Keep track of your receipts with ease using a free receipt log template. This simple tool helps organize and manage your receipts, making it easier to stay on top of your finances. Whether you need it for personal use or business, a receipt log can save you time and reduce stress during tax season or when tracking expenses.

The free template is easy to use and customizable to fit your needs. It typically includes columns for the date, receipt number, vendor name, amount, and category. You can add additional fields if you require more detailed information. Using this template ensures that all your receipts are recorded in one place, reducing the risk of misplacing important documents.

If you’re looking to stay organized, the free receipt log template is a great tool. With a clear, structured format, you can quickly enter details and refer back to them whenever necessary. Keep your finances transparent and accessible by using this template consistently for every purchase or expense.

Here are the corrected lines without word repetition:

Make sure each entry in your log is clear and concise. Avoid using similar terms repeatedly to enhance readability. If you list an item or action more than once, replace it with synonyms or simply remove redundancy.

Tips for streamlining your log:

- Use different phrases or words to express the same concept. For example, replace “purchase” with “buy” or “acquire” as needed.

- Be specific and avoid general terms that don’t add value, such as “item” or “thing,” unless necessary.

- Group similar expenses together in one entry instead of repeating the same category multiple times.

These small adjustments can make your log easier to follow, cutting down on unnecessary repetition while maintaining clarity.

- Free Receipt Log Template

A well-organized receipt log is a practical tool to keep track of your expenses and income. This simple template ensures that you record all the necessary details for each transaction, helping you maintain accurate financial records without much effort.

Key Information to Include

Your receipt log should capture essential details such as the date of the transaction, the item or service purchased, the amount paid, and the payment method used. Including these elements in your log will allow you to easily cross-reference any transactions with your financial statements or receipts.

How to Use the Template Effectively

Start by filling out the log right after each purchase or payment. Keep it updated regularly to prevent forgetting any transactions. For better organization, categorize purchases (e.g., office supplies, travel, or utilities). This helps in generating reports or quickly reviewing where your money is being spent.

Where to Find Receipt Log Templates Online for Free

If you’re looking for a simple and effective way to track receipts, several websites offer free receipt log templates. These templates come in various formats and are designed to suit different needs–whether for personal budgeting or small business expense management.

Popular Websites Offering Free Templates

Here are some reliable websites where you can download free receipt log templates:

| Website | Template Type | Download Format |

|---|---|---|

| Template.net | Receipts, expense tracking | Excel, Word, PDF |

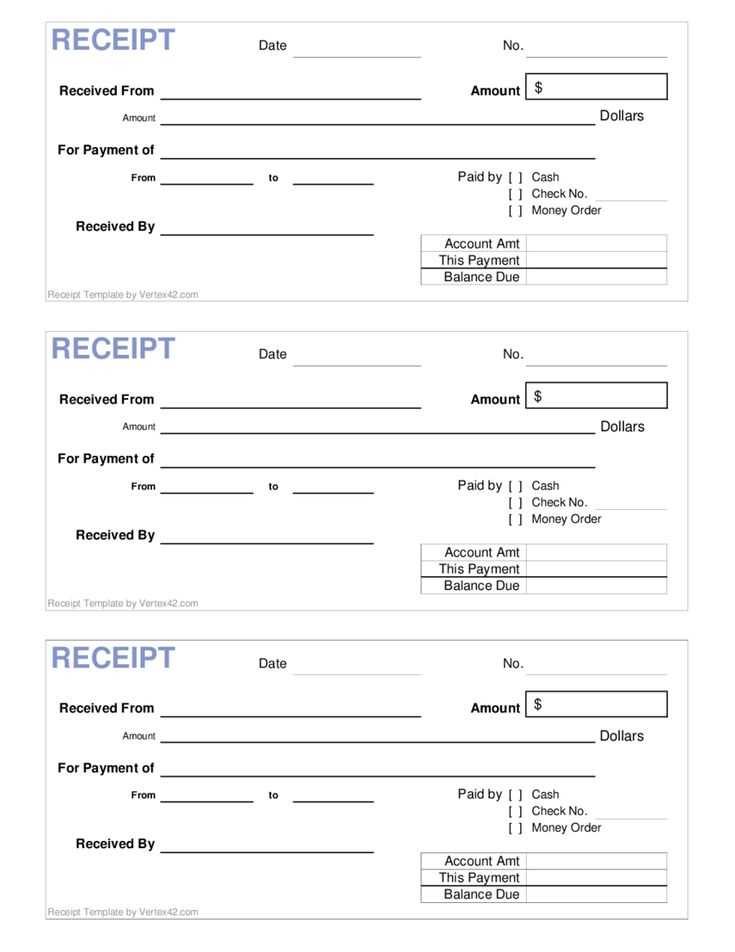

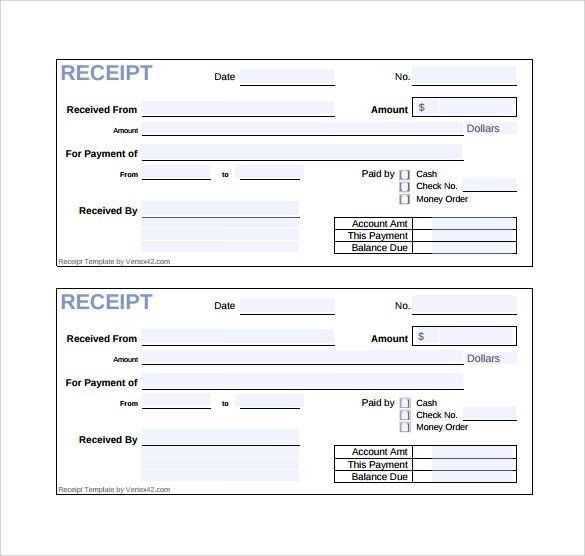

| Vertex42 | Expense logs, receipt trackers | Excel |

| Google Docs Templates | Simple receipt trackers | Google Sheets |

| Microsoft Office Templates | Receipt log, expense tracker | Excel, Word |

| Canva | Customizable receipt logs |

How to Choose the Right Template

Consider your specific needs when choosing a receipt log template. Some templates are better for businesses, while others are tailored for personal finances. Make sure the template format is compatible with the software you use (Excel, Word, Google Sheets, etc.). For a more visually appealing option, sites like Canva offer customizable templates that can be adjusted to match your branding or preferences.

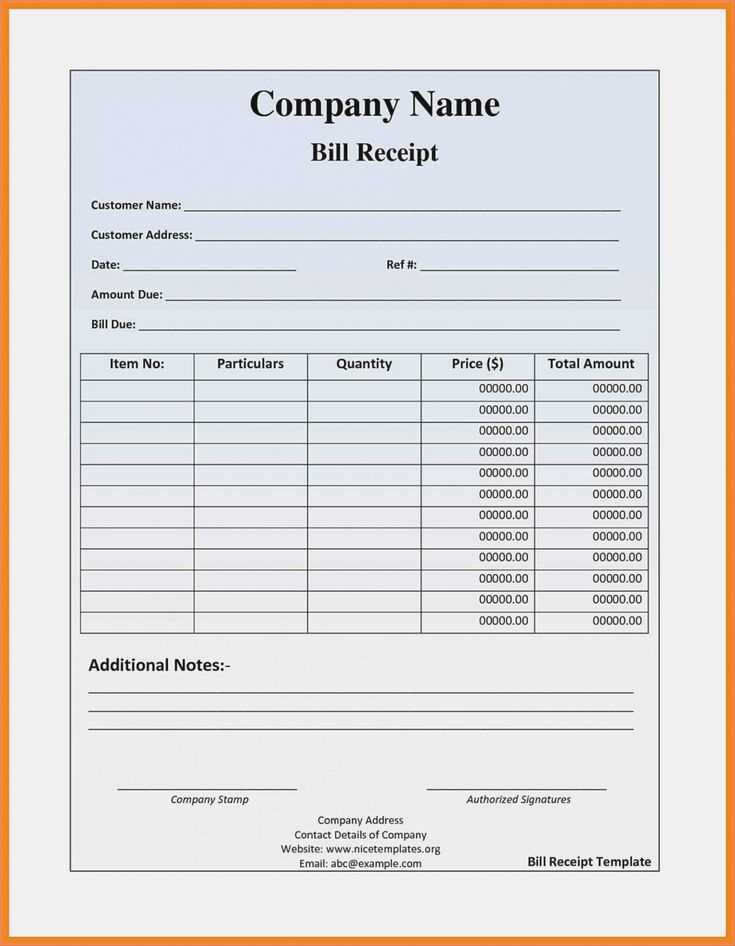

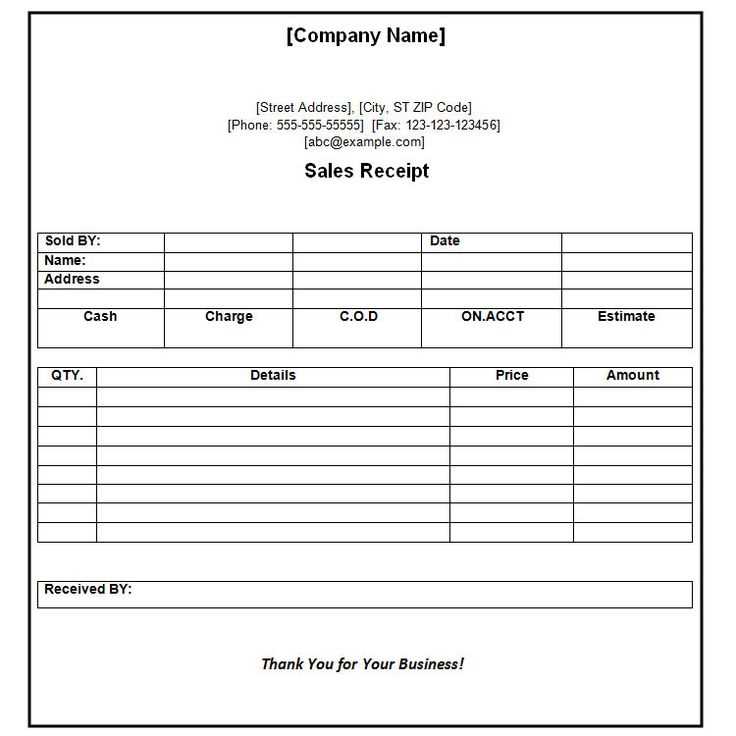

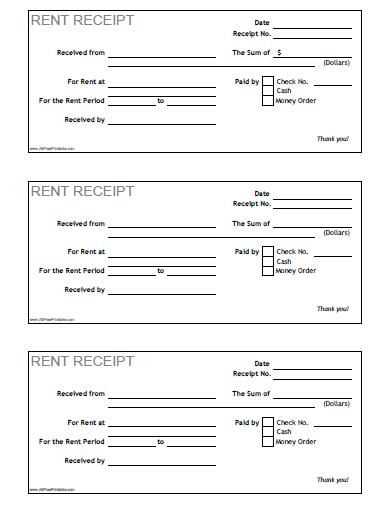

Adjust your receipt log template to fit your business needs by adding specific fields that match your operations. For example, include a “Product/Service Description” section to clarify what each transaction is for, which helps both you and your customers. If your business deals with taxes, incorporate tax details and a field for the tax rate to stay organized.

Personalize the header by including your business name, logo, and contact information. This not only adds a professional touch but also helps customers remember your brand. If your business operates in multiple locations, add a field to specify the location of each transaction.

Consider incorporating payment methods like cash, credit card, or digital payments into your template. This helps you track the modes of payment for financial analysis or reporting purposes. If your business issues refunds or discounts, include these fields to make the record complete.

Lastly, use a clear and consistent format for the date and time fields to ensure that all records are easy to read and follow. This will make it much easier for you to find specific transactions when needed.

Include the following key elements in your receipt log template for clarity and easy tracking:

Date: Record the date of the transaction. This is crucial for tracking when the purchase or payment occurred.

Receipt Number: Assign a unique number to each receipt for easy reference and organization.

Payee or Vendor Name: Include the name of the person or company you made the transaction with.

Amount: Clearly state the total amount of the transaction, including any taxes or additional fees.

Payment Method: Note whether the transaction was paid by cash, card, check, or another method.

Item or Service Description: Provide a brief but clear description of the items purchased or services received.

Transaction Type: Indicate whether the transaction was a purchase, refund, or any other type of exchange.

Purpose or Category: Categorize the transaction (e.g., office supplies, travel, or client services) to make future reference easier.

Tax Information: Include applicable tax rates or amounts if relevant to the transaction.

Signature or Authorization: If applicable, include a space for signatures or any other authorization related to the transaction.

By ensuring all these details are present, your receipt log will provide complete and organized records that are easy to follow.

First, create a dedicated folder on your device for all your receipt logs. This will keep everything organized and easy to access. Use a template that matches your needs, whether you want to track purchases by category, date, or vendor.

Enter each receipt into the log right after the transaction. Include the purchase date, amount, and the business name. If possible, scan or take a photo of each receipt and attach it to the corresponding entry in the template. This ensures you always have a backup in case the paper receipt fades or gets lost.

Customize the template by adding categories relevant to your expenses. For example, you might create sections for groceries, transportation, or office supplies. This helps you track where your money goes and quickly spot trends.

Set up a regular review routine. Once a week, go through your log to ensure all receipts are entered and accurately categorized. This will save you time when it comes to tax season or budgeting. If you use accounting software, export the data from your log template directly into the software to streamline the process.

Consider using cloud-based options for storing your receipts. By saving your digital log in a cloud service, you ensure your records are backed up and accessible from any device.

A receipt log template helps organize your expenses, making tax season smoother. By keeping track of every transaction, it ensures you have all the necessary records when filing your taxes. A detailed log prevents the risk of overlooking deductible expenses, saving you money on your tax return.

Accurate Documentation

Using a receipt log allows you to capture all relevant details of each expense, such as the date, amount, and business purpose. This level of detail provides accurate documentation in case of an audit, reducing the likelihood of issues with tax authorities.

Simplified Expense Tracking

Instead of scrambling to find receipts at tax time, a log provides a centralized, easy-to-access record. This simplifies the tracking of business expenses, especially if you have numerous transactions throughout the year. Organizing by category makes it easier to claim deductions, ensuring that you’re maximizing your tax benefits.

By maintaining a clear and consistent receipt log, you stay prepared for tax filing, avoid missed deductions, and minimize the risk of tax-related errors. It’s a practical solution that saves time and stress during tax preparation.

Printing and using a receipt log template for physical records is straightforward. Follow these steps for quick setup and efficient tracking.

1. Download the Template

- Choose a template that suits your needs. Many free options are available online in formats like PDF or Excel.

- Ensure the template includes basic fields such as date, receipt number, description, amount, and payment method.

2. Print the Template

- Once downloaded, open the file on your computer. Ensure it is formatted to fit your preferred paper size, usually A4 or Letter size.

- Check print settings for margins and alignment to avoid cutting off important information.

- Print the template on high-quality paper for durability, especially if the logs are to be stored for long periods.

3. Fill Out the Receipt Log

- After printing, begin filling in the details for each transaction as they occur. Include accurate information such as the receipt number and payment method.

- Record the transaction in chronological order for easy reference later.

4. Keep It Organized

- Use a binder or file system to keep the printed logs in one place. This will make it easier to locate specific receipts or track financial records.

- If necessary, categorize the receipts by type (e.g., sales, purchases, refunds) for quicker access.

By printing and organizing your receipt log template properly, you’ll have an efficient method for tracking physical records without any hassle.

To create a well-structured receipt log, begin by organizing your entries in a consistent order. Use bullet points or numbers to list each transaction clearly. Include details such as the date of the transaction, the item or service purchased, the amount, and the method of payment. This will ensure that each record is easily accessible for future reference.

Keep the format simple and clean. Each entry should be legible and free of unnecessary clutter. A straightforward table format can be very useful here, allowing you to add columns for the relevant details (e.g., Date, Description, Amount, Payment Method).

Consider adding space for additional notes, such as warranty details or contact information for returns. This will allow you to capture all relevant information in one place without the need to store separate documents.

For added convenience, you can create a template in Excel or Google Sheets for easy tracking and editing. This way, you can quickly update the log on your computer or mobile device without worrying about losing any paper copies.

Lastly, remember to back up your digital logs regularly to avoid losing any important information. A cloud storage service can help ensure that your records are safely stored and easily retrievable at any time.