A typeable cash receipt template helps streamline your payment processing by offering a convenient, editable format. This template ensures that you can quickly fill in the necessary details without printing and manually writing information each time. Whether you’re managing a small business or tracking personal transactions, it saves time and prevents errors.

Designing your own template is simple and allows you to customize it based on your specific needs. Key fields like the date, payer’s name, payment amount, and purpose can be easily modified to suit different types of transactions. Make sure to include a space for both the issuer’s signature and a receipt number for tracking purposes.

Incorporating clear instructions within the template can make the process even smoother. For example, indicating the currency format or specifying how to record discounts and taxes can help eliminate confusion. Keep the layout clean and straightforward to ensure that all necessary information is captured without clutter.

Here are the corrected lines:

Review the following adjustments for your cash receipt template:

- Typeable Cash Receipt Template

- How to Create a Customizable Receipt Template in Excel

- Key Fields to Include in a Cash Receipt Template for Small Businesses

- Tips for Automating Data Entry in a Typeable Receipt Template

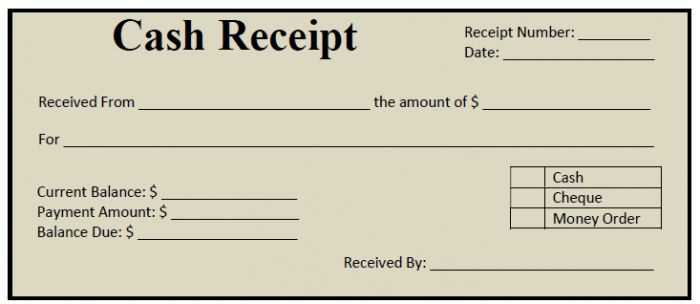

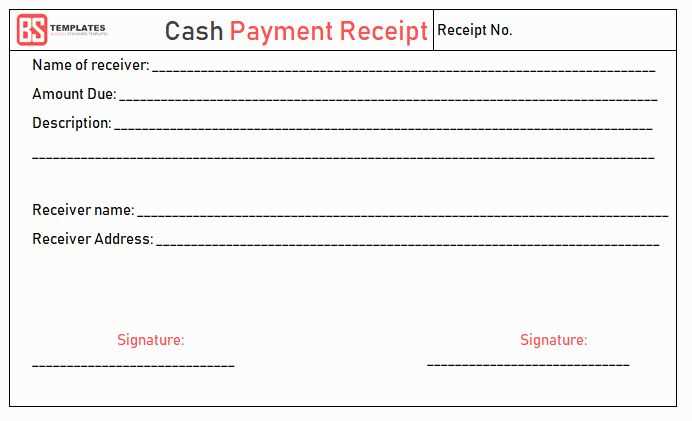

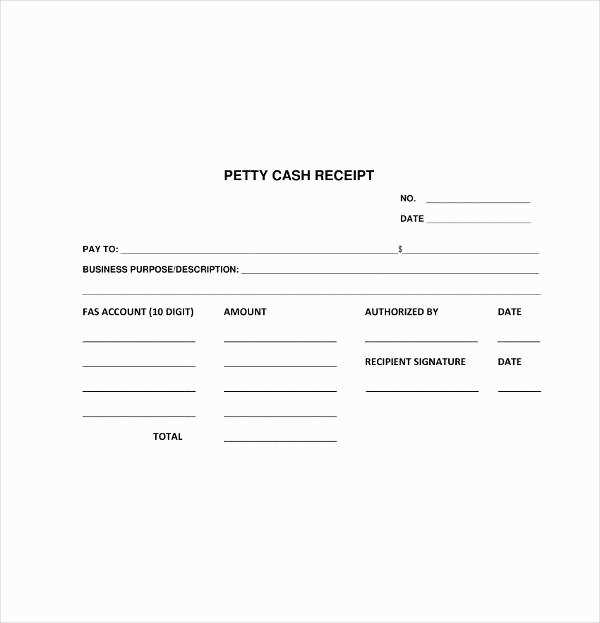

To create a typeable cash receipt template, start by including the basic elements: the date, receipt number, payer’s name, amount paid, and the reason for payment. Each section should be clearly labeled with space for the user to type the necessary information.

Use an intuitive layout with fields that are easy to fill out. This ensures that the document is user-friendly and maintains its professional appearance. For instance, create separate lines for the payer’s name and address, ensuring that each section is neatly aligned.

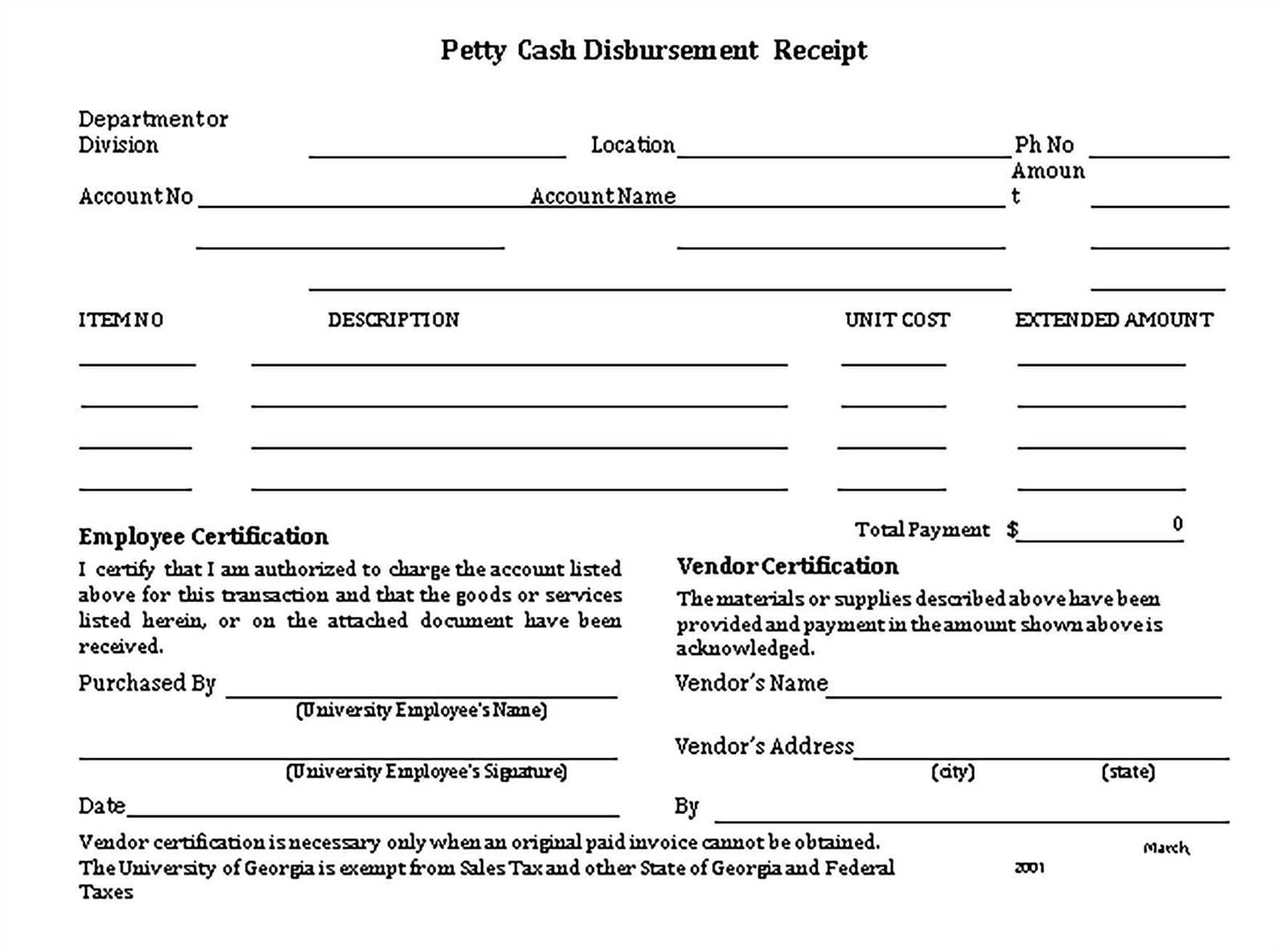

Next, make sure there’s a clear breakdown of the payment, such as an itemized list of products or services, along with their corresponding costs. Add a subtotal and the final amount due. Include a line for the cashier or receiving party to sign for confirmation.

Incorporating a space for tax calculations or discounts can also be useful depending on the transaction type. Make these fields editable so that users can adjust them accordingly.

Finally, ensure the template is easy to print or save. If using software like Microsoft Word or Google Docs, make sure to save the document as a template file, making it accessible for future use. Keep the design simple, using standard fonts and ensuring all text is legible for clarity.

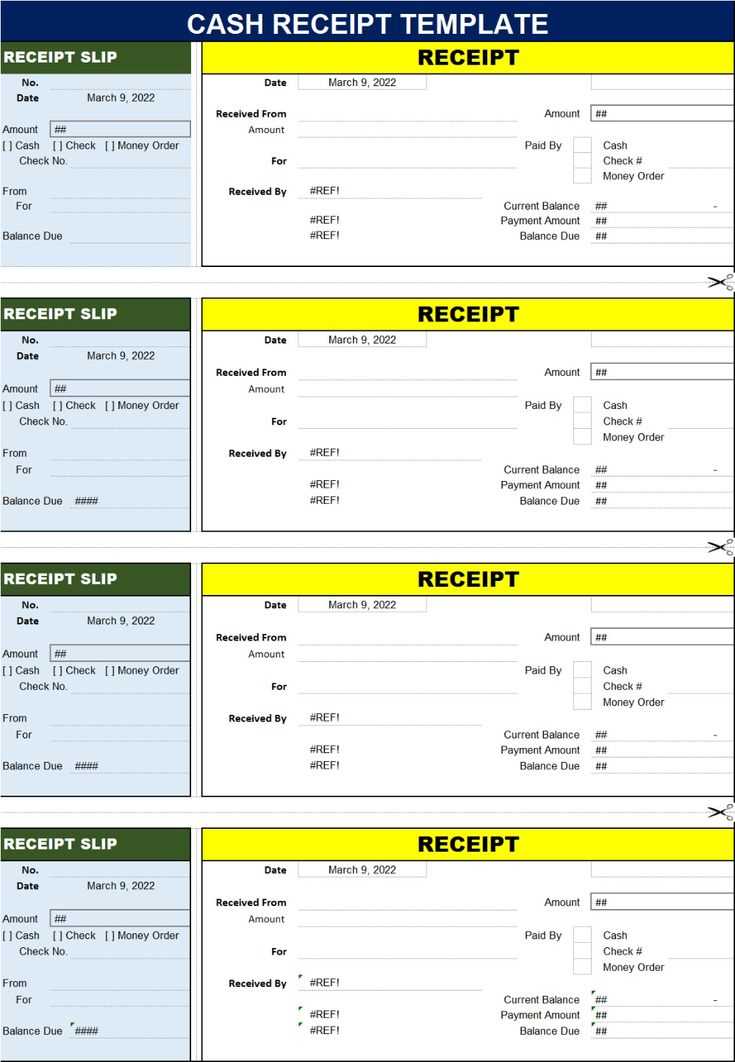

Set up a clean layout by dividing the receipt into distinct sections. Start with fields for “Receipt Number,” “Date,” “Customer Name,” and “Transaction Details.” Use borders and cell shading to separate these sections visually. Keep the information organized for quick data entry and readability.

1. Design the Core Structure

In the first row, include the basic information you need, such as the business name, address, and contact details. Below that, create rows for each purchased item. Include columns for “Item Name,” “Quantity,” “Unit Price,” and “Total Price.” For each item, use Excel formulas to multiply Quantity and Unit Price to calculate the Total Price automatically.

2. Add Calculations for Totals

At the bottom, sum up the item totals using the SUM formula. For any applicable tax, create another row to calculate the tax by multiplying the subtotal by the tax rate. Then, calculate the final total by adding the tax to the subtotal. This ensures the calculations are always accurate.

3. Personalize Your Template

Customize the template with your company logo and branding elements. You can insert a logo at the top using the “Insert Image” feature. Adjust the font size and style to match your brand’s identity, and make sure headers are bolded to stand out. Add space for customer signatures or payment method details if required.

Once you’ve set up the basic template, save it for repeated use. This way, you only need to update customer-specific information, keeping your receipts consistent and professional. For future receipts, create a new document by duplicating the template, ensuring a smooth workflow every time.

Include the transaction date to provide a clear record of when the payment was made. It helps maintain an organized accounting system and ensures that all entries are time-stamped for future reference.

Clearly state the payer’s name. This identifies who made the payment and ensures that your business records are accurate and complete.

Detail the payment amount and break it down if necessary. This should reflect the exact sum paid, and if there are multiple items or services, list them with corresponding amounts for clarity.

Specify the payment method, whether it’s cash, check, credit card, or another option. This information helps with reconciliations and tracking payment types for accounting purposes.

Include a unique receipt number for tracking and referencing purposes. It makes it easy to locate specific transactions and ensures that each receipt is distinct.

Provide the business name and contact details. This reassures the customer that they are dealing with a legitimate business and gives them a way to contact you if there are any questions.

Write a brief description of the goods or services provided. This gives context to the transaction and helps both you and the customer remember what was purchased.

Finally, leave space for signatures from both the payer and the payee. This adds an extra layer of formality and guarantees that both parties acknowledge the payment details.

Use data validation rules to reduce manual errors. Implement automatic checks for common errors, such as incorrect formats or missing fields. For instance, set up a rule that ensures a phone number contains only digits or that the email field has the proper “@” symbol.

Integrate your receipt template with accounting software or a database system. This enables automatic population of fields like customer details, tax rates, or item descriptions, reducing the need for manual input. Many tools support direct imports from CSV files or cloud storage platforms.

Leverage pre-filled dropdown lists for frequently used items or services. By setting up a list of products or categories, the template can suggest relevant options as you type, speeding up the process and reducing the chance of entering incorrect data.

Incorporate barcode scanning functionality if your business involves physical goods. Scanning a product’s barcode can automatically fill in details like the name, price, and description. This minimizes time spent manually entering product information.

Use macros or scripts to perform repetitive tasks. For example, create a script that automatically calculates the total amount based on the quantity and unit price, or a macro that automatically applies discounts based on specific criteria.

Enable auto-save features to avoid data loss. Make sure the template automatically saves entered information at regular intervals or after each update. This prevents the need to redo work in case of a system crash or accidental closure.

Consider setting up email or SMS notifications when a receipt is generated or updated. This can streamline communication with customers and ensure that all necessary parties receive accurate and timely information without additional input.

Removing Redundancies While Maintaining Meaning and Accuracy

Focus on eliminating repetitive phrases to streamline your message. Look for synonyms or restructure sentences to convey the same idea without restating it. For example, instead of repeating similar concepts, condense them into a single clear statement.

Keep the core message intact while avoiding unnecessary repetition. For instance, if the idea is already covered, don’t revisit it unless it’s to reinforce or clarify the point.

Take time to review your text and remove any excess words or phrases. A concise statement is more effective in maintaining the reader’s attention and ensuring the clarity of your message.