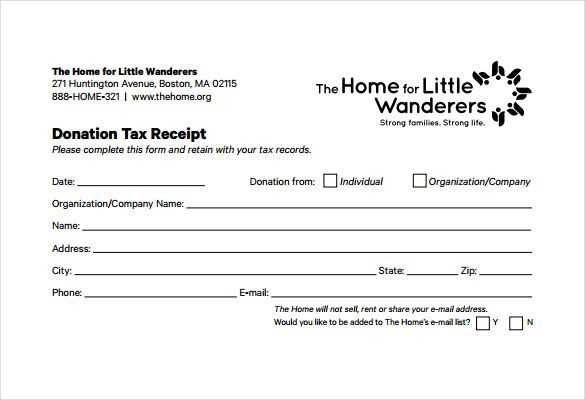

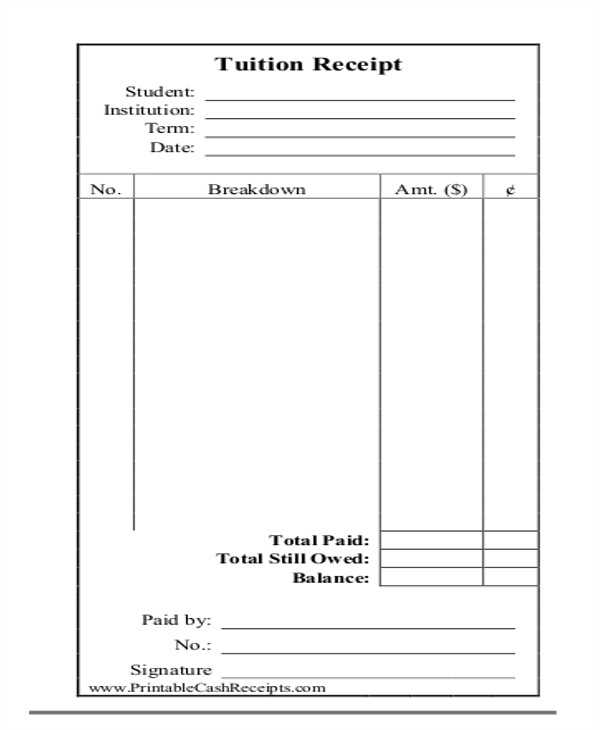

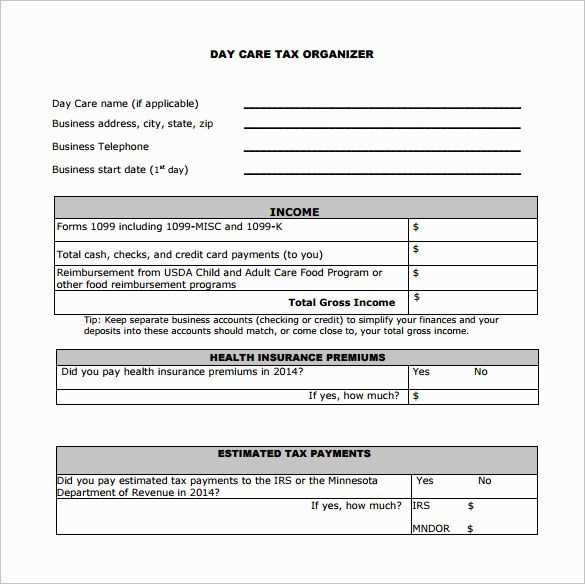

Use a tax receipt template designed specifically for after-school programs to ensure clear and accurate documentation for both parents and administrators. This template should include basic details such as the name of the program, the date of payment, the child’s name, and the amount paid. Make sure to incorporate the payment method and any discounts or scholarships applied to the fee.

It’s a good idea to include a space for notes that can address any special circumstances or additional fees, such as field trips or extended hours. By including these details, you provide transparency and help avoid misunderstandings about the costs associated with the program.

When creating a tax receipt, make sure that it meets local tax requirements. This may involve adding your business’s tax ID number, especially if the program qualifies for tax deductions. A well-structured tax receipt can also streamline the process of providing parents with the necessary documentation during tax season.

Here’s an improved version of the text with no redundant repetitions of words:

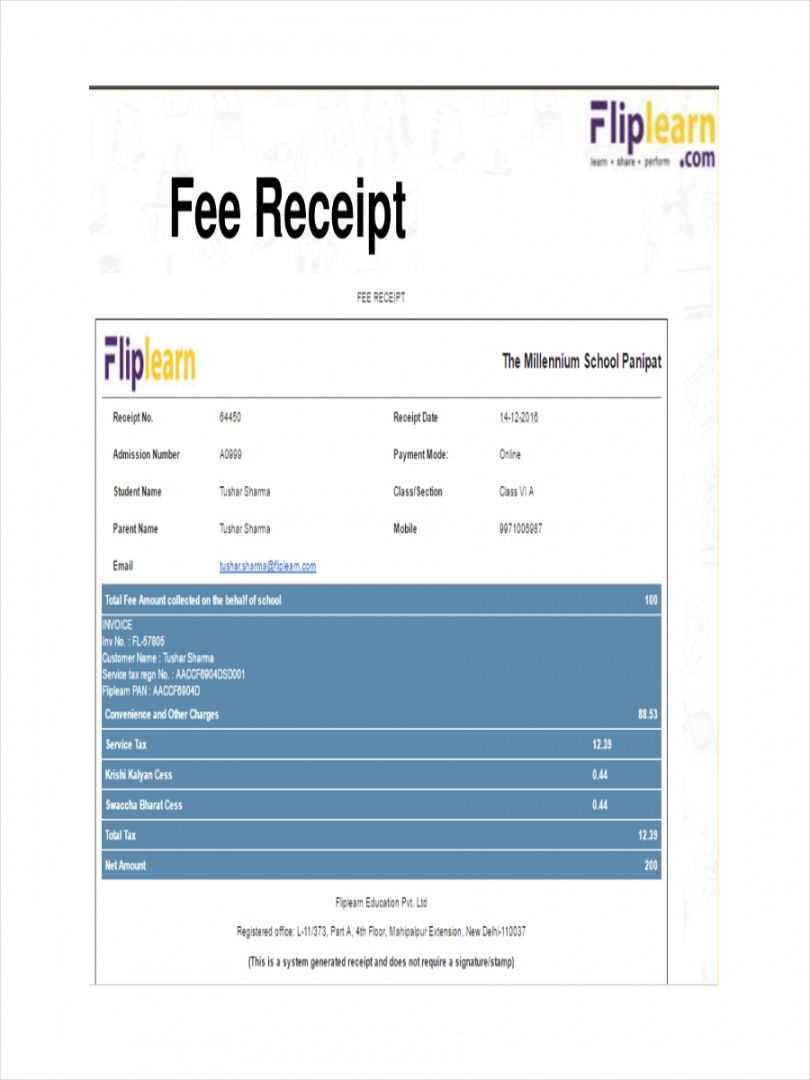

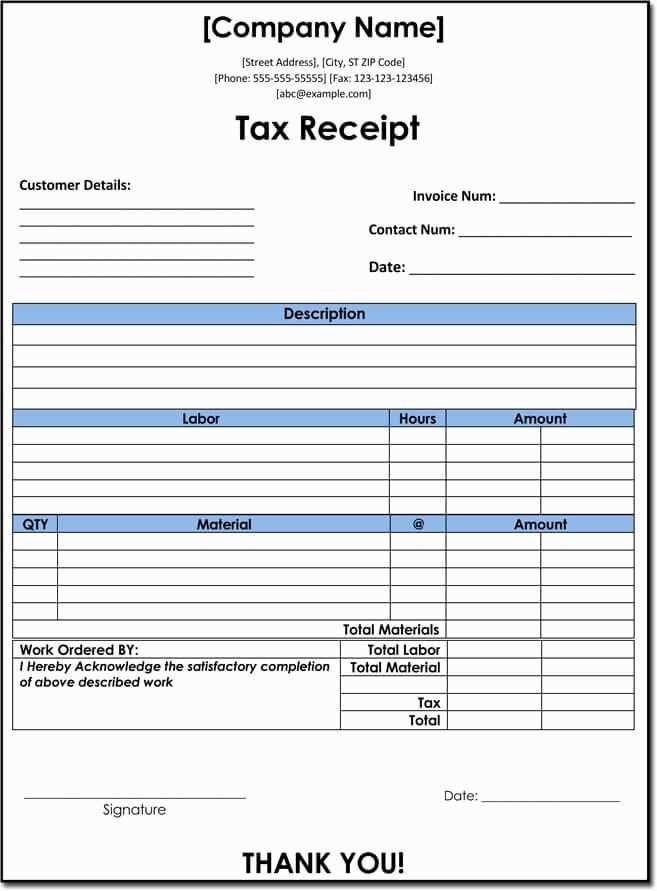

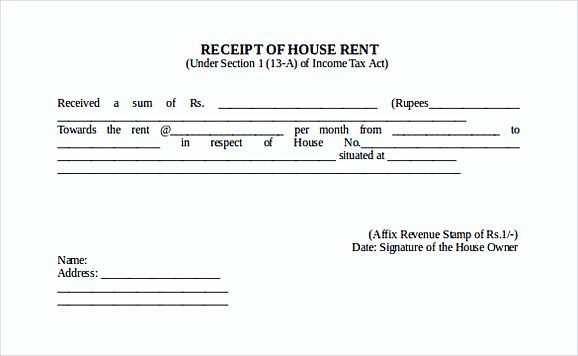

To create a tax receipt template after school, focus on clarity and accuracy. The document should include the necessary details such as the name of the school, date of payment, student’s name, and a description of the service or donation. Each item should be listed clearly with its corresponding value. Include a space for the school’s official contact information and the signature of an authorized person.

Tax Receipt Template Example:

| Item | Description | Amount |

|---|---|---|

| School Name | The official name of the school. | XYZ School |

| Student Name | Full name of the student. | John Doe |

| Service/Donation | Details of the service or donation made. | After School Program |

| Amount | The total payment made. | $150 |

| Date | Date of the transaction. | February 12, 2025 |

| Signature | Authorized person’s signature. | Jane Smith |

Ensure all sections are filled out with the correct details. This ensures compliance and makes the receipt easy to read and process for tax purposes.

- After School Tax Receipt Template: A Practical Guide

To create an effective after-school tax receipt, focus on clarity and completeness. Start by including the name of your organization and its contact details. Ensure you list the date the payment was received, along with the exact amount paid. If possible, specify the exact program the payment is for, especially if your after-school service offers multiple options.

Structure Your Template Properly

Organize your receipt by clearly marking the total amount paid. Specify whether the amount includes taxes or is tax-exempt. Include a reference number or transaction ID for better tracking. If the payment covers multiple months, provide a breakdown of costs per month.

Include a disclaimer about the non-refundable nature of the payment or any policies regarding refunds if applicable. This will help clarify the terms for both parties involved. Always include a clear signature section for the issuing representative, even if it’s just a digital signature for quicker processing.

Keep It Simple and Accessible

Design the receipt to be easy to read and understand. Use a standard, professional font and make sure all information is presented clearly. For accessibility, consider providing the receipt in multiple formats (PDF, Word, or email) to accommodate different preferences. This ensures that parents or guardians can access their receipt without issues.

To create a tax receipt for after school programs, include all the necessary information in a clear and organized format. Begin by listing the name of your organization, the date of the payment, and the total amount paid by the donor or participant. This ensures transparency and clarity for tax purposes.

Include Relevant Donation Details

Make sure to specify the donation amount if the payment is a charitable contribution. If the payment covers tuition or program fees, clearly distinguish between the portion that is deductible (for donations) and the non-deductible portion (for services). For a tax deduction, only the charitable portion is eligible.

Provide Additional Information for Tax Filing

Include your organization’s tax ID number or EIN (Employer Identification Number). This is critical for the donor’s tax filing. You should also mention that no goods or services were provided in exchange for the donation, if applicable, which is a requirement for charitable deductions.

Finally, ensure that the receipt is signed by an authorized person within your organization. This adds legitimacy and ensures that the tax receipt is valid for tax deduction purposes.

Make sure to include these key details in every after-school receipt:

- Program Name: Clearly state the official name of the after-school program.

- Child’s Full Name: Include the child’s name to avoid any confusion.

- Payment Amount: List the total amount paid for the after-school services.

- Payment Date: Include the date when the payment was received.

- Payment Method: Specify how the payment was made (cash, check, or credit card).

- Parent/Guardian Information: Include the name of the person making the payment.

- Service Period: Indicate the dates the child attended the program, covering the service period.

- Receipt Number: Assign a unique number for easy reference.

- Program Details: Provide a brief description of the services provided (e.g., tutoring, child care, enrichment activities).

Including these points ensures that your receipt is clear, organized, and useful for any future reference or tax purposes.

One common mistake is failing to include all required details on the tax receipt. Ensure each receipt contains the donor’s name, address, donation amount, and the date. If any information is missing or incorrect, it can delay processing and cause confusion for both parties.

Accurate Donation Amounts

It is critical to avoid rounding donation amounts incorrectly. If a donation is $100.50, make sure it is listed exactly that way, rather than rounded to $100 or $101. Accuracy in the reported amount is key for proper tax filing.

Failure to Specify Goods or Services Provided

If the donation includes goods or services, such as a ticket for an event, you must indicate the fair market value of those items on the receipt. Donors can only claim tax deductions for the amount exceeding the value of the goods or services received, and failing to specify this can lead to tax discrepancies.

Another common error is issuing receipts for amounts that do not qualify for tax deductions. For example, if the payment covers something that isn’t classified as a charitable contribution, it should not be treated as a donation. Always verify the eligibility of the contribution before issuing a receipt.

Lastly, ensure that your receipts are timely. Delays in issuing receipts can complicate tax filings for donors. Ideally, receipts should be sent within a reasonable time frame following the donation.

Modify Template for Clearer Tax Documentation

Make sure to update the template to include relevant details without overusing terms like “After School” or “Tax Receipt.” Below are a few steps to make your document more concise while retaining clarity:

- Include the program name or activity directly in the header instead of repeating “After School.”

- Instead of saying “Tax Receipt,” reference “Donation Confirmation” or “Contribution Summary” for a more specific description.

- State the date of the transaction, amount, and the purpose of the donation clearly to avoid redundancy.

- Ensure all necessary tax-related details are included without excessive repetition–clarity is key.

- Consider adding a section for donor information and the program’s name to link the contribution directly to the cause.

By using these changes, your template will avoid unnecessary repetition while keeping the information clear and functional for tax purposes.