For a smooth donor experience, create a simple and clear donation receipt email. Use a direct approach and make sure to acknowledge the donor’s contribution while providing key details such as the donation amount, date, and your organization’s tax information.

Subject line: Confirmation of Your Donation

Begin with a personalized greeting that includes the donor’s name. Express genuine gratitude for their support. Acknowledge the specific amount donated and the cause it supports. This lets donors know their contribution is making a real impact.

Next, provide a clear breakdown of the donation details, including the donation amount, date, and any relevant tax-related information. If applicable, include the donor’s unique donation ID for future reference. Don’t forget to mention how the donation will be used to support specific programs or initiatives.

Close with a warm thank-you message, reiterating your appreciation and offering the donor ways to stay involved with the organization. Provide links to your social media, newsletter sign-up, or future events to keep them connected to your cause.

Here are the corrected lines:

Make sure your donation receipt email template includes clear information. Start with a polite thank you note, acknowledging the donor’s contribution.

Personalize the Message

Address the donor by name, which creates a personal touch. A simple “Dear [Donor’s Name]” can make a big difference in how the message is received.

Include Key Details

Ensure that the email provides all relevant details: donation amount, date of donation, and a brief description of the purpose or project the funds will support. Be sure to state that the donation is tax-deductible if applicable.

End the email with a warm closing, reinforcing appreciation for the support. You can also include contact information in case the donor has questions about the donation.

Always review your template before sending to confirm accuracy and clarity. A clean, simple format helps the donor quickly find key information.

Donation Receipt Email Template Guide

Begin with a clear subject line to ensure the recipient understands the purpose of the email. A simple “Donation Receipt for [Organization Name]” works well.

Use a professional yet warm tone throughout the email. Acknowledge the donor’s contribution right away with a personalized greeting, followed by the donation details such as the amount and date of the donation.

Key Elements to Include

Here’s a breakdown of essential components to include in the donation receipt email:

| Element | Description |

|---|---|

| Subject Line | Clear, concise, and includes the organization’s name and donation receipt reference. |

| Greeting | Personalized greeting with the donor’s name. |

| Donation Amount | Clearly state the amount donated and the currency. |

| Donation Date | Include the date the donation was made. |

| Donor’s Information | Include the donor’s name and contact details for their reference. |

| Organization’s Information | Provide the organization’s name, address, and contact information. |

| Thank You Message | Express genuine gratitude for their support. |

| Tax Information | If applicable, include the tax-exempt status of the organization and any information related to tax deductions. |

| Closing | Close the email with a friendly and appreciative tone. |

Sample Template

Subject: Donation Receipt for [Organization Name]

Dear [Donor’s Name],

Thank you for your generous donation of [Amount] on [Date]. Your support helps us continue our mission to [insert mission or purpose].

Donation Details:

- Donation Amount: [Amount] [Currency]

- Donation Date: [Date]

- Donor Name: [Donor’s Name]

- Organization: [Organization Name]

If applicable, please note that [Organization Name] is a tax-exempt organization, and your contribution may be deductible for tax purposes.

Once again, thank you for your support. Should you need any additional information, feel free to contact us at [Contact Information].

Sincerely,

[Your Name]

[Your Title]

[Organization Name]

Use the donor’s name in the subject line and opening paragraph. Personalization creates an immediate connection and makes the recipient feel recognized for their contribution. Mention the specific amount they donated to show the impact of their generosity. This level of detail helps donors understand exactly where their funds are going and strengthens their engagement.

Include a heartfelt thank-you message, written in a warm and sincere tone. Instead of a generic “thank you,” acknowledge the donor’s support with a sentence that reflects the unique value their donation brings to your cause. You could say something like, “Your donation of [Amount] will help us [Specific Project/Goal].” This approach gives the donor clarity about how their contribution makes a difference.

Consider including a personal touch, such as a note from a team member or someone directly involved in the cause. A message from a volunteer, project manager, or beneficiary adds authenticity to the email and makes the donor feel more connected to the mission.

If the donor has a history of giving, reference their previous donations. Acknowledge their ongoing support and express appreciation for their continued commitment. For example: “We are grateful for your continued support over the years.” This reinforces the donor’s connection to the organization and encourages long-term engagement.

Close with a call to action that invites the donor to stay involved. You can offer them an opportunity to participate in future events, join a newsletter, or follow you on social media. A simple invitation like “We would love for you to stay updated on our progress–follow us on social media!” adds another layer of personalization.

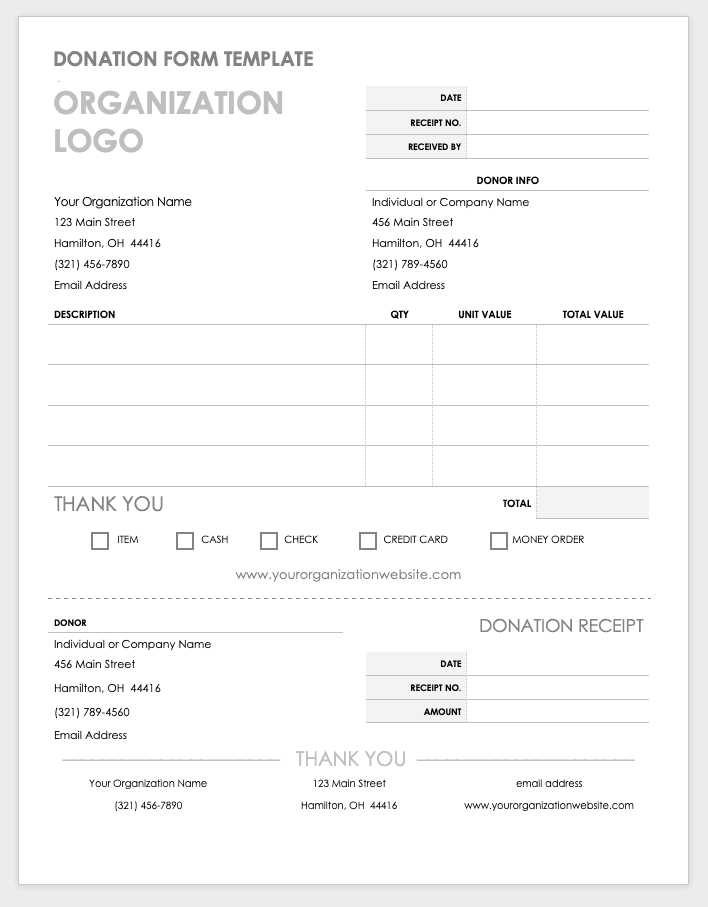

Ensure the following details are included in your receipt acknowledgment emails to make them clear and useful for donors:

1. Donor Information

- Full name of the donor

- Contact details (email or phone number, if relevant)

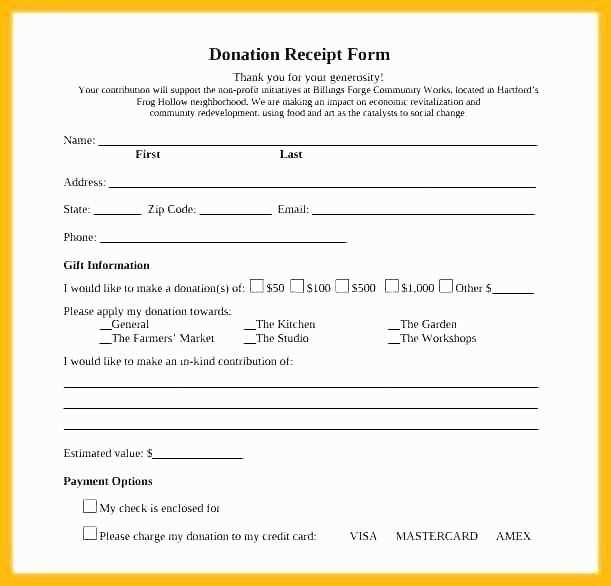

2. Donation Details

- Amount donated

- Date of the donation

- Payment method (e.g., credit card, bank transfer, etc.)

- Transaction or reference number

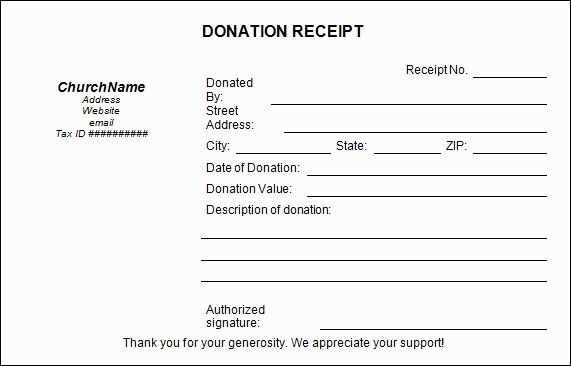

3. Organization Information

- Full name and address of the organization

- Tax-exempt ID number (if applicable)

- Official website or contact info for any follow-up inquiries

4. Acknowledgment Statement

- A clear thank-you note for the donation

- Confirmation that the donation is tax-deductible (if relevant)

- Any specific instructions or terms related to the donation

5. Next Steps or Opportunities

- Instructions for accessing a donation receipt for tax purposes

- Any follow-up actions or additional ways to support the cause

Keep your donation acknowledgment template simple and clear. A well-organized layout improves readability and strengthens your relationship with donors. Start by including a personalized greeting, such as the donor’s name, to establish a connection.

Clarity and Transparency

Clearly state the donation amount and any specific projects or programs the contribution will support. This helps donors feel confident that their money is being used appropriately. Avoid vague terms, and ensure your messaging is straightforward.

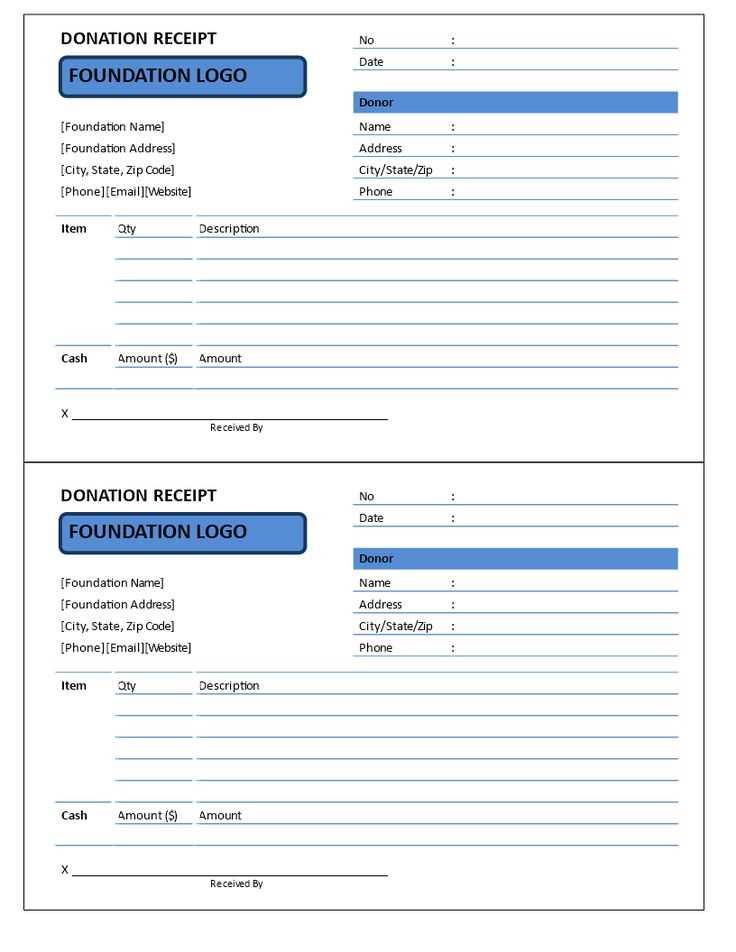

Visual Appeal

Choose a clean design with easily readable fonts and sufficient spacing between sections. Use contrasting colors for important information, such as donation amounts and thank-you messages. Including your organization’s logo adds professionalism without overwhelming the layout.

Incorporate a concise thank-you message that communicates gratitude. Acknowledge the donor’s generosity and the difference their support makes. Keep the tone warm and appreciative, using phrases like “your support is invaluable” to show sincere appreciation.

Don’t forget to include necessary details such as tax-deductible information and any next steps, like volunteering opportunities or events, that align with your mission. Keep your message brief, to avoid overwhelming the donor with too much information at once.

Donation Receipt Email Template

Include the donation details clearly at the beginning of the email. State the donor’s name, the donation amount, and the date of the transaction. For transparency, also mention the purpose of the donation if applicable.

Donation Confirmation

Make sure to confirm the receipt of the donation with a friendly tone. Acknowledge the donor’s contribution and express gratitude for their support. A simple line like “Thank you for your generous donation” goes a long way in making them feel appreciated.

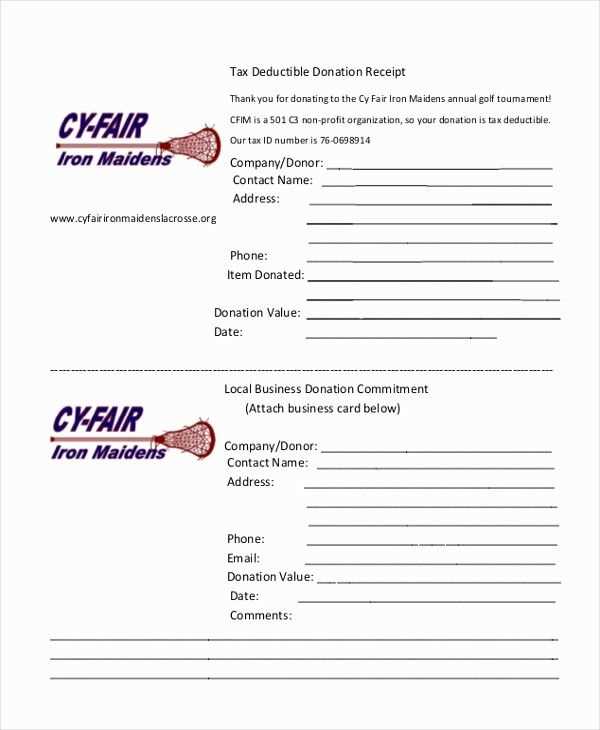

Tax Information

If the donation is eligible for tax deductions, include the necessary tax-exempt status information and any instructions for claiming the deduction. Provide a specific reference, such as the tax ID number, to ensure smooth processing when the donor files taxes.

Don’t forget to add a closing sentence thanking them again for their contribution. A good call-to-action is optional, inviting the donor to stay involved or learn more about your organization’s future efforts.