To create a bonus receipt template, focus on including the most relevant details that both the payer and receiver will need. Include clear information about the bonus amount, the date of issuance, and any applicable conditions or restrictions. Ensure that the recipient’s name and contact details are clearly visible, along with the payer’s company or organization information.

Make the template easy to understand by using simple and direct language. Avoid unnecessary jargon, and clearly outline the reason for the bonus, whether it’s performance-based or a company-wide incentive. This will prevent any confusion for both parties involved.

For added transparency, include a breakdown of how the bonus was calculated, if applicable. For example, if it’s a percentage of sales or a fixed amount based on achievements, provide a clear reference to the calculation method.

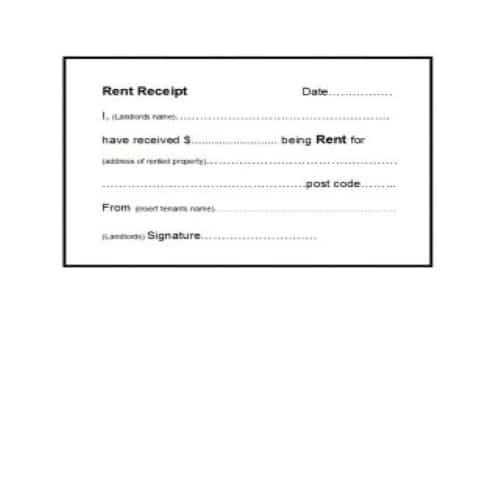

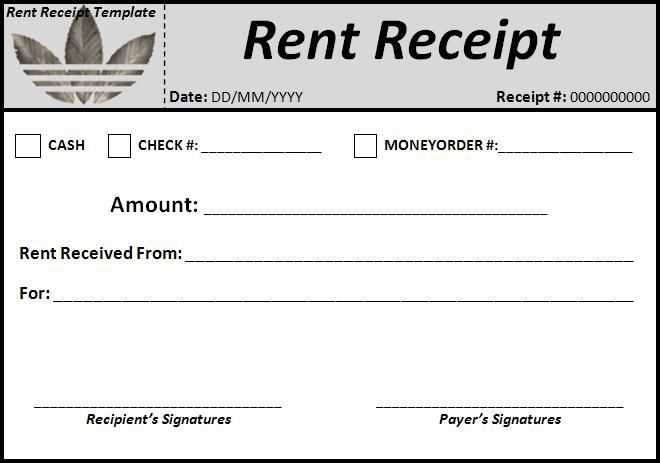

Don’t forget to include space for both signatures–the payer and the recipient. This serves as formal confirmation of the transaction and helps avoid any future disputes. Having both parties sign the receipt solidifies the agreement.

Here’s the corrected version:

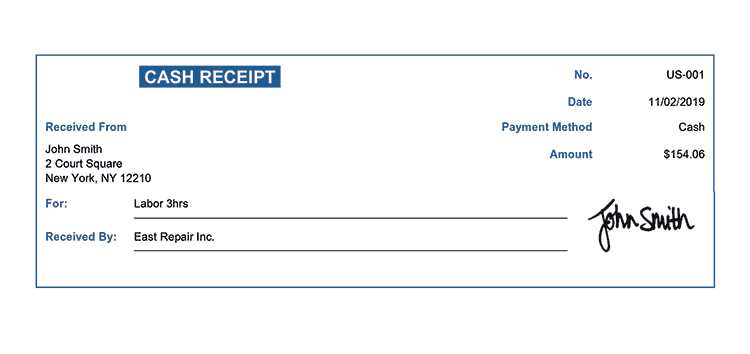

To ensure accuracy in your bonus receipt, include the employee’s name, the bonus amount, and the calculation method used to determine the bonus. Specify the date the bonus is awarded and outline any conditions that apply, such as performance metrics or specific milestones. This will make the receipt clear and transparent.

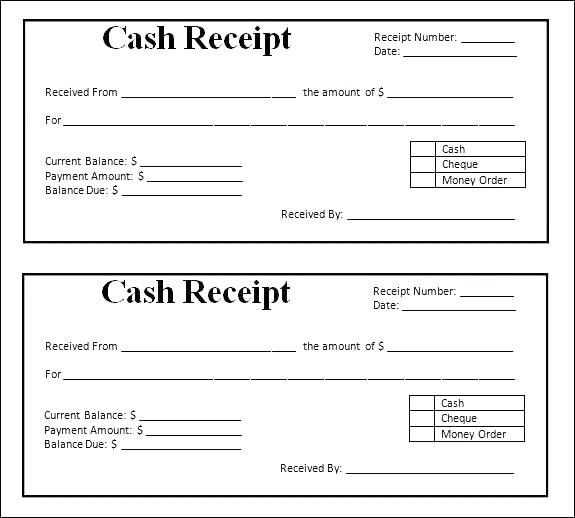

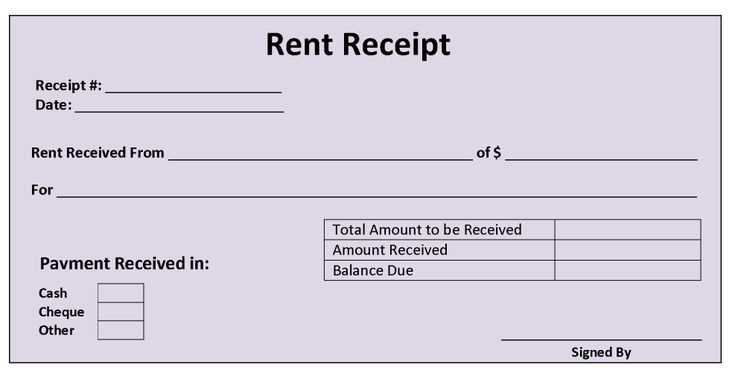

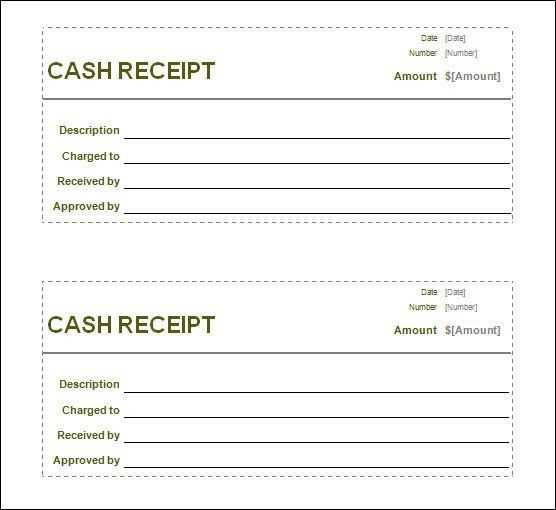

Double-check the format to ensure it aligns with your company’s payroll system. Include both gross and net amounts, and clarify if taxes have already been deducted or if they will be processed separately. A concise, straightforward breakdown of deductions and final amounts helps prevent misunderstandings.

It’s helpful to include a reference number or a unique identifier for each bonus payment. This will make it easier for both the employee and the finance department to track payments for future reference or in case of disputes.

End the document with a brief note about the bonus payment terms, such as whether it’s a one-time payment or part of an ongoing incentive program. Providing clear, detailed information makes the process more transparent for everyone involved.

- Bonus Receipt Template Overview

To create a clear and organized bonus receipt template, include the key details that ensure both parties are on the same page. The receipt should highlight the bonus amount, the reason for the bonus, and the date of issuance. A structured format helps avoid confusion and establishes transparency in any financial transaction.

Key Elements of the Template

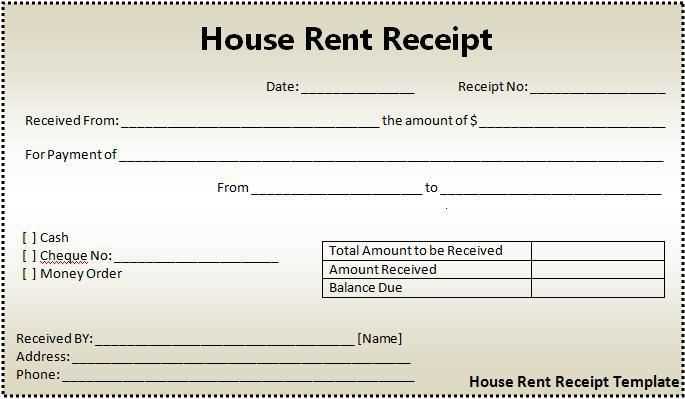

Start with the company name and contact information at the top, followed by the recipient’s details. Clearly state the bonus amount and the specific reason behind the bonus. Include the date when the bonus is given and a unique reference number for tracking purposes.

Formatting Tips

Use clean and simple fonts for readability. Ensure that the layout is straightforward, with sections properly separated. Bold key information, like the bonus amount and date, to make it easy to identify at a glance.

To create a clear and practical bonus receipt, follow a simple format that includes essential details such as employee name, bonus amount, and the date of issuance. Ensure the structure is straightforward to avoid confusion.

Key Information to Include

Start with the recipient’s name, followed by the date and the bonus amount in both numerical and written form. This helps in verifying the accuracy of the transaction. It’s also helpful to provide a reference number or code, in case further tracking or queries arise.

Formatting Tips

Organize the receipt into sections, with each one clearly labeled. For example, place the employee details in the top section, followed by the bonus amount and date. Keep the font size legible and ensure sufficient spacing for ease of reading.

Ensure that bonus receipts comply with local tax regulations. This includes accurate reporting of bonuses as taxable income for employees or customers. Failing to account for bonuses in this manner could lead to penalties or legal disputes.

Documentation and Transparency

Provide clear documentation that outlines the conditions under which bonuses are issued. This transparency helps both parties understand their rights and obligations. Be explicit about the amounts, timelines, and any relevant restrictions tied to the bonus.

Data Privacy Considerations

Maintain the confidentiality of recipients’ personal data when issuing bonus receipts. Secure storage and handling of sensitive information is a legal requirement under data protection laws. Only authorized personnel should have access to these details.

Customize your bonus receipts to fit the needs of your specific business type by adjusting the layout, fields, and information included. For retail businesses, include detailed information about the purchase, such as product descriptions and amounts. This helps customers track their bonus points or rewards more effectively. For service-based businesses, focus on including details like service type, time, and bonus earned based on the service rendered.

For Restaurants and Cafes

In foodservice establishments, add elements like the number of guests, order details, and a breakdown of bonuses based on the bill total. Customize the receipt with promotional offers or seasonal bonuses to increase customer engagement. Keep it clear and concise, so customers can easily understand how they earned their bonus and how it can be used.

For Online Retailers

Online stores can streamline bonus receipts by offering digital versions that are automatically sent via email or as downloadable PDFs. Include purchase history, a clear breakdown of bonuses earned, and expiry dates for bonus points. This format keeps the receipt compact and easily accessible for customers, reducing clutter and enhancing the online shopping experience.

For a smooth experience when creating a bonus receipt, follow these key steps:

- Ensure the receipt clearly lists the bonus amount and the date it was awarded.

- Include the reason for the bonus, such as performance, sales, or a specific achievement.

- State any applicable tax deductions or withholdings related to the bonus.

- Include the recipient’s full name and job position for clarity.

- Provide a unique reference number for record-keeping purposes.

This format helps maintain transparency and ensures both parties have a clear understanding of the bonus details.