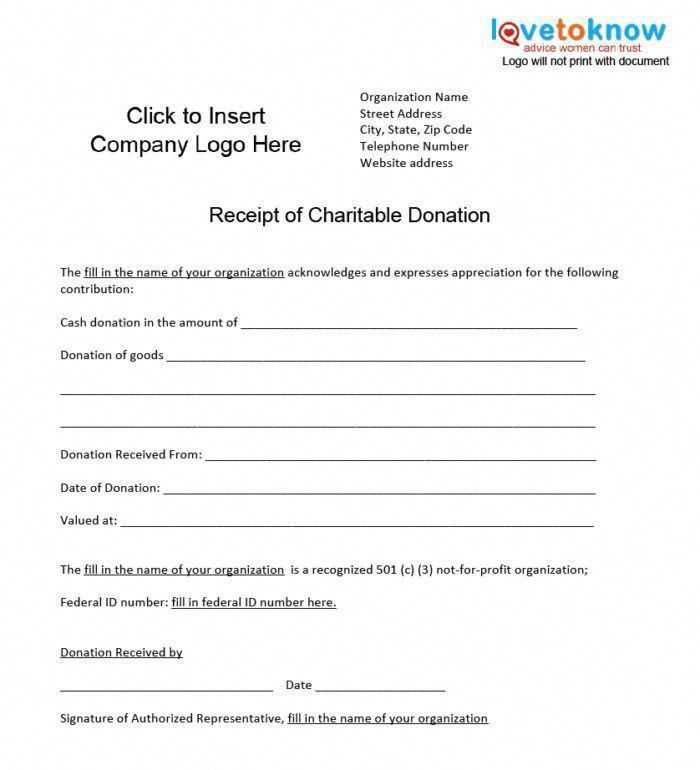

Creating a well-organized nonprofit contribution receipt helps you maintain transparency and ensures that your donors have the documentation they need for tax purposes. Start by including the donor’s name, the date of the donation, and a clear description of what was donated, whether it’s money, goods, or services. If the donation is in kind, specify the value of the goods or services donated, or include a statement that the nonprofit did not determine the value.

Make sure to clearly state that no goods or services were provided in exchange for the donation, if that is the case. This statement is required for the donor to claim a tax deduction. For monetary donations, include the amount given, and for non-cash donations, provide a brief description of the items. Also, don’t forget to include the nonprofit’s name, address, and tax identification number (TIN) for the donor’s reference.

Using a template for these receipts saves time and ensures consistency. Be specific about the donor’s contributions and avoid any ambiguity. Having this information readily available will help streamline your accounting and provide your supporters with the necessary documentation to maximize their charitable deductions.

Here is the revised version:

Make sure your nonprofit contribution receipt includes the donor’s full name, address, and the date of the donation. This information is essential for both the donor’s tax records and your nonprofit’s accounting. Clearly state the amount donated, and for non-cash contributions, provide a description of the items or services received. If applicable, include the IRS’s 501(c)(3) status to assure the donor that the organization is eligible for tax deductions.

Additionally, ensure your receipt reflects whether the donation was a cash donation or if the donor received any goods or services in return. For contributions of $250 or more, include a written acknowledgment that states the amount of cash received or a description of the non-cash contribution. You also need to confirm whether any goods or services were provided to the donor in exchange for the gift.

Provide a summary of the donor’s total contribution for the year, and make it clear if no goods or services were provided in return. This clarity will help the donor accurately claim their deductions. Double-check all the information before sending the receipt to avoid any errors that could affect the donor’s tax filings.

- Nonprofit Contribution Receipt Template

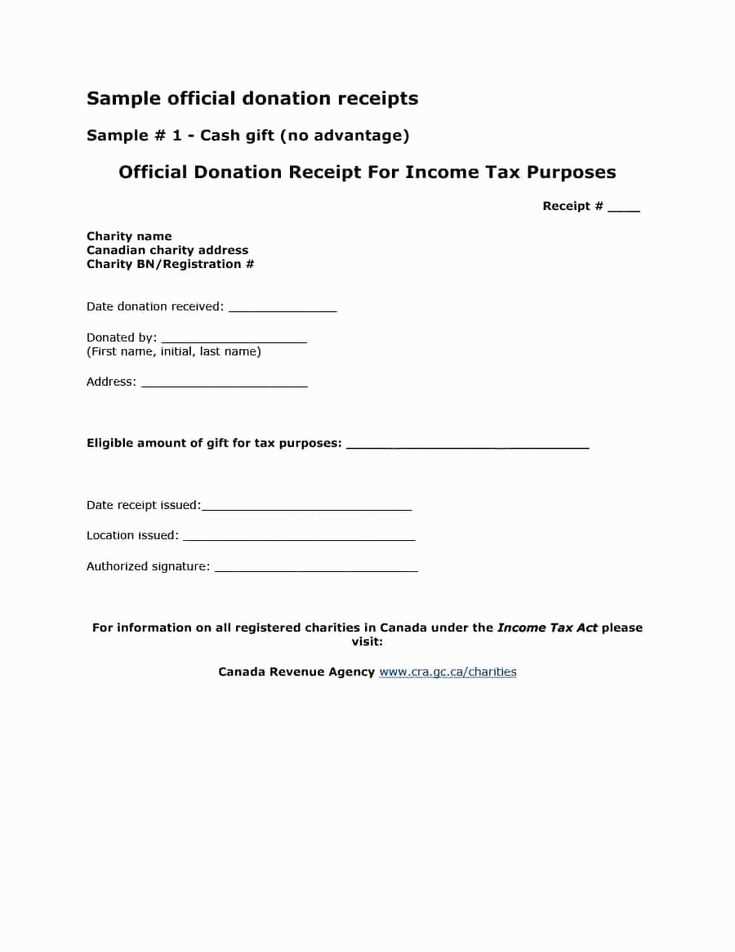

A nonprofit contribution receipt template should clearly communicate the donation details for both the donor and the organization. Here’s a guide on what to include:

- Organization Name and Contact Information: Include the nonprofit’s legal name, address, phone number, and website.

- Donor’s Name and Address: Ensure the donor’s full name and address are accurately listed for tax purposes.

- Date of Contribution: Indicate the exact date when the donation was made.

- Donation Amount or Description: For cash donations, list the exact dollar amount. For non-cash donations, describe the items donated and estimate their value.

- Statement of No Goods or Services Provided: If no goods or services were exchanged for the donation, include a clear statement such as, “No goods or services were provided in exchange for this donation.”

- Tax Identification Number (TIN): Add the nonprofit’s TIN or EIN (Employer Identification Number) to assist with the donor’s tax filing.

- Signature: Include space for a signature from an authorized representative of the nonprofit organization.

Using this template ensures clarity, helps build trust with donors, and maintains accurate records for tax reporting. Be sure to update this receipt template as necessary to comply with local regulations or changes in nonprofit requirements.

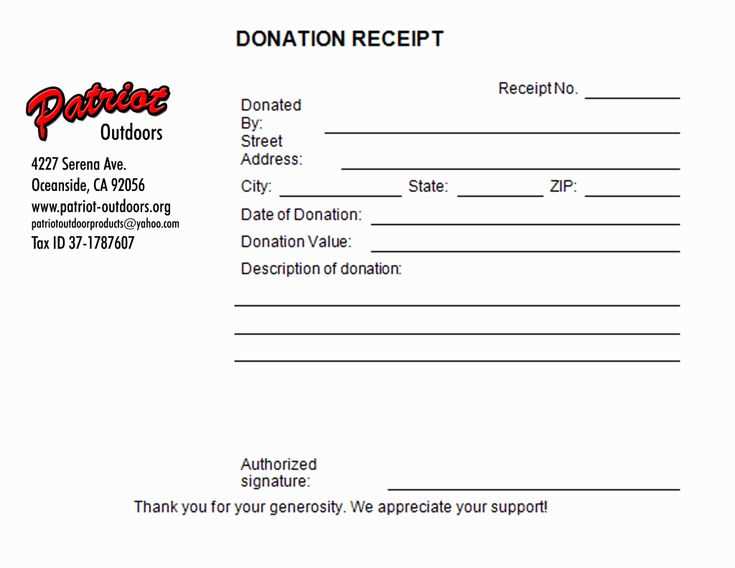

Begin with a clear header that identifies the nonprofit organization. Include the organization’s full name, logo, and contact details, such as address, phone number, and email. This ensures donors can easily reach out for questions or clarification.

Next, include the donor’s information. List their name, address, and any other relevant identification details. This personalizes the receipt and makes it easy to track for tax purposes.

Include a section that states the date of the donation. This helps the donor know when the transaction occurred and ensures the receipt aligns with the donor’s tax records.

Clearly state the amount donated. If the donation was in-kind, specify the type and approximate value of the gift. For financial contributions, include both the donation amount and the method of payment (cash, check, credit card, etc.).

Make sure to add a short statement acknowledging that no goods or services were provided in exchange for the donation, unless applicable. This is a necessary legal requirement for tax deductibility.

Finally, conclude with a thank-you note. Express appreciation for the donor’s support, reinforcing the impact their contribution has on your nonprofit’s mission.

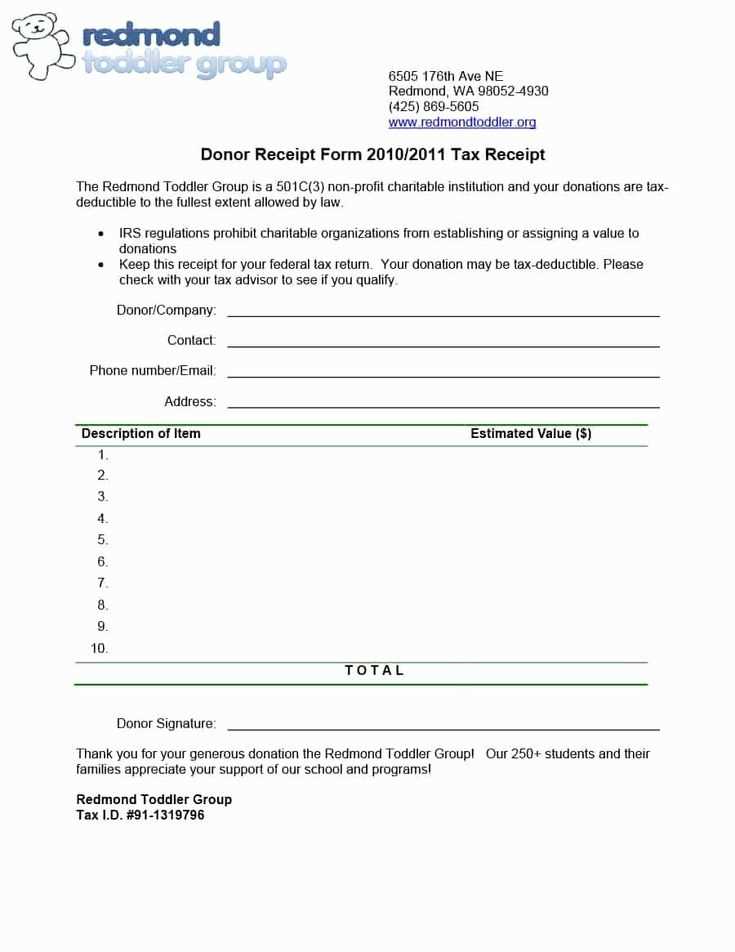

Nonprofits must issue receipts for charitable contributions that comply with IRS regulations to ensure donors can claim tax deductions. The receipt should include the nonprofit’s name, the donation date, and the amount given. For non-cash donations, the receipt must describe the items donated but does not need to assign a value. If the contribution includes goods or services in exchange, the receipt must also specify a good faith estimate of the value of those items. This helps donors accurately report their deductions.

For donations over $250, the IRS requires written acknowledgment that includes a statement on whether the donor received any goods or services in return for their contribution. The nonprofit should also include a description of any goods or services provided, as well as their fair market value. A clear statement of the contribution’s tax-deductibility is necessary, as the IRS requires transparency in these matters.

If the donation exceeds $75 and includes a benefit to the donor, the receipt must disclose the amount of the donation that is tax-deductible. This allows donors to differentiate between their charitable giving and the value of any benefits received, which is crucial for proper reporting to the IRS.

Address your donors by name in the opening of the receipt. A personal touch, such as “Dear [Donor’s Name],” immediately establishes a connection and makes the message feel more genuine.

Detail Their Contribution

List the exact amount donated and the date of the donation clearly. Provide specific information about how their contribution will be used, such as “Your $200 donation will sponsor 10 students for a month of after-school tutoring.” These details make the donor feel involved in your mission.

Express Gratitude and Include a Call to Action

Thank the donor with a heartfelt message, such as “Your support means the world to us.” You can also include a call to action, like an invitation to attend an upcoming event or to join a community initiative. This not only shows appreciation but also keeps the donor engaged with your cause.

Consider adding a brief, personalized note or even a digital signature from a staff member or board member. This extra effort helps donors feel they are more than just a transaction, reinforcing their commitment to your cause.

Receipt Elements and Structure

To create a well-organized nonprofit contribution receipt, include the following details in the template:

- Nonprofit’s Name and Contact Info: Include the full legal name of the nonprofit organization along with its address, phone number, and website link.

- Donor’s Name: Clearly display the full name of the donor who made the contribution.

- Date of Donation: Specify the exact date the donation was made to ensure accurate record-keeping.

- Amount of Donation: List the exact monetary amount of the donation or the fair market value for non-cash gifts.

- Description of Gift: For in-kind donations, describe the items donated along with their approximate value.

- Statement of No Goods or Services: If the donor did not receive anything in return for their contribution, include a clear statement like: “No goods or services were provided in exchange for this donation.”

- Tax Deductibility Statement: Include a statement verifying that the donation is tax-deductible, such as: “The [Nonprofit Name] is a 501(c)(3) organization, and donations are tax-deductible to the fullest extent of the law.”

Ensure all fields are filled out accurately to maintain transparency and provide the donor with the necessary documentation for tax purposes.