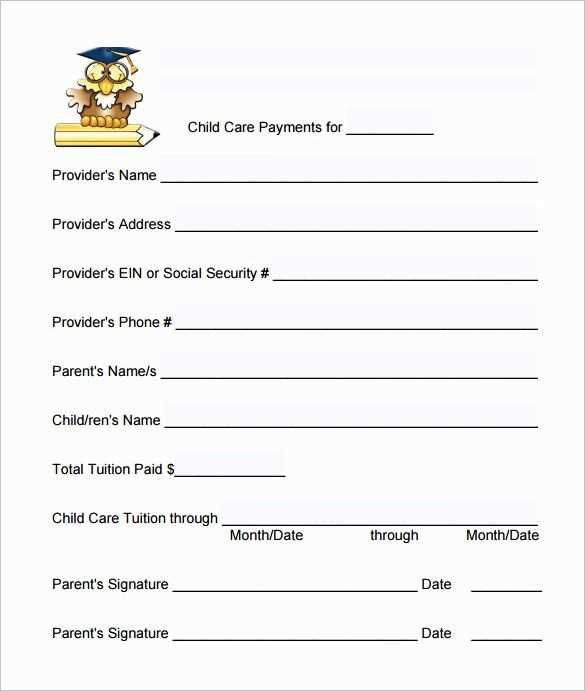

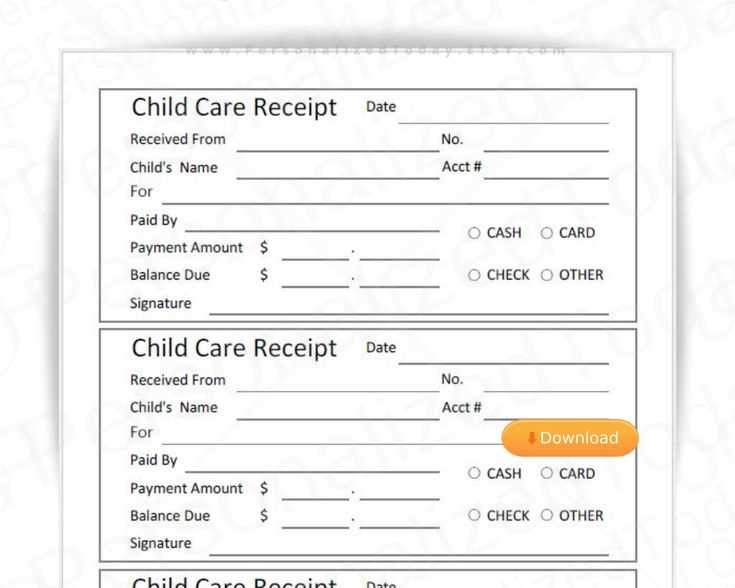

A well-organized day care receipt can simplify financial tracking and ensure transparency for both parents and providers. This template helps you create clear, concise records for each transaction, keeping all necessary information in one place. It includes details such as the provider’s contact information, the child’s name, dates of care, and the total amount due or paid. With a simple structure, you can tailor it to fit specific needs, whether for one-time payments or recurring charges.

Customize your template by including payment methods and any additional fees, such as late charges or special services. Make sure the date range of care is clearly stated to avoid confusion. This is particularly useful for tax purposes, as well as maintaining an accurate financial history for both parties.

By using a consistent format for receipts, both providers and parents can stay on the same page and easily track payments over time. A clean, straightforward document can prevent misunderstandings and keep the financial side of child care running smoothly.

Here is the corrected version:

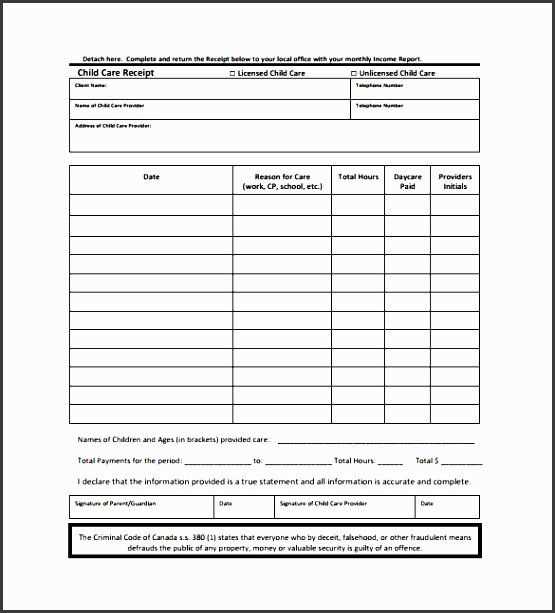

Ensure the date and time are clearly stated on the receipt. Include the exact hours of care provided to avoid confusion. Break down the cost per hour or per session if applicable, and specify any discounts or additional charges. This transparency helps both parties verify the transaction details.

Make sure to include the name and contact information of the daycare provider. This provides a point of reference in case of any questions or disputes. Also, include the child’s name and age for clarity.

Provide a section for both the daycare provider and the parent or guardian to sign, confirming the transaction. This step adds credibility to the receipt and serves as an acknowledgment of the service provided.

Always keep a copy of the receipt for your records. Having a backup ensures you have documentation in case of any future queries or audits.

- Day Care Receipt Template Guide

A well-structured receipt for day care services is a vital document for both the provider and the parent. It provides proof of payment, which can be used for tax purposes or record-keeping. When creating a day care receipt template, focus on clarity and detail. Ensure that all necessary fields are covered without overcomplicating the format.

Key Elements of a Day Care Receipt Template

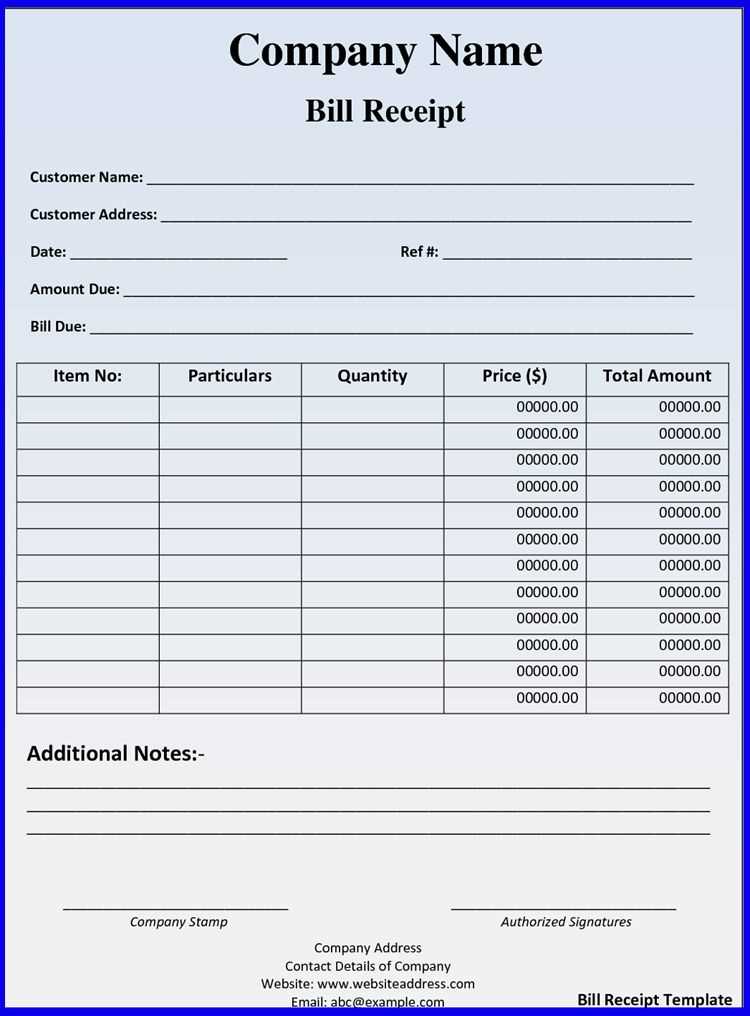

Your receipt should contain the following key details:

- Provider’s Name and Contact Information: Include the name of the day care center or individual, along with address, phone number, and email.

- Parent/Guardian Information: The name and contact information of the person receiving the services.

- Payment Details: Clearly state the amount paid, including any applicable taxes, discounts, or fees. Break down the total cost by hourly rates, full-day care, or special services if necessary.

- Date of Service: List the date or dates for which the payment is being made. For recurring services, include the billing period.

- Payment Method: Specify how the payment was made–whether through cash, credit, check, or digital payment platforms.

- Receipt Number: Include a unique receipt number for easy reference in case of inquiries or refunds.

Formatting the Template

When formatting the template, keep the layout simple and easy to read. Use a professional font and organize the sections logically. Place the payment details and the total amount prominently to avoid confusion. Consider adding a signature line or a “Thank you” note at the bottom to add a personal touch.

With a clean design, the receipt will not only be useful for documentation but also reflect a professional approach to your day care business.

Begin by listing the daycare provider’s full name, business name (if applicable), and contact details. Clearly state the child’s name and the service dates. Include a breakdown of the charges, such as the daily or hourly rate, any special services provided, and applicable taxes or fees. Calculate the total amount charged and the payment method used (cash, check, card, etc.). Assign a unique receipt number for easy reference. Finally, sign or initial the receipt to confirm the transaction is complete.

Provide the following details in your daycare receipt to make sure it is clear and complete:

| Item | Details |

|---|---|

| Provider’s Name and Contact Information | Include your full name, business name (if applicable), phone number, and email address. |

| Parent’s or Guardian’s Name | Clearly state the name of the child’s parent or guardian who made the payment. |

| Date of Service | List the specific days and times the daycare service was provided. |

| Amount Paid | Specify the total amount paid for services, including any applicable taxes. |

| Payment Method | Note how the payment was made (e.g., cash, check, credit card, online transfer). |

| Invoice Number or Receipt ID | Assign a unique identifier for each receipt to track payments easily. |

| Service Description | Provide a brief breakdown of the services rendered (e.g., hourly rate, full day care). |

| Any Discounts or Additional Fees | If any discounts or extra charges were applied, list them clearly. |

When issuing receipts for day care services, make sure to comply with both legal and tax requirements. These considerations ensure your business operates smoothly while offering transparency to your clients.

1. Accurate Record-Keeping

Keep detailed records of all transactions. Receipts should include the following information:

- Name and contact details of the day care provider.

- Details of the services provided, including the dates and times.

- Amount paid and payment method (e.g., cash, credit card, cheque).

- Tax identification number (TIN) of the provider.

- Signature of the person issuing the receipt (if required in your jurisdiction).

2. Tax Deductions for Parents

Many parents may qualify for tax deductions based on day care expenses. Ensure your receipts are detailed enough to help parents claim these benefits. Include a clear breakdown of charges, noting which portion applies to child care services. If you operate as a licensed provider, make sure your services are eligible for deductions and that you include your tax ID number on each receipt.

3. Local and State Regulations

Check your local and state regulations for specific rules regarding receipt issuance. Some regions require providers to issue receipts only if requested by the customer, while others may have mandatory receipt formats or digital receipt guidelines. Stay updated on local laws to avoid potential fines.

4. Employment Tax Compliance

If you employ staff to assist with day care services, make sure to withhold the appropriate taxes. This includes social security, Medicare, and any state-specific payroll taxes. Receipts issued to clients should clearly separate employee wages and service fees to maintain transparency and avoid tax issues.

5. Refunds and Adjustments

In cases of refunds or service adjustments, issue updated receipts showing the revised payment amounts. Always include a note explaining the reason for any changes to avoid confusion for both parties during tax season.

Receipt Formatting for Day Care Services

Ensure your day care receipt is clear and easy to understand. Begin with the child’s name, the date of service, and the total amount charged. List any individual charges separately for transparency, such as hourly rates or additional fees for special activities.

For better tracking, include the payment method, whether it’s cash, check, or credit card. If payments are made through a third party, note the payer’s details clearly.

Include your business’s name, address, and contact information at the top for easy reference. This allows clients to reach you if any questions arise regarding the charges.

Close with a statement confirming the payment status (e.g., “Paid in full” or “Partial payment received”) and provide a space for signatures or additional notes if necessary.