Creating a donation receipt template for nonprofit organizations ensures transparency and builds trust with donors. Make it clear, concise, and compliant with tax laws to streamline donor acknowledgment.

Required Information

- Organization Details: Include the nonprofit name, address, and EIN (Employer Identification Number).

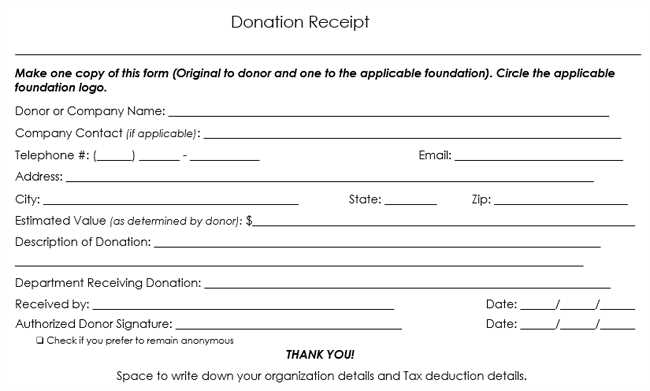

- Donor Information: Donor’s name, address, and contact details should be listed for easy recognition.

- Donation Information: Specify the amount, type (cash, check, or in-kind), and date of donation.

- Receipt Number: Assign a unique reference number to each receipt for tracking purposes.

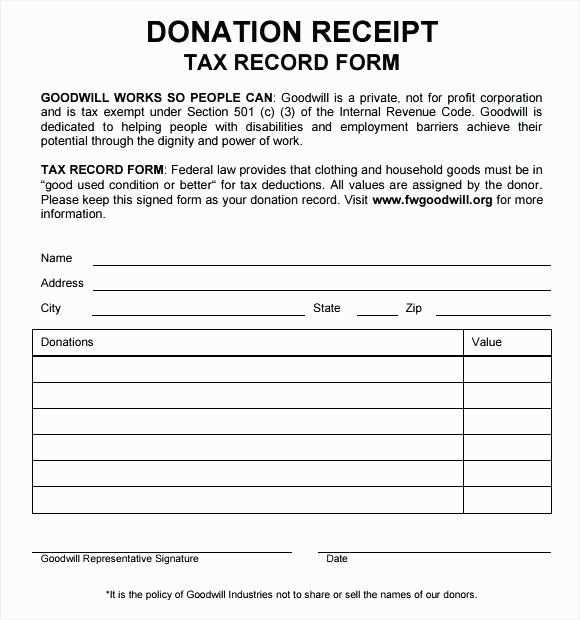

In-Kind Donations

If the donation includes goods or services instead of money, detail the description and estimated value. Acknowledge that the nonprofit does not assess the fair market value of the goods or services.

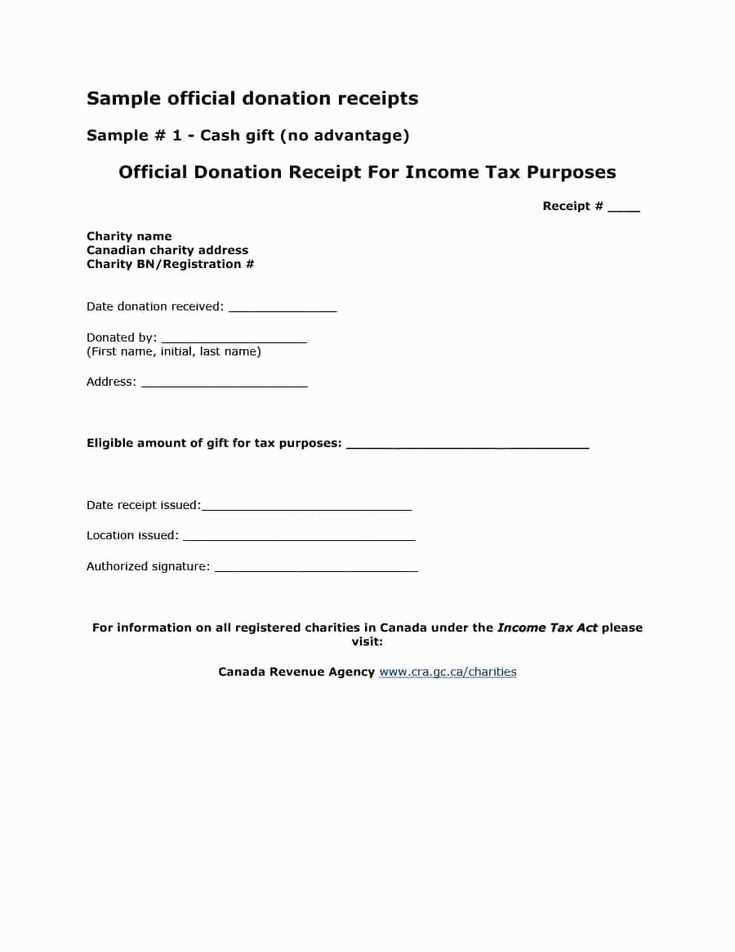

Tax Deductibility Statement

Include a clear statement such as: “No goods or services were provided in exchange for this contribution, except as noted above.” This ensures donors understand the potential for tax deductions.

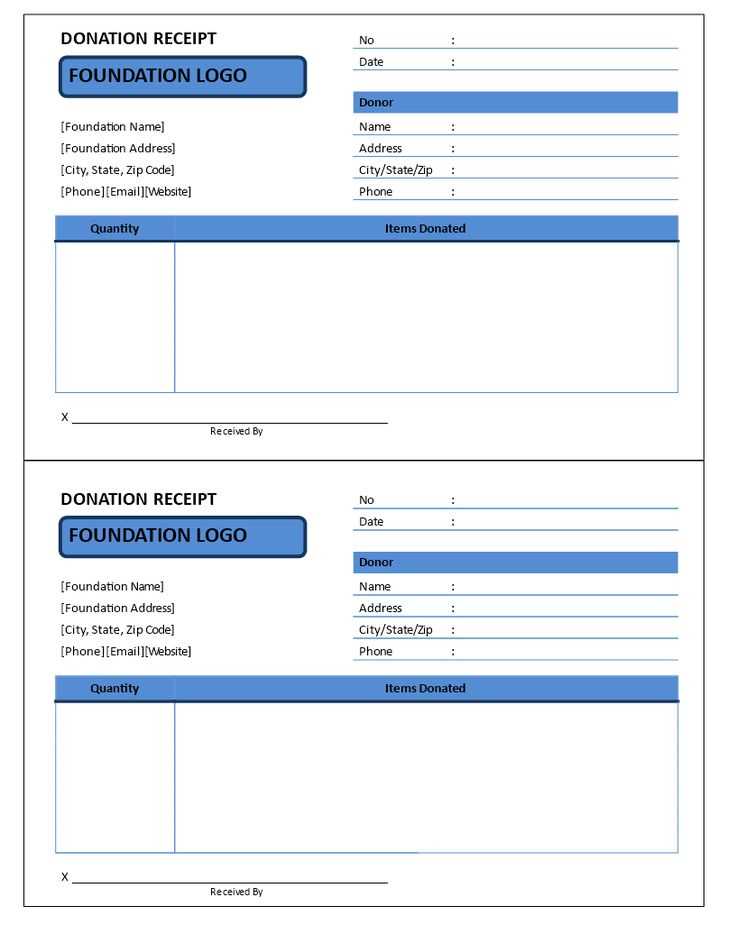

Format and Design Tips

- Clarity: Use readable fonts and a simple layout that emphasizes key details.

- Branding: Include the nonprofit’s logo and use the official color scheme for consistency.

- Professionalism: Make sure the design reflects the nonprofit’s mission and values.

Digital and Paper Copies

Offer both digital and paper receipt options. Ensure that digital receipts include a secure link to confirm the donation. Keep copies on file for future reference and reporting purposes.

Receipt Template for Nonprofit Contributions

To create a receipt for nonprofit donations, start with the donor’s full name, address, and donation amount. Include the date of the donation, a description of the donated items (if applicable), and confirm whether the donation was in cash, check, or in-kind. Ensure the organization’s name, address, and tax identification number (TIN) are clearly listed.

For simplicity, provide a statement confirming the nonprofit’s tax-exempt status. If the donation is non-cash, describe the goods donated and their estimated fair market value, but do not assign a specific dollar value. Include a statement that no goods or services were provided in exchange for the donation, if that applies.

Ensure the receipt includes a clear disclaimer stating that it is not a statement of value for tax purposes. Donors should keep the receipt for their own tax records. If your organization provides goods or services in exchange for the donation, make sure to itemize them and state their value.