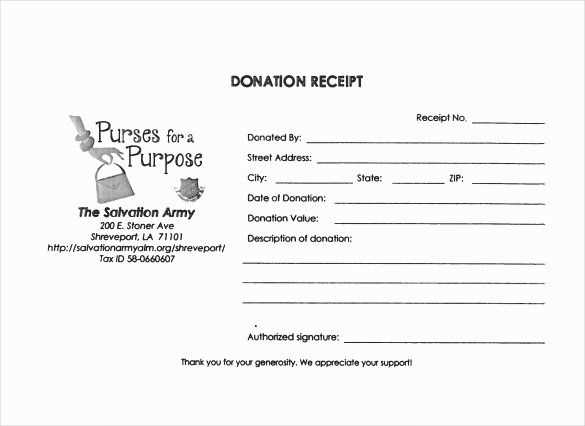

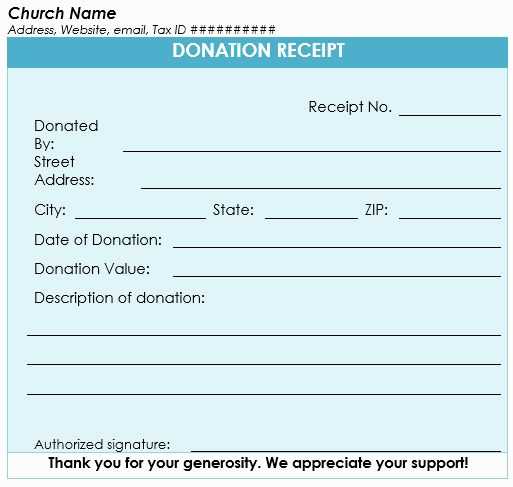

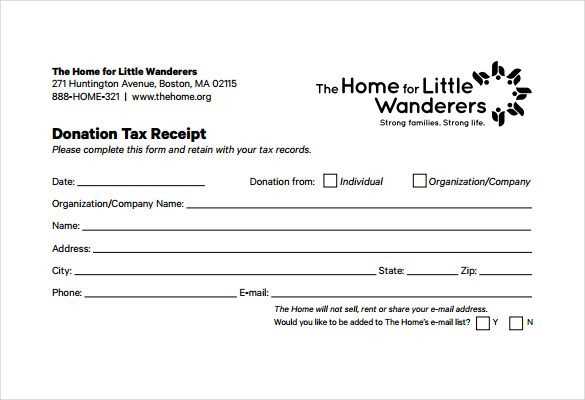

When issuing a tax receipt for a donation in Canada, make sure to include specific details to ensure compliance with the Canada Revenue Agency (CRA) guidelines. The donation receipt template should include the charity’s legal name, registration number, and the date of the donation.

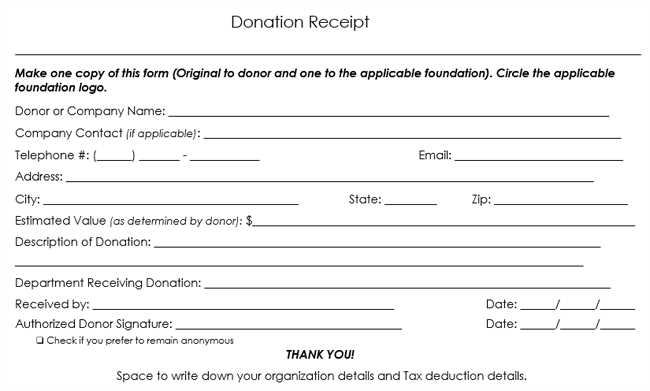

Include the full name of the donor, their address, and the amount donated. For non-cash donations, include a description of the donated item along with its fair market value. Ensure the receipt is signed by an authorized person from the charity, such as a director or officer.

It is also important to clearly state the official receipt number and the amount that is eligible for a tax credit. For example, if the donation was made by cheque or credit card, include the transaction details.

Keep the receipt simple and organized to avoid confusion, while ensuring all necessary legal and tax-related information is present. Make sure to provide a copy to the donor for their records and another for your organization’s filing purposes.

Here are the corrected lines with minimal word repetition:

Ensure that your tax receipt for donations includes the donor’s full name, donation amount, and the date the contribution was made. Specify the charity’s name, address, and registration number, as well as the signature of an authorized individual.

The receipt should also state whether the donation was a cash or in-kind gift. This will help ensure compliance with Canadian tax regulations. If the donation is non-monetary, provide a description of the donated item and its estimated value.

Key Details for the Donation Receipt

Include a clear statement that no goods or services were provided in exchange for the donation. This confirms the eligibility for a tax deduction under Canadian tax laws. Additionally, keep the record of all donations for both the donor and the charity’s accounting purposes.

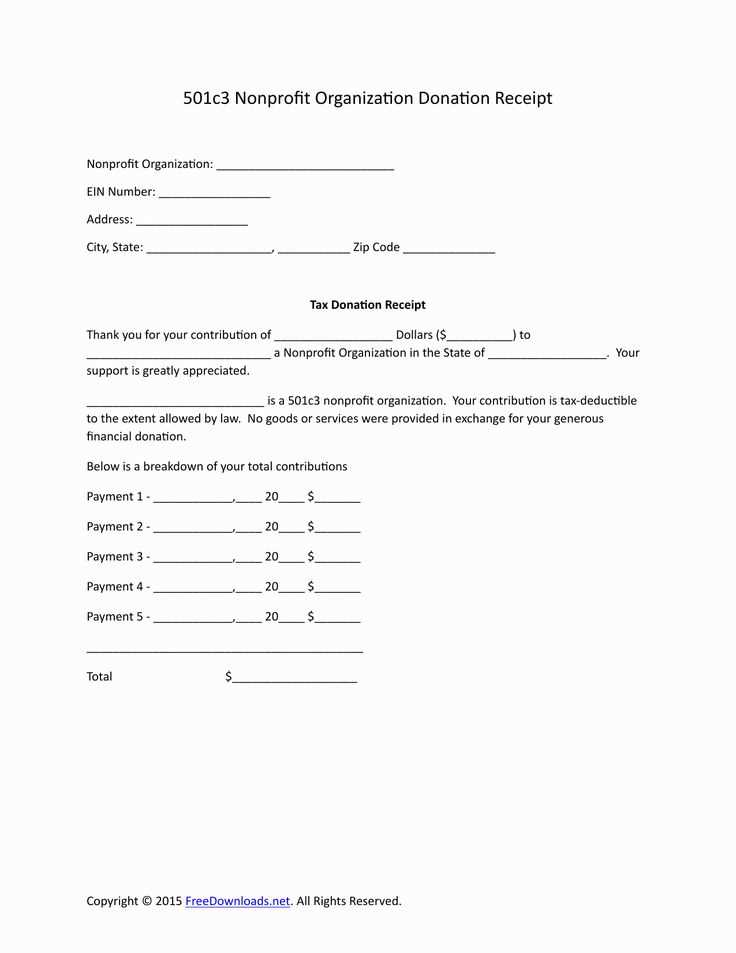

- Tax Receipt Template for Donations in Canada

To create a tax receipt for donations in Canada, ensure it meets the following key requirements outlined by the Canada Revenue Agency (CRA). A well-structured template should include the following details:

| Required Information | Details |

|---|---|

| Organization Name | The name of the registered charity or organization receiving the donation. |

| Charity Registration Number | A valid CRA-issued registration number for the charity. |

| Donor’s Information | Full name and address of the donor for proper identification. |

| Donation Amount | The total donation amount made, with a clear breakdown of cash or in-kind contributions. |

| Date of Donation | The exact date the donation was made. |

| Receipt Number | A unique number for tracking purposes and ensuring no duplicates. |

| Signature | A signature from a representative of the charity or organization. |

For in-kind donations, a description of the goods donated should be included, along with their estimated fair market value. This helps to ensure both transparency and compliance with CRA regulations.

After preparing the template with these details, make sure the receipt is issued promptly to the donor. The CRA requires that receipts be sent out for donations of $20 or more. Keep a copy for your organization’s records for audit purposes.

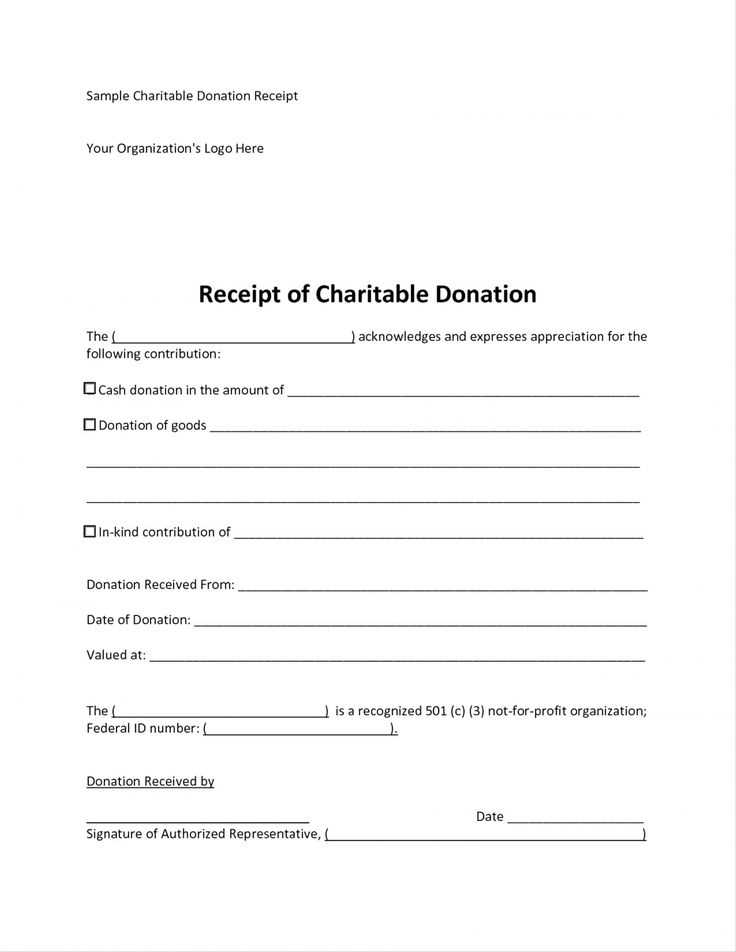

To create a tax receipt for charitable contributions in Canada, follow these key steps:

- Confirm Eligibility: Ensure the organization you’re issuing the receipt for is a registered charity with the Canada Revenue Agency (CRA). Only registered charities can issue official receipts for tax purposes.

- Include Required Information: The receipt must contain specific details, including:

- Organization’s name and CRA registration number

- Donor’s name and address

- Date of the donation

- Amount of the donation (or description of goods/services donated)

- Signature of an authorized person from the charity

- Statement that the receipt is for a charitable donation

- Use Official Templates: Make sure to use the CRA’s approved template for receipts, available through the CRA website, or your charity’s own template that complies with CRA guidelines.

- State the Fair Market Value (FMV): If a donor receives a benefit in exchange for their donation, you must subtract the FMV of the benefit from the donation total when issuing the receipt.

Additional Considerations

- Electronic Receipts: Charities can issue receipts electronically, but they must include the same required information and be sent directly to the donor.

- Record Keeping: Keep detailed records of all donations and receipts for at least 6 years, as CRA may request them for verification purposes.

A valid donation receipt must contain specific details to comply with Canadian tax laws. These elements ensure that the receipt is accepted for tax purposes and protect both the donor and the recipient organization.

Donor’s Information

The receipt must include the donor’s full name and address. If the donation is made by a corporation, the corporation’s name and address are required instead. Ensure that the name matches official records to avoid issues when filing taxes.

Charity’s Information

Include the legal name and address of the charitable organization, along with its charitable registration number issued by the Canada Revenue Agency (CRA). This ensures that the organization is recognized as a valid charity under Canadian law.

The date of the donation, the amount donated, and whether the donation was in cash or another form must also be clearly stated. For non-cash donations, a description of the donated items, their fair market value, and the method used to determine that value must be provided.

Lastly, the signature of an authorized representative from the charity, along with the receipt’s issue date, completes the document. Always ensure that the receipt complies with these guidelines to avoid complications during tax filing.

One of the most common mistakes is failing to include the correct date of donation. Always ensure that the date on the receipt reflects the actual day the donation was made. An incorrect date can complicate the donor’s tax filing and invalidate the receipt.

Another mistake is not providing a clear description of the donation. This is especially important when the donation is in-kind. A vague or missing description can lead to complications if the donor is audited or if they need to substantiate the donation’s value.

Ensure that the receipt includes the charity’s registration number. This number is necessary to verify the organization’s eligibility to issue receipts, which is crucial for the donor’s tax deduction.

Omitting the donor’s full name or address can also cause issues. Ensure that the receipt contains all required contact details, as this information helps confirm the legitimacy of the donation and is often necessary for record-keeping by the donor.

Another key mistake is failing to indicate whether the donation was in exchange for goods or services. If goods or services were provided in return, you must indicate the fair market value of those items. Without this, the receipt may not be considered valid for tax purposes.

Lastly, don’t forget to sign the receipt. A missing signature can make the donation receipt invalid. Always have an authorized representative sign the document before providing it to the donor.

When creating a tax receipt for a donation in Canada, ensure that it meets the specific requirements outlined by the Canada Revenue Agency (CRA). The receipt must clearly indicate the charity’s name, registration number, the date of the donation, and the amount received. It should also state that no goods or services were provided in exchange for the donation, unless this is not the case, in which instance the value of those goods or services must be listed.

What Should Be Included in the Tax Receipt?

The CRA has set clear guidelines to ensure donations are properly documented for tax purposes. The receipt should contain:

- Charity Name and Registration Number: This verifies the legitimacy of the organization.

- Donation Amount: Specify the monetary value of the gift.

- Date of Donation: This is crucial for tax purposes and to calculate the applicable tax year.

- Statement of Goods/Services: A declaration that no goods or services were provided in exchange for the donation, unless applicable.

Additional Tips for Accuracy

Ensure the receipt is signed and includes the charity’s address. Double-check that all details are correct, especially the amount and registration number, to avoid any issues when claiming the donation on your taxes.