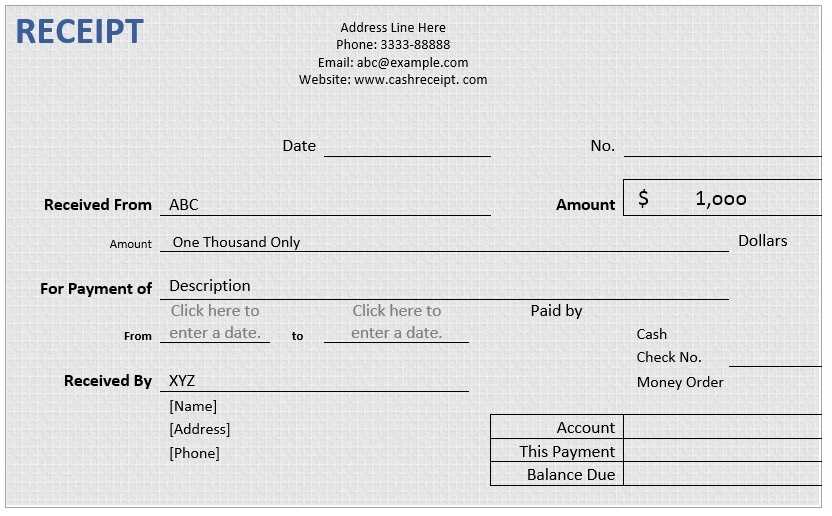

To make tax deductions easier, use a clear and structured receipt template. This template should include the recipient’s name, date of the transaction, and the exact amount paid for the service or product. Add a short description of the purpose or nature of the expense, along with the provider’s name and contact information. If applicable, ensure to include tax identification numbers or business registration details for legitimacy.

Keep the format simple yet professional. A well-organized receipt can serve as proof of an eligible deduction for your tax filing. If you’re a business owner, using such a template for transactions with clients or customers makes the process smoother for both parties during tax season.

By incorporating these elements, you ensure transparency and reduce the risk of audit issues. It’s not just about keeping records; it’s about creating documents that support your claims. Use this template to stay organized and simplify the tax deduction process for yourself or your business.

Tax Deduction Receipt Template

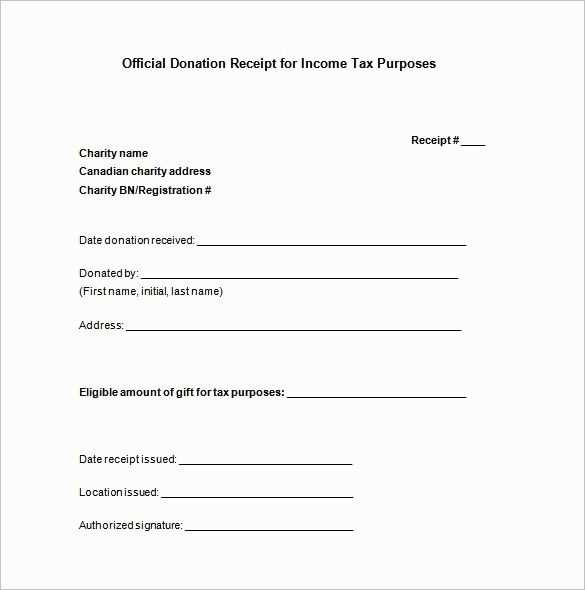

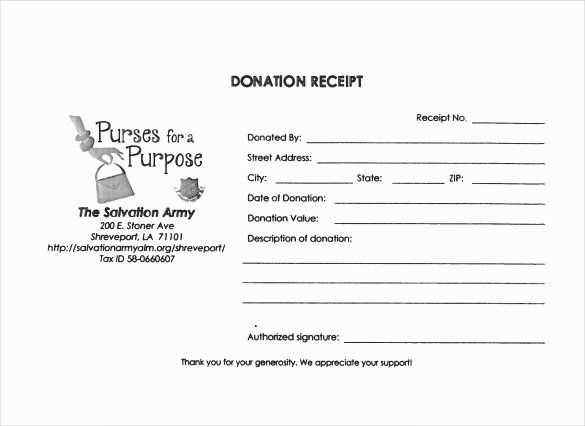

To create a tax deduction receipt, include these key details: the name and address of both the donor and the recipient, the date of the donation, a description of the item or service donated, and the fair market value of the donation. Make sure to also add a statement confirming whether the donation was made with or without any compensation or goods received in return. The receipt should be signed by the recipient organization.

Basic Information Required

Start with the donor’s full name and address, followed by the recipient’s organization name and contact details. Then, list the date of the donation and the specific nature of the gift. If it’s a non-cash item, provide a clear description along with the estimated fair market value. Ensure the receipt includes a declaration stating the donor did not receive any goods or services in exchange for the donation, or outline the details of any such exchange if applicable.

Receipt Format and Structure

The template should be straightforward. Use simple, clear language and break down the information into easy-to-read sections. A professional and organized layout ensures both parties understand the details of the transaction. Add a line for the recipient’s signature to validate the receipt and provide legitimacy.

Keep in mind, some jurisdictions may require additional information or specific language for tax deduction purposes. Always check the latest guidelines for accuracy before issuing the receipt.

How to Structure a Tax Deduction Receipt

Begin by including the full name and address of the organization or individual issuing the receipt. This information establishes authenticity and helps verify the source of the donation.

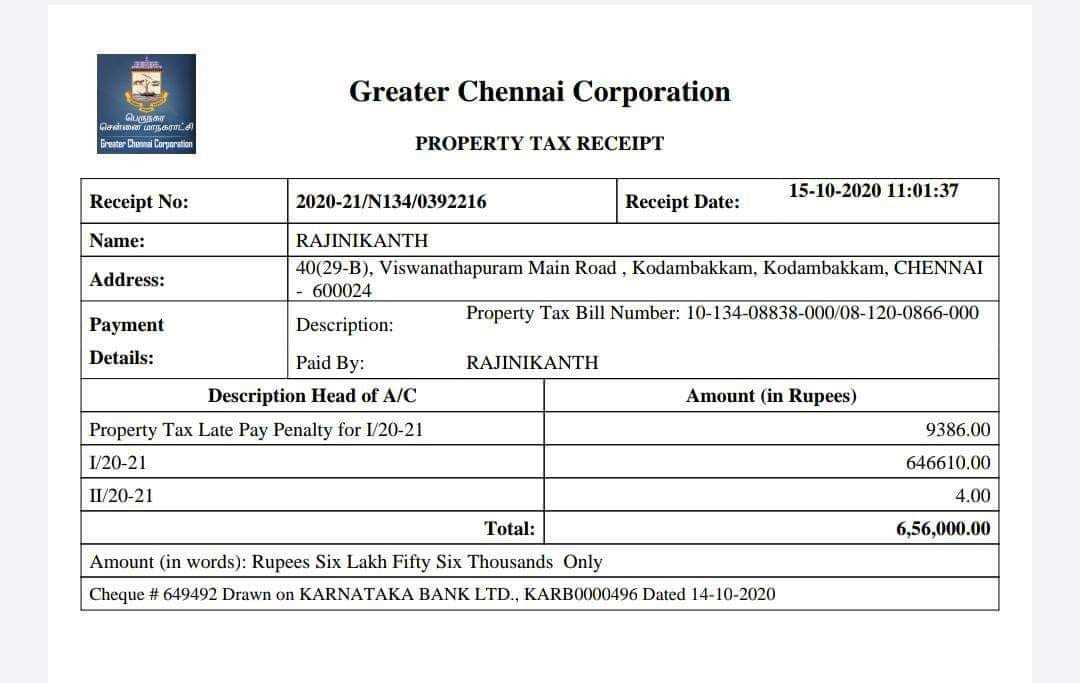

Next, clearly state the date when the donation was made. This provides a timeline for the transaction and is crucial for tax records.

Specify the donor’s name and address. This ensures that the deduction is linked to the correct individual or entity for tax purposes.

Describe the donation in detail. If it’s a cash donation, state the exact amount. For non-cash donations, provide a description of the items, their condition, and their estimated value. This helps establish the value of the deduction.

Include a statement confirming whether any goods or services were provided in exchange for the donation. If so, list these items or services and their fair market value. This ensures transparency and correct deduction calculations.

End the receipt with the signature of the authorized person issuing the receipt. This adds an official seal to the document and confirms its validity.

- Donor’s name and address

- Organization’s name and address

- Donation amount or item description

- Date of donation

- Goods or services received (if applicable)

- Authorized signature

Required Information for Tax Deduction Receipts

Each tax deduction receipt must include specific details for proper documentation. First, list the payer’s name and contact information, ensuring accuracy in the identity of the entity providing the deduction. Clearly state the date of payment and amount paid, showing the exact sum paid for the qualifying expense.

Next, describe the nature of the expense, including the service or product purchased and its relevance to the deduction. If applicable, include any invoice numbers or reference codes that verify the transaction. If the deduction relates to a specific purpose (e.g., education, healthcare), mention that clearly.

For transparency, include the method of payment (credit card, cash, check, etc.) and any corresponding transaction details. Finally, always ensure that the receipt is signed by the authorized person who processed the transaction, confirming the legitimacy of the information provided.

Common Mistakes to Avoid in Receipt Templates

Ensure the receipt clearly states the business name and contact details. Avoid vague or missing information about the seller, as this can cause confusion during tax reporting.

Incorrect or Missing Date and Time

Always include an accurate date and time of the transaction. An absent or incorrect timestamp can lead to issues during tax filing or audits. Be precise with the format and placement to avoid misinterpretation.

Unclear or Ambiguous Item Descriptions

Be specific about each item or service purchased. Ambiguous terms like “miscellaneous” or “various” are unhelpful. Detailed descriptions make it easier for both the buyer and tax authorities to understand what was purchased.

Check for accurate amounts, taxes, and totals. Small mistakes, like incorrect tax rates or rounding errors, can cause discrepancies. Double-check the math before finalizing the template.