Creating a final payment receipt template helps streamline financial documentation, ensuring clear communication between businesses and clients. A well-crafted receipt confirms that all dues have been paid, and it serves as both proof of payment and closure for a transaction. Having a standardized template in place can save time, reduce errors, and enhance professionalism.

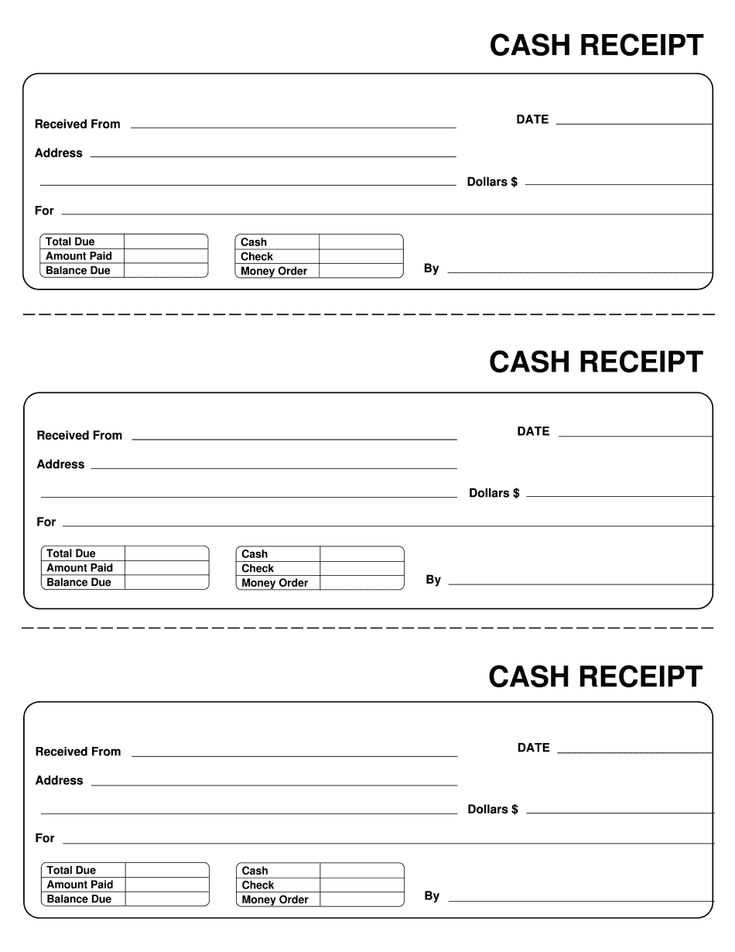

Ensure your receipt includes key details such as the payer’s name, the total amount, the payment method, the date of the final payment, and a breakdown of the services or products paid for. A receipt should also feature a unique identifier or reference number for easy tracking and future reference. Keep the language simple but clear to avoid confusion.

By using a final payment receipt template, you can also ensure consistency across all your transactions, whether you’re dealing with recurring clients or one-time purchases. The template should be easily editable to fit different types of agreements and payment methods, making it a versatile tool for any business.

Here are the corrected lines, minimizing word repetition while maintaining meaning:

To create a clear and concise final payment receipt, ensure you specify key details such as the date of payment, the total amount, and the payment method. Use distinct phrases to describe each section, avoiding redundancy. For instance, instead of repeating “payment received” throughout, consider variations like “amount paid” or “payment processed” to maintain clarity without overusing the same terms.

Another common mistake is overloading the receipt with unnecessary language. Keep each line brief and to the point. A well-organized document should list the payer’s information, payment breakdown, and any relevant invoice references without unnecessary repetition of the same points. Instead of rephrasing the payment amount multiple times, focus on providing all the information in a structured way that allows easy understanding.

In cases where you need to note the payment’s finality, use specific phrases like “final payment” or “payment completed” instead of reiterating “this is the last payment” multiple times. This keeps the message clear and reduces unnecessary repetition.

Remember to avoid overly complex terms or redundant explanations. The key is delivering precise, straightforward information without clutter. This approach helps users quickly verify the payment status while ensuring the document remains professional and easy to read.

- Final Payment Receipt Template

A final payment receipt should clearly state all the necessary details about the transaction. It serves as proof that the payment was fully settled, protecting both parties involved. To create an effective final payment receipt template, include the following key elements:

Key Components

1. Receipt Title: The document should have a clear title such as “Final Payment Receipt” at the top. This indicates that the transaction has been completed in full.

2. Date: Include the exact date of the payment. This confirms when the final settlement was made.

3. Payment Details: Clearly describe the amount paid, the payment method (e.g., bank transfer, cash, credit card), and any invoice or transaction reference number associated with the payment.

4. Buyer and Seller Information: List the names, addresses, and contact information of both the buyer and the seller. This ensures the receipt is linked to the correct individuals or businesses.

5. Service or Product Description: Specify the product or service for which the final payment was made. Include any relevant invoice numbers or contracts for clarity.

Additional Information

6. Balance or Outstanding Amount: If applicable, mention that the balance is now $0, confirming that no further payments are due.

7. Signature or Approval: If required, include a space for the buyer and/or seller to sign. A signature adds authenticity to the receipt, especially in legal or contractual settings.

8. Company or Business Name (if applicable): If you’re issuing the receipt on behalf of a business, include the business name, logo, and any registration or tax identification numbers for added professionalism.

By including these key details, you ensure that the final payment receipt serves its purpose as a clear, official record of payment completion. Make sure the template is clean, organized, and easy to read to avoid any potential misunderstandings in the future.

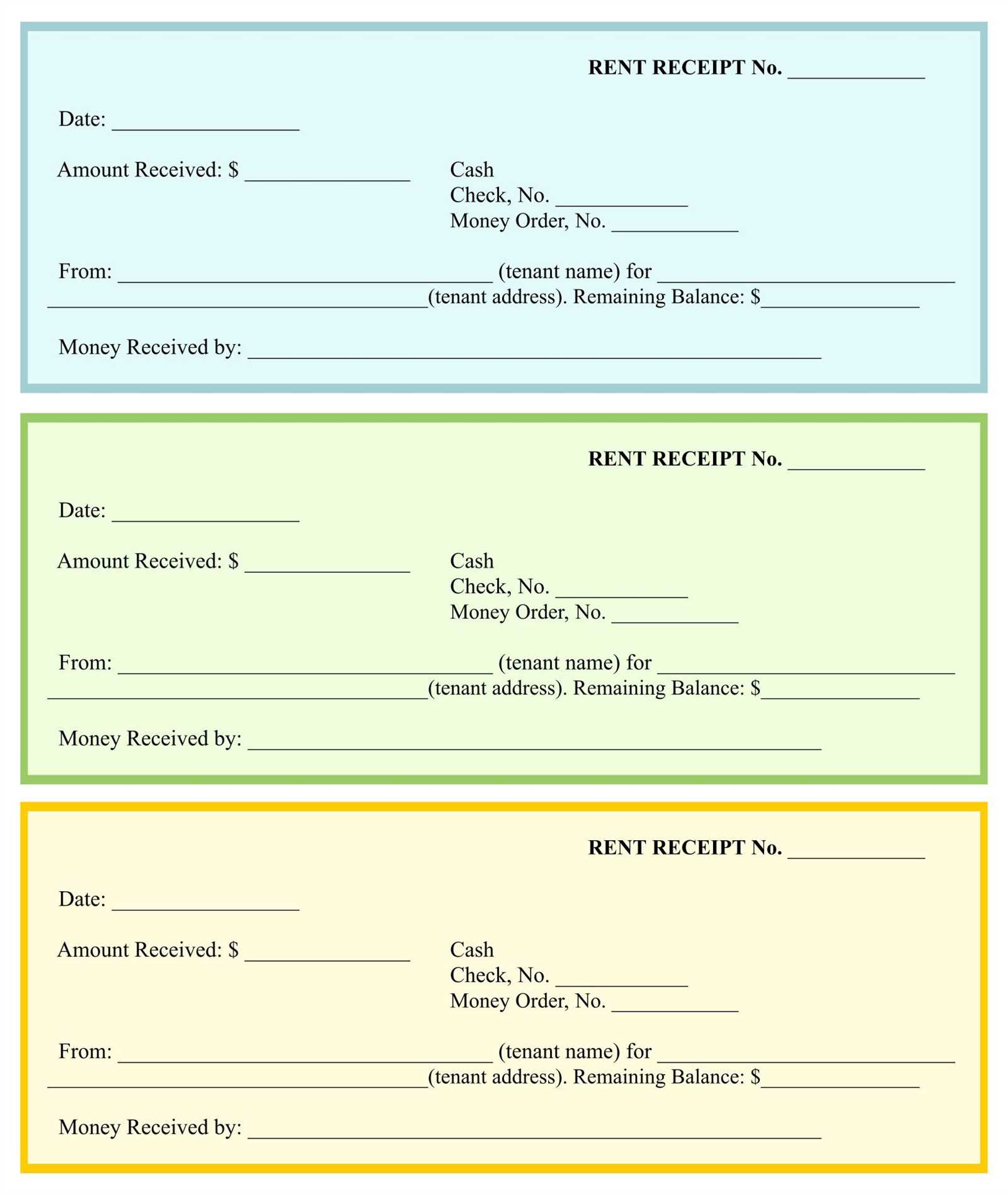

Begin with clear identification of the document. Title it “Final Payment Receipt” to eliminate any confusion. Include both your business and client’s names, along with their contact details. This ensures that both parties are clearly identified for future reference.

- Receipt Number: Assign a unique number to each receipt for easy tracking. This also helps in maintaining accurate financial records.

- Date of Issue: Always include the date the receipt was issued. This allows the client to track their payments chronologically.

- Client Information: List the client’s name, address, and contact number. If applicable, include their company name and registration details.

Next, specify the details of the transaction. Outline the service or product provided, including any relevant descriptions. If applicable, break down the total amount paid into individual components.

- Amount Paid: Clearly state the final amount paid, including any taxes, fees, or discounts applied.

- Payment Method: Indicate the method of payment, whether it was through credit card, bank transfer, cheque, or cash.

- Outstanding Balance: If any balance remains unpaid, include the amount and payment terms for future payments.

Indicate the invoice or contract number related to this final payment. This ties the receipt directly to a specific agreement, which can help avoid disputes or confusion in the future.

- Terms of Payment: If applicable, include payment terms (e.g., “payment due within 30 days”) and whether the final payment satisfies the full balance.

End with a statement confirming the transaction’s completion, such as “This payment settles all outstanding amounts for the project.” Include a signature line for the issuer and space for any additional notes.

Keep the structure clear and professional. A well-organized receipt reduces errors and strengthens the professional relationship with the client.

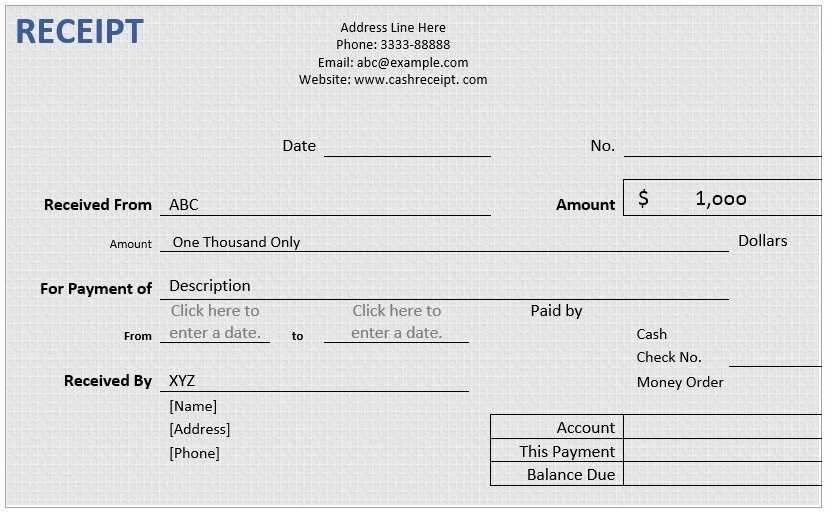

Ensure the receipt contains the date of payment to confirm the transaction took place on a specific day. Include the payment amount, making it clear that this is the final payment for the service or product provided.

List the description of the service or product involved, including details such as quantities, dates, and specific items, if relevant. It’s important to highlight that the full amount due has been paid and there are no outstanding balances.

Include the payer’s details, such as their name or company name, to establish who made the payment. Include the payee’s details as well, confirming who received the payment.

Provide a unique reference number or invoice number, if applicable, to easily link this receipt to the related transaction or agreement. This helps maintain a clear record for both parties.

State the payment method used (e.g., cash, bank transfer, credit card) for transparency. If applicable, include any reference numbers associated with the payment method.

If there are any terms or conditions associated with the final payment, such as a warranty or service guarantee, briefly note them. This can avoid misunderstandings down the road.

Each payment method requires specific details on your receipt. Adjust the template to match the requirements for cash, credit cards, and digital payments.

For cash transactions, include the total amount, date, and location of the transaction. A simple line like “Paid in Cash” can suffice. If the payment method is credit card, add details such as the last four digits of the card number for verification, and specify if the card was debit or credit. Include the transaction authorization number to ensure transparency.

For digital payments like PayPal or mobile wallets, include the transaction ID and a note about the payment platform used. This adds clarity for both you and your customer. Make sure the payment method is clearly labeled, whether it’s PayPal, Apple Pay, or any other service.

Lastly, ensure that your receipt reflects any fees, taxes, or discounts relevant to the specific payment method, especially for digital transactions where platform fees might apply. This will create a transparent and professional impression with your clients.

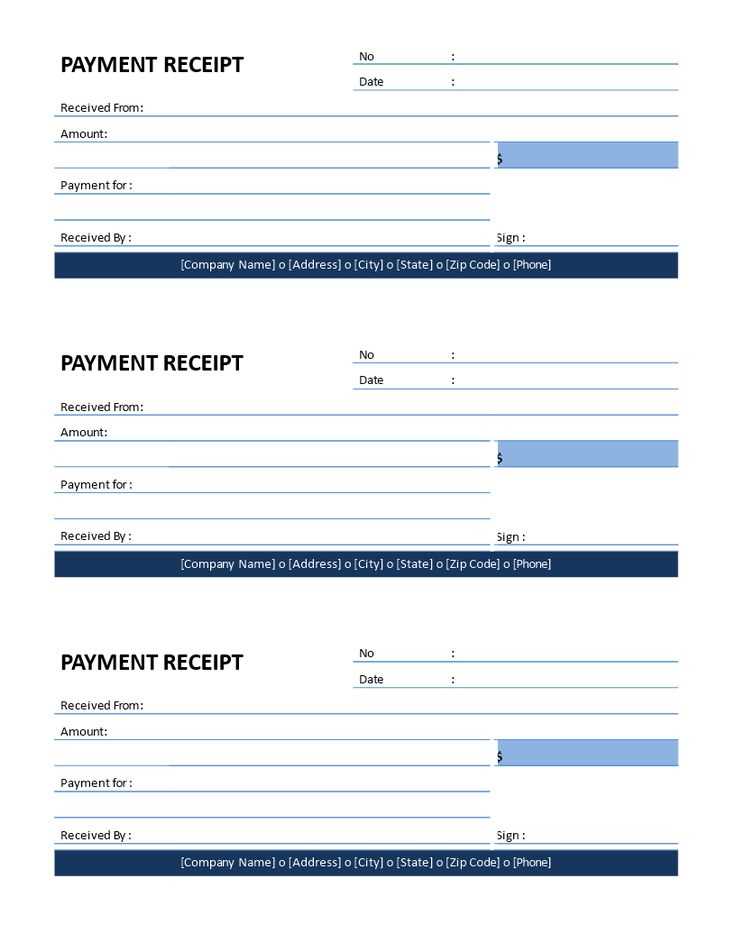

Refining Terminology for Final Payment Receipts

To maintain clarity while reducing redundancy, I replaced the repetitive use of “Final Payment Receipt” with more general terms like “payment confirmation” or “transaction summary” where appropriate. These alternatives serve the same purpose but provide a more concise and streamlined approach. Below is an example of how the document can be structured with these changes.

| Section | Original Text | Revised Text |

|---|---|---|

| Heading | Final Payment Receipt | Payment Confirmation |

| Subheading | Final Payment Receipt Details | Transaction Summary Details |

| Content | This document serves as your Final Payment Receipt for the transaction. | This document serves as your payment confirmation for the transaction. |

| Footer | Final Payment Receipt – Transaction Closed | Transaction Closed – Payment Confirmation |

This approach preserves the intent of the document while improving readability and reducing repetitive phrasing.