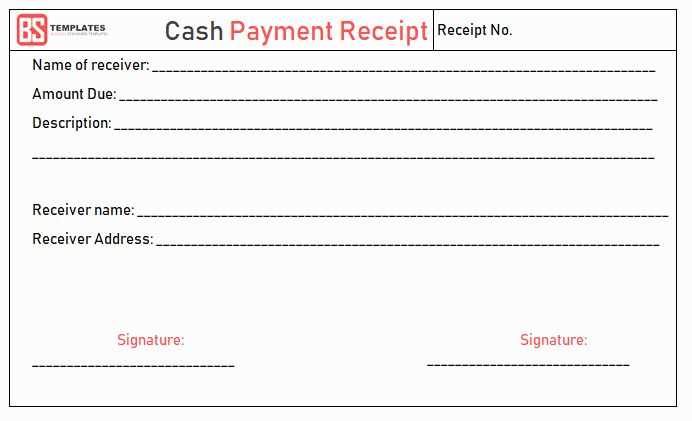

For a clear and standardized cash receipt, the following sections should be included:

- Receipt Header: Include the title “Cash Receipt” at the top for clear identification.

- Receipt Number: Assign a unique number to each receipt to keep track of transactions.

- Date of Transaction: Indicate the exact date when the cash payment was received.

- Received From: Specify the name of the person or entity making the payment.

- Amount Received: List the exact amount received, in both numeric and written form, to avoid confusion.

- Payment Method: State if the payment was in cash or another method, though for cash receipts, this will always be “cash.”

- Reason for Payment: Briefly describe the purpose or goods/services paid for, if applicable.

- Issued By: Include the name and title of the person issuing the receipt, along with their signature for verification.

- Additional Notes: Provide space for any extra information, such as refund policies, transaction terms, or a thank-you message.

This format ensures all key transaction details are captured and clearly presented for both the payer and the receiver. Use a clean, easy-to-read font and keep the layout straightforward for maximum clarity.

Creating a cash receipt template in Excel is simple and can streamline the process of recording transactions. Here’s how you can set it up for quick and consistent use:

Step 1: Set up the Basic Structure

Start by opening Excel and creating a new worksheet. Label columns with the following headings: “Receipt Number”, “Date”, “Received From”, “Amount”, “Description”, and “Payment Method”. You can customize these fields depending on your needs. This will help you easily track each transaction.

Step 2: Add Formulas for Calculations

If you want Excel to automatically calculate totals, add a row at the bottom of the “Amount” column to sum the amounts. Use the SUM function like this: =SUM(D2:D10) (adjust the cell range as necessary). This will make it easier to track total cash receipts without manual calculations.

Step 3: Create a Receipt Number System

For easy reference, set up a simple system for generating unique receipt numbers. In the “Receipt Number” column, use a formula like =ROW(A2)-1 to automatically generate sequential numbers based on row position. This ensures each receipt has a distinct identifier.

Step 4: Add Conditional Formatting

For better visibility, apply conditional formatting to highlight specific values. For example, you could highlight any large amounts or overdue transactions. Go to “Home” > “Conditional Formatting” and set rules for highlighting cells based on your chosen criteria.

Step 5: Save and Reuse

Once your template is set up, save it as a template by choosing “File” > “Save As” and selecting the “Excel Template” format. This way, you can reuse the same template without modifying your original document each time.

Example Table Format

| Receipt Number | Date | Received From | Amount | Description | Payment Method |

|---|---|---|---|---|---|

| 1 | 02/12/2025 | John Doe | $200 | Payment for goods | Cash |

| 2 | 02/12/2025 | Jane Smith | $150 | Payment for services | Credit Card |

This template helps keep your cash receipts organized and ensures that you can track transactions with ease.

To maintain precise records, ensure your receipt template includes the following key fields:

Date and Time of Transaction

Clearly document the date and time of the transaction. This is crucial for organizing financial data and ensuring that all activities are traceable to specific points in time. It helps with audits and verifying the timing of payments or purchases.

Transaction Number

Assign a unique transaction ID to each receipt. This serves as an important reference, especially when handling returns or tracking purchases in a larger system. It also helps in resolving disputes, as both parties can refer to the same transaction number.

Buyer and Seller Information

List both the buyer and seller’s details, including names and contact information. This ensures that the transaction can be linked to the right parties. For businesses, it’s also useful to include registration or VAT numbers if applicable.

Items or Services Purchased

Specify each item or service being purchased, including quantities, descriptions, and unit prices. This creates a clear and transparent record for both parties. If applicable, include product codes or serial numbers for more precise tracking.

Total Amount Paid

Display the total payment made, including any applicable taxes, discounts, or additional fees. A breakdown of the total amount ensures transparency and makes it easier for both parties to verify the final payment.

Payment Method

Clearly indicate the method of payment (cash, card, online, etc.). Including this information helps both the buyer and seller track the source of the transaction, especially in cases of refunds or disputes.

Refund/Return Policy

If relevant, state the terms for returns, exchanges, or refunds. This provides clarity to the customer and ensures that both parties understand their rights and obligations should the need arise.

Signature (Optional)

Although not always necessary, including a space for signatures can be helpful, especially for higher-value transactions. This offers an additional layer of verification that the transaction was agreed upon by both parties.

Double-check all information before finalizing the receipt. One of the most common mistakes is leaving out or entering incorrect details, such as the date, transaction amount, or client information. Ensure that every field is accurate to prevent confusion or disputes.

Avoid generic templates. Using a receipt template that is too basic or generic can make your receipt look unprofessional. Tailor the template to fit your specific business or transaction type. Add your logo, contact details, and any relevant terms to make the receipt more personalized.

Don’t overlook the payment method. Always indicate the payment method clearly–whether it’s cash, credit card, or other means. Failing to do so can lead to confusion, especially in cases of refunds or inquiries.

Be mindful of the layout. Poor formatting makes it hard for recipients to read or find key details. Ensure that sections like the total amount, taxes, and payment method are easy to spot. Use a clear, simple layout without overcrowding.

Include all required details. Depending on your jurisdiction, certain information may be mandatory. Missing tax identification numbers or legal disclaimers can cause problems with tax authorities or auditing procedures. Make sure your template includes everything required by law.

Keep it updated. Outdated receipt templates can be problematic, especially if your business information or legal requirements change. Regularly review and update the template to ensure it remains accurate and relevant.

Removing Redundant Word Repetitions While Maintaining Clarity

Eliminate unnecessary word repetitions to improve readability without altering the original meaning. This not only tightens the text but also ensures that each word serves a specific purpose. For example, replace phrases like “completely finished” with “finished,” or “advance planning” with “planning.” This makes sentences more concise and to the point, allowing the reader to focus on the key message.

Pay attention to context and meaning to ensure that the intended message remains clear after reducing redundancy. If needed, rephrase the sentence to keep it smooth and understandable. It’s not about omitting every second word but trimming excess to avoid overwhelming the reader with superfluous terms.

For instance, instead of “at this point in time,” simply use “now.” Similarly, phrases such as “due to the fact that” can be shortened to “because.” By doing this, you preserve the flow of the content while making it more direct and easier to digest.

Each time you identify a redundant pair or phrase, ask yourself whether both words add value. If not, opt for the more concise option. Over time, this habit will make your writing more streamlined and precise.