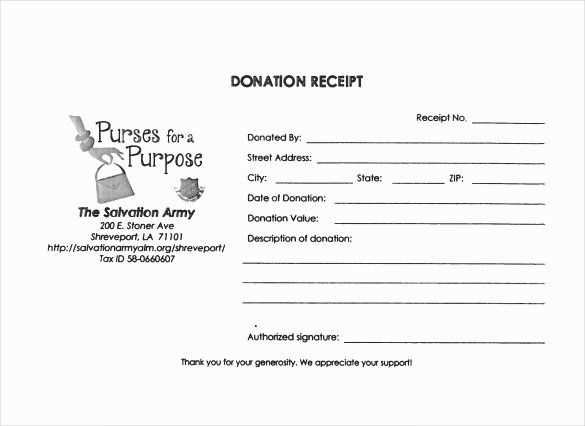

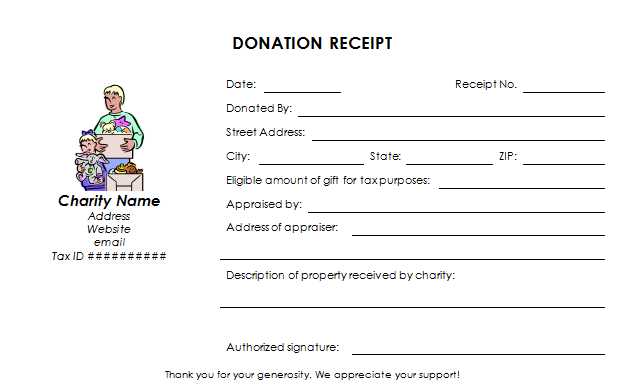

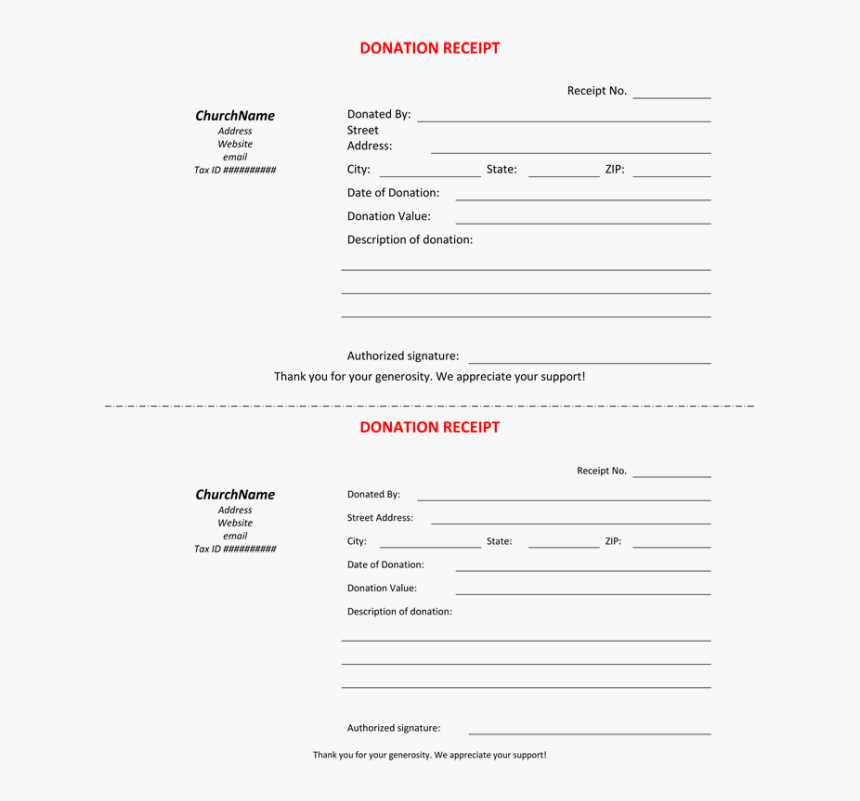

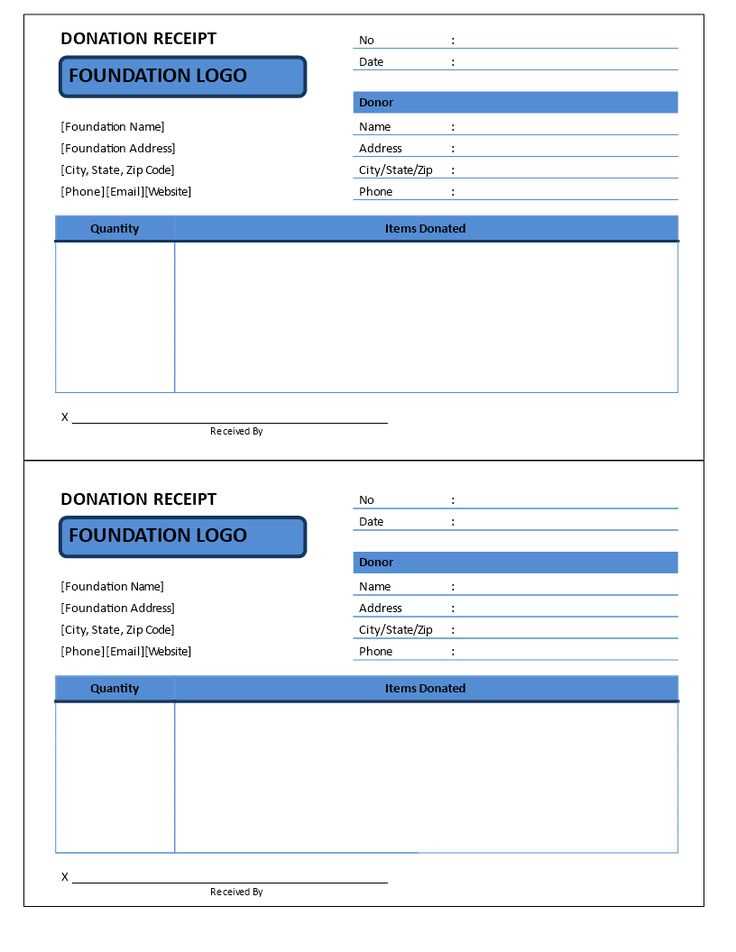

Creating a donation receipt is a straightforward task that ensures both transparency and compliance with tax regulations. This template serves as a useful tool to acknowledge donations and offer a clear record for both the donor and the recipient organization.

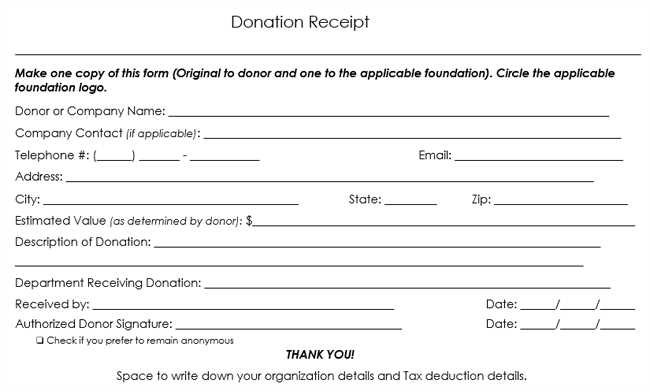

Include the donor’s name, donation date, and amount donated as basic components of your receipt. If the donation is a product or service, be sure to describe it accurately. Also, specify whether any goods or services were exchanged in return for the donation, as this affects the value of the tax deduction.

A good receipt should feature the organization’s details, such as its name, address, and tax-exempt status, to reassure donors that their contributions are supporting a legitimate cause. This will help establish trust and assist donors in claiming appropriate tax deductions where applicable.

Including the receipt number or reference number ensures each donation is easily tracked and can help maintain orderly records. If applicable, also mention if the donation is tax-deductible.

Receipt for Donations Template: A Practical Guide

To create an effective donation receipt, begin with these key components:

- Organization’s Name: Clearly state the name of the organization receiving the donation.

- Donor’s Information: Include the donor’s name, address, and any relevant contact information.

- Date of Donation: Specify the date the donation was received.

- Amount Donated: Include the exact amount, along with any relevant currency symbols.

- Donation Type: Identify whether the contribution was in cash, check, or goods. Be specific to avoid confusion.

- Statement of Tax Deductibility: If applicable, include a statement such as, “No goods or services were provided in exchange for this donation.” This confirms the donation is eligible for tax deductions.

- Signature: The receipt should be signed by an authorized person from your organization to validate the document.

For added clarity, ensure the receipt is printed on official letterhead or includes a footer with your organization’s contact information. This will not only help with organization but also provide donors with a way to reach out if needed.

Keep the language clear and straightforward, avoiding any unnecessary details. A clean and concise receipt ensures that donors feel confident in their charitable contribution and simplifies any future tax reporting for both parties.

How to Include Required Information on a Donation Receipt

Ensure that the donor’s name and address are listed clearly at the top of the receipt. This helps confirm the identity of the individual or organization contributing to your cause.

Include the exact date of the donation. This date is important for tax purposes and ensures clarity on when the contribution was made.

State the amount donated. If the contribution was monetary, list the amount in both words and numbers to avoid any misunderstandings. For non-cash donations, describe the donated item and its estimated value.

If the donation was a non-cash gift, include a description of the item along with a statement indicating that the organization did not provide any goods or services in return for the contribution. This helps the donor claim tax deductions accurately.

If applicable, note any special instructions for the donation, such as designating the funds for a particular project or campaign. This helps both parties stay on track with the donation’s intended purpose.

Include the organization’s name, address, and tax-exempt number. This proves your organization’s eligibility for the donor to claim a deduction, especially if it’s a charitable organization.

Finally, remember to include a clear statement that the receipt serves as an acknowledgment of the donation. A closing statement like “Thank you for your generosity” adds a personal touch to the document.

Designing a Donation Receipt Template for Easy Customization

Focus on creating a template that is flexible and user-friendly. Start by using placeholders for key elements like donor name, donation amount, date, and organization details. This approach simplifies customization for different donors and events. Ensure the template has clear sections for donor information and donation specifics. Use bold or larger fonts to highlight important data, making it easy for recipients to quickly locate necessary details.

Incorporate Custom Fields for Special Donations

Design the template with the option to add custom fields, like specific fund designations or campaign names. This allows your organization to track various types of donations without modifying the structure each time. Make these fields easily editable to accommodate different donor needs and special requests.

Ensure Compatibility with Common Software

Use formats that are widely supported, such as .docx or .pdf, so the receipt can be easily opened, printed, or shared. Ensure that the template works across different platforms, allowing both administrators and donors to access it with no trouble. Test your template to ensure it maintains formatting across various devices and software.

Maintain a clean, professional design with enough white space to avoid clutter. This not only makes the receipt visually appealing but also ensures clarity in the details provided. Keep the layout simple and avoid unnecessary design elements that could distract from key information.

Legal Requirements for Donation Receipts: What to Keep in Mind

Donation receipts must include specific information to comply with tax laws. The receipt should clearly state the charity’s name, the donor’s name, and the date and amount of the donation. For non-monetary contributions, provide a description of the donated items along with an estimate of their value. Make sure the receipt states whether the donor received any goods or services in exchange for their contribution.

Include Tax-Exempt Status Information

If your organization is tax-exempt, include your tax-exempt status and the IRS determination letter (or its equivalent in your country) reference on the receipt. This confirms that the donation is eligible for tax deductions.

Provide Clear and Accurate Descriptions

Ensure that descriptions of non-cash donations are detailed and accurate. If the item has a significant value, consider providing an appraisal or an estimated value range. For cash donations, include the exact amount contributed. It’s important not to overestimate or misrepresent the value of any donation.