When you’re handling a real estate transaction, a deposit receipt serves as a formal acknowledgment that a buyer has provided a deposit to secure the purchase. It’s an important document that ensures both parties are clear about the amount, terms, and conditions of the transaction. A well-crafted deposit receipt can help avoid disputes and set expectations from the start.

Make sure the deposit receipt includes the buyer’s full name, the property address, the amount of the deposit, and the date the deposit was made. These details will clarify the transaction and protect the buyer and seller throughout the process. Don’t forget to include any contingencies or conditions attached to the deposit, such as deadlines for further payments or steps for returning the deposit if the deal falls through.

The template should also state the purpose of the deposit, whether it’s for securing the property or as part of a larger agreement. Clear wording around the deposit’s non-refundable or refundable nature can prevent confusion. A simple, straightforward receipt can streamline the process and provide both parties with the confidence that their agreement is documented properly.

Here’s the revised version:

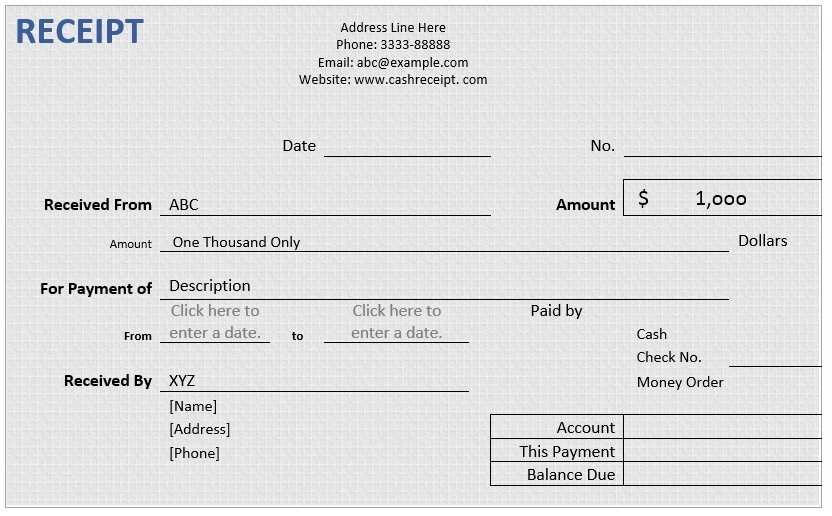

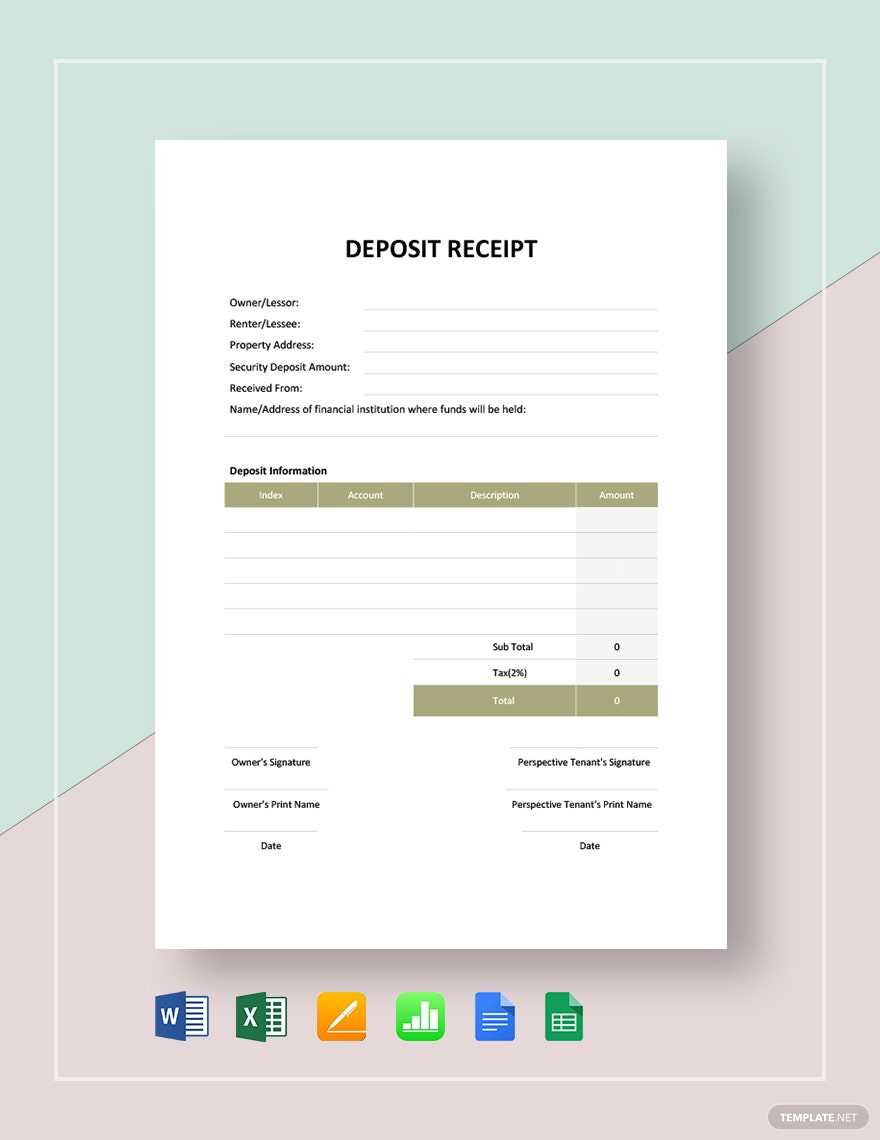

Begin by clearly stating the full names and contact information of both parties involved in the real estate transaction. Include the buyer’s and seller’s addresses, phone numbers, and email addresses. This ensures both sides are easily reachable throughout the process.

Specify the property details, such as the address, legal description, and any other identifying information. This helps avoid any confusion regarding which property is being discussed.

Next, include the deposit amount and the payment method. It’s essential to outline whether the deposit is refundable or non-refundable, as well as any conditions attached to it, such as inspection results or financing approval.

Detail the timeline for when the deposit is due, including any deadlines for the payment and conditions that might trigger a refund. Clarity around the timing helps both parties manage their expectations and responsibilities.

Outline any contingencies that might affect the agreement, such as the buyer’s ability to secure financing, or if certain repairs need to be completed before finalizing the sale. It’s crucial to include a provision for how the deposit will be handled if these contingencies are not met.

Finally, ensure that both parties sign and date the document, indicating their agreement to the terms. It’s also wise to have the document notarized to add an additional layer of legal validation.

- Real Estate Deposit Receipt Template

When creating a real estate deposit receipt, make sure to include the following key elements to ensure clarity and legal validity:

| Element | Description |

|---|---|

| Receipt Number | A unique reference number for the deposit receipt. This helps in organizing and tracking the payment. |

| Date of Deposit | The exact date when the deposit was received. This is crucial for the buyer and seller to have a clear timeline. |

| Buyer Information | Full name and contact details of the buyer. This identifies the person making the payment. |

| Seller Information | Full name and contact details of the seller. This identifies the party receiving the payment. |

| Property Details | Address and description of the property involved in the transaction. Include specific details like unit number or land size if applicable. |

| Deposit Amount | Exact amount paid as a deposit. Specify the currency used to avoid any confusion. |

| Payment Method | Specify how the deposit was made, such as by check, wire transfer, or cash. This ensures clarity about the transaction process. |

| Signature | Both buyer and seller should sign the document, indicating agreement to the transaction and receipt of the deposit. |

This template can serve as a straightforward record of a deposit made during a real estate transaction. Always double-check that all fields are completed accurately to avoid any confusion in the future.

To draft a deposit receipt for a property transaction, follow these steps:

- Include the transaction details: Start with the full names of the buyer and seller, and the date of the transaction. Include the address of the property being sold.

- State the deposit amount: Clearly mention the exact deposit sum being paid. Ensure the currency and payment method (e.g., bank transfer, check) are specified.

- Reference the purpose of the deposit: Specify that the deposit is being made in connection with the purchase of the property. You can also note if it’s part of the total purchase price or a separate payment.

- Define terms of refund: If applicable, mention under what conditions the deposit will be refunded or forfeited (e.g., if the transaction doesn’t proceed). Include any timelines for refunding the deposit.

- Signatures: Both the buyer and the seller must sign the receipt, confirming that they agree with the terms of the deposit. Include space for the signatures of both parties and the date they sign the document.

- Include additional clauses: If there are specific conditions related to the deposit (e.g., inspections, financing approval), include them clearly. Also, mention if the receipt is binding and enforceable by law.

With these components, the deposit receipt will provide clear documentation of the payment and the terms surrounding the transaction.

Ensure the date is clear and accurate. Mistakes in recording the deposit date can create confusion and complicate legal proceedings. Always write the exact day the deposit is made.

Double-check the amount: Failing to list the deposit amount correctly or leaving out key details like whether the payment is in cash or through another method can lead to disputes. Be specific about the sum and the payment method used.

Identify all parties involved: Avoid vague references like “buyer” or “seller.” List the full legal names and addresses of all parties, including the buyer, seller, and agent, if applicable.

Clear terms for deposit handling: Specify whether the deposit is refundable or non-refundable, under what circumstances, and how it will be applied. Ambiguous terms can cause problems if a dispute arises later on.

Incomplete property description: Be sure to include the exact address of the property. A vague or incomplete description can make the contract difficult to enforce.

Overlooking signatures: Both parties must sign the receipt to validate it. Without signatures, the document might not hold up in court, rendering it ineffective in legal matters.

Not clarifying the receipt as a contract: Clearly label the receipt as a formal agreement to avoid confusion. This helps ensure that all parties understand their obligations.

By avoiding these common mistakes, you can ensure that your deposit receipt is clear, accurate, and legally binding. This will provide both the buyer and the seller with peace of mind and help streamline the transaction process.

Ensure the deposit receipt template includes accurate details of both parties involved. The names and addresses of both the buyer and seller should be clearly stated, along with the date of the transaction and the amount of the deposit. Verify that the template specifies whether the deposit is refundable or non-refundable, as this can prevent future disputes.

Incorporate a section on the purpose of the deposit–whether it’s securing the property, holding it until the final agreement, or as part of a larger down payment. It’s important to outline any conditions under which the deposit can be forfeited or refunded. This clarity reduces the potential for misunderstandings and legal issues later on.

Clearly mention the terms of the agreement in relation to the property. This includes any contingencies, such as the sale being subject to certain conditions (e.g., financing, inspection). Make sure the template reflects local real estate laws, especially when dealing with the timelines for returning the deposit if the sale does not proceed. Local legal requirements may influence how long the buyer or seller has to return the deposit.

Consult a real estate attorney to ensure that your template complies with the applicable laws in your jurisdiction. In some cases, you may need additional clauses or protections depending on the property type or the location of the transaction. Double-check that the terms within the receipt are enforceable in court if disputes arise.

Always ensure the template is signed by both parties. A signature acknowledges that the terms are understood and agreed upon, and it can serve as an official record in case of any future legal proceedings. This will help both parties in case they need to defend their position in court or in negotiations.

Deposit Receipt: Guidelines for Clarity

To ensure a clear and concise deposit receipt, use the term “deposit receipt” no more than twice per line. This approach prevents redundancy while maintaining readability and precision in legal or financial documentation.

For example, when stating the amount paid, structure the sentence as follows: “The deposit receipt confirms a payment of $500.” This makes the document straightforward, avoiding unnecessary repetition.

Additionally, ensure the deposit receipt includes key information such as the payer’s name, the date of transaction, and any relevant terms or conditions. This balance ensures a professional and comprehensive receipt without overcrowding the content with repetitive phrasing.