If you’re looking for a way to quickly document down payments, a receipt template is a simple and efficient solution. Using a template streamlines the process, ensuring all key details are captured without missing any important information. Whether you’re managing a business or making personal transactions, it’s important to have a clear record of the down payment for future reference.

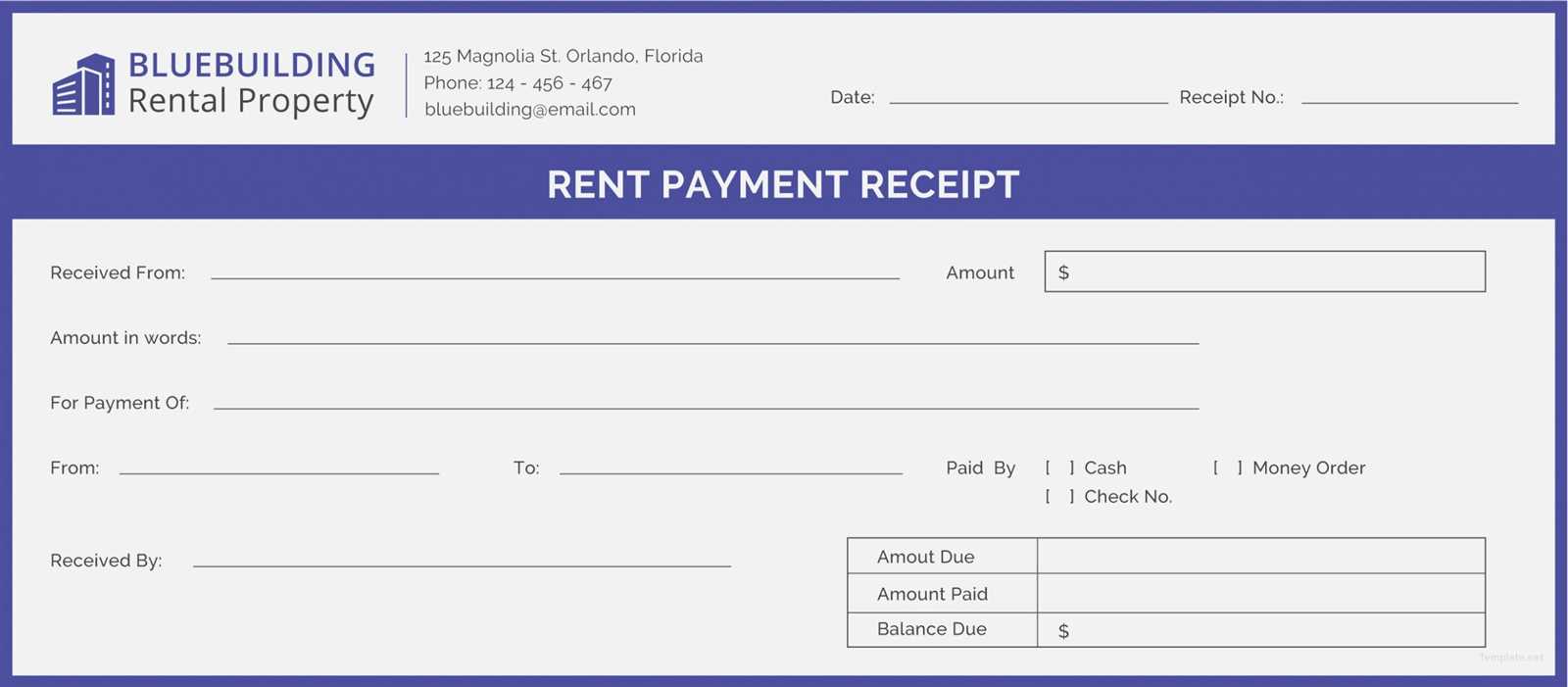

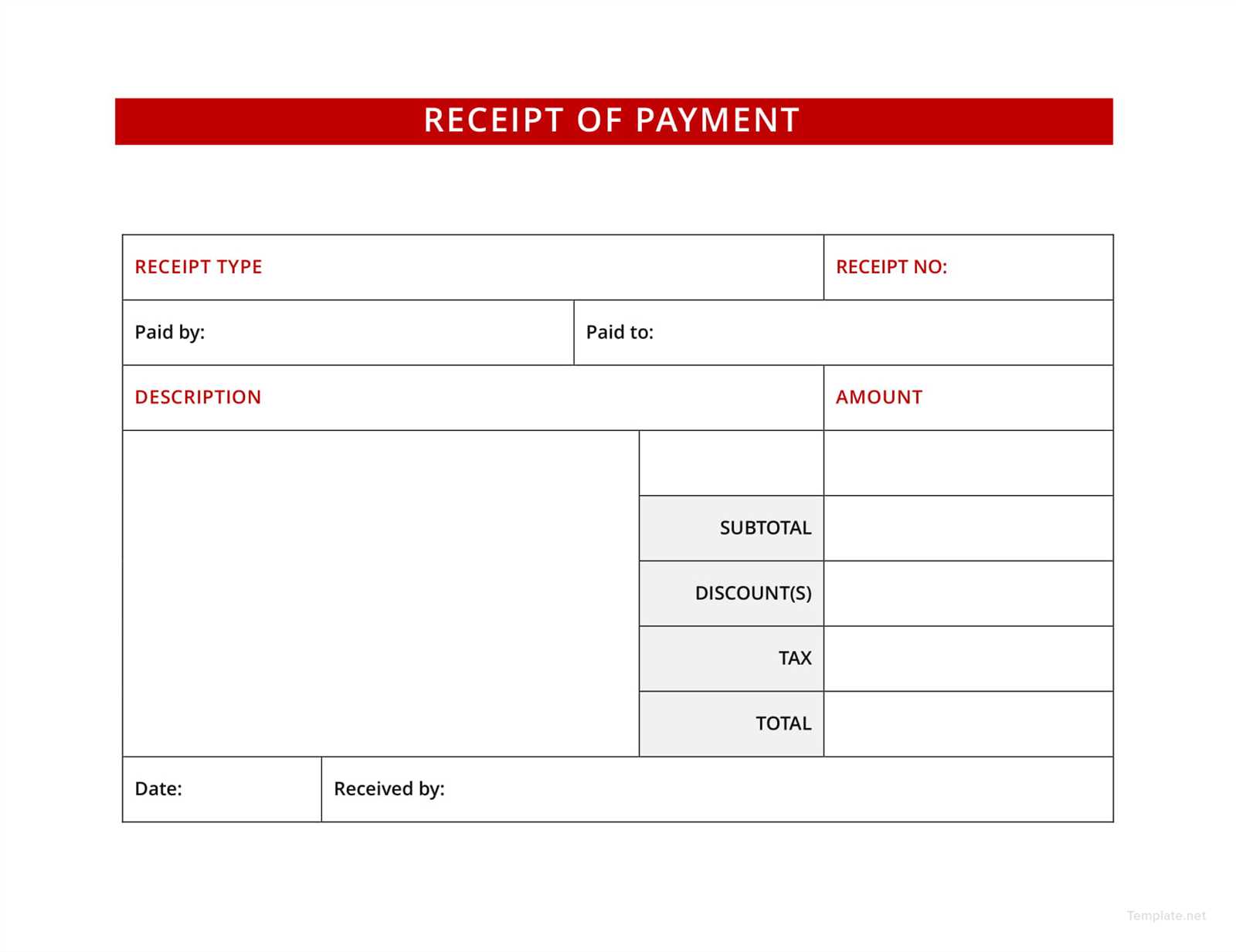

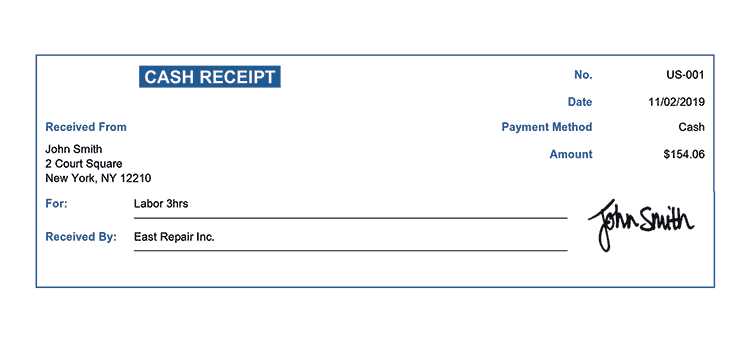

Choose a template that includes fields for the payer’s details, the amount paid, the date of the transaction, and a description of the purpose of the payment. This makes it easier to track payments and avoid confusion down the line. Many templates come preformatted, allowing you to focus on inputting the relevant details rather than worrying about layout or design.

Make sure to update the template with your own branding or business details if you’re using it for commercial transactions. A simple, professional-looking receipt can make your business appear more organized and trustworthy to clients. Save time and effort with a template that can be reused whenever needed, reducing the hassle of creating a receipt from scratch each time.

Here’s the corrected text, maintaining the meaning while reducing repetitions:

When creating a down payment receipt, focus on clear and concise wording. Specify the date, amount paid, and the remaining balance. Include buyer and seller details, and indicate the purpose of the payment. Use a simple format to ensure readability. Avoid unnecessary details that don’t contribute to the transaction, and keep the structure organized. Always verify that the receipt includes a space for signatures to confirm the transaction is acknowledged by both parties.

Free Down Payment Receipt Template

How to Customize a Payment Receipt

Key Details to Include in a Receipt

Choosing the Best Template for Your Needs

Top Tools for Editing Receipts

How to Ensure Legal Validity of the Document

Examples of Common Errors to Avoid in Receipts

Customizing a payment receipt involves adjusting key elements like the buyer and seller details, payment amount, and date of transaction. Make sure all fields are clearly labeled and easy to understand. Choose a template that suits the nature of the payment and the parties involved, ensuring that the format aligns with your business needs.

Key details to include in a receipt should cover the names of both parties, the transaction date, the amount paid, and a description of the goods or services exchanged. Be clear about any taxes or additional fees, and ensure the receipt includes a payment method (e.g., cash, card, check). Include your business contact information for reference.

Choosing the best template depends on the complexity of your transactions. For simple down payments, a basic receipt may suffice, while more complex agreements may require detailed templates with more sections, such as installment schedules or payment conditions. Search for templates that are customizable and adaptable to different scenarios.

Top tools for editing receipts include online platforms like Microsoft Word, Google Docs, or specialized receipt-generating tools. These offer easy-to-use interfaces and pre-built templates, allowing for quick customization. Use programs that allow easy formatting and saving in multiple formats like PDF or Word for easy sharing.

Ensuring legal validity involves making sure your receipt meets all local requirements, including applicable tax laws. Confirm that the receipt reflects accurate transaction details, contains necessary signatures (if applicable), and complies with business regulations in your jurisdiction. It’s also important to keep a copy for both the seller and buyer’s records.

Common errors to avoid in receipts include missing transaction dates, incorrect amounts, or failing to include payment methods. Double-check the accuracy of the buyer and seller details, and ensure there are no typographical errors. Also, avoid leaving out crucial elements like payment terms or conditions, which can lead to confusion later on.