Send a clear and professional deposit receipt email by using a straightforward template that includes all relevant details. Start with a clear subject line, such as “Deposit Receipt for [Company Name] – [Date]”. This ensures the recipient understands the purpose of the email immediately.

In the body of the email, begin by thanking the customer for their deposit. Include the transaction details such as the amount, payment method, and any reference numbers that could help the recipient verify the transaction. This transparency builds trust.

For easy readability, break the information into short sections, such as a brief paragraph with the deposit confirmation, followed by a bulleted list with the details. This ensures the recipient can quickly scan and find the most important data. Close the email by offering assistance should the recipient have any questions or need further information.

Here’s an example of a template structure to follow:

- Subject Line: “Deposit Receipt – [Company Name] – [Date]”

- Opening Line: “Thank you for your recent deposit of [amount] received on [date].”

- Transaction Details: Amount, payment method, reference number, etc.

- Closing: “Please contact us if you have any questions or require further details.”

By using this format, you ensure that your email looks organized and maintains a professional tone. This is a great way to confirm transactions and keep communication clear.

Here’s the corrected version:

To create a professional deposit receipt email, make sure to include the key details. Begin with a clear subject line, such as “Deposit Confirmation – [Amount]”. In the email body, thank the recipient for the deposit and confirm the amount received. Include any relevant reference numbers or transaction IDs for easy tracking.

Key Elements to Include:

- The deposit amount and currency.

- The date of the transaction.

- Transaction or reference number.

- Contact details for further questions.

Ensure the tone remains polite and clear, and include a closing line inviting the recipient to contact you for any issues. Avoid unnecessary jargon, keeping the email straightforward and concise.

Deposit Receipt Email Template Guide

Crafting a clear and professional deposit receipt email template is straightforward when you focus on the essentials. Make sure to include the following key components for a seamless customer experience:

- Subject Line: Keep it brief and specific. For example, “Deposit Receipt Confirmation – [Company Name]”.

- Greeting: Address the recipient by name to maintain a personal tone.

- Deposit Details: Clearly mention the amount deposited, the payment method, and the date of the transaction.

- Transaction ID: Include a reference or transaction ID for easy tracking.

- Contact Information: Offer a way for recipients to reach out in case of questions.

- Closing: End with a polite and professional closing, like “Thank you for your payment!”

By including these elements in your deposit receipt email, you can ensure that the communication is efficient and clear, creating a positive experience for your customers.

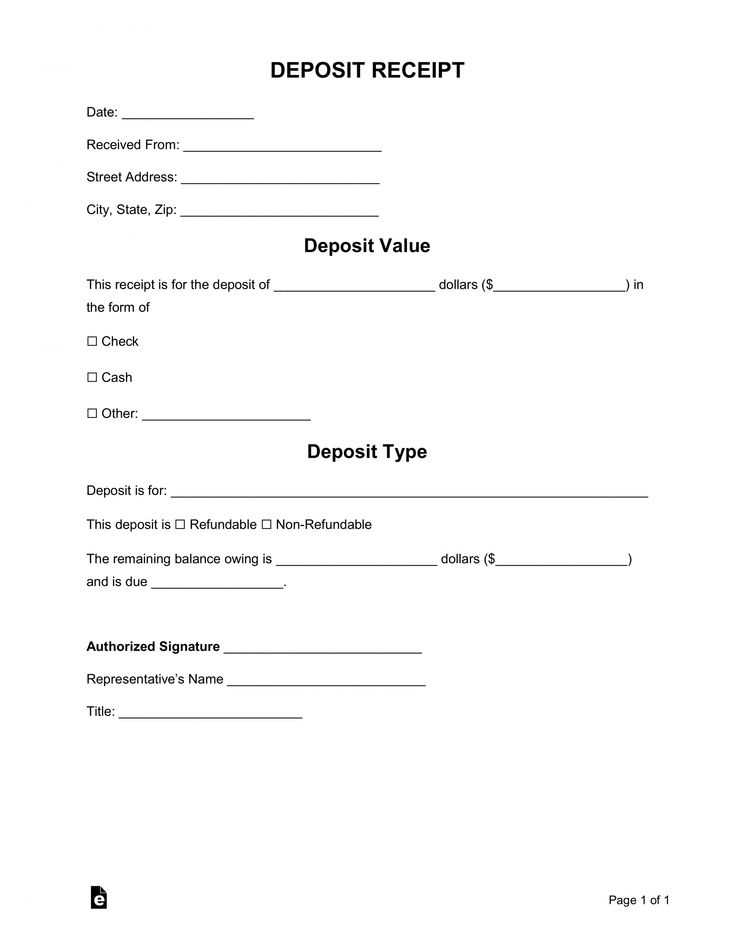

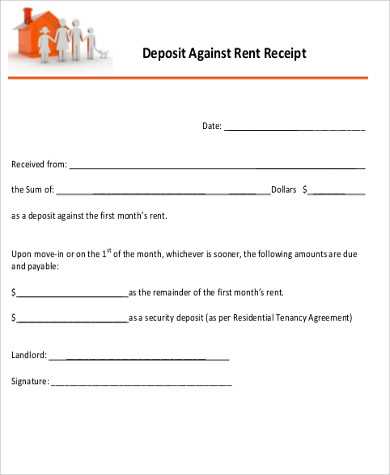

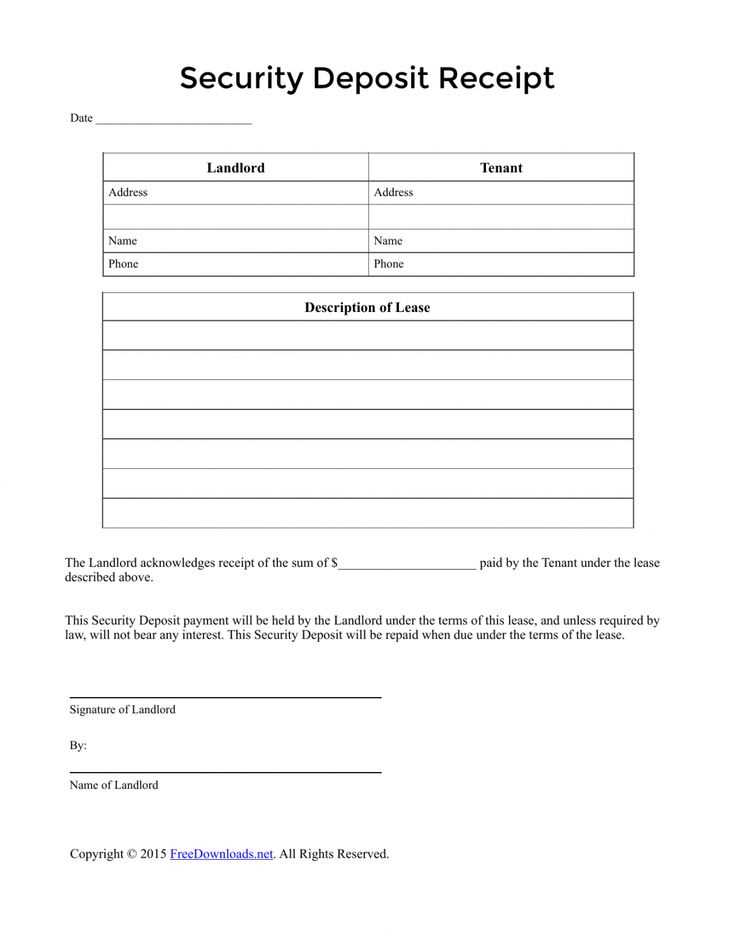

Begin by including the date and time of the deposit. This ensures the transaction is properly timestamped and can be referenced in the future. Next, provide the deposit amount, breaking it down into any applicable subcategories if necessary (such as principal and interest). This transparency prevents confusion over the deposit’s details.

Include the name of the depositor, along with contact information such as an email or phone number for easy follow-up. Specify the deposit method–whether it’s cash, check, or an electronic transfer–to clarify how the funds were submitted.

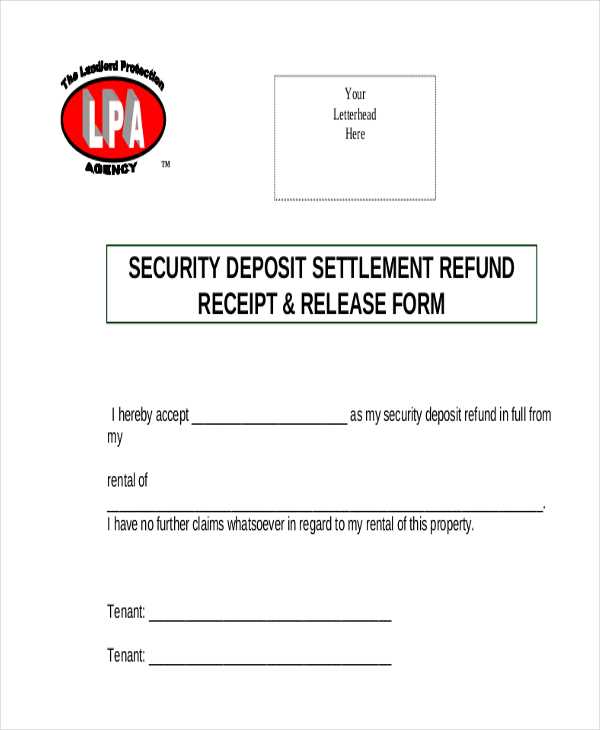

Identify the recipient of the deposit clearly, particularly if it involves a business transaction. This could be the company or individual receiving the payment, along with any relevant account numbers or reference codes for further identification.

Next, include a unique transaction ID or reference number. This acts as a quick identifier in case of disputes or follow-up questions. Always make sure to include the balance remaining (if applicable), showing any adjustments or previous deposits.

Finally, it’s important to provide clear instructions on what the depositor should do if they notice any issues or discrepancies with the deposit. Offering contact details for inquiries ensures smooth communication in case of problems.

Keep the email clean and organized. Begin with a clear subject line that mentions the receipt or payment confirmation. Structure the content logically, using short paragraphs or bullet points to highlight key details like transaction number, amount, date, and payment method.

Consistency in Style

Stick to a simple, professional font such as Arial or Times New Roman. Maintain consistent font sizes and avoid excessive use of bold or italics. Ensure that your branding (if applicable) is visible but not overwhelming, keeping the email aesthetically balanced.

Polite and Clear Tone

Write in a direct yet courteous tone. Avoid jargon and unnecessary complexities. The recipient should easily understand the purpose of the email and feel reassured by the clarity of the message. Always express appreciation for their transaction and invite further questions if needed.

Focus on clarity from the start. Avoid ambiguous language that could lead to confusion about the deposit amount or terms. Ensure that the email clearly states the exact amount and purpose of the deposit. Using vague terms like “around” or “approximately” can create uncertainty, so be specific.

Incorrect Subject Line

Subject lines should be direct and clear. Avoid using generic subject lines like “Deposit Confirmation” or “Payment Received” as these can confuse recipients or be ignored. Instead, use a subject that reflects the content of the email, such as “Deposit Confirmation for Invoice #12345” or “Deposit of $500 for Rent Payment”.

Forgetting Important Details

Leaving out key information such as the transaction date, recipient details, or the reference number can lead to confusion. Always include the necessary details for easy identification and record-keeping. This also helps to avoid future disputes or misunderstandings.

Don’t use overly formal or impersonal language. A friendly, polite tone keeps communication clear and professional. Make sure the recipient feels informed, not overwhelmed by excessive jargon or lengthy descriptions.

Ensure that your deposit receipt email includes clear and concise information. Start by confirming the deposit amount, the account it was received from, and the date of transaction. This avoids any confusion or need for follow-up queries. Provide a unique reference number for easy tracking, and mention the transaction method used (e.g., wire transfer, credit card). If applicable, include a breakdown of any applicable fees or deductions. Additionally, make sure the email is visually easy to read, with appropriate formatting that separates key details like the amount, date, and reference number.