Provide your customers with a clear, professional document by using a signed cash payment receipt template. This template ensures transparency and confirms the exchange of cash in any transaction. By incorporating all the necessary details, it serves as an official record for both parties.

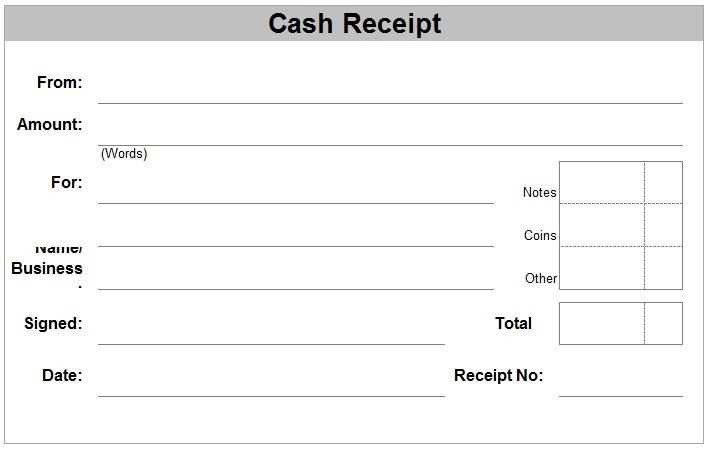

A well-structured cash receipt includes fields for the amount received, the date, the purpose of the transaction, and signatures from both the customer and the seller. These elements make the receipt legally binding and easy to reference. When creating this document, make sure to include the seller’s name or business name and contact information for added clarity.

The receipt template should allow space for both the cash amount and any additional notes. This helps avoid future misunderstandings. Customizing the template to reflect your business branding or specific needs adds a professional touch and reinforces trust with your customers.

Lastly, make it a habit to provide a copy of the signed receipt to the customer immediately after payment. This ensures both parties have a record of the transaction, which can be crucial in case of disputes or record-keeping purposes.

Here’s the reworked text without word repetitions:

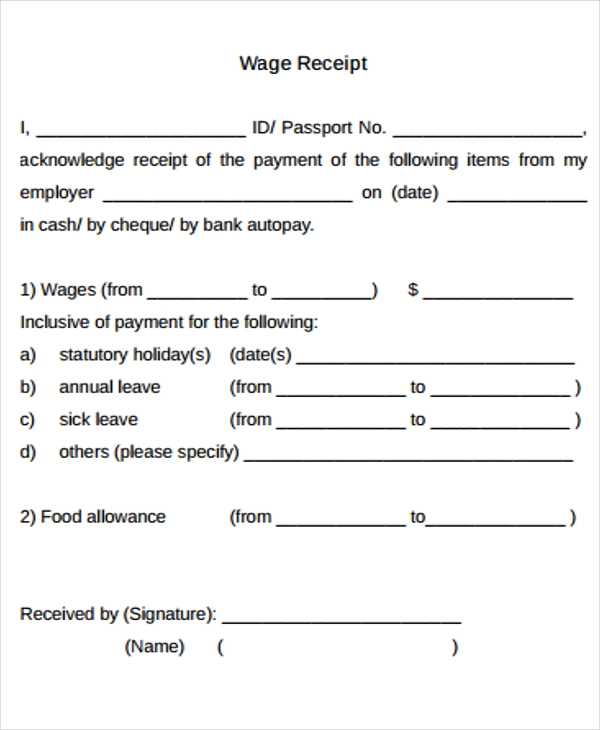

A signed receipt should clearly show the details of the transaction. Start with the date and payment method used. Specify the amount paid, including any taxes, and mention the products or services involved. Ensure both parties understand the terms of the transaction by including the signature field for the customer. The seller should also sign and include contact details for reference.

Key Components of a Signed Receipt

Each receipt must have a unique identifier for tracking. The seller’s business name, address, and contact number are necessary for clarity. The receipt should also highlight any discounts or promotions applied, if applicable. Avoid ambiguity by providing clear wording and numbers, ensuring both parties understand their rights and obligations.

Legal Considerations

It is important that both signatures are written by hand or electronically verified. Each party must keep a copy for their records. If disputes arise, the receipt serves as a binding document. Ensure that any refund policies or terms are clearly stated to prevent confusion later.

- Signed Cash Payment Receipt Template for Clients

A signed cash payment receipt template helps clarify the transaction details for both the business and the customer. It serves as proof of payment and outlines important transaction elements. Ensure the template includes the following sections:

Key Information to Include

The receipt must clearly specify:

- Receipt Number: A unique identifier for each transaction.

- Date of Payment: The exact date the payment was made.

- Amount Paid: The total amount in clear terms, including any currency symbols.

- Payment Method: Specify that the payment was made in cash.

- Client’s Name: The customer’s full name for identification.

- Purpose of Payment: A brief description of what the payment is for (e.g., goods, services, etc.).

Signed Acknowledgment

At the bottom of the receipt, include a section for both the client and the representative to sign. The client’s signature confirms the payment made, while the business representative’s signature indicates receipt of cash. The acknowledgment section can look like this:

Client’s Signature: _______________________

Representative’s Signature: _______________________

Ensure that both signatures are present for a valid transaction record. The signed receipt protects both parties in case of any future disputes. It is also recommended to issue a copy to the client and retain one for your records.

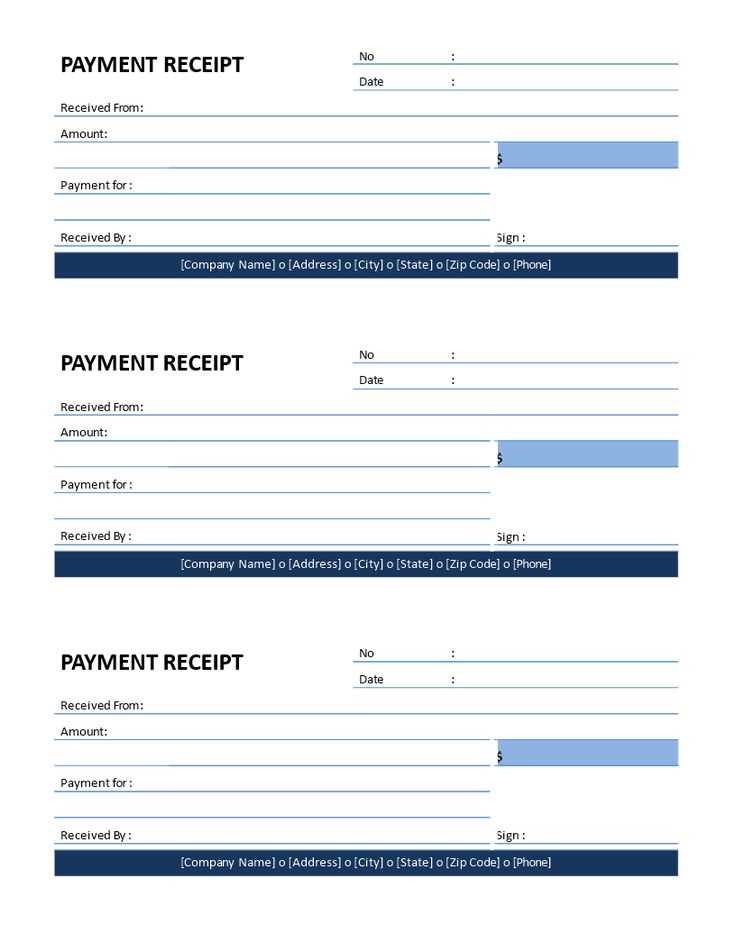

To create a legally binding receipt for a cash payment, include key details that clearly identify the transaction. Start by specifying the full name and contact information of the payer and the recipient. Include the exact date of the payment and a clear description of the goods or services exchanged. The amount paid must be explicitly stated, along with the currency used.

Ensure the receipt includes a unique identifier, such as a receipt number, for easy reference. Both parties should sign the document to confirm the transaction was completed. The payer’s signature confirms the payment, while the recipient’s signature acknowledges the receipt of cash.

If applicable, include a statement confirming that the payment was made in full and that no further payments are owed. Always keep a copy of the receipt for both parties’ records. Having these elements in place ensures the receipt serves as proof of payment in case of any disputes.

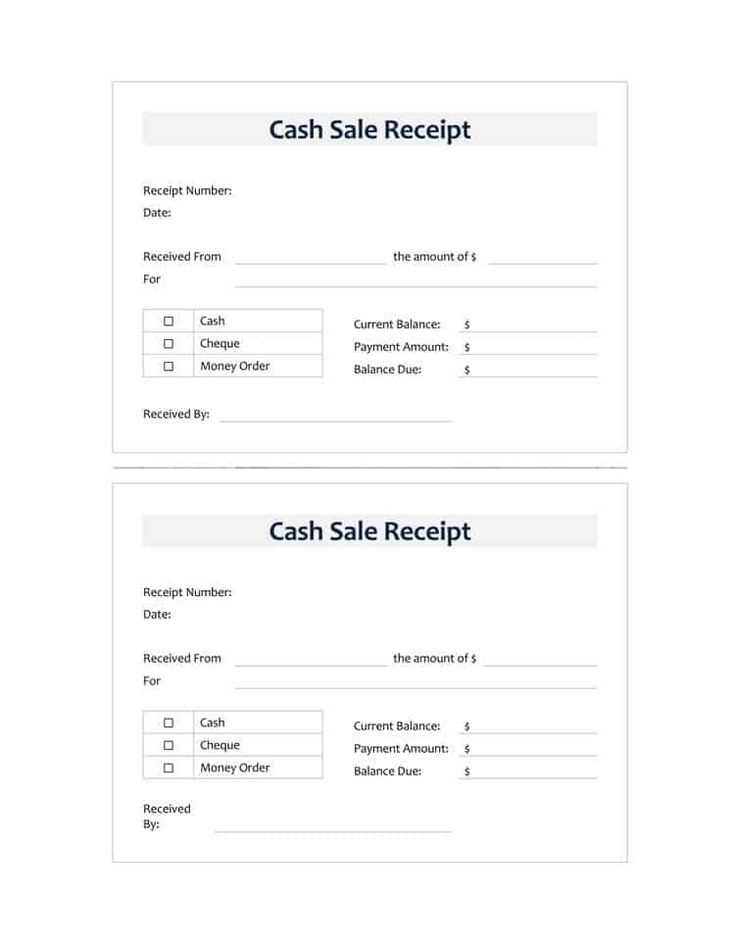

Clearly list the business name, address, and contact information at the top of the receipt. This provides customers with a way to reach you if they have questions or need to return an item.

Specify the date and time of the transaction. This helps both you and the customer keep accurate records and proves the timing of the purchase.

Include a description of the product or service purchased. Detail each item or service with quantities and individual prices, making it clear what the customer is paying for.

State the total amount paid, including any applicable taxes or fees. Break down the payment if there are multiple items or discounts applied.

Note the method of payment, which in this case is cash. This eliminates any ambiguity about how the transaction was completed.

Provide a unique receipt number for record-keeping purposes. This helps with easy tracking in case of disputes or returns.

Include a space for the signature of both the business representative and the customer, if required. This serves as a confirmation that both parties agree on the transaction details.

Optionally, include return or refund policies, especially if they apply to the purchased items or services. Clear terms help avoid confusion later.

Store signed receipts in a safe, easily accessible location, whether physically or digitally. If opting for paper receipts, organize them in labeled folders or file cabinets to prevent loss. For digital copies, use secure cloud storage or a dedicated document management system with backups.

Maintaining Clear Records

Each receipt should include key information, such as the date, amount paid, payer’s name, and the nature of the transaction. This helps in easy identification and verification of payments when needed. Ensure that the receipt is signed by both the payer and the cashier to confirm mutual agreement on the payment terms.

Regular Audits and Verification

Schedule periodic audits of receipts to verify payment records. Cross-check them with financial records to ensure consistency. In case of discrepancies, resolve them quickly to maintain accurate financial documentation.

| Action | Frequency | Responsible Party |

|---|---|---|

| Store receipts | Ongoing | Cashier/Accountant |

| Audit receipts | Monthly | Accountant |

| Cross-check with records | Quarterly | Financial Officer |

Ensure that each signed receipt is easily retrievable when needed for customer inquiries, audits, or disputes. Clear and organized record-keeping will save time and reduce the risk of errors.

Cash Payment Receipt Template

Include the following key elements when creating a signed cash payment receipt template for your customers:

- Receipt Number: Ensure each receipt has a unique identifier for tracking and record-keeping.

- Date of Payment: Clearly mention the date when the cash payment was received to avoid confusion later.

- Amount Paid: Specify the exact amount of money received in both words and figures to prevent disputes.

- Recipient’s Information: Include the name, address, and contact details of the business or individual receiving the payment.

- Customer’s Information: Mention the full name of the customer making the payment, along with any other relevant details such as address or phone number.

- Payment Method: Note that the payment was made in cash to confirm the mode of transaction.

- Description of Goods/Services: Briefly describe what the customer paid for. This helps in referencing the transaction if needed.

- Signature: Provide space for both the recipient and the customer to sign, acknowledging the transaction.

Template Example:

Here’s a simple cash payment receipt layout:

- Receipt Number: 001234

- Date of Payment: 12th February 2025

- Amount Paid: $150 (One hundred and fifty dollars)

- Received By: John Doe, ABC Company, 123 Main St.

- Customer: Jane Smith, 456 Oak Rd.

- Payment Method: Cash

- Description: Payment for consulting services

- Signature of Recipient: _____________________

- Signature of Customer: _____________________

This template ensures clear documentation of the cash transaction and avoids potential confusion.