To create a savings bond receipt, include all relevant transaction details, such as the buyer’s name, bond denomination, and the date of purchase. Make sure to provide a clear description of the bond’s terms, including interest rates and maturity date. It’s also important to include a unique receipt number for easy tracking.

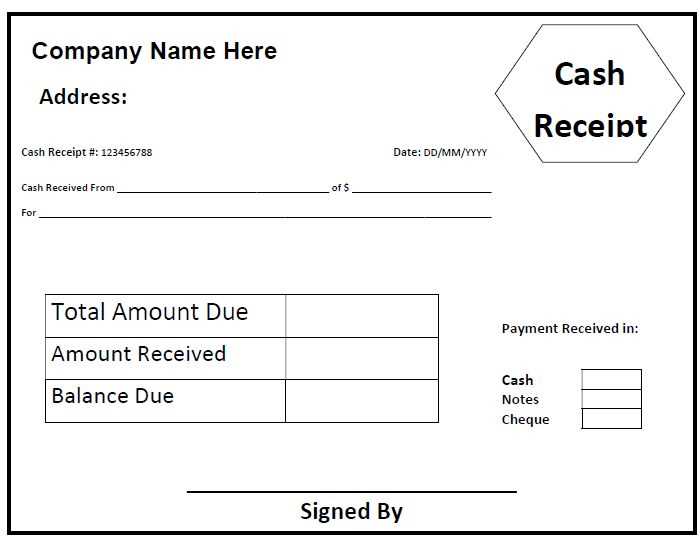

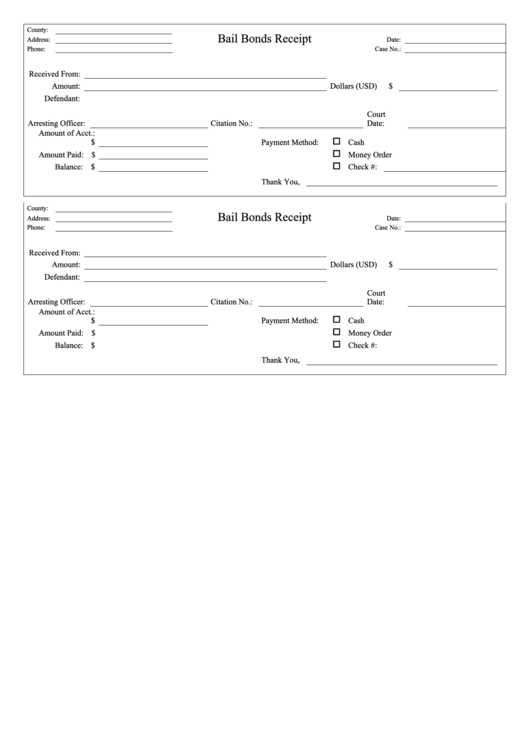

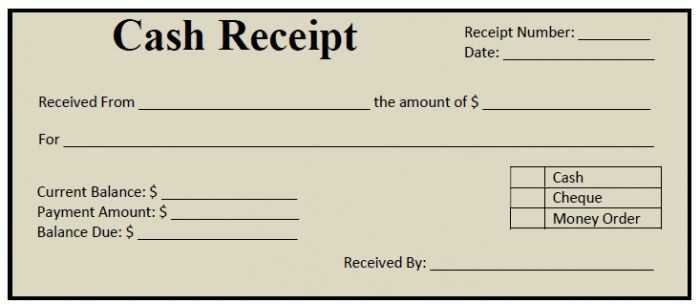

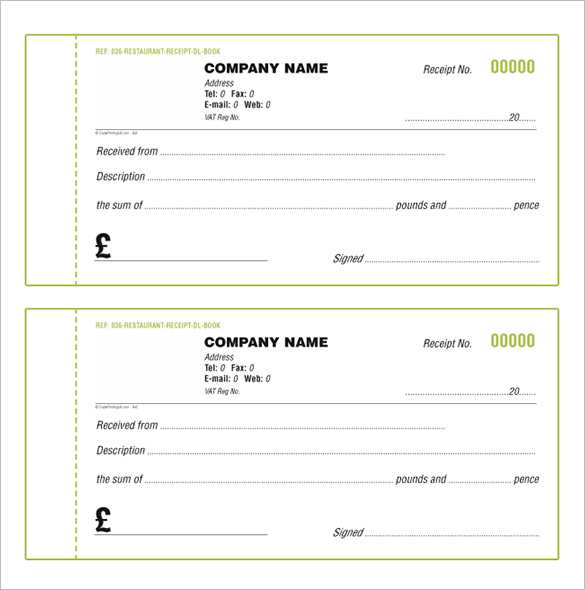

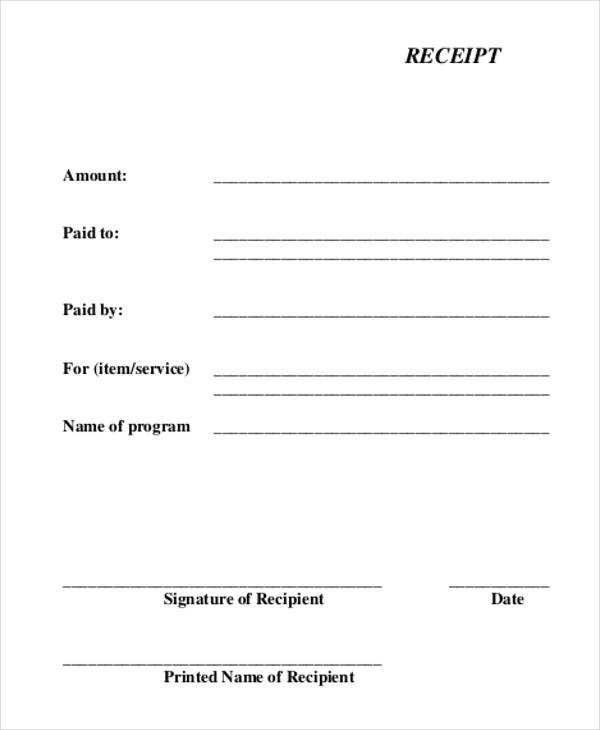

For a clean and professional look, use a simple template with sections for personal information, bond details, and payment confirmation. Start by listing the buyer’s name and contact information, followed by a breakdown of the bond type and its corresponding value. The receipt should clearly show the amount paid and method of payment used, whether it be cash, check, or electronic transfer.

Finally, ensure there is space for both the issuer’s signature and the date the receipt is issued. This adds authenticity and confirms the transaction has been processed. Always store receipts securely for reference or future claims.

Here’s the adjusted version of the text with reduced repetition:

If you’re looking for a savings bond receipt template, focus on a few key elements to ensure clarity. Begin by including the name of the issuer, bond series, and the issue date. Include space for bond identification numbers and the face value of the bonds. You should also provide fields for both the buyer’s and recipient’s names, along with the purchase date and amount paid. Make sure to include a section for the total value of bonds, and any applicable interest or maturity details. These details are important to ensure that the transaction is clearly recorded and easily accessible for future reference.

Template Details

For a well-organized template, arrange the bond details in a table format. The left column can contain labels such as “Bond Series,” “Issuer,” and “Value.” The right column should contain space to fill out the corresponding information. This approach keeps the document neat and easy to follow. Ensure the template is adaptable, allowing for additional bonds if needed.

Formatting Tips

Use simple, clean fonts and enough spacing between fields to improve readability. Avoid using overly complicated formats that may confuse the user. Keep the design professional but straightforward to make the process of completing and referencing the receipt as smooth as possible.

- Receipt of Savings Bonds Template

Create a clear and concise receipt for savings bond transactions by following this template:

- Title: Clearly label the document as “Receipt of Savings Bonds Purchase”.

- Buyer Information: Include the full name, address, and contact information of the buyer.

- Bond Details: Specify the series, denomination, and quantity of the bonds.

- Purchase Date: Include the exact date the purchase was made.

- Payment Information: Describe how the payment was made (e.g., check, bank transfer, cash).

- Total Amount: List the total amount paid for the bonds, including taxes or fees, if applicable.

- Issuer Information: Include the name and contact details of the issuer of the bonds.

- Signatures: Provide space for both the buyer and issuer to sign, confirming the transaction.

Double-check all entries for accuracy. Keep a copy of the receipt for your records.

Design the bond receipt template to include key details that make tracking and verifying the transaction straightforward. Focus on clarity and accuracy to ensure all relevant information is easy to find.

Important Sections for Your Template

- Bond Information: Include the bond’s serial number, denomination, and issue date to clearly identify the bond.

- Transaction Date: Clearly note the date the bond was purchased or redeemed.

- Purchaser Information: Include the name, address, and contact details of the buyer or bondholder.

- Issuer Details: Provide the name and contact information for the institution issuing the bond.

- Payment Details: Specify the amount paid, payment method, and any transaction reference numbers.

Formatting Tips

Keep the layout clean and organized. Use tables to structure information, making it easy to read and update. Ensure the template includes enough space for all necessary details while remaining uncluttered. Choose a clear, legible font for easy comprehension.

Before issuing a bond receipt, ensure compliance with local and federal laws governing bond transactions. Confirm that the bond receipt is legally recognized and includes all necessary elements to validate the transaction. Below are the key components to review:

Key Elements of a Bond Receipt

| Component | Description |

|---|---|

| Issuer Information | Full name and legal entity details of the issuer must be included. |

| Bondholder Information | Clear identification of the bondholder must be included. |

| Bond Details | The bond’s face value, issue date, and maturity date should be clearly stated. |

| Interest Terms | Include the interest rate, payment schedule, and any associated terms. |

| Legal Signatures | Signatures of authorized representatives are necessary to authenticate the bond receipt. |

Verification and Legal Compliance

Consult legal experts to verify that the bond receipt meets regulatory standards. Incorrect or incomplete receipts may result in disputes or non-enforceability. Ensure that both parties (issuer and bondholder) agree to the terms outlined in the receipt, and include clauses that safeguard both parties’ rights in case of discrepancies or defaults. Keep records of all transactions for future reference and compliance audits.

Ensure all bond details are accurate before issuing receipts. Double-check the bond amount, interest rate, and maturity date for consistency. After verification, prepare the receipt document containing the bondholder’s name, the bond issue date, and the unique bond identification number.

1. Verify Bond Details

Confirm the information for each bond to ensure the records match the official bond issuance documentation. Incorrect data can delay processing or cause confusion for bondholders. Verify the issuer’s information, bondholder’s address, and payment terms before proceeding.

2. Create and Customize the Receipt Document

Design a receipt template that includes space for all relevant details such as the bond type, purchase amount, issue date, and a serial number. Customize the document to match the branding and legal requirements of your institution. Incorporate necessary disclaimers, terms, and conditions as required.

3. Distribute the Receipt

Once the bond receipts are ready, distribute them to the bondholders. Use secure channels for delivery, such as postal services or encrypted emails, depending on the preferences of the bondholder. Ensure that each receipt is sent to the correct recipient, and track the distribution process to avoid errors.

4. Record Distribution

Maintain a record of all distributed receipts. Create a tracking system that logs the delivery date, recipient details, and method of distribution for future reference. This will be useful for any future inquiries or audits related to the bond issuance.

5. Follow-Up with Bondholders

After sending the receipts, check in with bondholders to ensure they have received their documents. Address any discrepancies or issues promptly. Keep communication lines open for any further questions or concerns regarding the bonds.

To create a reliable receipt for savings bonds, begin by clearly stating the bondholder’s name, the bond type, and the serial number. List the denomination and issue date next. This ensures proper tracking of each bond. Include the amount paid for the bond and any additional information like interest rates if applicable. For record-keeping, note the transaction method, whether by check or wire transfer, along with the date of purchase.

Additionally, consider adding space for a unique reference number or barcode that can be scanned for easy verification. This helps when tracking bonds for future transactions. Keep the format simple and consistent across receipts for easy reference.

Ensure the receipt includes contact information for customer service or inquiries related to the bonds. This provides a point of reference in case the bondholder needs assistance. Always make sure the receipt is legible and clearly printed, especially if it is handed out physically or stored electronically.