For businesses and individuals looking to provide accurate and professional receipts, a well-crafted official receipt template is a must. The BIR (Bureau of Internal Revenue) receipt template ensures that all transactions comply with government regulations and help keep your financial records organized. By following a specific format, businesses can easily document sales and provide proof of payment to customers.

Using a BIR official receipt template allows you to maintain transparency and accountability in your business operations. Make sure that the template includes important elements such as the receipt number, business details, transaction date, description of goods or services, and the total amount paid. Having these details in place not only helps in smooth financial tracking but also establishes trust with clients.

When setting up your receipt template, take extra care to ensure that the format matches the guidelines provided by the BIR. This reduces the chances of errors that could lead to compliance issues. Having a clear and precise receipt template can save you time, reduce mistakes, and help you maintain a positive business reputation. A well-structured template offers a straightforward way to document your sales while meeting legal obligations.

Here is the corrected version:

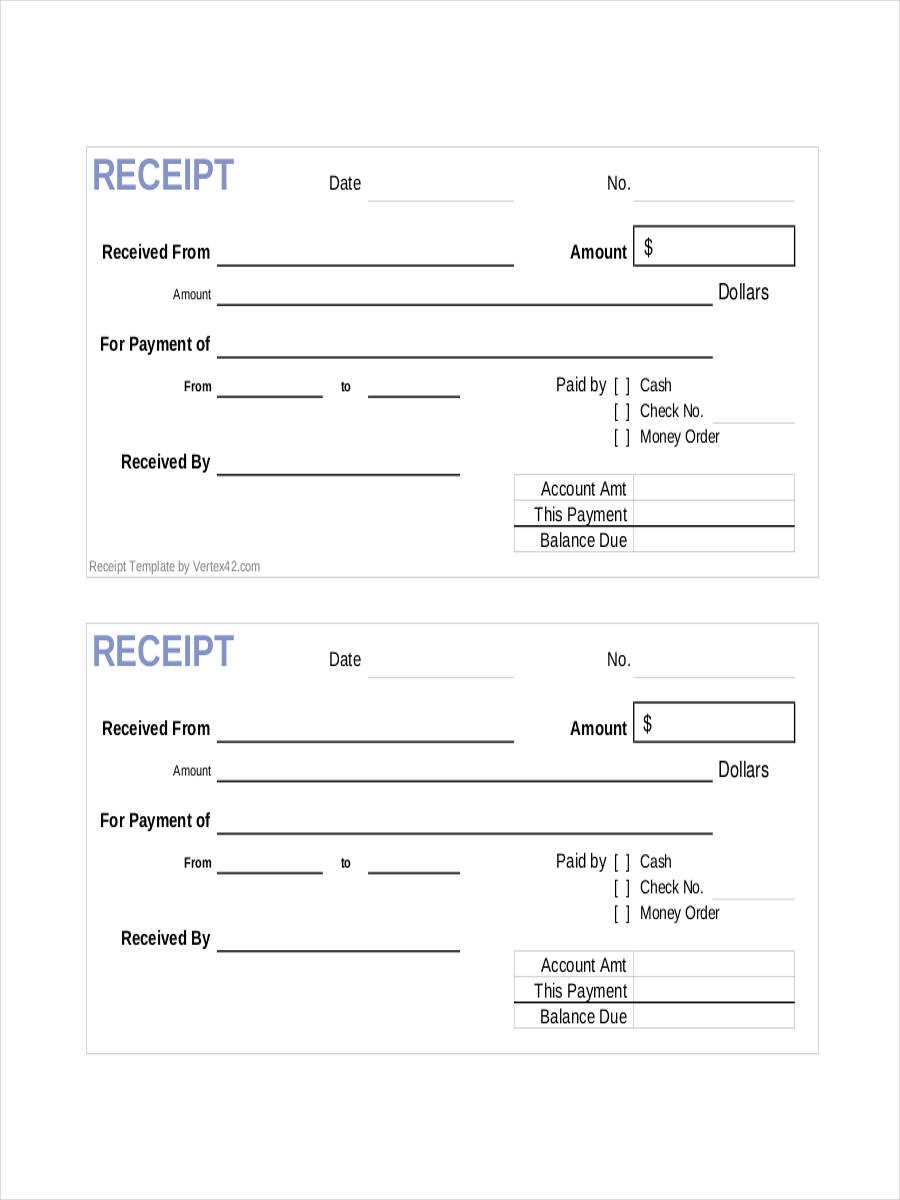

To create an official receipt, ensure the document includes the following details:

- Receipt Number: A unique identifier for each receipt issued.

- Issuer Information: Include the name, address, and contact information of the business or individual issuing the receipt.

- Recipient Information: Name and contact details of the person or entity receiving the payment.

- Date of Issue: The exact date the transaction occurred.

- Amount Paid: Specify the total amount received, including any taxes, fees, or discounts.

- Description of Goods or Services: List the items or services for which the payment was made.

- Payment Method: Specify how the payment was made (e.g., cash, card, bank transfer).

Make sure the format is clear and all required fields are filled out properly. This ensures legal validity and provides a clear record of the transaction for both parties.

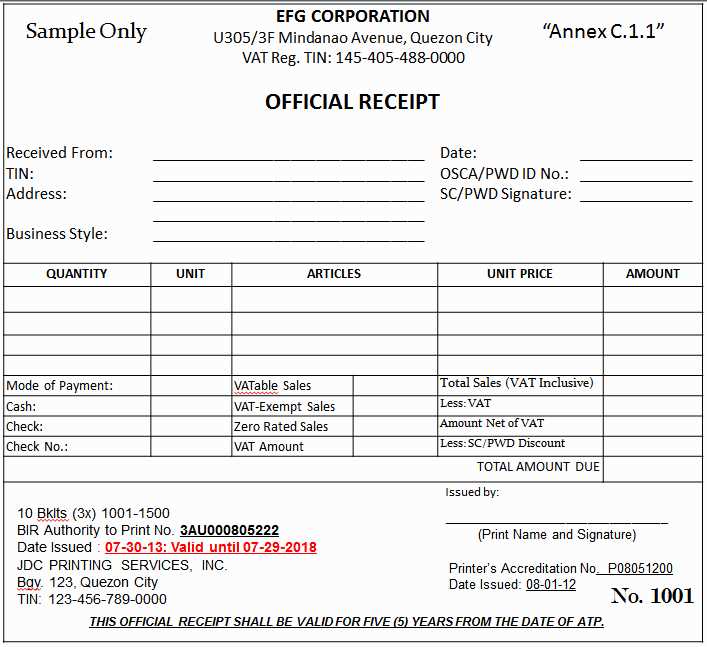

Official Receipt Template BIR

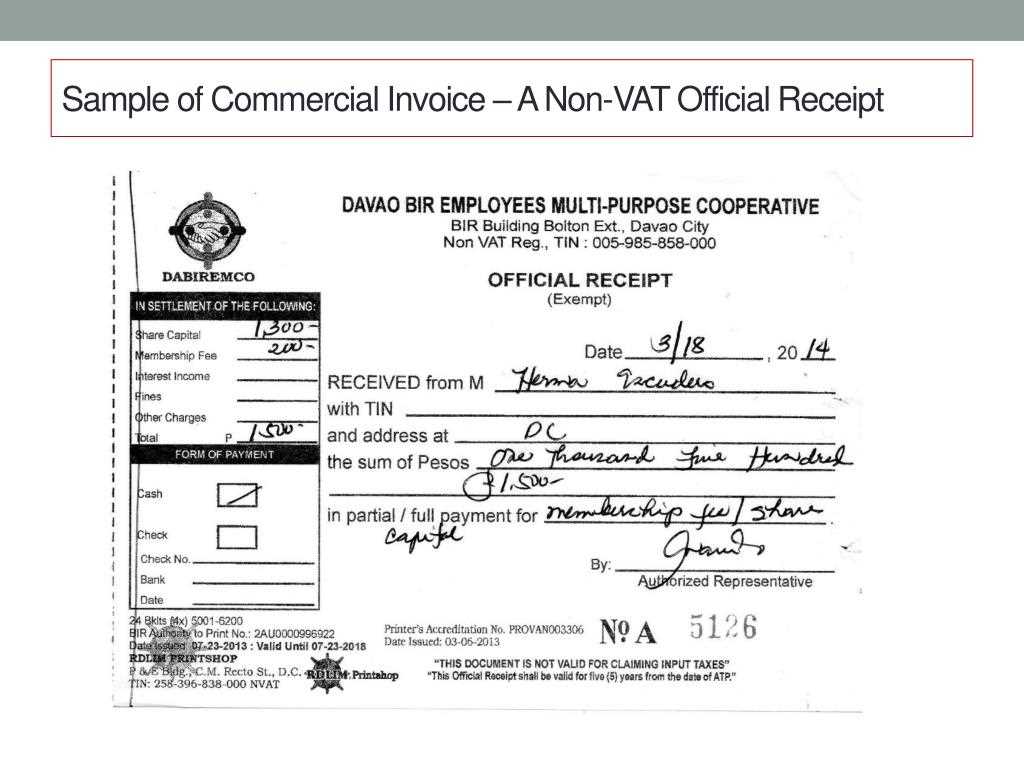

Properly formatting an official receipt for BIR compliance ensures that your business meets the legal requirements and provides clear documentation for transactions. A BIR-compliant receipt template must include specific details and follow the prescribed format to avoid penalties. Below is a guide to help you create a BIR-approved receipt template.

How to Properly Format an Official Receipt for BIR Compliance

The key elements to include in a BIR-compliant receipt template are:

- Receipts Number – This must be sequential and unique to each transaction.

- Business Name and Address – Ensure your business name and full address are clearly displayed.

- Taxpayer Identification Number (TIN) – The TIN must be displayed to validate your business.

- Official Receipt Date – Always include the transaction date.

- Description of the Product or Service – Clearly state the details of the sale or service rendered.

- Amount Paid – Show the total amount, including taxes where applicable.

- Signature of the Issuer – The issuer’s signature authenticates the receipt.

Step-by-Step Guide to Customizing Your BIR Receipt Template

Follow these steps to ensure your receipt template is BIR-compliant:

- Choose a reliable template or create one from scratch.

- Ensure the template allows you to add all mandatory details like TIN, business name, and transaction details.

- Format the receipt with a clear and readable layout, separating each section for better visibility.

- Incorporate an auto-numbering system to ensure each receipt is unique and sequential.

- Test the template by generating a sample receipt to check for proper alignment and accurate data representation.

- After finalizing the design, register the template with the BIR if required.

Common Mistakes to Avoid When Creating a BIR Official Receipt

Be aware of these common pitfalls to prevent errors in your receipt formatting:

- Failing to include all mandatory information, such as your TIN or transaction date.

- Using inconsistent numbering for receipts.

- Formatting the template in a way that makes it difficult to read or understand.

- Forgetting to include your business address and contact information.

- Omitting tax details, which may result in tax discrepancies.