For businesses or individuals handling transactions in Tennessee, a TN deposit receipt template is a practical tool to ensure clarity and accuracy. By using a standard format, you can efficiently document payments and create a clear record for both parties involved. The template helps streamline the process, ensuring consistency in how information is presented and reducing the chance of errors.

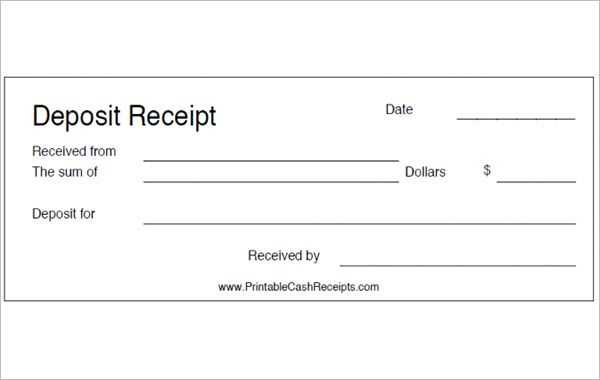

The TN deposit receipt should include basic details such as the date of the transaction, the amount deposited, the payer’s and payee’s information, and a unique receipt number. Adding a brief description of the payment’s purpose also provides useful context. A straightforward format helps maintain organization and ensures that both parties understand the terms of the deposit.

Customizing your TN deposit receipt template to fit specific needs can be done with ease. For example, adding a space for payment method, such as cash, check, or electronic transfer, can provide a complete overview of how funds were received. Be sure to maintain legibility and simplicity in the design for maximum usability and clear communication.

Here are the corrected lines:

Ensure that the deposit receipt template clearly states the transaction details. This includes the amount deposited, the name of the depositor, and the date. Also, include the unique reference number for each transaction to avoid confusion.

Use a consistent format for all receipts to maintain clarity. Align the fields such as deposit amount, date, and reference number to the left or right side for easy scanning. Avoid cluttering the template with unnecessary information.

Double-check that all amounts are in the correct currency format and that the date reflects the actual deposit day. Include space for both the depositor’s signature and the receiver’s confirmation to validate the transaction.

Finally, test your template with real transactions to ensure it meets all practical needs and that no important details are overlooked. A well-organized template leads to smoother processing of deposits.

- TN Deposit Receipt Template Guide

For a clear and reliable deposit receipt, follow this format:

1. Deposit Amount

Clearly state the amount of the deposit. This will serve as a reference for both parties in case of discrepancies.

2. Transaction Date

Include the exact date when the deposit was made. This detail is important for tracking and verifying the transaction.

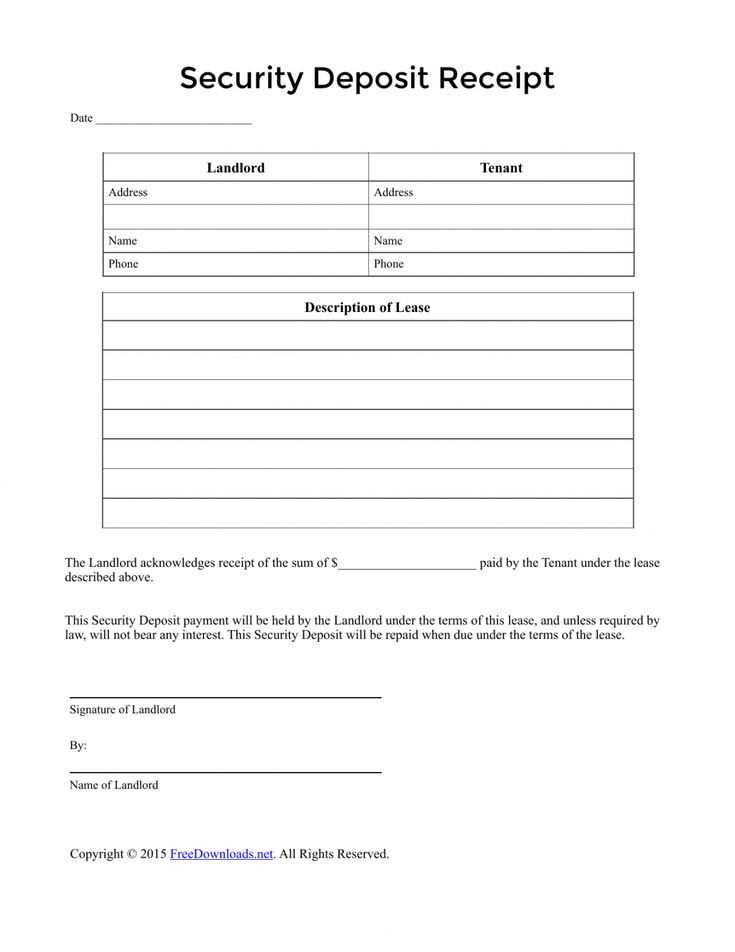

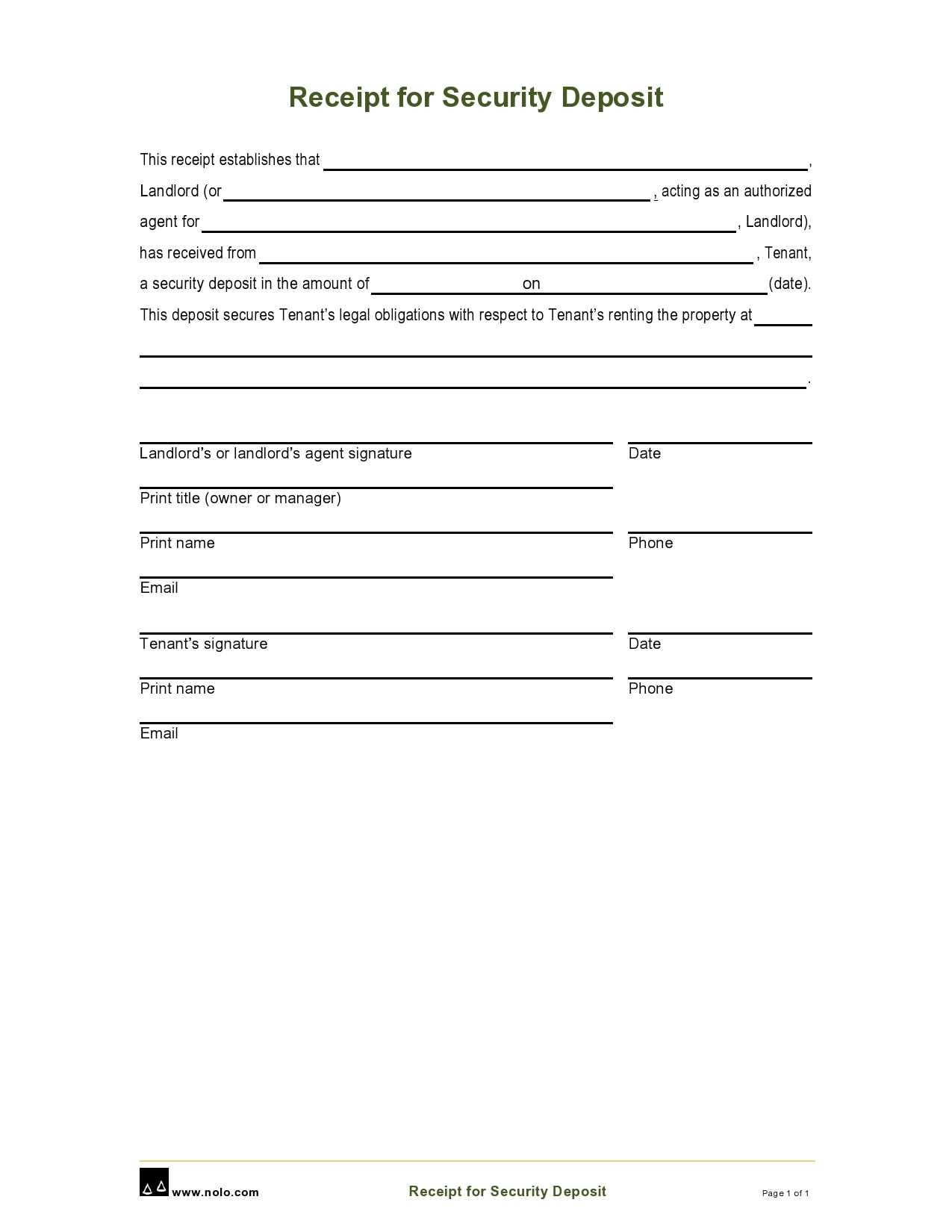

3. Parties Involved

Provide the full names and contact information of both the payer and the recipient. This ensures accurate identification of both parties in the transaction.

4. Payment Method

Specify the method used for the deposit, whether it’s cash, check, or bank transfer. This ensures clarity in how the payment was made.

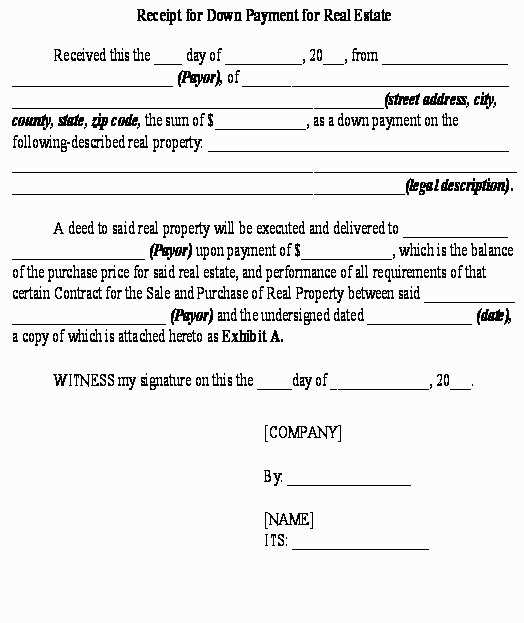

5. Reason for Deposit

State the purpose of the deposit, such as for rent, security, or services. This helps clarify the nature of the transaction.

6. Signatures

Include spaces for both the payer and the recipient to sign. Signatures act as confirmation of the transaction and agreement.

This template will provide clear, structured records of deposits and help both parties maintain transparency in financial dealings.

Begin by including key details that clearly identify the deposit. This ensures both the sender and receiver have a record of the transaction.

- Deposit Date: Include the exact date of the deposit. This helps in tracking the transaction and aligns with financial records.

- Deposit Amount: List the amount being deposited in both numerical and written form for clarity.

- Account Number or Name: Specify the account number or the name under which the deposit is made. This identifies the recipient.

- Deposit Type: State whether it’s a cash, check, or transfer deposit. This adds transparency to the transaction method.

- Transaction Reference Number: Include a unique reference number or ID to help both parties locate and verify the deposit if needed.

- Depositor’s Name: If applicable, include the name of the person or entity making the deposit to avoid confusion with other transactions.

Double-check the spelling of names, account numbers, and other sensitive details to avoid any mistakes that could lead to complications.

Finally, include a clear statement of receipt. A simple line like “This receipt confirms the deposit on [date] for the amount of [amount]” will suffice.

Begin by identifying the key elements your deposit receipt needs. Customize the template by including necessary fields such as the date, amount, payer’s name, and any reference numbers for easy tracking.

1. Set Up the Header Section

- Insert the company name and logo at the top for clear identification.

- Ensure the title “Deposit Receipt” is bold and easily visible, preferably centered.

- Add a space for the receipt number to help with organizational tracking.

2. Include Payer and Payment Details

- Specify the payer’s full name, address, and contact information.

- Provide a line to list the payment method (e.g., cash, check, or bank transfer).

- Include the amount in both numerical and written form for clarity.

3. Add Transaction Reference

- Include a unique transaction or reference number that matches the system you use for your records.

- If necessary, add additional details, such as the purpose of the deposit or associated account number.

4. Incorporate a Signature Section

- Add a space for the recipient’s signature or a confirmation that the deposit has been acknowledged.

- If possible, include a digital signature option for online transactions.

5. Finalize the Footer

- Include your company’s contact information in the footer section, such as the address, phone number, and website.

- Consider adding any legal disclaimers or terms related to deposits.

Once all the components are added, save your customized deposit receipt template as a reusable file for future transactions. Be sure to adjust formatting and layout for consistency and professionalism.

Ensure that the TN deposit receipt is clear, concise, and legally compliant. Start with including the full name of the party receiving the deposit, followed by the full address. The date of receipt should be placed prominently at the top, ensuring it reflects the transaction’s accurate time frame.

Another key aspect is outlining the deposit amount in both numerical and written forms. This eliminates any ambiguity in interpreting the sum. A clear description of the goods or services linked to the deposit is necessary, along with the agreed terms for future payments, if applicable.

The receipt must also feature a statement specifying whether the deposit is refundable or non-refundable, along with any conditions tied to it. Include information about the return process, including any timeframes or fees, as well as the applicable laws or regulations governing the deposit in the jurisdiction.

Proper formatting involves ensuring legible font sizes, avoiding overcrowded text, and maintaining consistency throughout the document. Tables can be used for organizing payment breakdowns, dates, or conditions. Below is an example of how you might structure such information:

| Item Description | Amount | Refundable |

|---|---|---|

| Deposit for Service | $500 | No |

| Additional Costs | $100 | Yes, if canceled 24 hours in advance |

Finally, ensure the signature section is placed at the bottom with space for both parties to acknowledge the agreement. This confirms mutual understanding and adherence to the deposit terms.

Ensure that each line item on the TN deposit receipt template is clearly labeled and easy to understand. Include specific fields for the deposit amount, date, and any associated reference numbers to help streamline tracking and prevent confusion.

Formatting Tips

Organize information in a clean, structured manner. Break down sections into easily identifiable blocks, such as “Deposit Details,” “Transaction Reference,” and “Amount Confirmed.” Use bold for headers and italics for optional or supplementary information to keep the focus on key data.

Final Review

Before finalizing the template, double-check the accuracy of the details. Ensure the document includes enough space for any additional notes or adjustments that might arise during the deposit process. This helps avoid the need for constant revisions in the future.