A paid receipt template is a straightforward and practical tool for documenting payments. It confirms the transaction between a buyer and seller, providing both parties with an official record of the exchange. Using a template ensures consistency and professionalism in all your financial dealings, whether you’re running a small business or managing personal transactions.

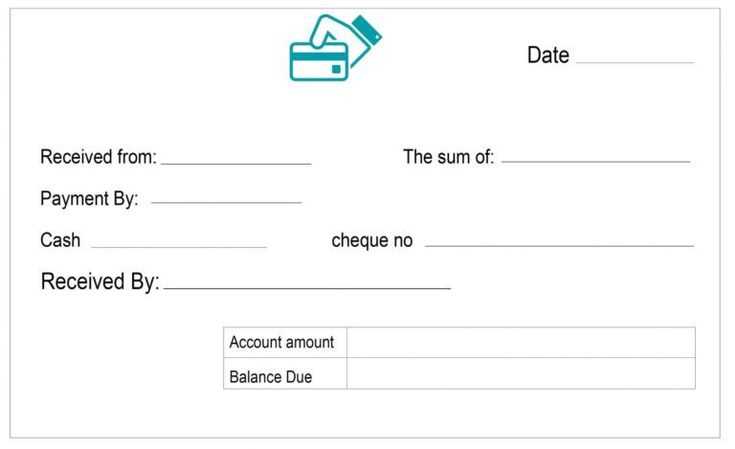

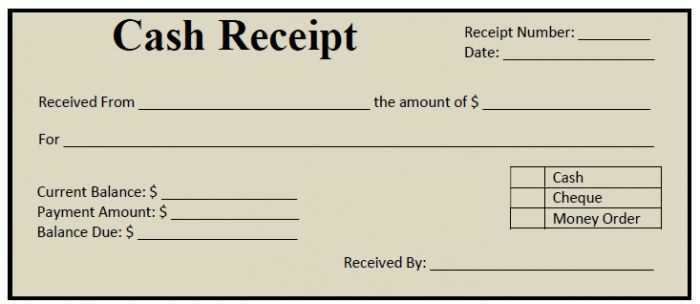

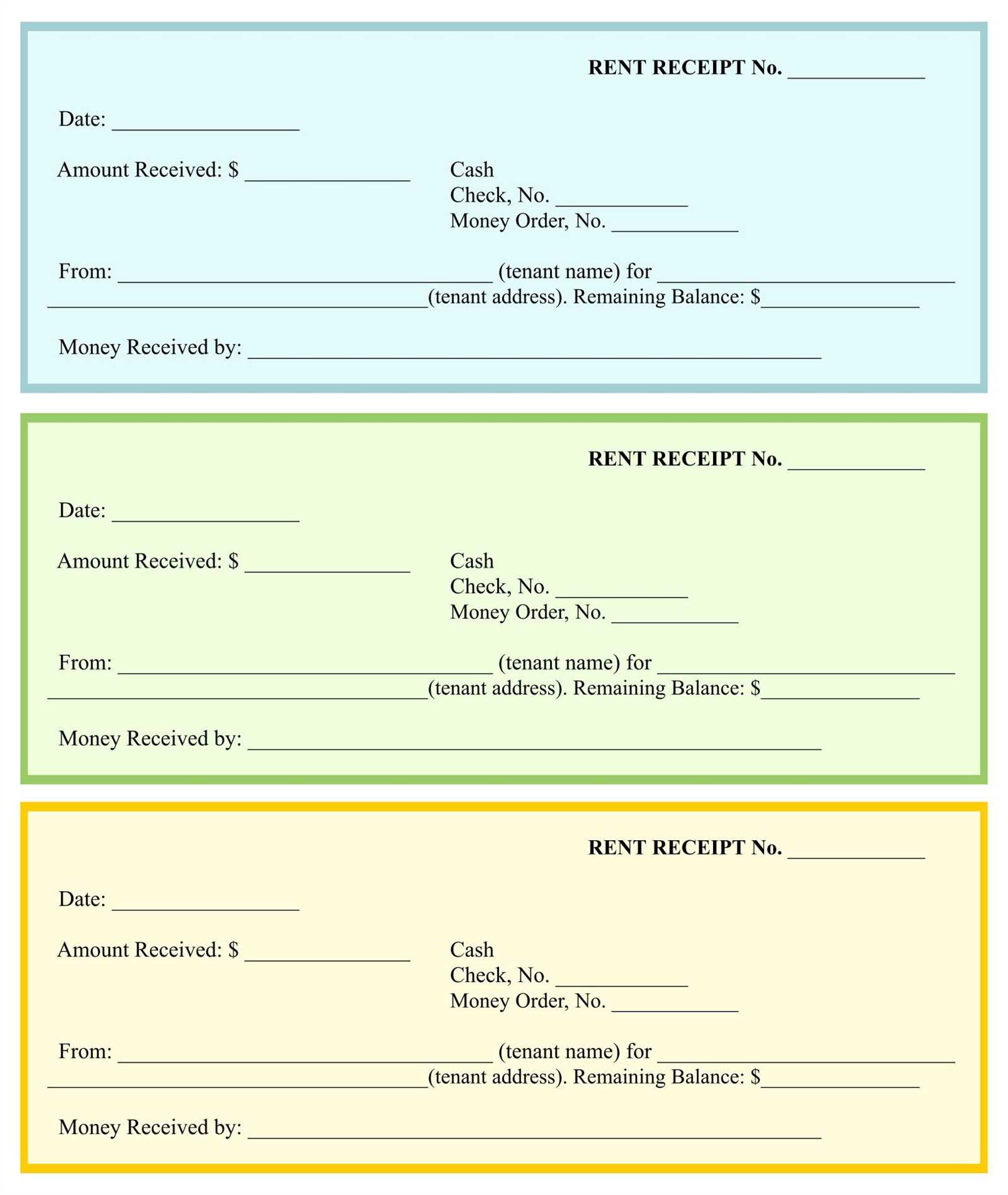

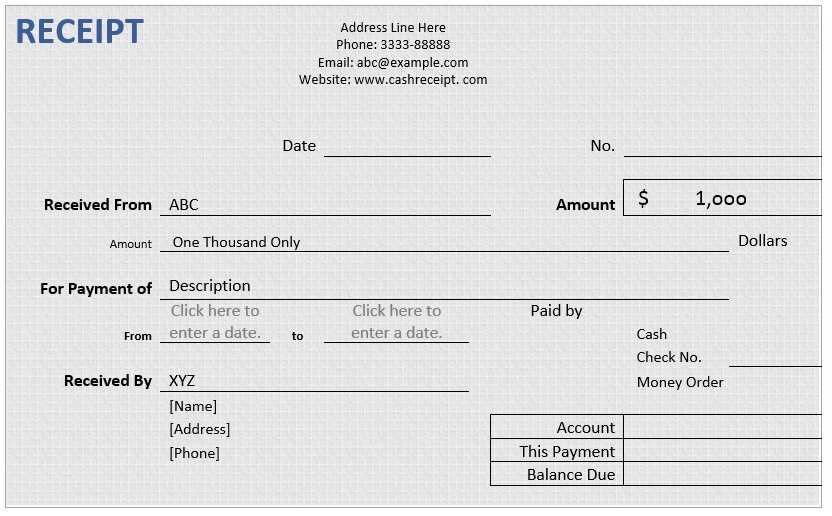

Choose a template that includes key details such as the payer’s and payee’s information, date of payment, payment method, and the item or service purchased. Make sure the total amount is clearly stated along with any applicable taxes or discounts. By keeping the format clean and simple, you make it easier for both parties to reference the receipt in the future, should the need arise.

Ensure the template allows for customization to suit your specific needs. This includes adjusting fields for different payment methods like cash, credit card, or bank transfer. A flexible template not only saves time but also adds professionalism to your transactions. With a few simple adjustments, you can create a template that works for various types of payments, from one-time purchases to recurring payments.

Here’s the revised version:

To create a clear and concise paid receipt, ensure it includes all the necessary details to avoid confusion. Start with the name of your business, followed by its contact details. Include the receipt number for tracking purposes. Clearly state the date of payment and specify the amount paid, along with the payment method used. Make sure to list the items or services purchased with their respective prices.

Example Format:

- Receipt Number

- Business Name & Contact Information

- Date of Payment

- Amount Paid

- Payment Method

- Description of Items/Services

- Taxes (if applicable)

For clarity, include a brief note that acknowledges the payment, such as “Thank you for your payment.” This helps in maintaining transparency and professionalism in your records.

By following this structure, you will ensure your receipt is both professional and functional, making it easy for both you and your customer to keep track of transactions.

Paid Receipt Template: A Practical Guide

How to Design a Paid Receipt Template for Small Businesses

Customizing Your Paid Receipt Template for Various Payment Methods

Legal Considerations When Using Receipt Templates

Design a paid receipt template with clear sections to highlight transaction details. Include the date of payment, the total amount, the items or services paid for, and the method of payment (credit card, cash, check, etc.). This ensures the receipt is easy to understand and provides transparency for both the customer and the business.

Make sure to tailor your template based on the payment method. For instance, when using a credit card, include the last four digits of the card number for reference, or if it’s a cash transaction, indicate the amount given and the change returned. This level of detail reduces ambiguity and builds trust.

Stay aware of legal requirements for receipts in your region. Some jurisdictions require specific information to be included, such as tax identification numbers or business registration details. Research the local regulations to ensure your receipt template complies with all necessary legal standards.