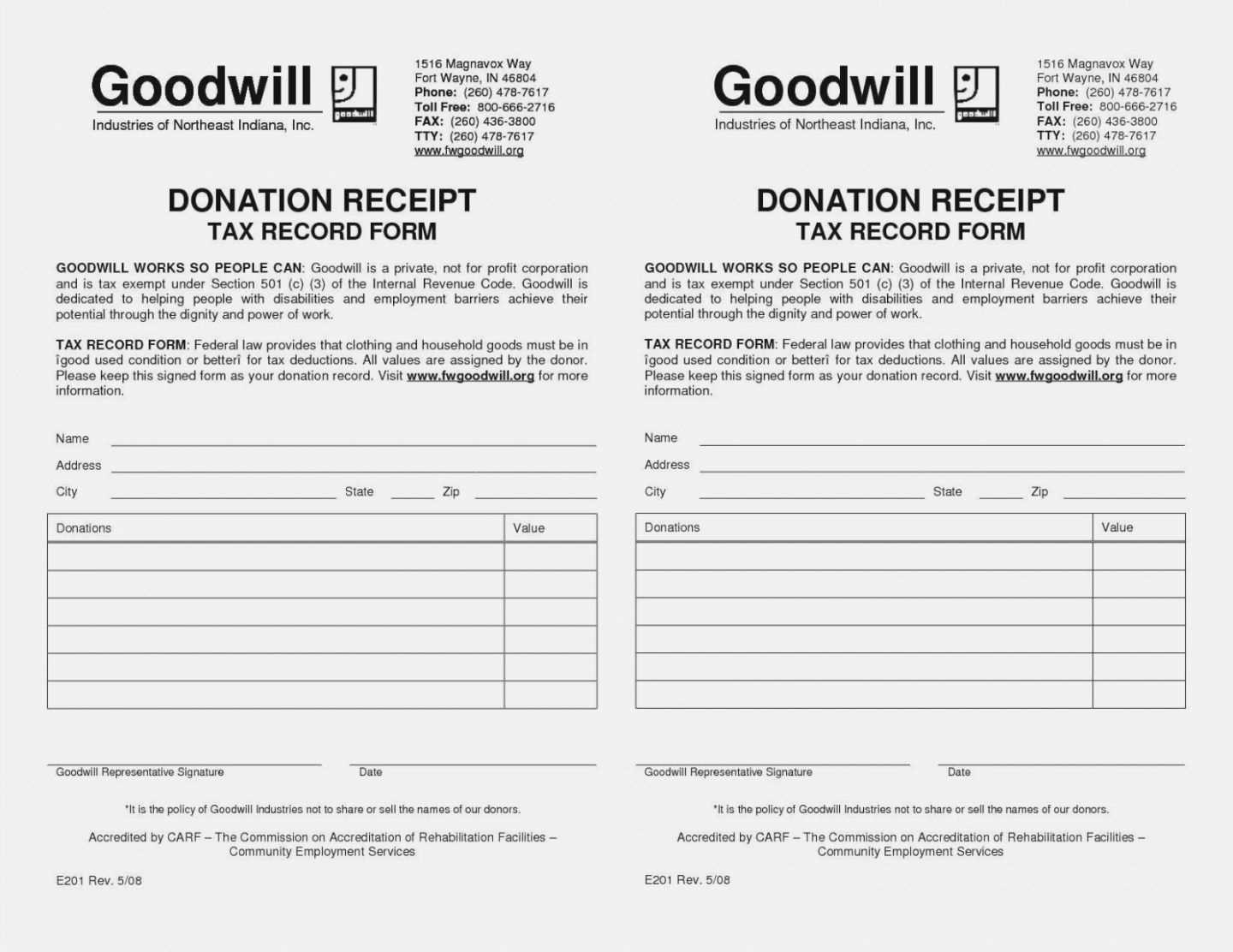

To ensure proper documentation of your donation to Goodwill, it is important to use a structured donation receipt template. A clear, concise template provides both you and the recipient organization with a record of the contribution made. This document will be beneficial for tax deductions, tracking your charitable activities, and maintaining transparency in donations.

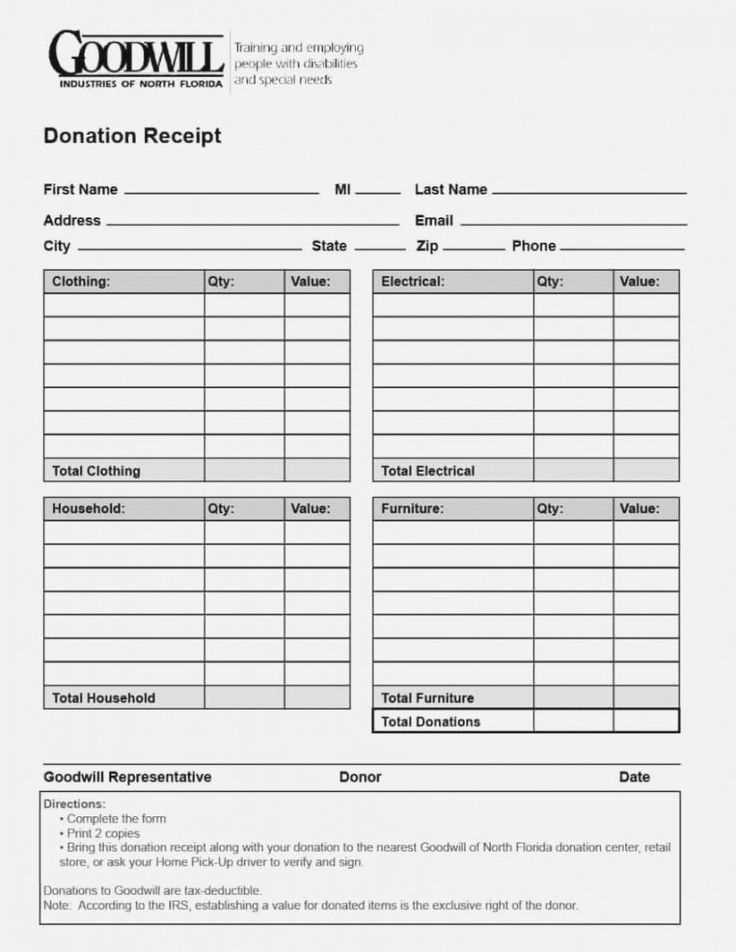

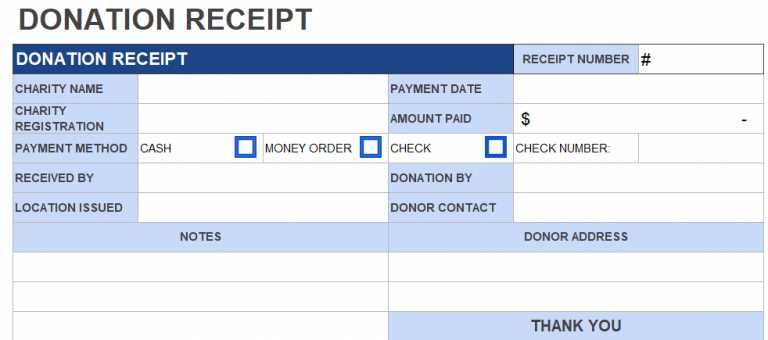

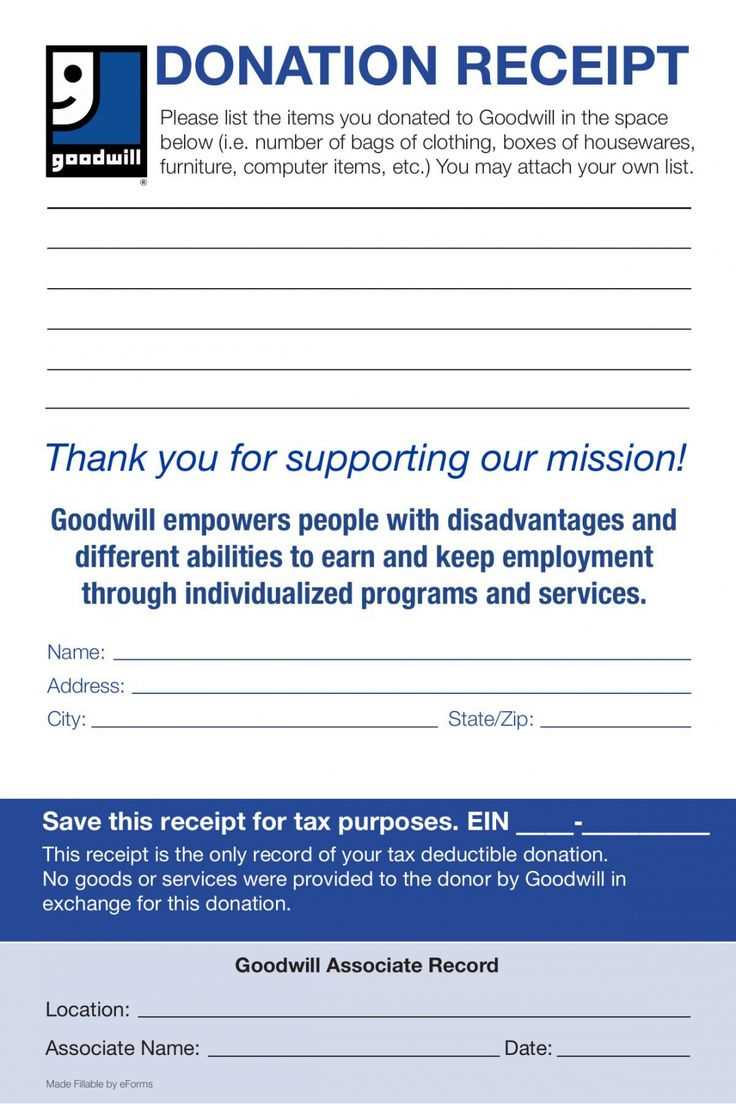

When creating your donation receipt, include essential details such as the donor’s name, the donation date, and a brief description of the donated items. It’s also important to note if the items are in-kind donations or monetary gifts. This ensures the receipt is complete and provides all necessary information for record-keeping or tax reporting purposes.

The template should also specify whether the goods were provided without any goods or services in exchange. This detail will help determine the value of the donation for tax purposes. Keep your receipt clear and accurate to avoid any confusion or issues when submitting it for deductions or proof of donation.

By using a straightforward donation receipt template, both the donor and Goodwill can maintain accurate records, making the process of charitable giving seamless and well-documented.

Sure! Here’s the revised version with reduced repetition:

Use a simple template to streamline your goodwill donation receipt process. Clearly list the donor’s name, donation date, and a description of the items or cash donated. Specify the fair market value of items, if possible, and include a statement confirming no goods or services were provided in return for the donation.

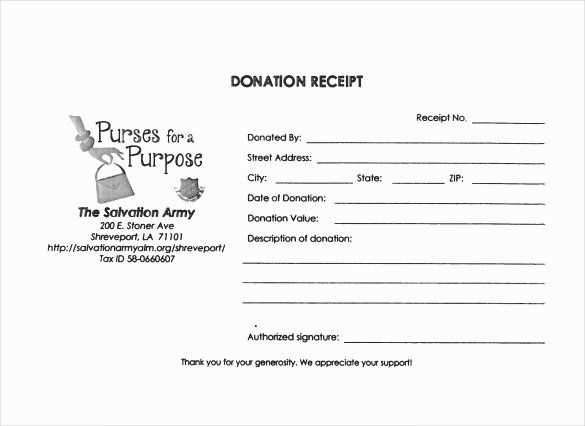

Receipt Layout and Details

Ensure the receipt includes the name and address of the organization, along with a unique receipt number for tracking. Provide space for the donor’s signature and a statement about tax deductions, such as “No goods or services were provided in exchange for this donation.” This ensures clarity and complies with tax regulations.

Tracking and Filing

Keep a copy of each receipt for your records. Consider creating a digital archive to track donations over time, making it easier for both donors and organizations to manage their tax deductions efficiently.

Goodwill Donation Receipt Template

Creating a donation receipt for tax deductions requires attention to specific details. You can design a receipt template easily by including the necessary information and adjusting it for your purposes. Start with a clear header such as “Goodwill Donation Receipt” and make sure it includes the donor’s name and the organization’s name, along with contact information. This will ensure that the receipt can be identified and traced when needed.

How to Create a Receipt for Tax Deduction

Include a description of the donated items or monetary contributions, along with their approximate value. For item donations, listing the condition (new, gently used, etc.) is helpful. If you received cash donations, ensure that the exact amount is recorded. Add the date of donation to ensure proper tracking. The IRS may require donors to have proof of donations, so make sure the receipt reflects the accurate amount and donation type.

Key Information to Include in a Donation Receipt

In addition to the donor’s details and donation information, the receipt should clearly state if any goods or services were provided in exchange for the donation. If no goods or services were exchanged, include a statement to that effect. A simple line like “No goods or services were provided in exchange for this donation” works well. This helps the donor in claiming their tax deduction.

Formatting your receipt template is straightforward once you have all the required details. You can use any standard word processor or template software, and include areas where the donor’s name, donation value, and description can be easily filled in. Make sure the font is readable, and consider adding your organization’s logo for a more professional touch.