If you run a nonprofit organization, providing tax-deductible receipts for donations is a key part of your financial and legal responsibilities. A well-structured receipt ensures that your donors can claim their contributions as tax deductions. It also helps you maintain proper records for your organization.

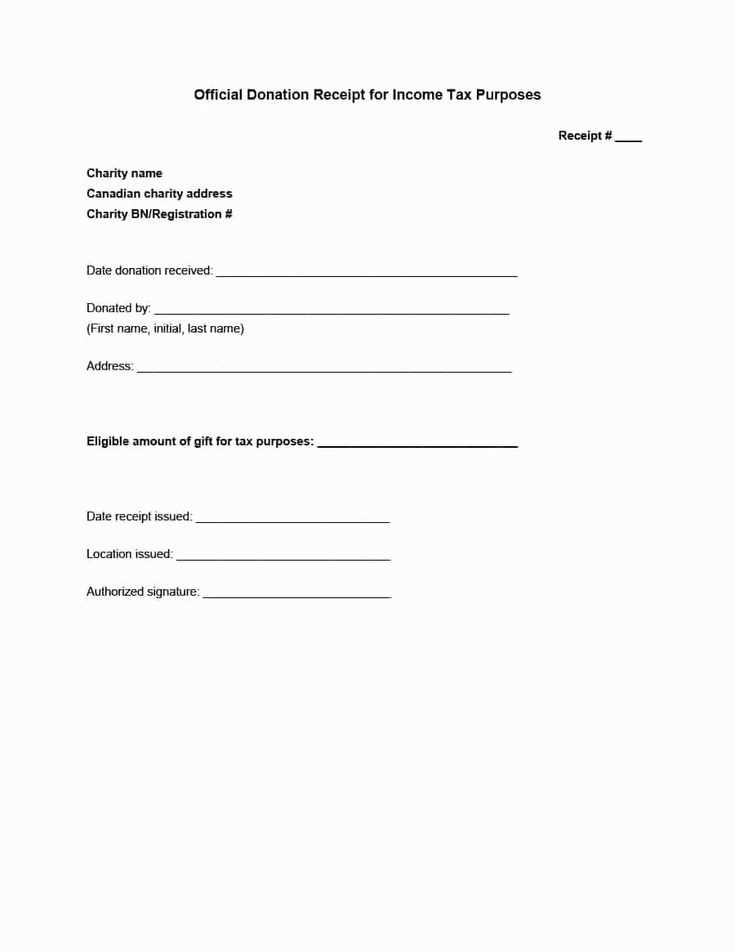

A tax-deductible receipt template should include several key components. First, include the nonprofit’s name, address, and tax-exempt status. Clearly state that the donation is tax-deductible and specify the amount or description of the contribution. For in-kind donations, provide a description of the items donated. It is also important to note if any goods or services were exchanged in return for the donation.

Ensure that each receipt includes the following details:

- Donor’s name and address

- Amount donated or a description of in-kind donations

- Nonprofit’s tax-exempt status and EIN (Employer Identification Number)

- Statement of no goods or services provided in exchange for the donation (if applicable)

- Date of the donation

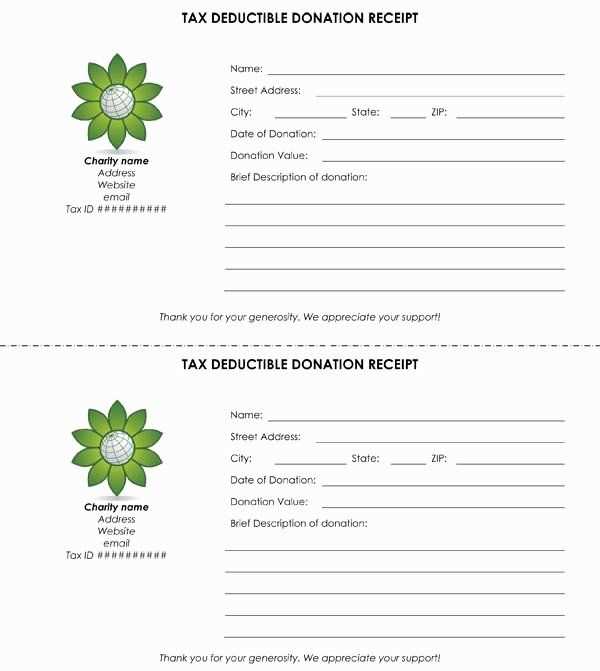

Use this template for clear, professional receipts that meet IRS guidelines. Donors appreciate receiving a straightforward and accurate receipt, and your nonprofit can stay organized while ensuring compliance with tax laws.

Nonprofit Tax Deductible Receipt Template Guide

Ensure your nonprofit tax-deductible receipt includes all the necessary details to comply with IRS requirements. Begin by listing the organization’s name, address, and EIN (Employer Identification Number). This makes the receipt traceable and confirms its legitimacy. Clearly state the donation amount, whether it is monetary or in-kind. For non-cash donations, describe the donated items and estimate their fair market value.

Include a statement confirming that no goods or services were provided in exchange for the donation. If any goods or services were provided, list them along with their estimated value. The date of the donation is also essential for tax purposes. Be clear about whether the donation is a one-time gift or recurring, especially for monthly contributions.

Provide a brief statement about the nonprofit’s tax-exempt status, and ensure that the receipt is signed by an authorized person from the organization. This validates the document and ensures accuracy. Finally, add a reminder that donors should retain the receipt for tax filing purposes. This ensures transparency and allows for easy record-keeping for both parties.

Creating a Basic Template for Donations

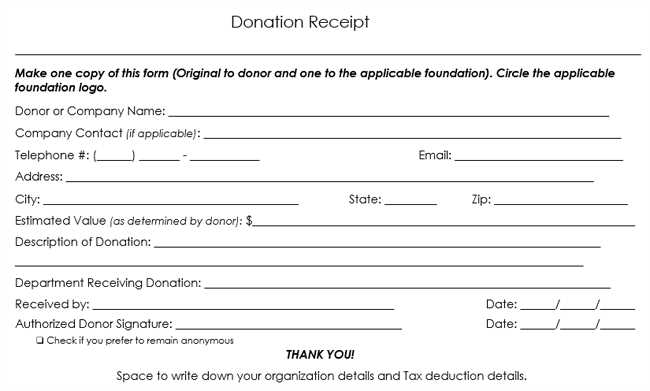

Begin by including your nonprofit’s name and logo at the top of the receipt. This ensures that the donor recognizes the organization instantly. Next, include a clear statement acknowledging the donation. For instance, “We hereby acknowledge a donation from [Donor’s Name] received on [Date].” This provides a record of the transaction for both parties.

Provide a breakdown of the donation amount. This can be listed as a total sum or itemized if applicable, depending on the nature of the donation (e.g., cash, goods, services). If the donor is entitled to any goods or services in exchange, you must clearly state that value to ensure IRS compliance.

Include your nonprofit’s tax ID number. This number is crucial for tax deduction purposes and must be visible on the receipt. Make sure it’s accurate and easy to find.

- Donor’s name

- Date of donation

- Donation amount (and description if relevant)

- Nonprofit tax ID number

- Statement on goods/services provided (if applicable)

Finally, add a thank you note. A simple message such as “Thank you for your generous contribution” goes a long way in showing appreciation and making the donor feel valued.

Ensuring Compliance with IRS Requirements

Ensure your nonprofit tax-deductible receipts contain the required information as outlined by the IRS. This includes providing a statement that the donation is tax-deductible, and confirming whether any goods or services were provided in exchange for the donation. Clearly state the date of the contribution and the amount donated, especially for non-cash donations.

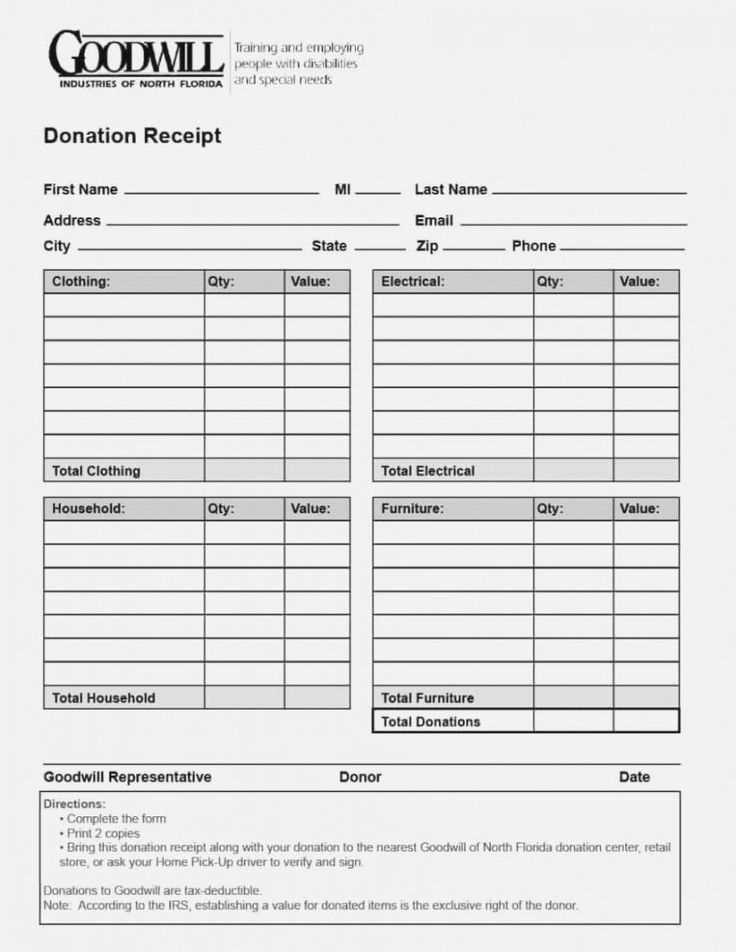

Provide a description of non-cash donations that accurately reflects their fair market value. Do not assign a value to the donation; instead, leave it to the donor to determine its worth. If goods or services are exchanged for the donation, you must disclose an estimate of their value, allowing the donor to know how much of their contribution is tax-deductible.

Double-check the IRS guidelines on donation acknowledgment to make sure your receipts follow current tax laws. Keep accurate records and ensure that all donations are accounted for, especially large ones or those requiring special handling, like property or stocks.

Customizing Receipts for Different Donation Types

Adjust your receipt format to reflect the type of donation, ensuring accuracy and clarity. For cash donations, include the total amount and date, along with a clear statement that no goods or services were provided in exchange. For non-cash donations, list the description of the items or services donated, as well as their estimated value, if applicable. If donations involve volunteer time, specify the number of hours donated and the hourly rate used for tax deduction purposes. When dealing with pledges, note the total pledge amount and payment schedule to help donors track their contributions.

Make sure to include all relevant tax information, such as the organization’s tax ID number, to streamline the donor’s tax filing process. Additionally, customize the language of your receipts based on whether the donor is an individual or a corporation, as some forms of donation might require different treatment. Keep records of these donations, as tax laws can require specific details for reporting purposes.