Use a payment receipt log to track transactions and manage your finances. A simple template can help you record the necessary details such as the date, payment method, payer, and amount. This ensures accurate documentation of each transaction, making it easier to monitor and reconcile accounts.

Track Every Detail for each payment, ensuring you include all relevant fields like transaction ID, item description, and any additional notes. This helps avoid confusion and provides clear records for future reference.

Keep It Organized by categorizing receipts based on date, customer, or payment type. A well-structured template allows you to quickly locate specific receipts, saving time and reducing errors in your accounting process.

Regularly update your log to keep your records current. By maintaining this habit, you’ll have an accurate history of all payments, which can be useful for auditing, taxes, or customer inquiries.

Here is the corrected version:

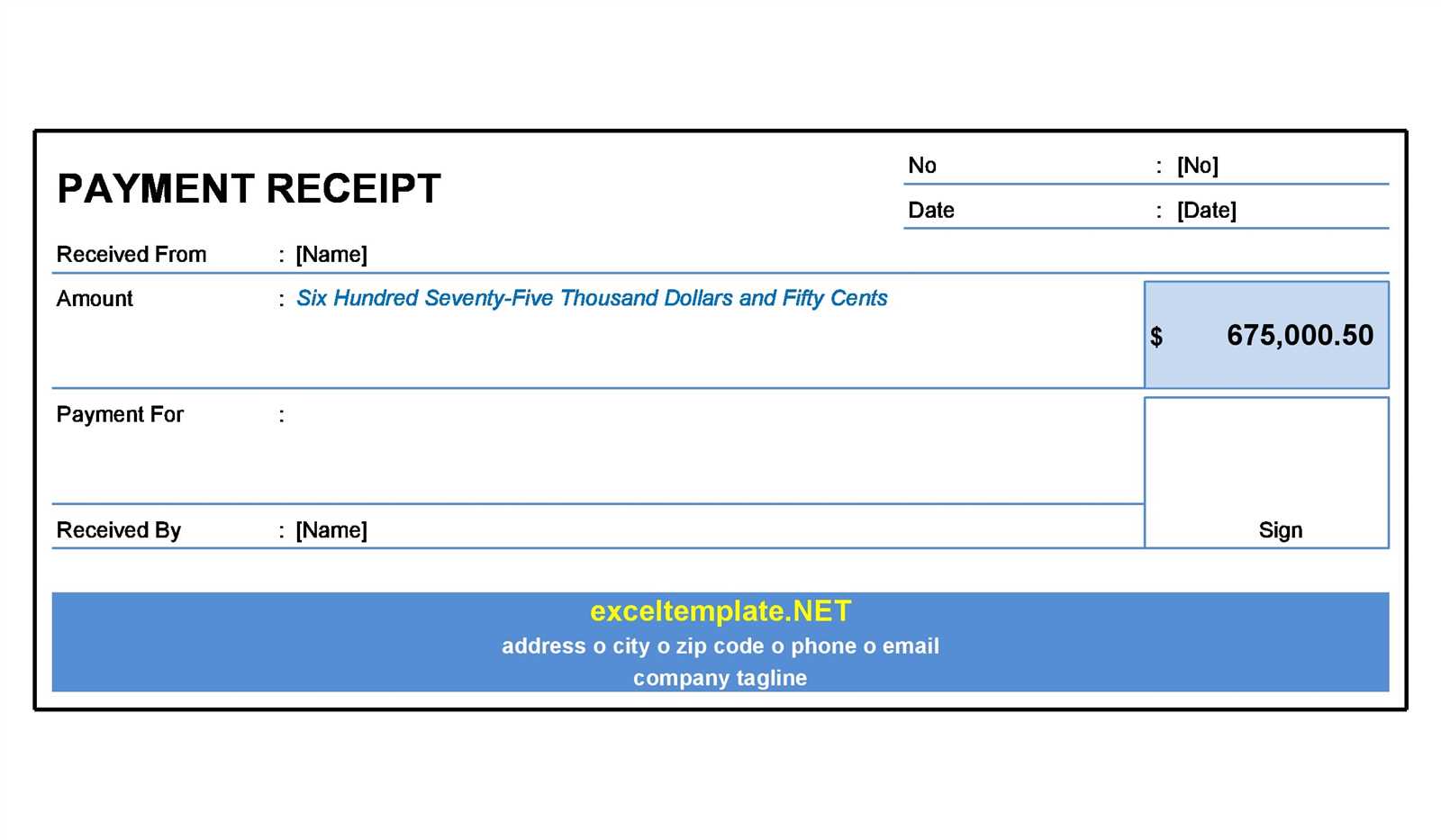

For better organization and clarity in your payment receipt log, create clear columns for essential details. Begin with the transaction date and time, followed by the payer’s name, amount received, and payment method used. Include a reference number for each transaction to ensure you can easily trace any entries. Additionally, it is helpful to include a description or note for each payment to explain the purpose or nature of the transaction.

Example: The first column should list the transaction date, the second should list the payer’s name, and the third should include the payment method, whether it is cash, credit, or digital transfer. This structure makes the log readable and accessible for quick reference.

Consistency is key. Make sure all entries follow the same format, so anyone reviewing the log can easily understand the data. This includes keeping the same decimal places for monetary amounts, using clear abbreviations for payment methods, and following the same order for each transaction detail.

Lastly, implement regular audits to ensure that all logs match actual payments received. This will help you maintain accuracy and avoid discrepancies in financial records.

- Payment Receipt Log Template: Practical Guide

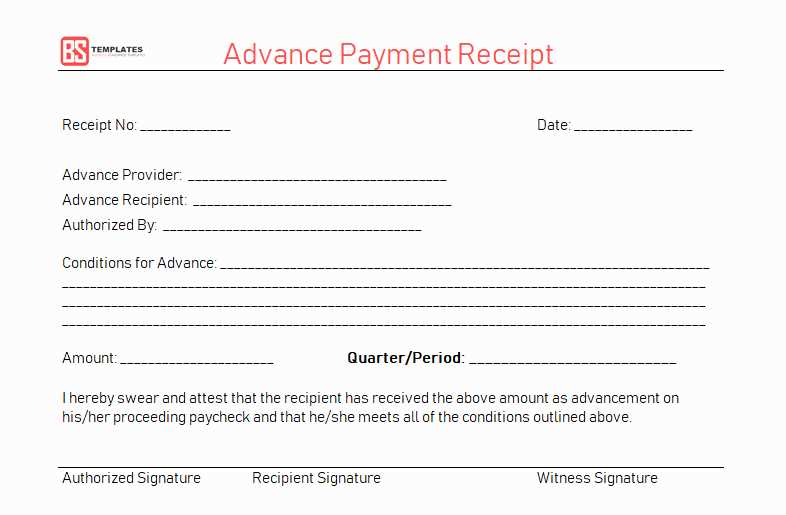

To create a useful payment receipt log, focus on keeping it clear and structured. The log should include fields for essential details: payment date, payer information, payment method, amount received, and the purpose of the payment. This ensures that all relevant data is captured for easy tracking and reference.

Start with the date. Each entry should clearly state the exact date the payment was made. This is crucial for organizing records chronologically, which helps when reviewing past transactions.

Include payer information. Collect details such as the payer’s name and contact information. This provides context and helps identify the payer in case of discrepancies or future communication.

Specify the payment method. Record how the payment was made, whether via cash, cheque, or electronic transfer. This can help with auditing and in resolving any disputes that may arise later.

List the payment amount. Make sure to record the exact amount received. This eliminates any confusion over payment discrepancies and serves as a reference for accounting purposes.

Clarify the payment purpose. Note what the payment is for, whether it’s for services rendered, a product purchased, or a deposit. This adds transparency and makes it easier to track payment trends.

By following this template, you can maintain a comprehensive payment log that makes reviewing transactions straightforward and ensures all necessary information is included. Keep your log organized, and update it regularly to stay on top of your payments.

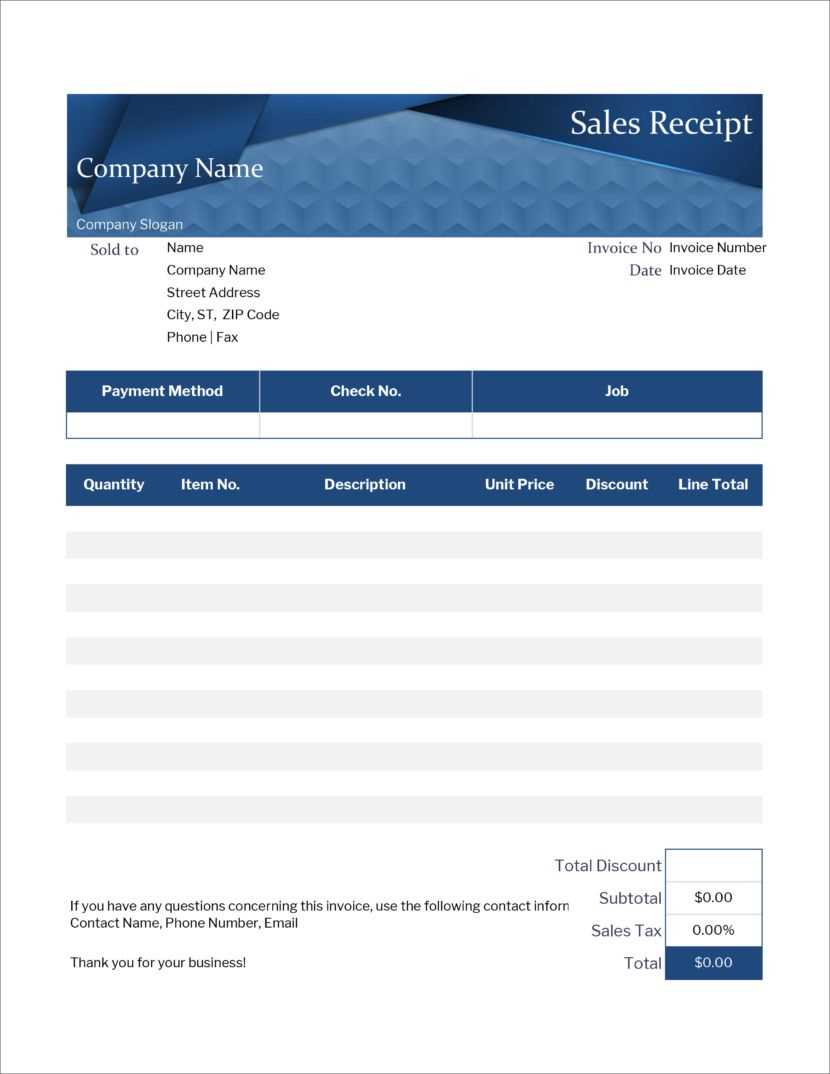

To create a payment log template, follow these steps to ensure clarity and accuracy in tracking payments:

1. Choose the Right Platform

- Opt for a spreadsheet software, like Microsoft Excel or Google Sheets, to provide flexibility in data entry and analysis.

- For automated tracking, consider using accounting software that includes payment log features.

2. Define Key Fields

Ensure your template includes the following columns:

- Date: Record the exact date of each payment.

- Payment Method: Specify how the payment was made (e.g., cash, credit card, bank transfer).

- Amount: Include the exact amount paid.

- Payee: List the person or entity receiving the payment.

- Description: Provide a brief note about the reason for the payment.

- Status: Indicate whether the payment is pending, completed, or canceled.

3. Organize Data Effectively

- Use filters or conditional formatting to sort payments by date, amount, or status.

- Create separate sheets or tabs for different payment types or months for better tracking.

4. Automate Calculations

- Set up formulas to calculate the total payment amount automatically.

- Use built-in features like sum or sumif to track payments by categories or dates.

5. Maintain Accuracy

- Regularly update the log after each transaction to avoid errors.

- Double-check entries for typos or missing information to ensure data integrity.

Sort receipts by categories such as “business,” “personal,” and “tax-deductible.” This step ensures that you can easily locate relevant receipts without mixing them up. Consider using folders, either digital or physical, for each category to keep things streamlined.

Scan and store digital copies of your receipts. If you don’t have a scanner, use a mobile app to capture images and organize them directly into your folder system. This helps keep backups and makes it easier to share receipts when needed.

Implement a consistent filing system for both paper and digital receipts. For paper receipts, use a binder or accordion file with labeled dividers. For digital receipts, use a cloud service like Google Drive or Dropbox with folder names based on date or category.

Regularly update and maintain your records. Set a reminder to file receipts at the end of each week. A cluttered pile of receipts is harder to process, and a quick weekly session prevents future overwhelm.

| Category | Suggested Filing Method |

|---|---|

| Business | Folder labeled “Business” with subfolders by month or project |

| Personal | Folder labeled “Personal” organized by year or purpose (e.g., groceries, dining) |

| Tax-deductible | Folder marked “Tax Deductible” with subfolders for each tax year |

Tag each receipt with key information like date, amount, and vendor in digital systems. If using physical receipts, include this information on the back for quick reference. This additional data makes receipts easier to track, especially during tax season.

Review receipts periodically to remove unnecessary ones. Old receipts can accumulate and take up space, both digitally and physically. Keep only what is necessary for taxes or warranty purposes to avoid clutter.

Organize receipts chronologically. Make it a habit to log each receipt immediately after a transaction, recording details like the date, amount, vendor, and category of the expense. This ensures accuracy and reduces the risk of missing or misclassified transactions.

Use categories that align with your budgeting needs, such as office supplies, travel, or meals. By grouping receipts into meaningful categories, you can quickly analyze spending patterns and adjust your financial plans if necessary.

Regularly reconcile your log with bank statements or credit card transactions. This will help verify your records and identify discrepancies early, saving time and preventing errors down the line.

Consider digitizing your receipts using scanning apps or taking photos, then storing them alongside the log. This method reduces paper clutter and makes it easier to access records for tax purposes or audits.

Review your log monthly. Look for any areas where spending might be higher than expected and assess if adjustments are needed. Use this review process to refine your financial strategy and stay on top of your budgeting goals.

Use clear, consistent formatting to track payments. Begin by structuring each entry with the transaction date, payment method, and amount. This ensures each record is easily searchable. For quick reference, include a “Payment ID” or invoice number in each log entry to differentiate transactions. You can opt for a simple table format for easy viewing, listing all details under separate columns for easy sorting.

Don’t forget to regularly update your log to maintain accuracy. Record each payment promptly to avoid confusion or errors down the line. In the case of partial payments, break down amounts clearly to show the balance remaining. This transparency reduces misunderstandings for both you and the recipient.

Make sure to include the payer’s contact information in case you need to follow up. This can be especially useful for recurring payments or subscription services. Lastly, always save backups of the payment log–consider using cloud storage for easy access and security.