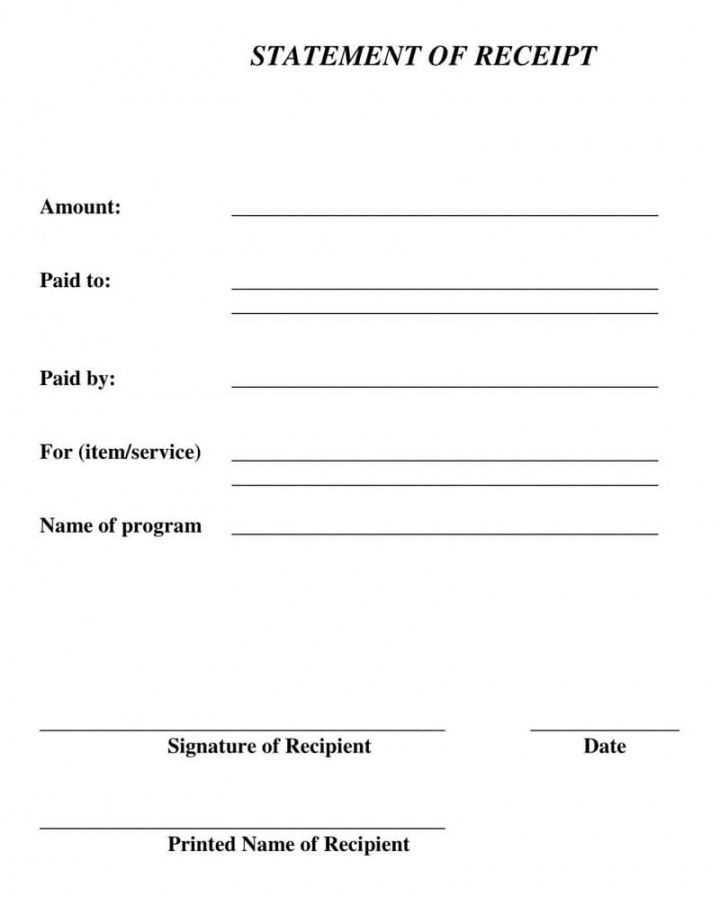

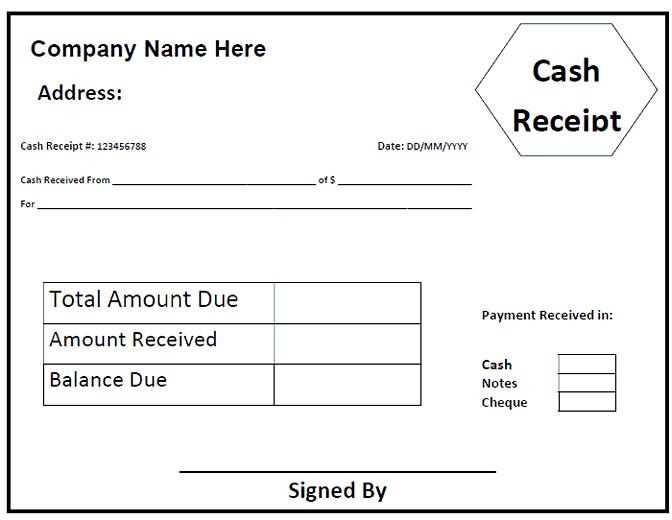

To streamline the process of issuing a receipt for legal fees, ensure that all critical elements are included in your template. Begin with clear identification of the payer and payee, including full names and addresses. This establishes a record of the transaction and can be essential for both parties when reviewing payment history.

Make sure to specify the amount paid, as well as the payment method used, such as check, credit card, or bank transfer. Including a date of payment ensures accuracy and prevents confusion about the timing of the transaction. Additionally, it’s important to detail the services provided and the corresponding fees, so that the client understands exactly what they are being charged for.

Lastly, provide a unique receipt number for tracking purposes, which can help in organizing financial records. This simple practice can aid in future reference and ensure that all transactions are properly documented. By following these guidelines, you can create a receipt template that is both professional and easy to understand.

Receipt of Legal Fees Template

To create a legal fees receipt, include the following details for clarity and professionalism:

Key Elements

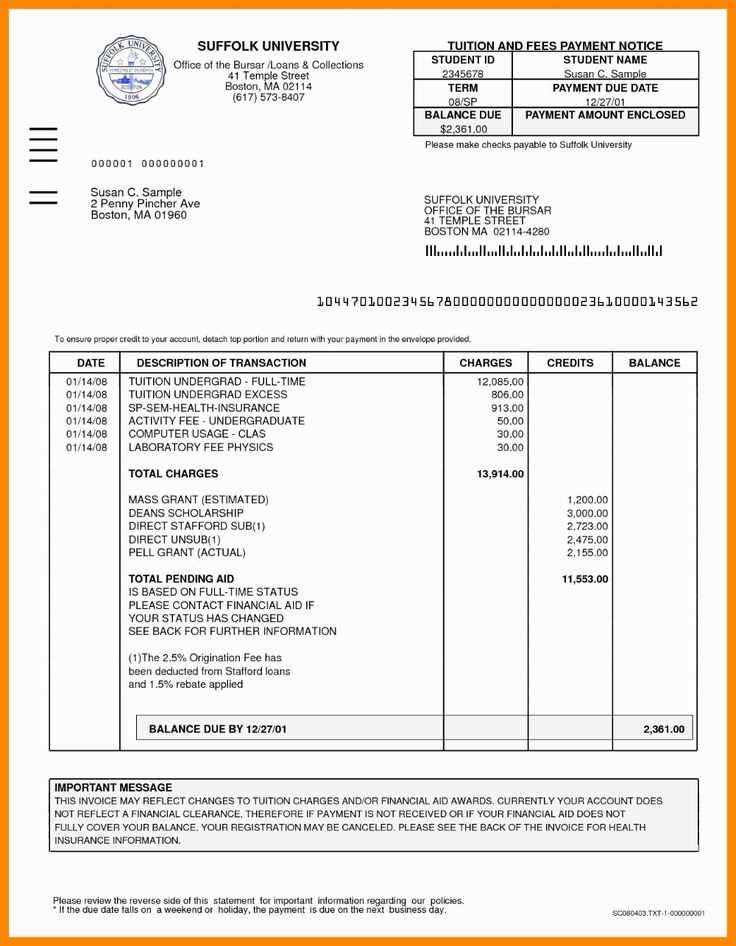

Receipt Number: Assign a unique receipt number to track payments effectively.

Date of Payment: Clearly state the date when the payment was made.

Client’s Name: Include the full name of the client who made the payment.

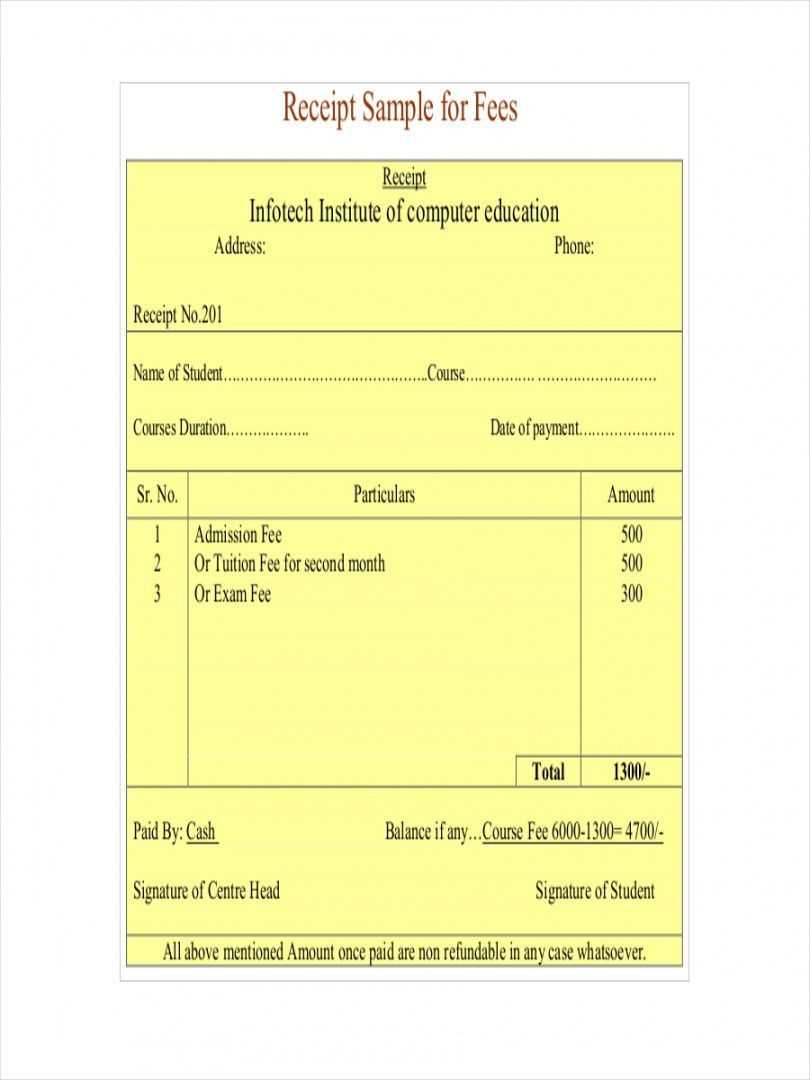

Service Provided: Specify the legal service rendered, such as consultation, document drafting, or representation.

Amount Paid: List the exact amount paid by the client.

Payment Method: Indicate how the payment was made (e.g., cash, check, bank transfer).

Additional Recommendations

Law Firm’s Information: Add the firm’s name, address, and contact details for reference.

Legal Professional’s Name: Include the name of the attorney who provided the service.

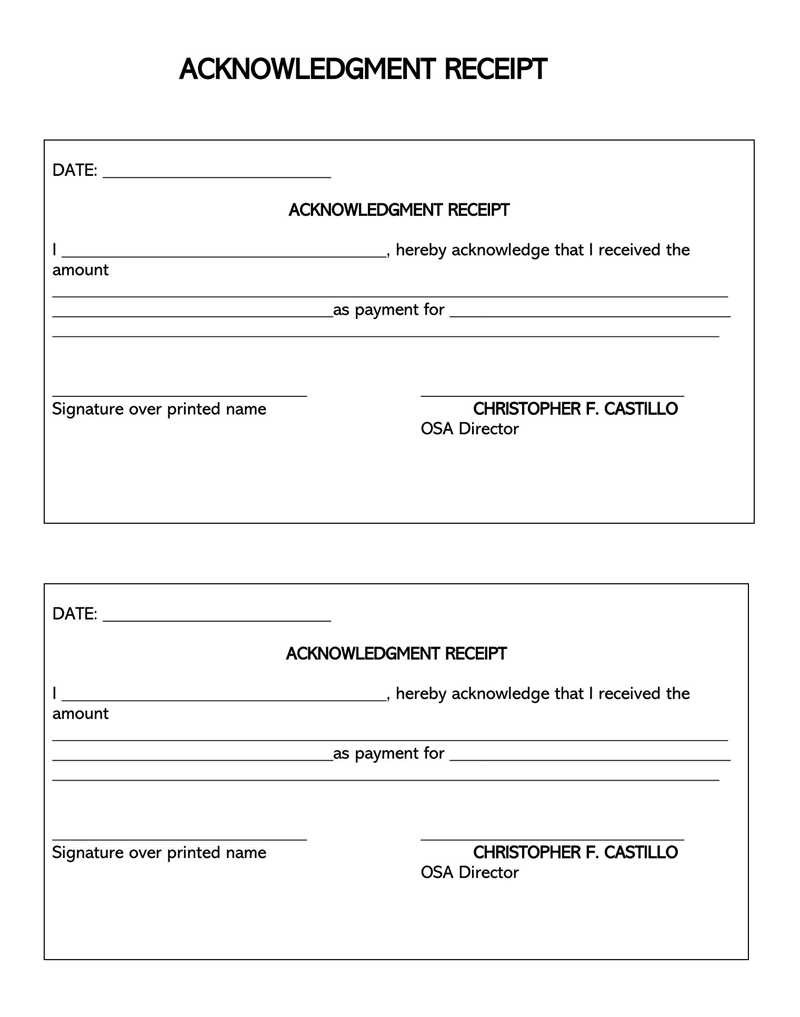

Signature: Ensure the receipt is signed by the authorized representative, confirming the payment.

This template helps maintain transparency and can be used for personal or business records.

Drafting a Clear Legal Fee Agreement

Outline the fee structure clearly at the outset. Specify whether the fees will be hourly, flat-rate, or contingency-based. Include the rate or percentage, and detail how it applies to the case. This ensures there is no ambiguity regarding the costs.

Clarifying Payment Terms

Define the payment schedule and due dates. Include whether the client will be required to pay upfront, after specific milestones, or upon completion of the service. Consider including provisions for late payments and interest charges if applicable.

Addressing Additional Expenses

- List potential extra costs such as filing fees, expert witness fees, and travel expenses.

- Make it clear whether these expenses will be charged separately or are included in the agreed fee.

- State if any additional approval is needed before incurring such expenses.

Lastly, outline the process for revising the agreement. Specify under which circumstances the fees might change, and how the client will be notified about any adjustments. This keeps both parties on the same page throughout the engagement.

Structuring Payment Terms and Conditions

Define clear payment deadlines. Specify whether payments are due immediately, within a set period, or after a specific milestone is reached. For example, you might specify “Due within 30 days from invoice” or “Upon completion of service.” This avoids ambiguity and helps both parties manage expectations.

Set up the payment schedule based on the complexity of the legal work. For projects requiring multiple phases, break down payments into installments tied to each stage. This ensures that you’re compensated as the work progresses and prevents delays in funding.

Late Payment Penalties

Include a clause for late payments. This should specify any additional fees for overdue amounts, such as a fixed percentage (e.g., 5%) per month after the due date. A clear penalty structure encourages timely payments and discourages delays.

Accepted Payment Methods

List all available payment methods–bank transfers, credit cards, checks, or online payment services. Providing multiple options gives clients flexibility, improving the likelihood of on-time payments.

Specify any requirements or fees related to each payment method. For example, you might require clients to cover transaction fees for credit card payments or set a minimum amount for wire transfers. This ensures that both sides are clear on any associated costs.

By organizing payment terms with specific guidelines, both the client and the provider benefit from a transparent, predictable process.

Ensuring Legal Compliance in Fee Receipts

Include all relevant details such as the recipient’s name, the legal services provided, the date of payment, and the amount paid. Clearly specify the payment method to avoid disputes. Make sure to indicate whether the payment includes any taxes, such as VAT, and break down the amount paid accordingly. It’s necessary to provide information about any retainer fees, hourly rates, or other types of billing arrangements if applicable.

Detailed Description of Services

Detail each service provided and the time spent, if applicable, to ensure transparency. For hourly rates, provide a clear breakdown of hours worked. If there were any adjustments or discounts, these should also be clearly stated on the receipt. Clients should understand exactly what they are paying for.

Legal Disclaimer and Signature

Include a disclaimer about the receipt, stating that it is for payment purposes only and does not constitute legal advice. A signature from both parties helps confirm that the fee receipt is accurate and agreed upon. Make sure the receipt is dated, and it’s advisable to retain copies for both the client and your records.