If you’re managing a small business or freelancing, having a clear and professional receipt template is crucial. A well-designed receipt not only keeps your records organized but also builds trust with your clients. Instead of creating one from scratch, you can start with a free template that fits your needs and saves time.

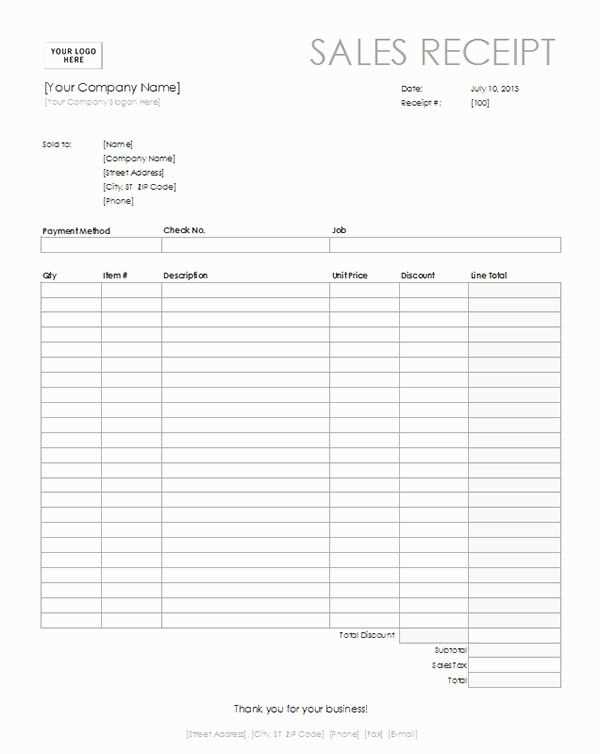

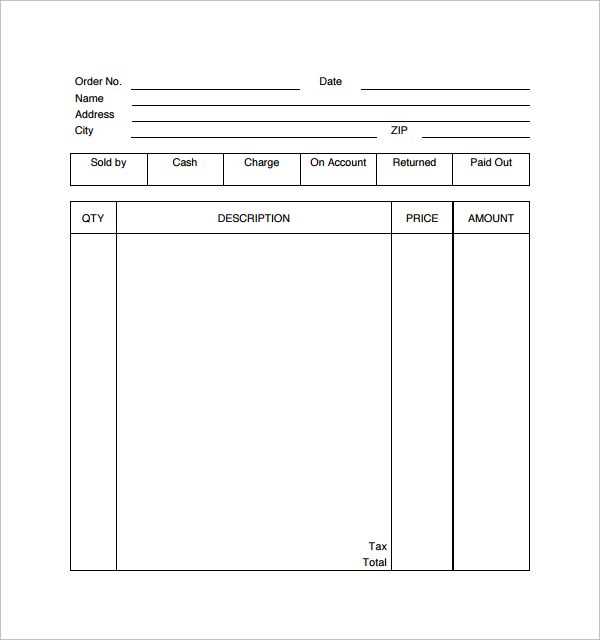

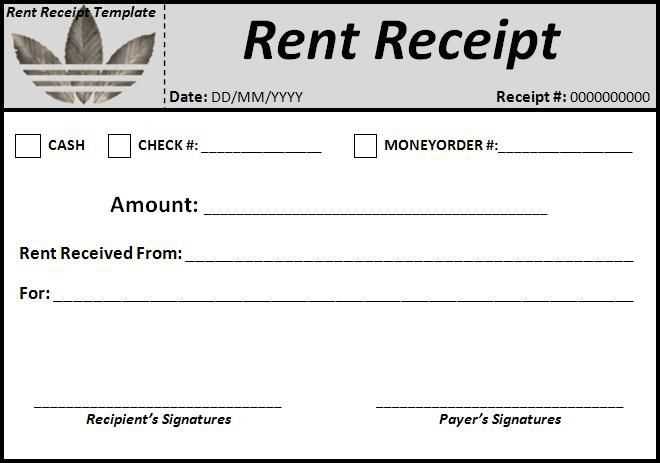

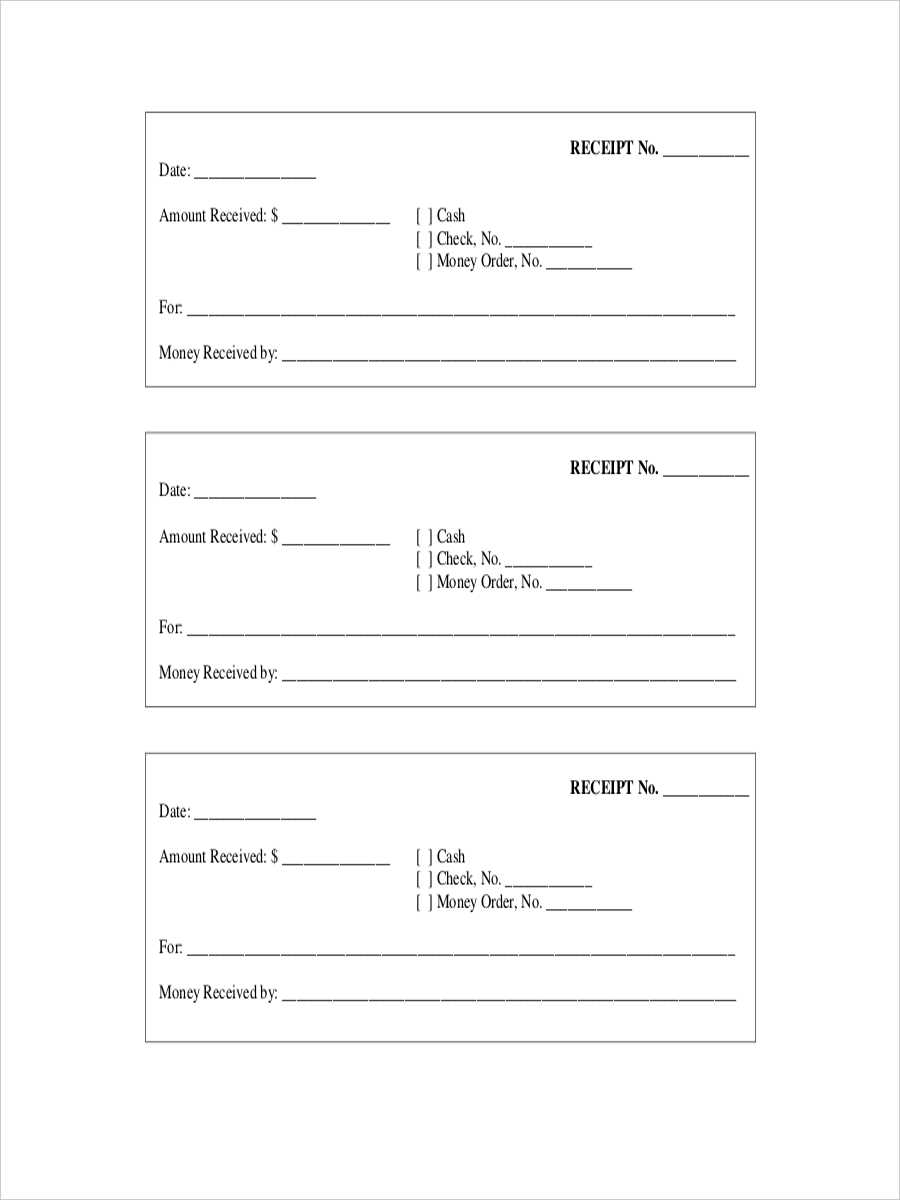

The right receipt template should be simple, yet cover all necessary details. Make sure the template includes fields like the date of transaction, description of goods or services, the amount paid, and contact details. This information makes your business appear more professional and helps your customers keep track of their purchases.

When looking for a free template, prioritize customization options. A good template should allow you to adjust company details, payment terms, and add your branding. This way, you can quickly tailor the template to suit your business and ensure consistency in your financial records.

Start using a free receipt template today, and streamline your business transactions with ease.

Here is an improved version where each word is repeated no more than two or three times:

To create a clear business receipt, focus on a simple layout. Include key information like the company name, date, items or services provided, and total amount. Ensure that each entry is distinct, making it easy for both you and your clients to follow.

For best results, use a clean font that enhances readability. Group related details together, such as the description, quantity, and price. A well-organized format will reduce confusion and streamline record-keeping.

If using a template, customize it to match your business’s branding. Add your logo or company colors, keeping the design professional and recognizable. Keep it consistent for a polished look across all your receipts.

Lastly, provide a clear payment method section, ensuring customers understand how and where to pay. This will prevent unnecessary follow-ups and improve transaction clarity.

- Free Template for Business Receipts

If you’re looking to streamline your business transactions, a free receipt template is a quick and simple solution. Using a template can help you maintain consistency in your record-keeping and ensure your receipts are clear and professional. Here’s how you can make the most out of a free template:

Key Features to Look For

Ensure the template includes fields for essential information like company name, customer details, date of transaction, itemized list of purchases, total amount, tax, and payment method. A clean and straightforward layout will make it easy for both you and your clients to review the receipt quickly.

Where to Find Free Templates

There are plenty of platforms that offer customizable free receipt templates, such as Google Docs, Microsoft Word, and various online accounting tools. Look for options that allow you to personalize your receipt with your logo and branding elements to maintain a professional image.

To download a free receipt template for your business, visit websites offering customizable templates. You can find these templates on platforms like Microsoft Office, Google Docs, or specialized template websites. These platforms allow you to choose from a variety of designs suitable for different types of businesses.

Steps to Download from Microsoft Office

1. Go to the Microsoft Office template gallery.

2. Search for “receipt templates.”

3. Browse through the options and select the one that fits your business needs.

4. Click “Download,” and the template will open in Microsoft Word or Excel for immediate customization.

Steps to Download from Google Docs

1. Open Google Docs and search for “receipt templates” in the template gallery.

2. Pick a template that suits your business style.

3. Click on the template to open it, then make adjustments to the content as necessary.

4. Save it to your Google Drive for easy access and use in the future.

Adjust your template layout based on your business needs. For retail businesses, include fields for product descriptions, SKU numbers, and sales tax. This helps clients easily track their purchases and ensures accuracy. Service-based businesses, such as consulting or repair services, should prioritize sections for detailing hours worked or services rendered. Add a section for the hourly rate or flat fee to clarify charges.

If you’re in the food or hospitality industry, integrate a line for tips or delivery charges. This makes the receipt clear for customers and simplifies your accounting. For businesses that handle large transactions, like real estate or construction, ensure the template allows for itemized lists of materials, labor costs, and taxes. You can also add a deposit section to track partial payments.

Small businesses in the arts and entertainment sectors benefit from adding a customizable description area for tickets, performances, or products. Use a clean and readable font to maintain professionalism. Adjust your template for different business types by focusing on the unique elements of each, ensuring the receipt provides both clarity and functionality for your customers.

A business receipt should provide all the details needed to document a transaction clearly. Make sure the following elements are included:

| Element | Description |

|---|---|

| Receipt Number | Assign a unique number to each receipt for tracking purposes and organization. |

| Business Name and Contact Information | Clearly display your business name, address, phone number, and email address. |

| Date of Transaction | Include the exact date of the transaction for accurate record-keeping. |

| Customer’s Information | Provide the customer’s name and contact details, if applicable. |

| Itemized List of Products/Services | Break down the purchased items or services, including quantities and unit prices. |

| Total Amount | Display the total cost of the transaction, including taxes and discounts. |

| Payment Method | Specify how the transaction was paid (cash, credit card, etc.). |

| Tax Information | Show applicable tax rates and the tax amount for transparency. |

| Return/Refund Policy | If relevant, include a brief note on your return or refund policy. |

Each of these elements helps ensure transparency and proper documentation for both parties involved in the transaction.

Common Mistakes to Avoid When Using Receipt Templates

Using receipt templates can save time and ensure accuracy, but several common mistakes can undermine the effectiveness of these tools. Avoid these errors to make the most of your templates.

1. Missing Key Information

Always include essential details such as the business name, address, contact information, date of transaction, itemized list of products or services, and total amount. Skipping any of these can lead to confusion and may impact the validity of the receipt, especially for accounting or tax purposes.

2. Using Outdated Templates

Check that your receipt template is up-to-date. Outdated templates might not comply with current tax laws or business requirements. Periodically review and adjust the template as necessary to stay in line with any regulatory changes.

By avoiding these common mistakes, you’ll ensure that your receipts are accurate and professional every time you use them.

To integrate your business receipt template with accounting software, begin by ensuring the template is formatted in a way that matches the requirements of your software. Most platforms support CSV, Excel, or PDF files, so save your receipt template in one of these formats.

Step 1: Choose Compatible Accounting Software

Pick accounting software that allows easy import of data. Popular options like QuickBooks, Xero, or Zoho Books allow users to upload documents directly or via integrations with cloud storage services. Ensure that your software supports seamless integration with external templates or file formats like CSV for receipt data.

Step 2: Map Template Fields to Accounting Categories

Adjust your receipt template to include fields that match your accounting software’s categories, such as date, amount, tax, and items purchased. This mapping helps the software accurately record the data when uploaded. For example, if your receipt template includes “Product Description,” make sure this field corresponds to the “Item Name” in your software’s inventory section.

Once your template is set up, configure the software to recognize and categorize the fields properly. Some accounting software may allow you to set custom fields to match your template for automatic syncing.

Step 3: Upload and Sync the Receipt Template

Upload your receipt file to the accounting software. Depending on the software, you may need to manually import receipts or set up automatic syncing via integrations with cloud services like Google Drive or Dropbox. After uploading, verify that the data from the receipt correctly flows into the accounting software’s transaction records.

Test the integration by generating a receipt and ensuring all relevant data, like tax amounts and product names, sync to the right categories. This will help streamline bookkeeping and ensure accuracy in financial reporting.

Legal Considerations When Using Receipt Templates for Business

Ensure that the receipt template you use complies with local tax laws. Many countries require specific information on receipts, such as tax identification numbers, business registration details, and tax rates applied to transactions. Failing to include these can result in legal issues during audits.

- Check that your receipt template includes your business name, address, and contact details.

- Make sure to specify the date of the transaction and a clear description of the goods or services provided.

- Include the correct tax rate and amount, especially if you are collecting sales tax or VAT.

- Ensure your template clearly differentiates between taxable and non-taxable items.

It’s also important to avoid using a template that misrepresents the nature of your transactions. Be honest and transparent in the details you input. Fabricating or altering transaction details can lead to severe penalties, especially if it affects tax filings.

- Provide accurate quantities, prices, and discounts to avoid disputes.

- Do not omit required information that could be considered misleading by regulatory authorities.

Lastly, verify that your receipt template accommodates all payment methods used in your business. Some regions have specific regulations for receipts related to credit card transactions or digital payments, and your template should reflect that.

- Include payment method information (e.g., cash, credit card, bank transfer).

- Consider offering receipts in electronic form if requested by customers, especially if they engage in e-commerce.

By ensuring your receipt template is compliant with legal requirements, you protect both your business and your customers.

Free Template for Business Receipts

Using a free template for business receipts can save time and effort while maintaining a professional appearance. Choose a simple layout with clear sections for transaction details. Ensure the template includes fields for the date, itemized products or services, amount, tax, and total. Providing space for your business name, contact information, and logo adds a personal touch and strengthens branding.

How to Use a Free Receipt Template

- Download the template from a trusted website. Ensure it is compatible with your preferred software, such as Microsoft Word or Google Docs.

- Customize the template by adding your business details, such as the name, address, and contact information.

- Fill in the necessary transaction information, including items or services sold, quantity, price, tax, and total.

- Save and print the receipt, or send it electronically to your customer.

Benefits of Using a Receipt Template

- Saves time: Pre-designed templates reduce the need to create receipts from scratch.

- Professional appearance: Templates offer a polished look that builds trust with your customers.

- Consistency: Using the same template ensures your receipts have a uniform design and layout.

By selecting the right template and customizing it to fit your business needs, you can streamline your receipt process while keeping your brand’s image intact.