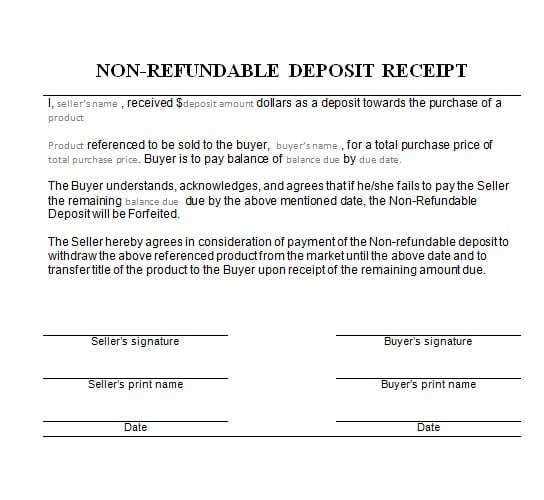

For anyone needing to create a car deposit receipt, a template in PDF format offers a simple and professional solution. This document serves as proof of a transaction, ensuring both parties are clear on the agreed terms. A car deposit receipt includes the amount paid, the car’s details, and the date of the transaction, which can prevent misunderstandings down the road.

When crafting a car deposit receipt, be sure to include key elements: the names and contact information of both parties, a description of the vehicle, the deposit amount, and the balance due upon completion of the sale. Including these details will provide clarity and establish a transparent agreement.

Using a PDF format for the receipt ensures that the document remains accessible and easy to share. PDF files are universally accepted and can be printed or sent electronically, making them convenient for both buyer and seller. Be sure to customize the template to reflect your specific transaction needs for accuracy and professionalism.

Sure! Here’s the revised version:

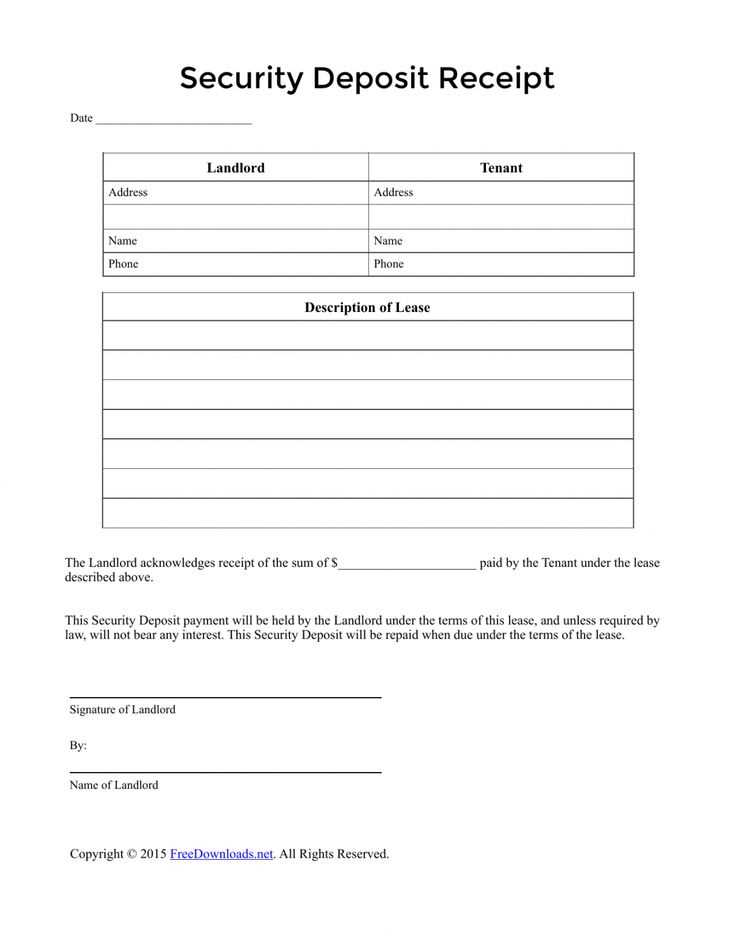

When creating a car deposit receipt, it is important to include key details for clarity and future reference. Ensure that both the car owner and the recipient sign the document to validate the agreement. Clearly state the amount of the deposit, the date it was paid, and the purpose for which it was made. The receipt should also outline any terms related to the refund or conditions under which the deposit may be forfeited. This helps prevent misunderstandings later.

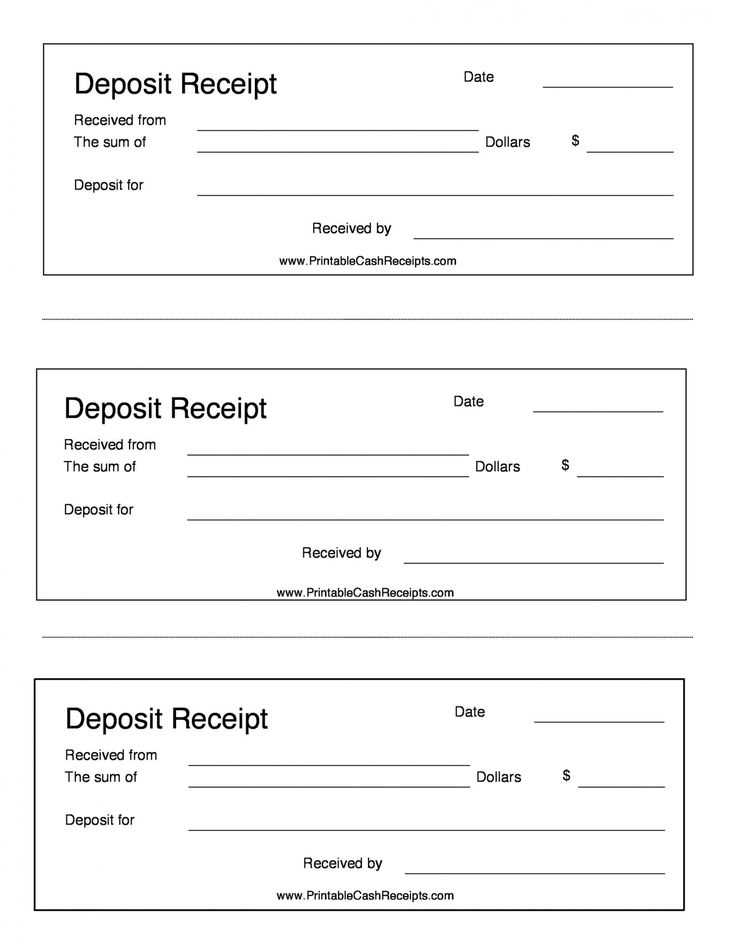

Use a table format to organize this information neatly. Here’s an example of what to include:

| Field | Description |

|---|---|

| Depositor’s Name | The full name of the person making the deposit. |

| Recipient’s Name | The full name of the person receiving the deposit. |

| Deposit Amount | The exact amount of money deposited. |

| Purpose of Deposit | A brief description of why the deposit is being made (e.g., reservation, damage waiver). |

| Deposit Date | The date the deposit was paid. |

| Refund Conditions | Details about how and when the deposit may be refunded, if applicable. |

| Signatures | Both the depositor and recipient should sign to confirm agreement. |

Ensure all details are clear and precise to avoid confusion in the future. Keep a copy of the receipt for both parties, and consider sending a digital version for added convenience.

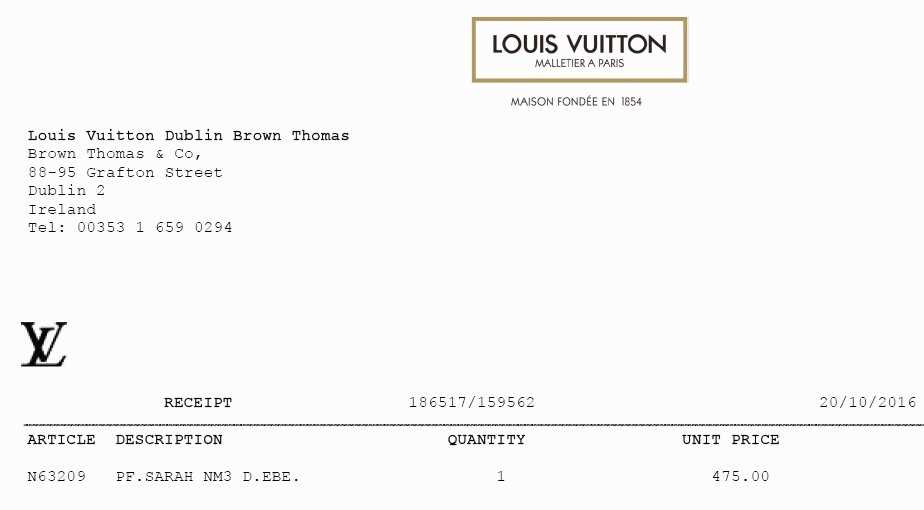

- Car Deposit Receipt Template PDF

Use a car deposit receipt template to ensure both the buyer and seller have a clear record of the transaction. A well-structured template helps avoid confusion and protects both parties. You can find various customizable templates in PDF format that suit your needs.

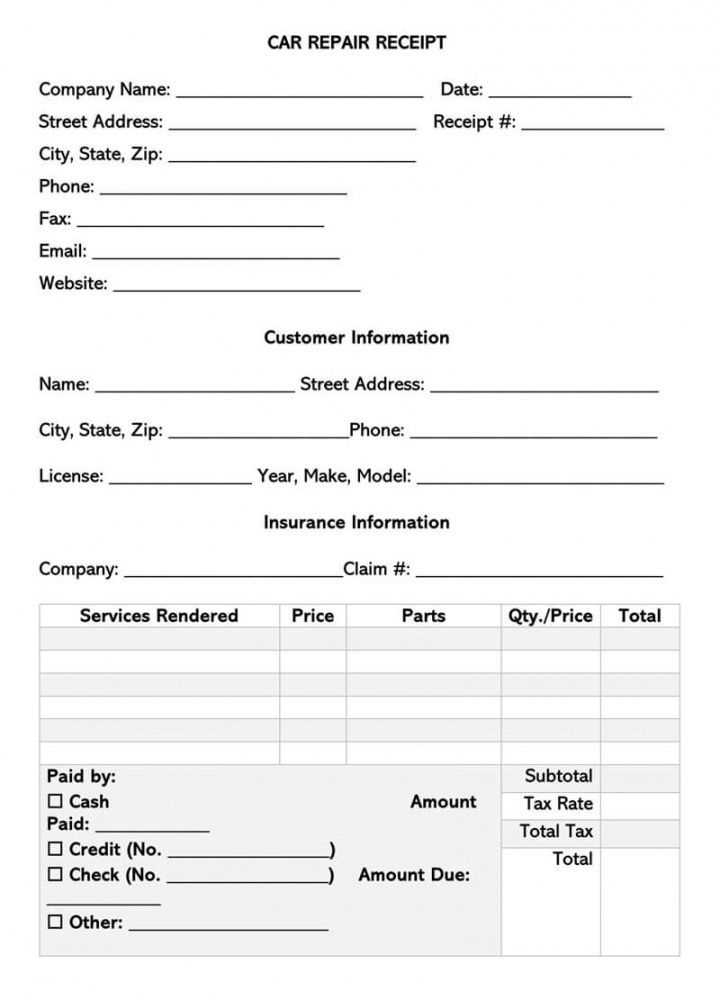

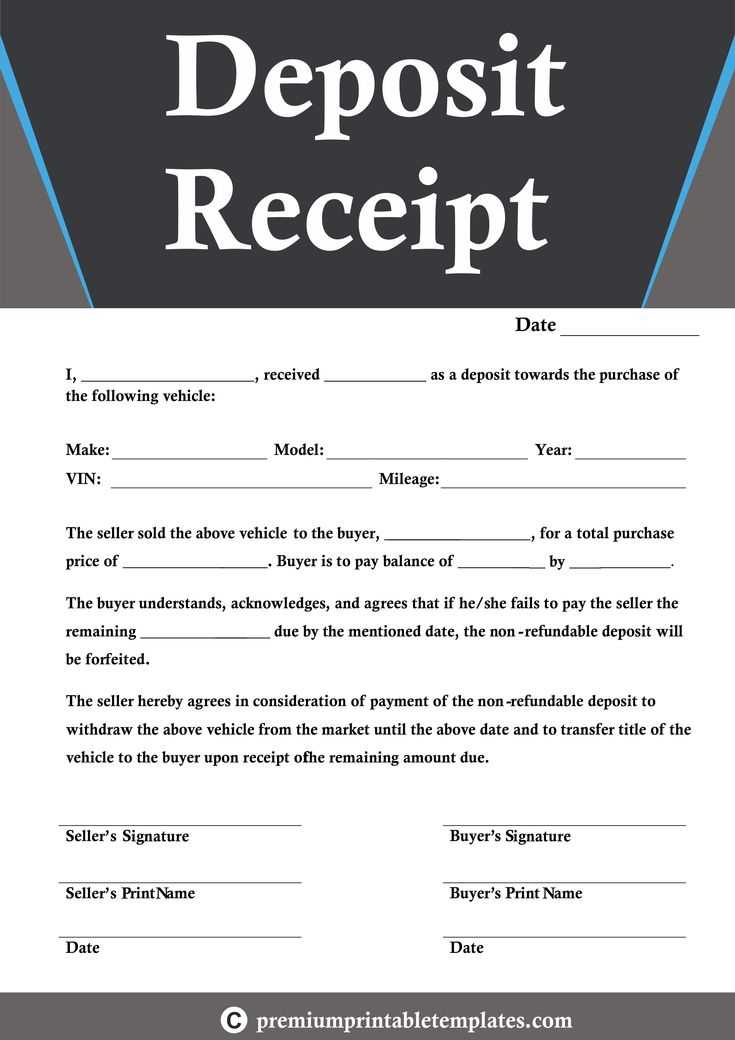

Here’s a step-by-step guide for creating a car deposit receipt:

- Title: Include “Car Deposit Receipt” at the top for clarity.

- Date: The date of the deposit should be listed clearly.

- Buyer and Seller Information: Both parties’ names, addresses, and contact details should be included.

- Deposit Amount: Specify the exact amount of the deposit paid.

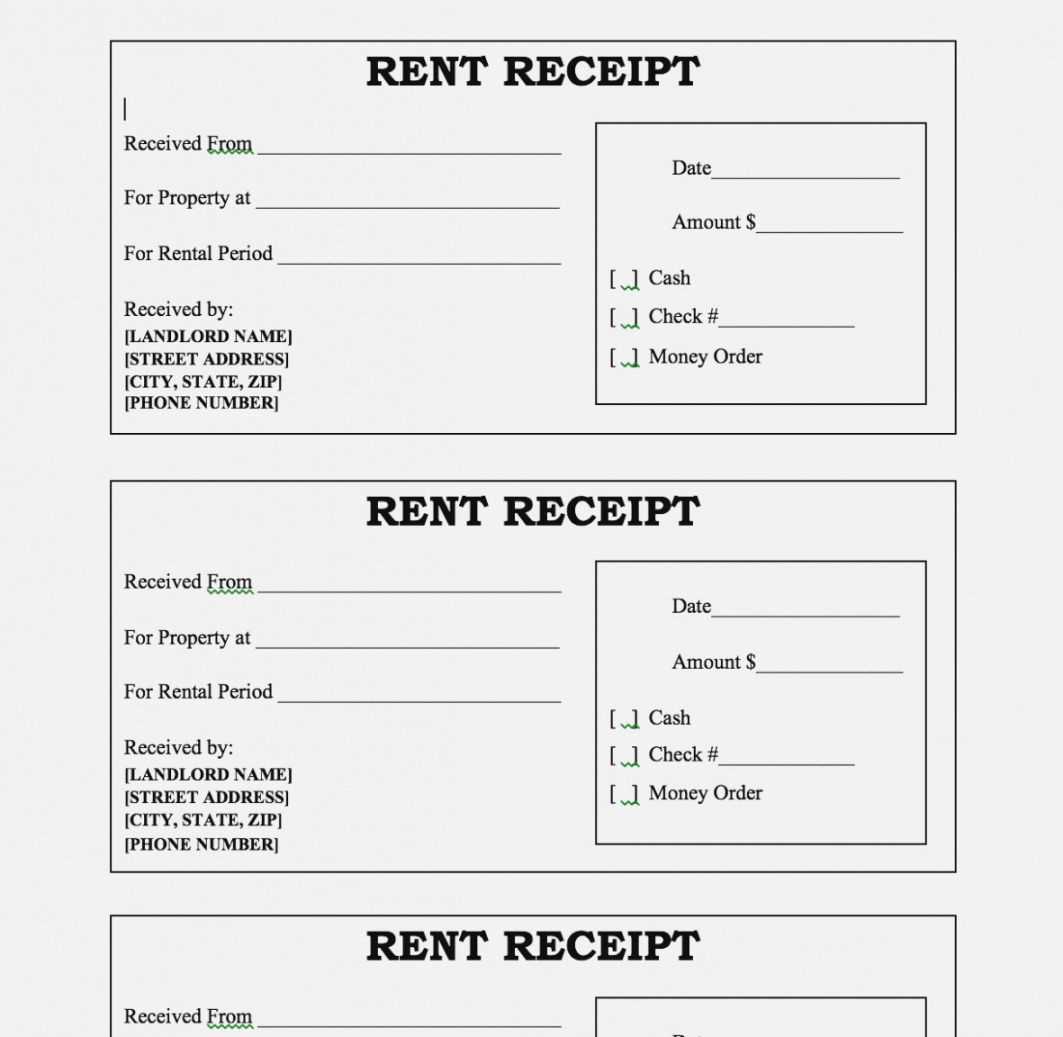

- Payment Method: Indicate how the deposit was made (e.g., cash, check, bank transfer).

- Vehicle Details: Include the make, model, year, and VIN (Vehicle Identification Number) of the car.

- Balance Due: Mention the remaining amount due for the full payment.

- Signature: Both the buyer and seller should sign the receipt to confirm the transaction.

After filling out the template, save it as a PDF. This format ensures the document is easily accessible and can be shared with both parties. Make sure to keep a copy for your records and provide one to the buyer for theirs.

Begin by clearly outlining the key details on your car deposit receipt. Start with the date of the transaction, as this provides context for both parties. Next, include the names of the buyer and seller, ensuring that both are identifiable. Specify the amount paid as a deposit, highlighting the agreed-upon sum.

Ensure you list the vehicle details, including the make, model, year, and VIN number. This information is essential to avoid confusion about the car involved in the agreement. Add a section that outlines any remaining balance due and the terms for the final payment. Be clear about the deadline for the remainder of the payment, as this sets expectations.

Include a clause that confirms whether the deposit is refundable or non-refundable, depending on the agreement. This helps to protect both parties in case of cancellation. Add a signature line for both parties to sign, affirming the details of the agreement. The signature section should also include printed names for clarity.

Finally, keep the template clean and concise. Avoid unnecessary sections that may complicate the agreement. Ensure all the required legal terms are covered, and double-check for any local regulations that may require specific language in the deposit agreement.

Ensure the deposit amount matches the amount actually paid. Double-check the numbers to avoid discrepancies that could lead to confusion or disputes. This small step prevents problems later, especially in legal or financial contexts.

Clearly identify both parties involved. A common mistake is not properly listing the buyer and seller’s names or contact details. Both parties should be easily identifiable to avoid misunderstandings in case of future communication.

Always specify the reason for the deposit. Without a description of the deposit’s purpose, it becomes unclear what the deposit pertains to, potentially complicating matters if there’s a need for a refund or a dispute arises.

Include the correct date and time of the transaction. Missing or incorrect dates can create confusion, especially when there’s a need to verify the timing of the deposit in legal or contractual discussions.

Check for proper signatures. Both parties should sign the receipt. Failure to include a signature can make the document incomplete or less valid in a legal setting.

Provide a unique reference number or identifier. This ensures that each deposit receipt is easily traceable, which is useful for record-keeping and resolving any future disputes.

Do not leave blank spaces in the document. Ensure every section is filled out correctly to avoid the possibility of alterations later. Blank spaces can lead to misunderstandings or fraudulent activities.

Be careful with deposit terms. Clearly define whether the deposit is refundable or non-refundable to prevent confusion later on. Avoid ambiguous language, as it can result in misinterpretation of the terms.

If you’re looking for free car deposit receipt templates, several online platforms offer them without cost. Websites like Template.net provide various receipt formats, ready for use and customizable to your needs. Simply search for “car deposit receipt” or a similar term in their template section, and you’ll find both basic and more detailed versions.

Google Docs is another great option. It has free, editable receipt templates you can easily access by searching through their template gallery. The best part is that you can modify them according to your requirements, such as adding details like car make, model, and deposit amount.

For those who prefer downloadable files, platforms like PDFFiller allow you to search for specific templates and fill them out directly on the site. You can then download your receipt as a PDF for free.

Finally, check out Canva. Known for its easy-to-use design tools, Canva offers free receipt templates that can be customized visually. You can modify fonts, colors, and layout to make your receipt match your style while keeping the required fields intact.

Got it! How can I assist you today?