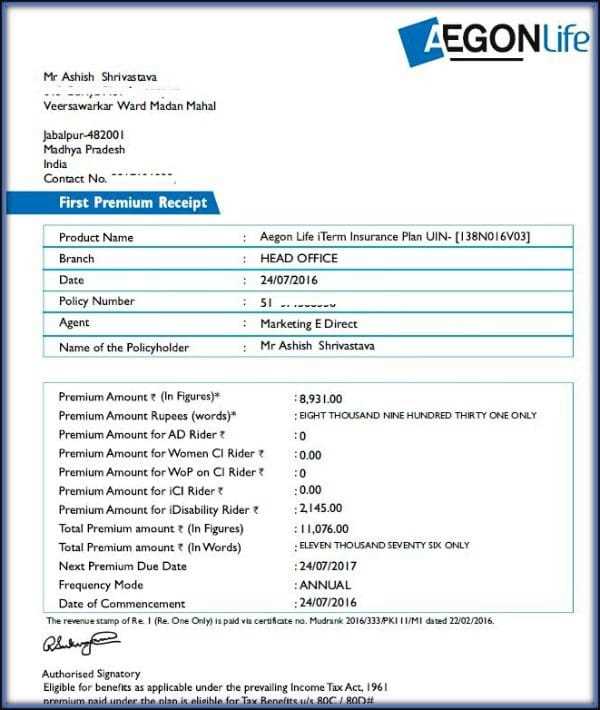

To create a precise medical insurance premium receipt, include key details like the payer’s name, the insurance provider, and the specific coverage period. Ensure that the receipt reflects the correct amount paid, including any discounts, taxes, or additional fees applied. Clearly state the date of payment and method, whether it’s through credit card, bank transfer, or check. Also, note the unique reference number or transaction ID for tracking purposes.

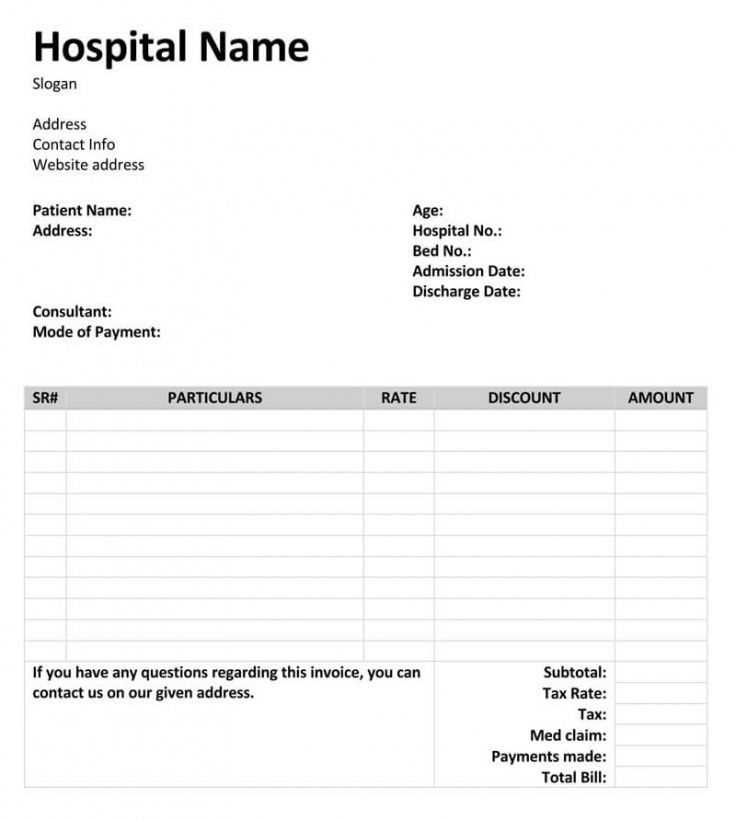

Make sure the template is easy to follow, with sections for payer and recipient information, payment details, and a breakdown of the premium cost. For accuracy, include a line item for each service or coverage type included in the premium. This will help both parties verify the transaction and maintain proper records for future reference or tax purposes.

To streamline the process, you can use an automated template that populates relevant fields based on entered data. This saves time and reduces the risk of error, ensuring that all necessary information is consistently included with each receipt. By following this format, you can provide clear, concise documentation for both the payer and the insurance provider, fostering transparency and trust.

Here are the corrected lines with duplicates removed:

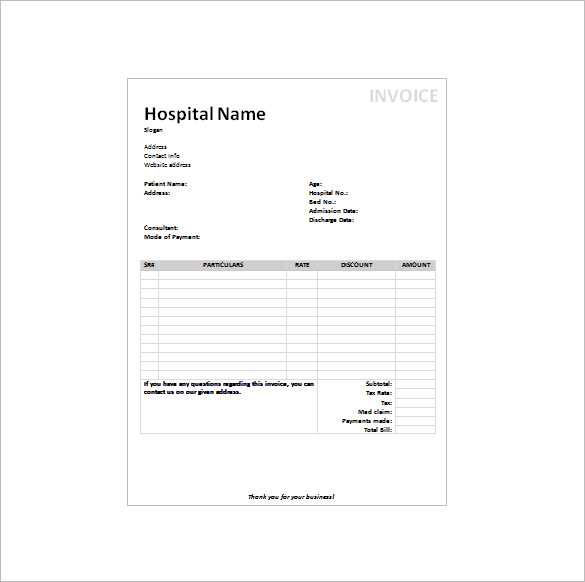

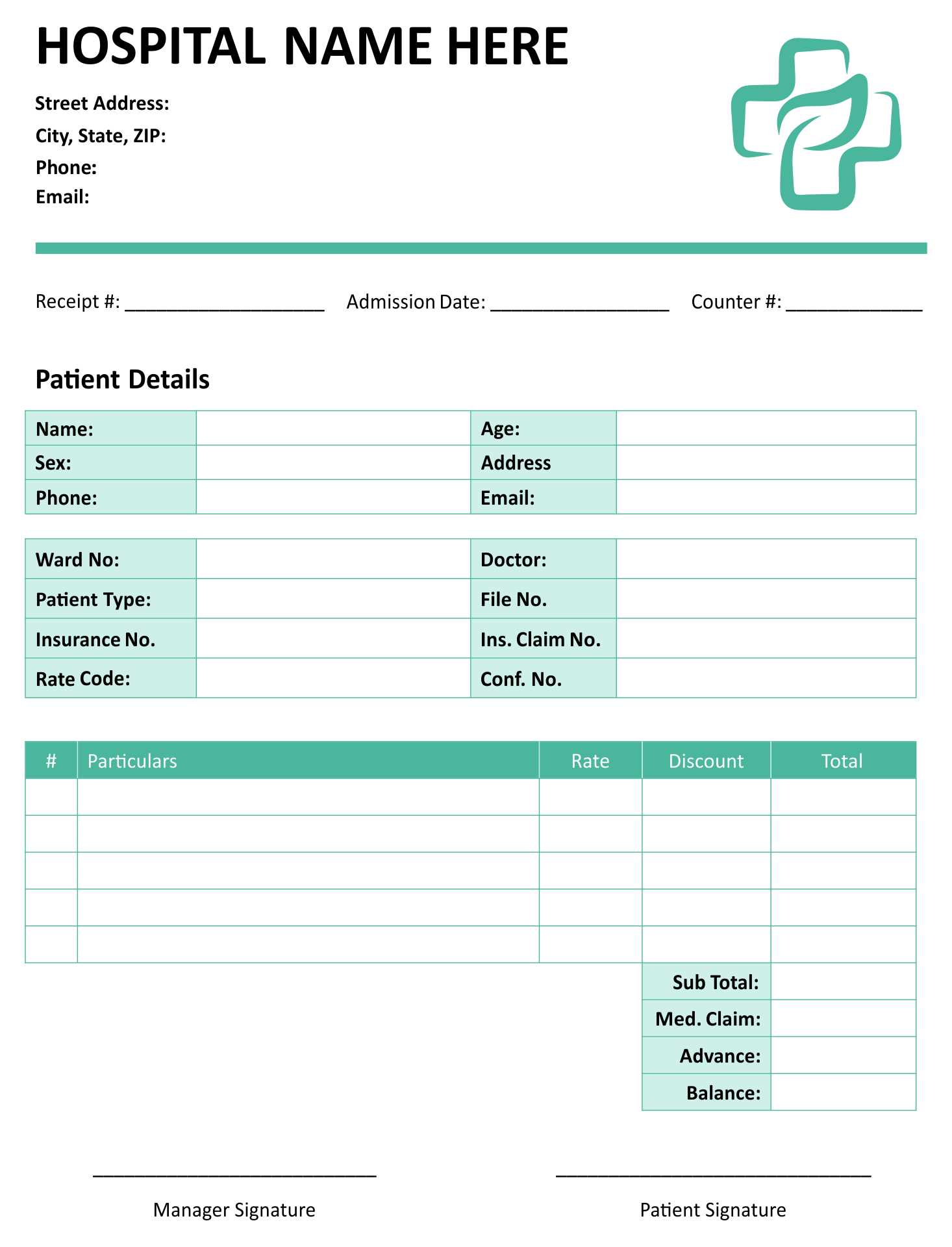

When designing a medical insurance premium receipt template, it is important to ensure clarity and precision. Start by streamlining the format to include only essential details. Avoid repetitive information such as multiple mentions of the policyholder’s name or address. Each section should serve a distinct purpose, from the coverage breakdown to payment verification.

Personal Information Section

Ensure the policyholder’s name, address, and contact details appear only once. Remove any redundant entries, as this could confuse the recipient. Double-check spelling and formatting consistency to maintain professionalism.

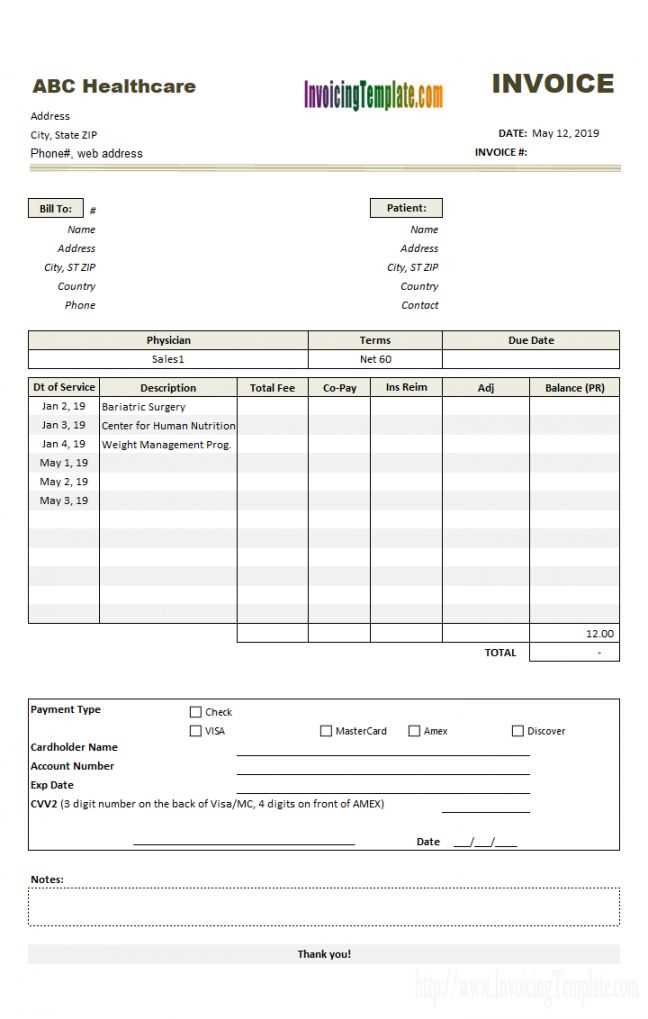

Payment Details

For payment-related information, list only the necessary details: the premium amount, payment method, and date of payment. Avoid repeating the premium amount in separate fields. If there are multiple payment options, include a separate line for each one instead of repeating the same information throughout the template.

- Medical Insurance Premium Receipt Template

To create a clear and complete medical insurance premium receipt, ensure it contains the following elements:

Required Information

- Insurance Company Details: Include the name, address, and contact information of the insurer.

- Policyholder’s Information: Mention the policyholder’s name, policy number, and any other relevant personal details.

- Payment Amount: State the total premium amount paid, including the payment date and method.

- Coverage Period: Specify the start and end dates of the coverage associated with the premium payment.

- Receipt Number: Assign a unique number for reference to track payments efficiently.

Formatting Tips

- Use Clear Headings: Organize the receipt into sections like “Payment Details,” “Policyholder Information,” and “Insurance Company Details” for easy reference.

- Readable Font: Choose a simple font like Arial, ensuring all text is legible.

- Include Summary: Add a brief summary at the bottom of the receipt, including key details such as the amount paid and the coverage period.

Following this structure guarantees a professional and efficient receipt format, keeping both the insurer and policyholder well-organized.

List the policyholder’s full name, the insurer’s name, and the policy number. These details should be prominently displayed at the top of the receipt for easy identification.

Necessary Information

Include the payment date and the amount paid. Specify the payment method, such as credit card, check, or bank transfer. If taxes or additional fees are involved, make sure to list those as well.

Formatting Tips

Arrange the information in clear sections or a table format. Separate each data point, such as the name, payment date, and amount, so that the receipt is easy to read and understand. Finish with a statement confirming the payment has been received.

List the total premium paid by the policyholder, including any additional charges or discounts applied. Make sure the amount is clearly visible and separated from other information to avoid confusion.

Policyholder and Insurer Information

Provide the full name, contact information, and address of both the insured and the insurance company. This ensures the document can be identified by both parties easily.

Payment and Coverage Details

State the date of payment and the effective dates of the insurance coverage. This provides clarity about the period the premium covers, avoiding misunderstandings later.

Include a transaction reference number or receipt number for record-keeping. This makes it easier to track or resolve any issues that may arise regarding the payment.

Ensure accuracy with each detail on the receipt. Missing or incorrect information, such as policy numbers or payment amounts, can lead to confusion and potential legal issues. Always cross-check the policyholder’s details, the exact payment received, and the correct payment date.

1. Incorrect or Incomplete Personal Information

Always verify the personal details of the insured party. Double-check names, addresses, and contact information to avoid mistakes. An incorrect name or address could lead to complications when a claim is filed or when reaching out for customer support.

2. Failing to Include Payment Details

Clearly state the amount paid and the payment method. Whether it’s credit card, bank transfer, or cash, the method of payment should be outlined to avoid any future disputes. Omit this and it can raise questions about the legitimacy of the transaction.

Providing a breakdown of the payment amount, such as premiums, taxes, and fees, enhances clarity and reduces misunderstandings.

3. Missing Legal or Policy Information

Make sure to include any legal or policy-related details that are necessary for the receipt’s validity. This can include policy numbers, terms of coverage, and specific dates. Without these, the receipt may not hold up in legal or administrative settings.

4. Overcomplicating the Format

While including all necessary details is crucial, the format should remain clear and straightforward. Avoid overwhelming the recipient with excessive information that isn’t relevant. A simple, clean design makes the receipt easier to understand and reference when needed.

Ensure your medical insurance premium receipt template includes the following key elements:

- Policyholder Details: Include the full name, contact details, and policy number of the individual paying the premium. This ensures that the receipt is correctly attributed to the right person.

- Payment Date: Specify the exact date when the premium was paid. This helps track the timing of payments and can be important for policy renewal or claims.

- Amount Paid: Clearly state the amount paid and the method of payment (e.g., credit card, bank transfer). This provides transparency in the transaction.

- Coverage Period: List the start and end dates of the insurance coverage. This allows both the policyholder and the insurer to confirm the period covered by the payment.

- Insurer Information: Include the name, address, and contact information of the insurance provider. This ensures that the receipt is verifiable and can be traced back to the issuing company.

- Receipt Number: Assign a unique receipt number for reference. This helps in managing records and simplifies the process for future inquiries or audits.

Make sure all these details are clearly formatted, making it easy for both the payer and the insurance company to refer to the receipt in case of any follow-ups or verification.