To create a babysitting tax receipt, make sure to include all key details for both the sitter and the client. This ensures clarity and accuracy when filing taxes. A well-structured template should feature the babysitter’s name, address, and contact information, along with the client’s details. The date(s) of service, hours worked, and agreed-upon rate are important data points to capture for tax purposes.

Ensure that the total amount paid for services is clearly stated, and include any tips if applicable. You should also mention any special arrangements or services that were provided, such as additional care, driving, or other non-routine tasks. A receipt that accurately reflects the terms of your agreement helps protect both parties and provides a solid record for tax filing.

A simple format can make all this information easy to access. For example, creating a document that includes a header with your contact details and the client’s, followed by a section for service dates, hours worked, and rate calculation, will save time and avoid confusion when reviewing receipts later. Remember to include a signature line for both the babysitter and the client to acknowledge the payment and the services rendered.

Sure! Here’s a version with less repetition:

To create a clear babysitting tax receipt template, start with key details. Include the sitter’s name, address, and contact info, along with the parent’s details. Clearly state the services provided, including the number of hours worked, the hourly rate, and the total payment received.

Breakdown of hours and rates helps parents and sitters keep track of the work completed. If the babysitting involves special tasks like overnight care, detail those separately. This transparency makes the receipt more useful for both parties.

Payment method should also be noted. Specify whether the sitter was paid by check, cash, or another method. If applicable, include transaction references or confirmation numbers for digital payments.

Finally, ensure that the receipt is signed by both parties to confirm its accuracy. This adds legal protection in case of any future inquiries.

- Babysitting Tax Receipt Template

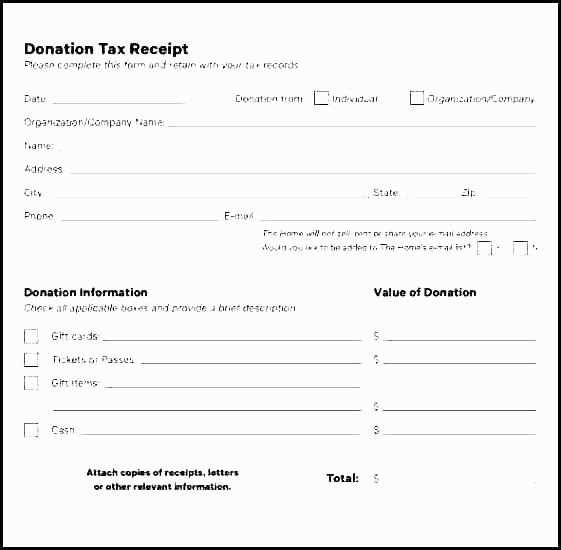

A babysitting tax receipt is a helpful document for clients and caregivers, ensuring proper record-keeping of payments for tax purposes. Here’s how you can create one that includes all the necessary details.

Key Elements of the Template

Make sure the receipt includes the following key elements:

- Caregiver’s Name – Clearly state the name of the babysitter providing the service.

- Client’s Name – Include the full name of the parent or guardian who hired the babysitter.

- Date(s) of Service – Specify the date(s) the babysitting took place.

- Hours Worked – List the number of hours worked, including the start and end times.

- Hourly Rate – State the agreed-upon rate per hour.

- Total Payment – Calculate the total payment for the service, based on hours worked and the hourly rate.

- Payment Method – Indicate whether the payment was made in cash, by check, or electronically.

- Caregiver’s Contact Information – Include phone number or email for any future references.

- Signature – Both the caregiver and client should sign the receipt for verification.

How to Format the Template

When creating the template, keep the design simple and clear. Use a clean, easy-to-read font and provide enough space for all details. Avoid clutter by organizing the information into sections, as outlined above. You can use a word processor or a spreadsheet program to create a template and save it for future use.

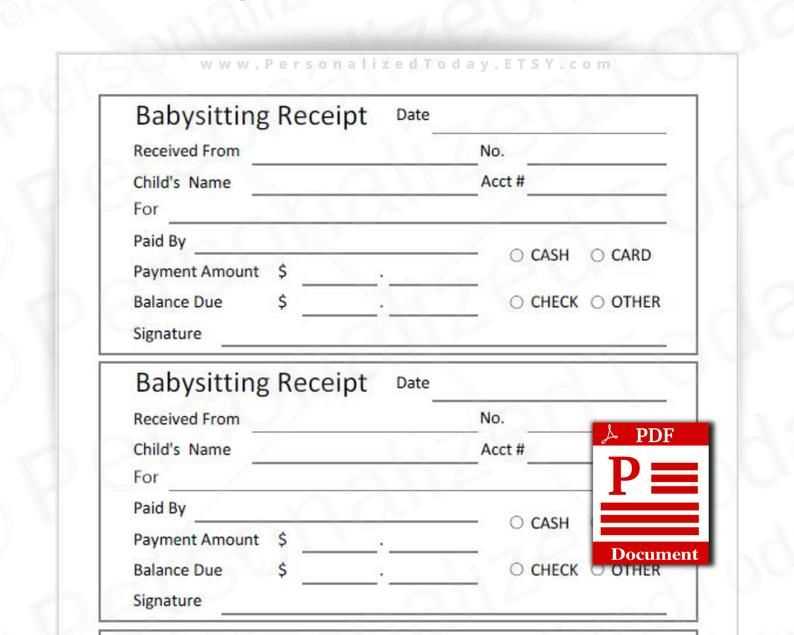

Creating a babysitting receipt template is simple and ensures both the caregiver and the parent have clear documentation of services rendered. Follow these steps to design one that’s both straightforward and useful.

1. Include Basic Information

- Caregiver’s Name – Write the full name of the babysitter providing the service.

- Client’s Name – Include the parent or guardian’s name.

- Date of Service – Add the date when the babysitting occurred.

- Time Worked – Specify the start and end times of the babysitting session.

- Rate – Clearly state the hourly rate or flat fee.

2. Outline Service Details

- Description of Services – Briefly note the duties performed (e.g., supervising children, feeding, bedtime routines).

- Total Hours Worked – Calculate and list the total number of hours worked, or mention if a flat fee applies.

- Amount Due – Multiply the hours worked by the hourly rate, or state the agreed-upon flat fee.

3. Payment Information

- Payment Method – Indicate how the payment was made (e.g., cash, check, bank transfer, or Venmo).

- Payment Status – Include a note like “Paid” or “Pending,” depending on the payment status.

Once you’ve completed these sections, your babysitting receipt will be clear and professional, leaving both parties with a record of the transaction.

Include the sitter’s full name and contact information at the top of the receipt. This helps confirm the identity of the person who provided the service. Add the client’s full name as well, so there is no confusion about the transaction. Clearly state the date(s) the babysitting service was provided, including start and end times. This gives a detailed record for tax purposes.

Payment Details

List the hourly rate or flat fee charged for the babysitting services. Specify the total amount paid and include a breakdown if needed (e.g., total hours worked and rate per hour). Any additional expenses (like transportation or meals) should also be noted, with clear amounts for each.

Tax Information

If applicable, indicate the tax rate and the amount of tax charged. In some regions, babysitting services may require tax reporting, so make sure to check if tax is applicable. Be transparent with the tax calculation to avoid discrepancies during audits or future reference.

Use a clean and readable layout. Choose a font that is easy to read on both printed and digital copies, such as Arial or Times New Roman. Keep the font size between 10-12 points for the main text and slightly larger (14-16 points) for headers to help organize information clearly.

Incorporating Key Information

Ensure that your template includes all relevant details, such as the babysitter’s name, contact information, the client’s details, service dates, hours worked, and payment breakdown. Group similar information together to improve clarity and create a natural flow. For example, the client’s name and contact details can be placed at the top, followed by service details and payment information in separate sections.

Customizing with Your Branding

If you run a babysitting business, consider adding a logo, business name, or slogan to personalize your receipt. Keep the design simple to maintain a professional look while still giving it a unique identity. This also helps clients associate the receipt with your services.

Consider including payment methods (cash, check, credit card) and space for any additional notes. Customizing these elements ensures that your receipt is tailored to your style and client needs, which can make it more efficient for both parties.

To use your babysitting tax receipt for deductions, keep these key steps in mind:

1. Make sure the receipt includes all necessary details: the date of service, the total amount paid, the sitter’s name, and the address or location of service. This information ensures the validity of the receipt.

2. Record the expense accurately in your financial records. The amount paid to the babysitter can be listed under “childcare expenses” for tax purposes.

3. Check if you qualify for any tax credits or deductions. Depending on your location, expenses related to childcare can often be deducted from your taxable income.

4. If you are claiming the Child and Dependent Care Credit in the U.S., report the total amount paid to the babysitter. Be sure to include the sitter’s taxpayer identification number (TIN) or Social Security Number (SSN) for IRS purposes.

5. Maintain a copy of the receipt and any related documents, such as the sitter’s contact information, for your records in case of future audits.

By following these steps, you can ensure that your tax receipt is used effectively for deductions and reduce your overall taxable income.

Legal Requirements for Babysitting Receipts in Your Area

In most areas, babysitting receipts are not legally required unless you are running a business or earning a significant amount of income. However, providing a receipt is a good practice for record-keeping and transparency, especially if the payment is substantial or recurring. Some regions may have specific tax reporting rules for independent contractors or self-employed individuals offering babysitting services. In these cases, a detailed receipt helps document income for tax purposes.

The receipt should include the babysitter’s name, the date and time of the babysitting services, the hourly rate or agreed-upon fee, and any additional charges (e.g., for extra children or overtime). In some jurisdictions, you might need to provide a tax identification number (TIN) if the payment meets a certain threshold. It’s important to stay informed about local laws regarding income reporting and whether you need to collect or remit sales tax on babysitting services.

Check with your local government or tax authority for precise requirements based on your earnings and business setup. Keep in mind, even for casual babysitting jobs, maintaining clear records of all payments can help prevent any potential tax issues in the future.

Common Mistakes to Avoid When Issuing Tax Receipts

Inaccurate or incomplete tax receipts can lead to confusion or even tax issues. Here are key mistakes to avoid:

1. Missing or Incorrect Information

Always double-check the details before issuing a receipt. A missing address, the incorrect name, or an error in the amount paid can make the receipt invalid for tax purposes. Ensure all fields, such as date, service description, amount, and client information, are correctly filled in.

2. Failing to Issue Receipts on Time

Delay in issuing receipts can cause unnecessary complications. Make sure to provide tax receipts promptly after the service is completed. A receipt issued well after the transaction may not be valid for tax deductions or reporting.

3. Not Including Necessary Tax Information

- Ensure the receipt clearly mentions whether taxes were included or not.

- If applicable, indicate the tax rate used and the total amount of tax charged.

4. Using Generic Templates Without Customization

Generic templates may not cover all necessary details specific to your business or service. Customize the receipt template to include your business name, address, and contact information, along with any other required data that applies to your services.

5. Not Keeping Copies of the Receipts

Always keep a copy of every receipt issued for your own records. Digital or physical copies help in case of discrepancies or audits. Lack of proper documentation can create unnecessary stress down the line.

6. Inconsistent Formatting

Maintaining consistency in formatting helps avoid confusion. Use clear fonts, organized sections, and standard fields. A cluttered or poorly formatted receipt may be difficult to read and cause misunderstandings with clients or tax authorities.

This preserves the original meaning while reducing redundancy.

Keep your babysitting tax receipts clear and simple. Clearly list the services provided, hours worked, and agreed-upon rates. Include your name, contact details, and tax identification number (TIN), if applicable. Additionally, mention the total amount earned, along with the date the services were rendered.

Itemized Breakdown

Provide an itemized list of the babysitting services, breaking down the hours worked and rates for each service, whether it’s day care, after-school care, or overnight sitting. This will make the tax receipt easier for your client and tax authorities to understand. If you offer additional services, like meal preparation or transportation, include them as separate line items with their respective costs.

Additional Notes

If there are any special agreements, like discounts or long-term contracts, note those on the receipt. This transparency ensures that both parties are on the same page. Including these details helps maintain an organized record for tax reporting purposes.