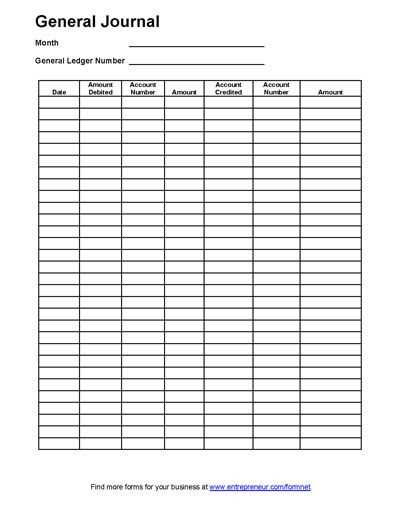

Using a blank cash receipts journal template can simplify your financial tracking process. It provides a straightforward way to document all incoming cash transactions, ensuring nothing slips through the cracks. This template will help you categorize receipts by date, amount, and source, making it easy to generate reports and maintain accurate records.

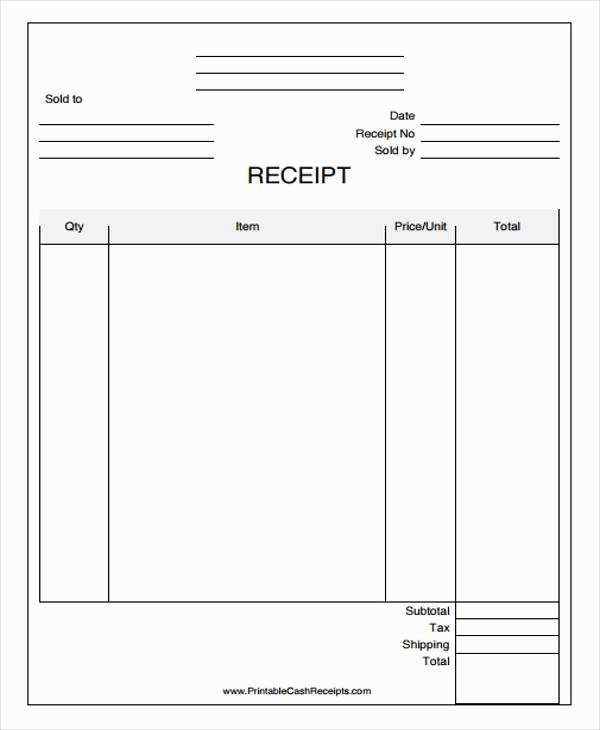

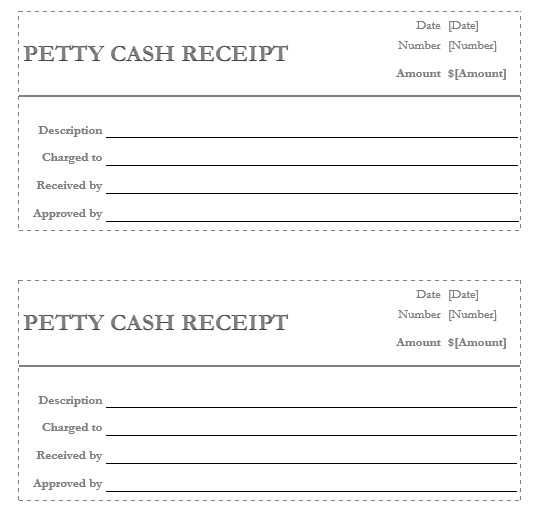

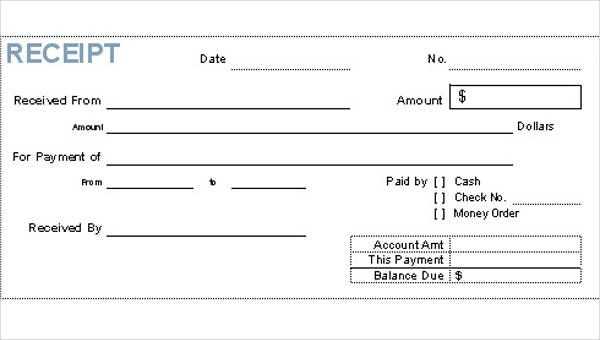

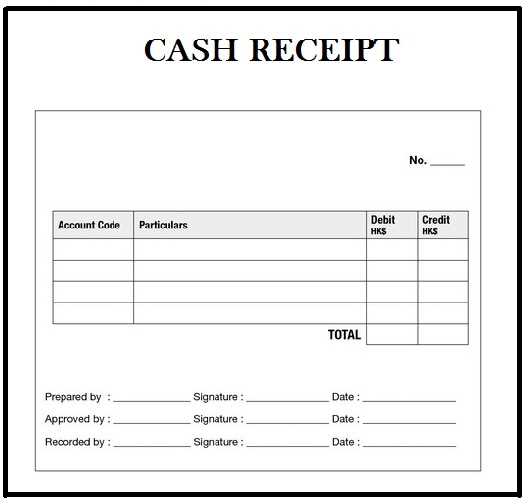

Make sure the template includes essential fields, such as the receipt number, payer details, amount received, and method of payment. These fields ensure clarity and make it easier to review financial records when needed. You can easily customize the template to fit your specific business needs by adding or removing categories.

A well-structured journal template not only supports better organization but also helps with financial reconciliation. It reduces the chance of errors or omissions in your accounting system, creating a smoother workflow for both small and large businesses. Consider integrating this tool into your regular accounting routine to save time and enhance accuracy.

Here’s the corrected version with reduced repetition:

Ensure each entry in your cash receipts journal is unique and specific. Avoid redundancy by using distinct descriptions for transactions. Instead of repeatedly entering similar wording, focus on varying the phrasing for each type of receipt. This makes tracking easier and improves clarity for auditors.

Separate the date, amount, and payee information into individual columns to prevent unnecessary repetition of the same details. For example, if a customer makes several payments on the same day, enter each transaction in its own row. This method will help maintain an organized and accurate record.

Additionally, use consistent terminology across the journal for different types of receipts to minimize confusion. Avoid using the same terms for different types of transactions, as this can lead to overlap and errors. Instead, choose clear labels for each category of receipt and stick to them consistently.

Lastly, review your journal template regularly. Make adjustments based on your business needs to streamline the process and eliminate any unnecessary repetition. A well-organized journal will save time and reduce the risk of errors in the long run.

Blank Cash Receipts Journal Template

How to Choose the Right Template for Your Business

Setting Up a Cash Receipts Journal in Excel or Google Sheets

Key Columns to Include in Your Receipts Journal

How to Track and Record Payments Correctly

Customizing Your Receipts Journal for Specific Business Needs

Common Mistakes to Avoid When Using a Receipts Journal

Choose a blank cash receipts journal template that aligns with the specific needs of your business. Make sure the template is clear and easy to customize. Look for one with essential fields like date, payment amount, payment method, and source (customer or invoice number). You want a layout that helps you track all transactions efficiently without overwhelming you with unnecessary columns.

For simple setup, Excel or Google Sheets works best. Create columns for the date of the transaction, customer name, amount received, payment method (e.g., cash, check, credit card), and reference number. If you’re tracking multiple payments from the same customer or dealing with sales taxes, include additional columns for these details. Both Excel and Google Sheets allow for easy data manipulation, filtering, and basic formulas to sum totals or calculate balances.

Key columns to include are:

- Date

- Receipt Number

- Customer/Source Name

- Amount Received

- Payment Method

- Reference/Invoice Number

- Account/Revenue Category

Recording payments requires consistency. Each time a payment is received, enter it promptly. Double-check the payment method and ensure it matches the recorded transaction. If possible, attach any relevant receipts or documentation for verification. For businesses handling multiple transactions daily, batch processing payments at the end of the day can help maintain accuracy.

Customizing your receipts journal helps tailor it to your business model. For instance, service-based businesses may want to track payment for individual services, while product-based businesses might prefer to include product codes or quantities. Adjust the template so that it fits your workflow without adding unnecessary complexity.

Avoid common mistakes like not updating the journal regularly, entering payments incorrectly, or failing to match payments with corresponding invoices. Also, ensure that the format stays consistent, and avoid altering column headers mid-way through the year. Missing or inconsistent data can lead to errors that are difficult to correct later.