To simplify the process of tracking electronic waste donations, create a detailed receipt that captures the transaction. The template should clearly list the items donated, their estimated value, and the donor’s information. This provides both the donor and recipient with an accurate record for tax purposes or future reference.

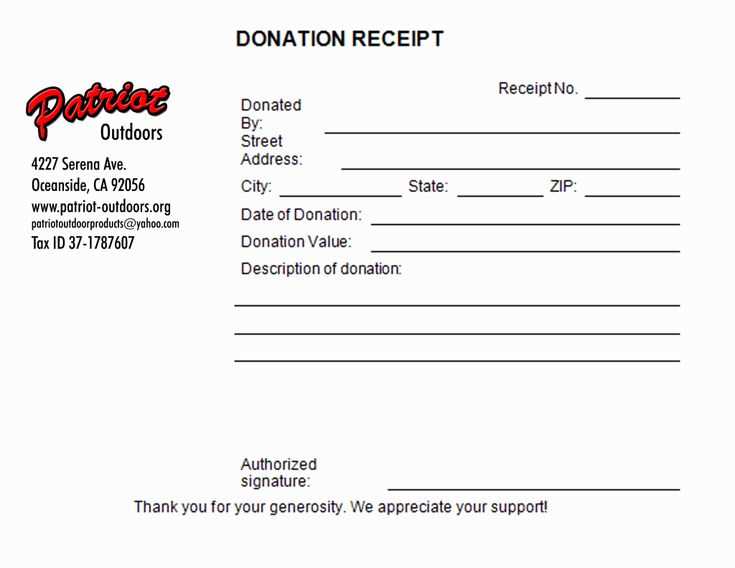

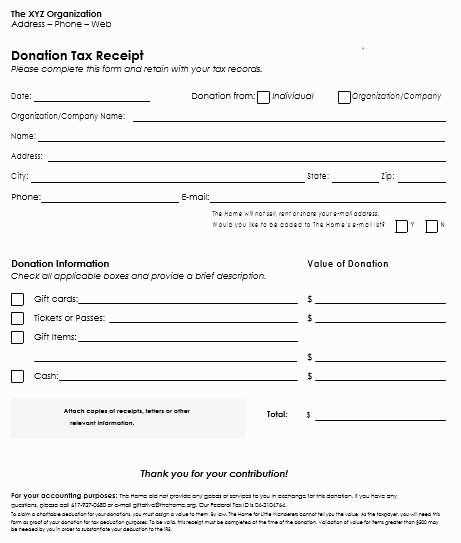

Start with clear headers. Include the donor’s name, address, and contact details. Add the date of donation and the name of the organization receiving the items. This ensures all relevant information is easy to find and organized in one place.

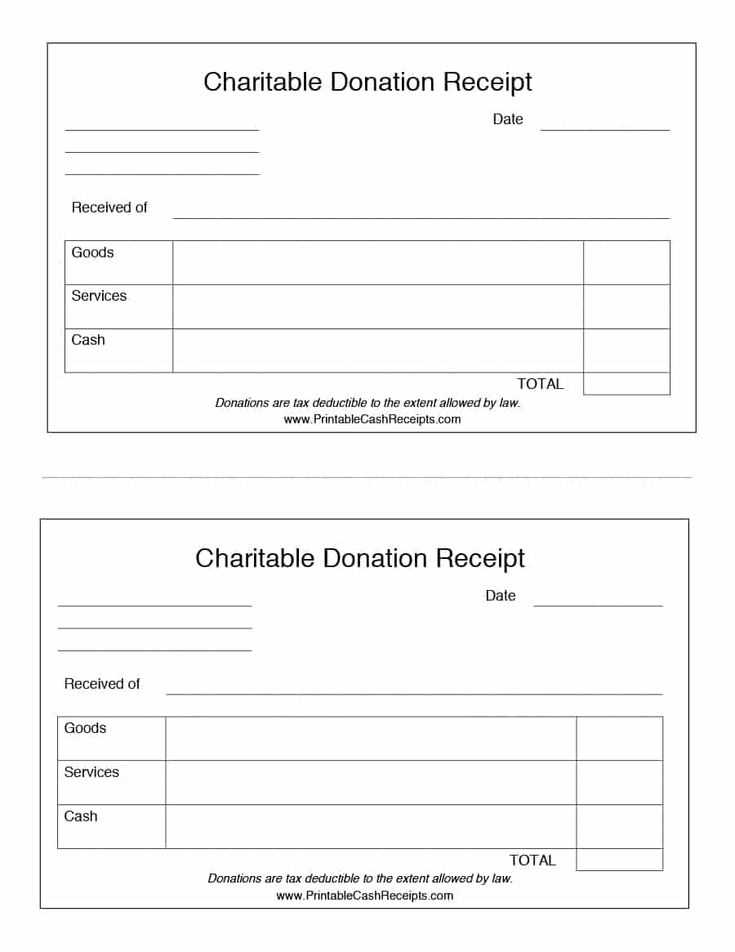

Itemize the donation. List each item donated, including the type of electronic device, its condition, and an estimated value. While an exact value might be difficult to determine, using a reasonable estimate ensures transparency and accuracy. A brief description can be included to clarify what was donated.

Don’t forget about the signature section. Both the donor and the organization should sign the receipt, confirming the donation. This adds an extra layer of verification and helps protect both parties in case of any discrepancies.

By following these steps, you can create a donation receipt template that simplifies the process and ensures proper documentation for both electronic waste donors and recipients.

Here is the revised version without repeats:

The donation receipt for e-waste should contain specific details to ensure clarity and transparency for both the donor and the recipient. Be sure to include the date of donation, the name of the organization receiving the items, and a description of the donated items. Clearly list the items donated, including model numbers if applicable, to avoid confusion.

Details to Include

For each item, provide a brief description, such as “used laptop,” “broken printer,” or “old desktop computer.” The receipt should also include an estimated value of the items donated, especially if the donor plans to claim tax deductions. This value is typically determined based on the condition and market price of the item.

Additional Information

Include the donor’s name, contact information, and a statement that the donor received no goods or services in return for the donation. Make sure the receipt is signed and dated by a representative of the receiving organization. Keep the format clean and easy to read to avoid misunderstandings later on.

- EWaste Donation Receipt Template

For smooth processing of e-waste donations, providing a detailed receipt is essential. This document should contain key elements to ensure transparency and meet tax deduction requirements.

Basic Information to Include

| Information | Details |

|---|---|

| Donor Name | Full name of the donor |

| Donation Date | Date the items were donated |

| Organization Name | Name of the receiving organization |

| Items Donated | List of electronic items donated (e.g., phones, computers) |

| Condition of Items | Brief description of the condition (e.g., working, broken) |

| Estimated Value | Donor’s estimate of the value of donated items |

| Tax-Deductible Status | Statement that the donation is tax-deductible if applicable |

Example Receipt Layout

| Item Description | Quantity | Estimated Value |

|---|---|---|

| Old laptop | 1 | $150 |

| Smartphone (not working) | 2 | $40 |

Always ensure the receipt is signed and dated by an authorized person within the organization. This confirms the donation and the information provided by the donor is accurate.

To create a legally valid donation receipt for EWaste, include key details that confirm the transaction. Start by adding the donor’s full name and address, as well as the organization’s name, address, and tax identification number (TIN). This ensures transparency and establishes the legitimacy of the receipt for tax purposes.

Include the Date and Description of the Donation

Record the date of the donation and describe the donated items clearly. Specify the type and condition of the electronics being donated. For example, list “10 desktop computers, 5 monitors, and 3 printers in used condition.” A brief description helps both parties keep track of the donation, especially for any future references.

Indicate the Value of the Donation

If the donor requests a tax deduction, they must provide an estimated value of the items. The organization is not required to assign a value, but it’s helpful to mention that the value is determined by the donor. A common format is: “The donor has valued the donated items at $200.” Ensure that the donation receipt does not imply any valuation for tax purposes unless an official appraisal was performed.

Conclude with a statement clarifying that no goods or services were provided in exchange for the donation, as this will be important for the donor’s tax deductions. This straightforward receipt helps maintain compliance with tax regulations while confirming the donation of EWaste.

Each donation receipt for e-waste must provide clear, accurate details to ensure transparency for both the donor and recipient. Here’s what needs to be included:

1. Donor Information

Include the full name and contact details of the donor. This can be their name, address, phone number, and email. These details are necessary for the organization to acknowledge the donation and maintain accurate records.

2. Description of Donated Items

List the donated items, specifying their type and condition. This could include old computers, phones, printers, or other electronics. Ensure that the description is clear and concise. If possible, mention the quantity or specific model numbers.

3. Date of Donation

Clearly state the date the donation was made. This helps in tracking the timing of donations and for any tax-related purposes the donor might require.

4. Value of Donation

If the donor requests it, provide an estimated value of the donated items. If no value is provided, a statement like “No goods or services were provided in exchange for this donation” should be included to meet tax documentation requirements.

5. Tax Deductibility Notice

Include a notice that the donation is tax-deductible, if applicable. This informs the donor that they may be eligible for tax benefits related to the donation, in accordance with local laws.

6. Organization Details

List the organization’s name, contact details, and any applicable registration numbers. This ensures legitimacy and provides the donor with the necessary information for tax purposes.

Distribute receipts immediately after receiving e-waste donations. Send digital receipts via email or provide printed ones at the point of donation. Digital receipts are more efficient and environmentally friendly. Ensure that the receipt contains essential details like donor name, donation date, and a brief description of the items donated.

Store receipts securely in a centralized system. Consider using cloud storage or dedicated software to organize and track donations. This method allows easy retrieval for tax reporting or future inquiries. If paper receipts are used, keep them in a well-organized filing system, categorized by donation date or donor name.

- Ensure data privacy when storing donor information. Avoid sharing sensitive details with unauthorized individuals or systems.

- Make backups of digital receipts regularly to prevent data loss.

- Label receipts clearly with a unique ID or reference number for easy identification.

For tax purposes, include a clear statement on the receipt explaining that the donor did not receive any goods or services in exchange for their donation. This can help streamline the process for donors who intend to claim deductions.

Regularly review and update your record-keeping processes. Stay aligned with any changes in local tax laws or donation guidelines that may affect how you issue receipts.

Donation Receipt Template for E-Waste

Provide a detailed list of all items donated. Include the make, model, and condition of each item to ensure transparency.

Key Information to Include

- Donor’s Full Name – Include the full name of the donor for proper identification.

- Date of Donation – Specify the date when the donation took place.

- Description of Donated Items – List the items with clear descriptions (e.g., brand, model, type, and any noticeable condition details).

- Estimated Value – Mention the approximate value of the items donated. This can be based on market value or assessment by the donation center.

- Tax Identification Number – Include the charity’s tax ID number for potential tax purposes.

- Signature – Obtain the signature of both the donor and the receiving party for verification.

Format Example

- Donor’s Name: John Doe

- Donation Date: February 10, 2025

- Item 1: HP Laptop, Model 4500, condition: working, valued at $150

- Item 2: Dell Monitor, Model 2210, condition: working, valued at $80

- Tax ID: 123-456-789

- Signature of Donor: __________________

- Signature of Recipient: __________________

This template provides a straightforward way to document e-waste donations for both parties involved.