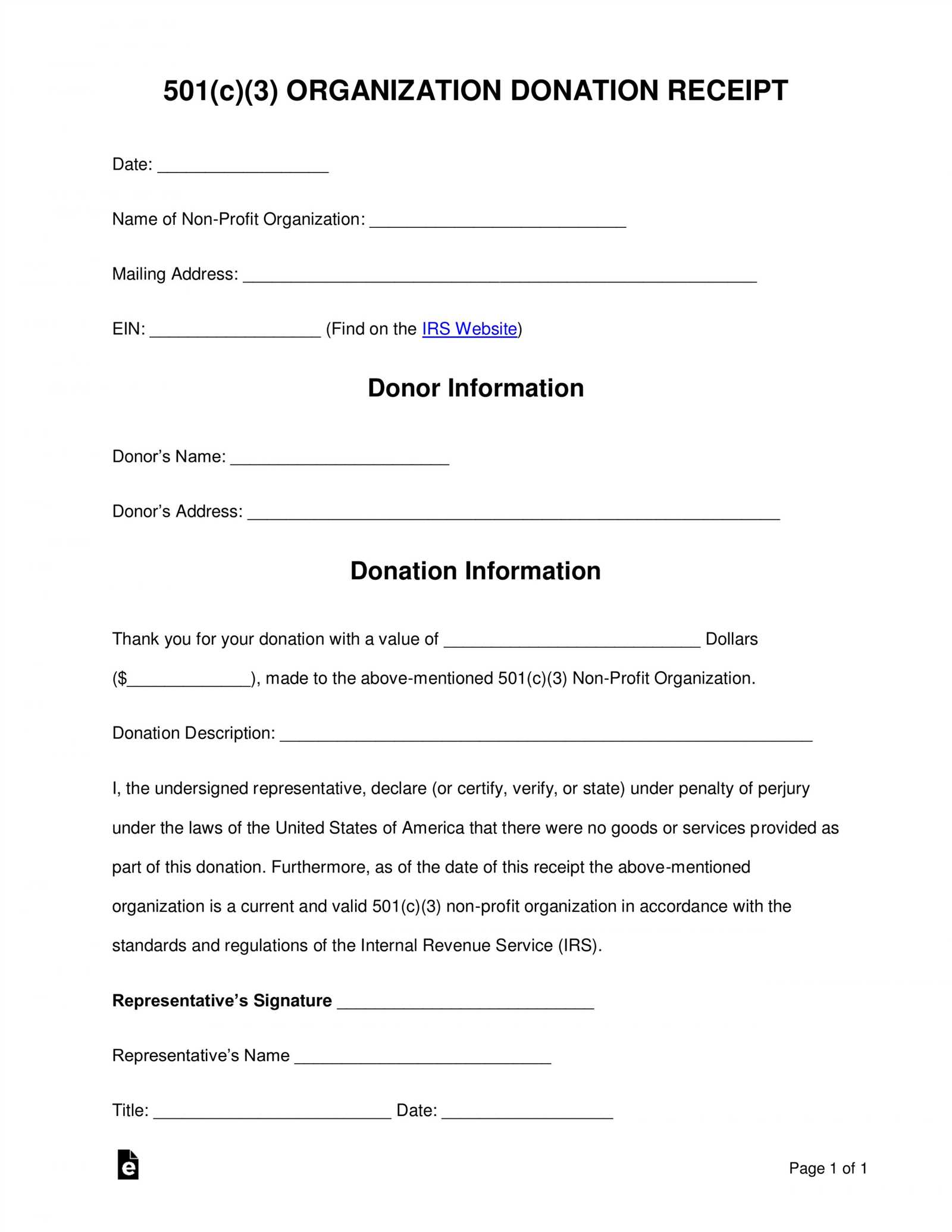

To create a charity tax receipt template, ensure the key components are clearly presented for the donor’s convenience and compliance with tax regulations. The receipt should include the charity’s legal name, address, and registration number. Specify the donation amount, whether it was in cash or goods, and the date of the contribution.

Make sure to clearly state the value of any non-cash donations. If the donor contributed goods, provide an estimated value of the items donated. For in-kind donations, you can also include a statement that the charity did not provide any goods or services in exchange for the donation, which is necessary for tax purposes.

Don’t forget to sign the receipt. Having a signature from an authorized person at the charity adds legitimacy to the document and ensures it is officially recognized. It’s also helpful to include a section that acknowledges the donor’s consent to use their information for tax filing purposes.

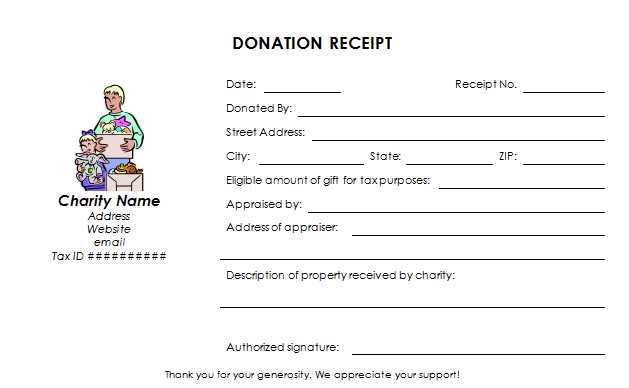

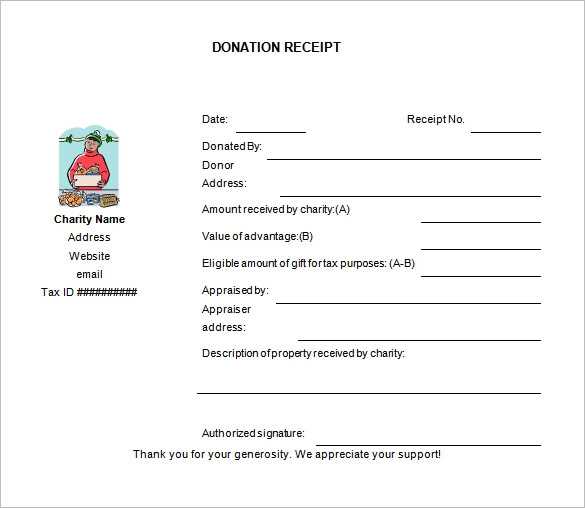

Charity Tax Receipt Template

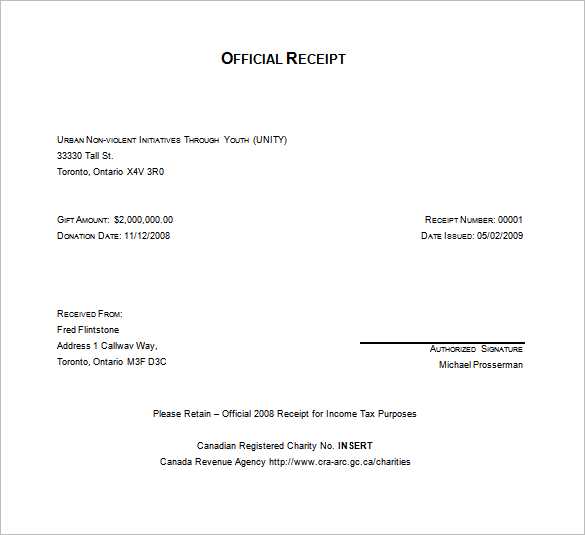

Include the charity’s name, address, and tax identification number at the top of the receipt. Specify the donor’s name, address, and contact information to ensure proper documentation. Clearly state the donation amount or the value of the in-kind contribution, along with the date of the donation. If applicable, mention the goods or services received by the donor in exchange for their donation, and clarify that the donation is tax-deductible. Ensure that the receipt includes a statement confirming that no goods or services were provided in exchange for the donation, if that is the case.

For accuracy, provide a unique receipt number and ensure the signature of an authorized representative of the charity. This helps maintain transparency and accountability. Always include a disclaimer about the donor’s responsibility to confirm the deduction eligibility with their tax advisor.

Key Information to Include in a Charity Tax Receipt

Ensure your charity tax receipt contains the donor’s full name and address, as this is necessary for record-keeping and for the donor to claim the deduction. Include the charity’s legal name, address, and registration number. This helps verify that the donation was made to a legitimate organization.

Donation Details

Clearly state the amount or value of the donation, and specify whether it was cash, property, or other items. If applicable, include a description of non-cash donations with their estimated fair market value. If the donation involved goods or services in return, indicate the value of these benefits to avoid confusion.

Date and Acknowledgement

Provide the date of the donation. This is important for the donor’s tax filing. Also, include a statement that confirms no goods or services were provided in exchange for the contribution, or if they were, specify their value.

Customizing Your Template for Different Donation Types

Adjust the content and format of your charity tax receipt template to reflect the specific nature of each donation. For monetary donations, include the exact amount given and the date of the contribution. For in-kind donations, provide a detailed description of the items donated and their fair market value. Ensure the donor’s name and contact information are clearly visible on the receipt for both types of donations, as this helps maintain transparency and assists in future communication.

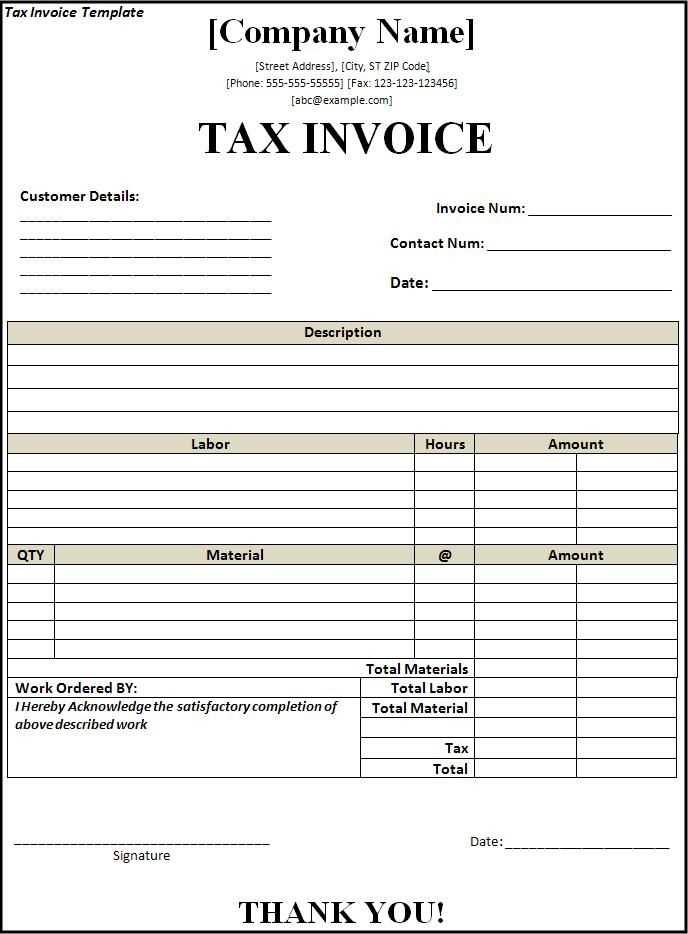

Monetary Donations

When customizing your template for cash or check donations, clearly display the monetary amount and specify whether the donation was a one-time or recurring gift. Include payment details like the check number or transaction ID, especially if the donation was processed through an online platform. This information provides clarity and helps the donor track their contributions for tax purposes.

In-Kind Donations

For non-cash donations, outline the itemized list of goods donated. Describe the condition of the items and, if applicable, include the fair market value. This section should be as detailed as possible, as the IRS requires donors to estimate the value of their non-cash contributions. Include a disclaimer stating that the organization is not responsible for appraising the value of donated items.

Common Mistakes to Avoid When Creating a Tax Receipt

Ensure the donation amount is clear and accurate. Double-check that you have correctly entered the sum donated, including any specific details like matching gifts. Any discrepancies may delay the processing or lead to complications for the donor during tax filing.

Include the charity’s legal name. Some receipts incorrectly use nicknames or shortened forms. The IRS requires the full legal name of the charity to validate the donation for tax purposes.

Verify the date of the donation. Make sure the receipt includes the exact date the donation was made. An incorrect or missing date could raise questions during an audit.

Clarify whether goods or services were provided in exchange. If the donor received something in return for their contribution, you must state the fair market value of the goods or services. Failing to do so may result in the donation being considered partially non-deductible.

Do not forget the organization’s tax-exempt status. Always list the charity’s EIN (Employer Identification Number) or other identifiers to confirm its tax-exempt status. This information helps the donor qualify for tax deductions.

Confirm the donor’s details. Be sure to input the donor’s name and address correctly. A misspelled name or wrong address can lead to confusion and might prevent the donor from claiming a tax deduction.

Leave no room for ambiguity. Avoid vague language like “generous gift” or “donation.” The receipt should clearly define what the contribution was, whether cash, check, or property, so that there is no uncertainty regarding the deduction.

Failing to keep accurate records of receipts can lead to discrepancies or complications if donations are ever questioned. Always maintain a systematic record for every donation processed.