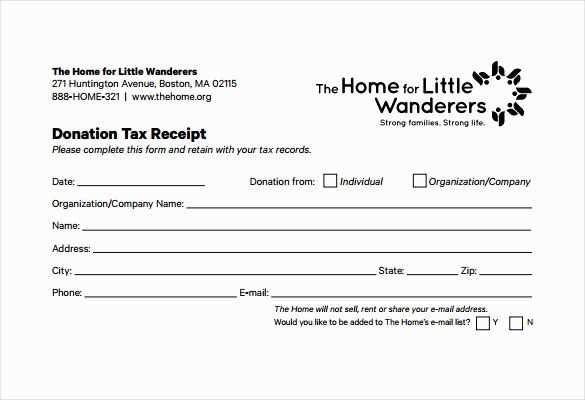

For a non-profit organization, providing a clear and professional receipt for donations is not just a legal requirement, but also a way to build trust with your supporters. A receipt template should include all the necessary details to validate the donation and make it easy for donors to use for tax purposes. Keep it concise and organized, ensuring that the recipient’s information is accurately reflected.

Start with the donor’s name, the donation amount, and the date the donation was received. Include a brief description of the donation type, whether it’s monetary or an in-kind gift. If the donation is eligible for tax deduction, make sure to include a statement to that effect, along with your organization’s tax-exempt status number.

Providing a personalized touch on the receipt, such as a thank you message, enhances the relationship between your organization and the donor. Templates should be simple to customize, allowing for quick adjustments depending on the donation details, while maintaining a consistent and professional look across all receipts.

Templates for a Receipt of Donation to a Non-Profit Organization

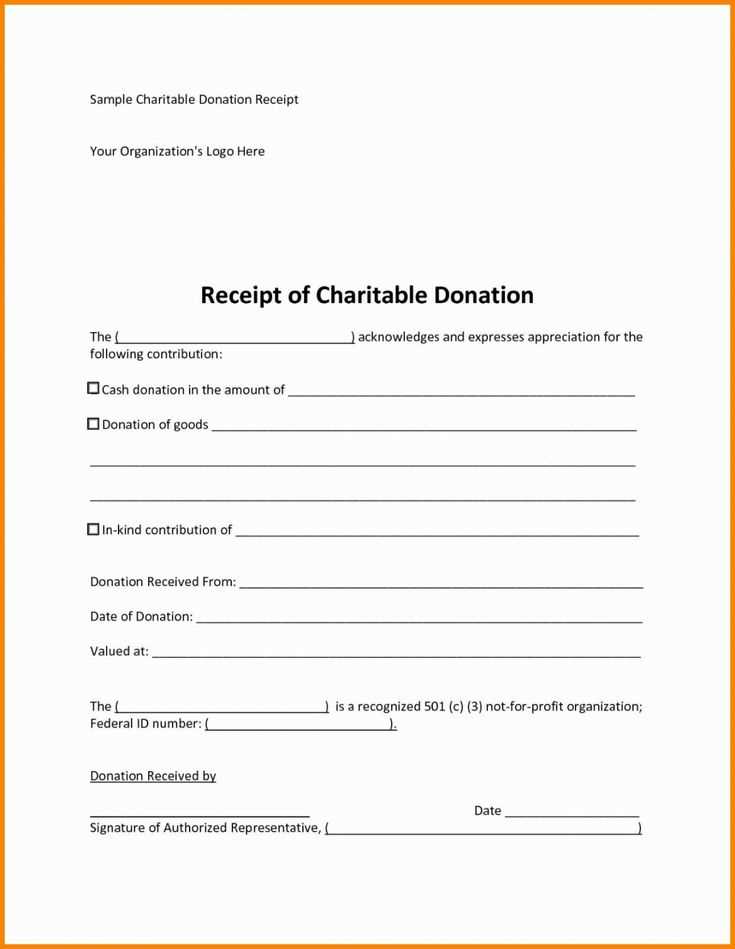

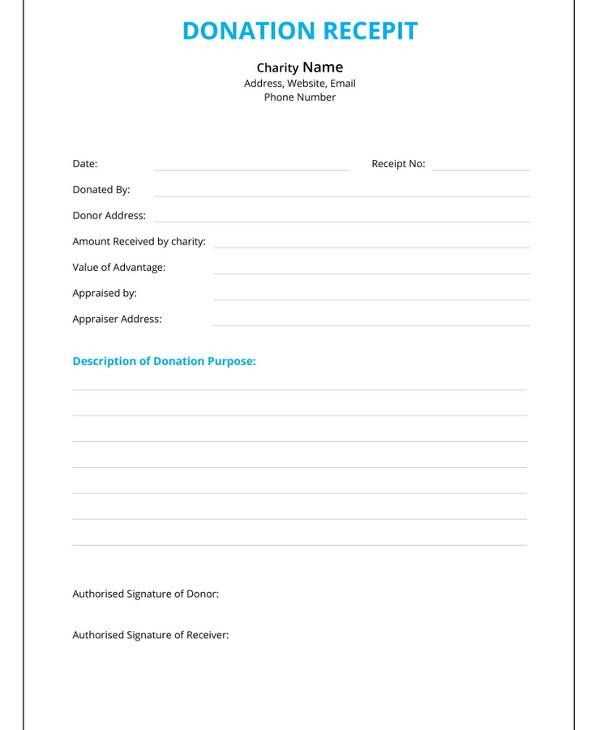

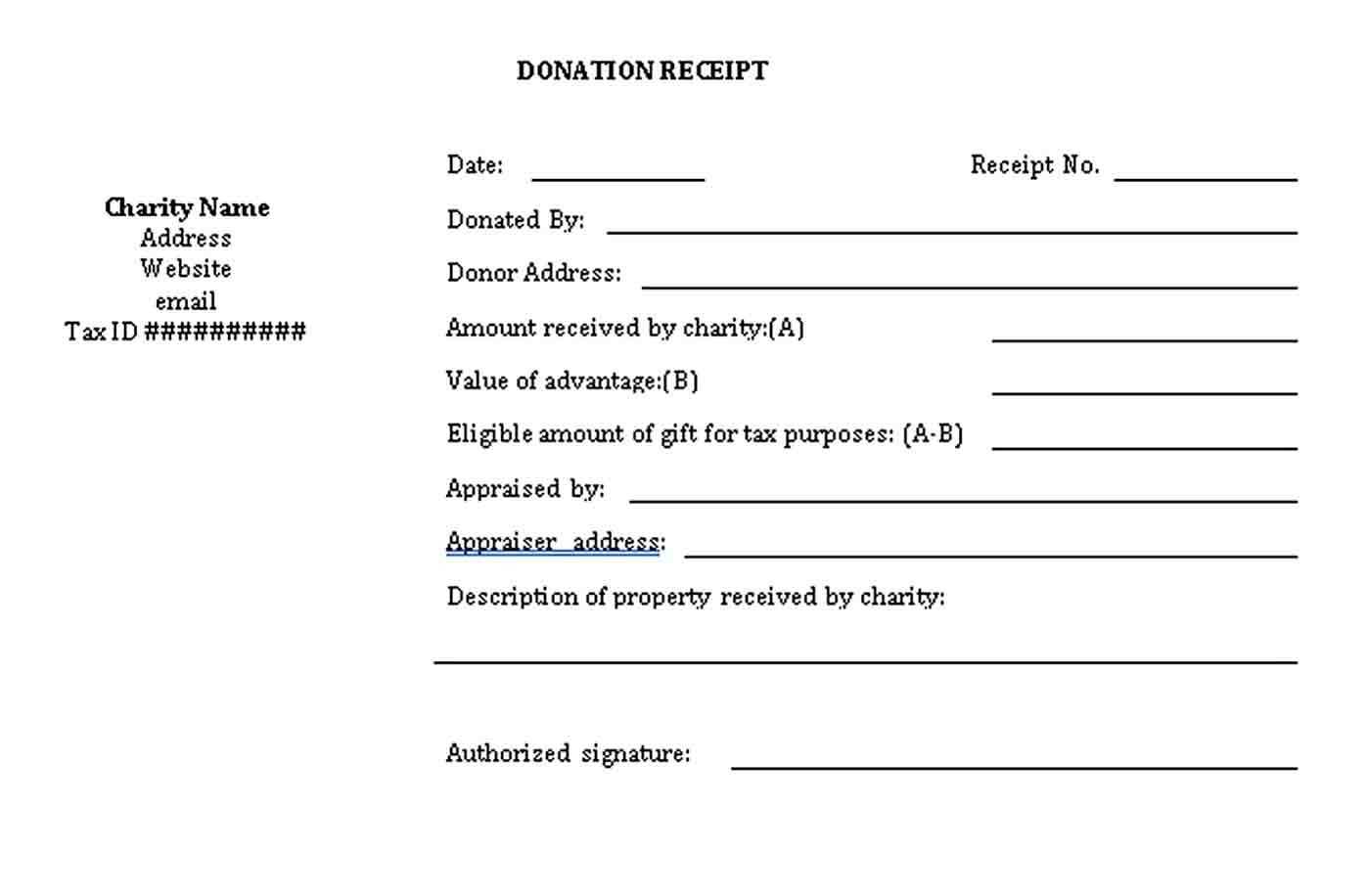

Provide a simple and clear structure for your donation receipt template. Include the non-profit organization’s name, address, and tax identification number at the top. Then, add the donor’s name and contact details, followed by the date of donation. Clearly state the amount donated and specify whether the donation was in cash, check, or other forms.

Make sure to include a brief description of the purpose of the donation if applicable, such as a specific program or project it supports. Add a statement confirming that no goods or services were provided in exchange for the donation, as this is required for tax purposes.

Conclude the receipt with a thank-you message and contact information for the non-profit organization. Always include space for the authorized signature to validate the document. Keep the design simple and professional to ensure clarity and compliance.

Creating a Simple Receipt Template for Cash Donations

Begin with including the name and contact details of your organization at the top. This helps the donor immediately recognize who is issuing the receipt.

Include Date and Donation Amount

Clearly state the date of the donation and the exact amount of cash donated. Be specific to avoid confusion and ensure both parties are aligned.

Describe the Purpose of the Donation

It’s helpful to include a brief description of how the donation will be used or the cause it supports. This adds transparency and gives the donor a sense of contribution.

Don’t forget to include a thank you note at the end of the receipt. A simple line like “Thank you for your generous support!” adds a personal touch.

Finish with a unique receipt number for tracking purposes. This ensures the receipt can be referred to in future communications or for tax purposes.

How to Include Tax Deductible Information on a Donation Receipt

Include clear tax-deductible information by confirming the nonprofit’s tax-exempt status. This will help donors understand that their contribution qualifies for a tax deduction. Mention the organization’s IRS 501(c)(3) status if applicable, or other relevant tax-exempt designations, including the registration number if needed.

Key Details to Add

- Nonprofit status: Clearly state the organization’s tax-exempt status (e.g., 501(c)(3), charitable organization).

- Amount of donation: Include the total value of the donation, specifying if it was in cash or property.

- No goods or services received: Indicate that the donor did not receive any goods or services in return for their contribution, or provide details of any goods/services received if applicable.

- Tax identification number (TIN): If required by local tax laws, include the nonprofit’s TIN or EIN (Employer Identification Number).

- Date of donation: Ensure the exact date of the donation is recorded for tax purposes.

Common Mistakes to Avoid

- Failing to clearly state the nonprofit’s tax-exempt status.

- Leaving out the donor’s name or the donation date.

- Forgetting to note if the donor received any goods or services in return.

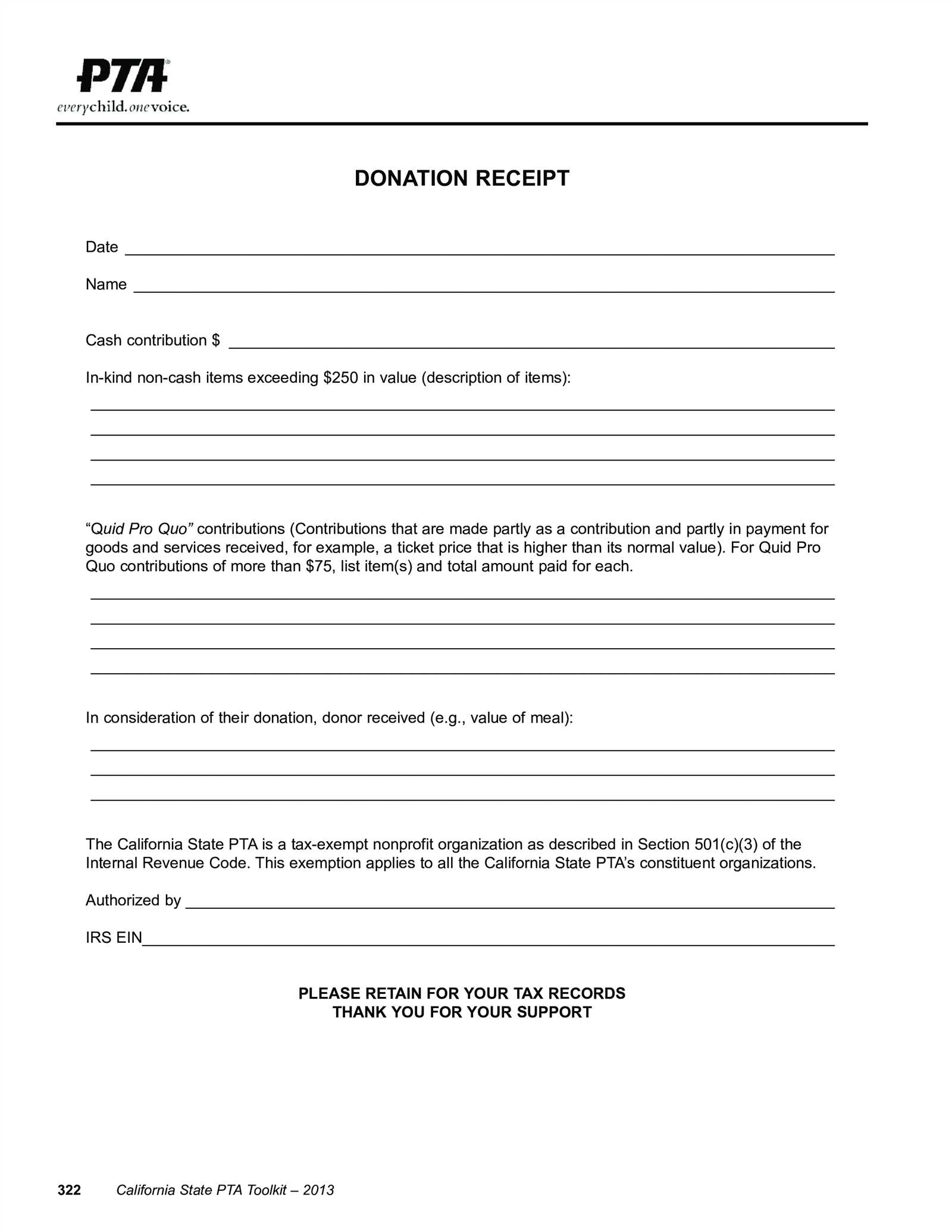

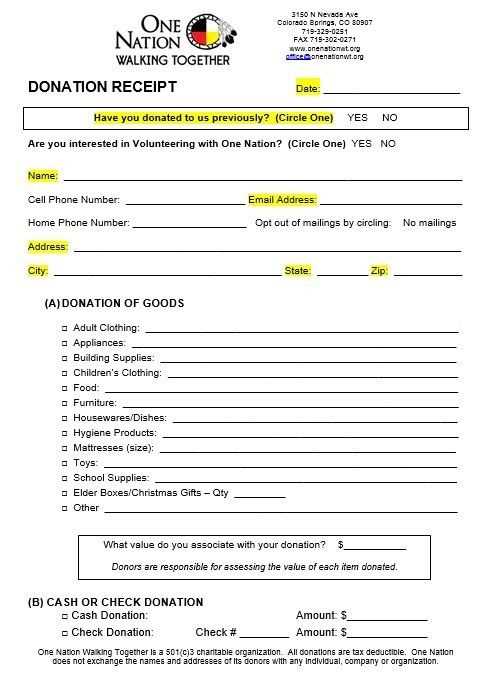

Designing a Template for Non-Monetary Contributions

Include a section that clearly identifies the donor’s information. Use fields for the donor’s name, contact details, and the date of donation. Make sure to specify the type of contribution being made, whether it’s physical goods, services, or time.

Provide a brief description of the item or service donated. Include relevant details such as quantity, condition, and any other specifics that highlight the value of the contribution. If the donation is volunteer hours, specify the number of hours and the type of work provided.

Clearly state the organization’s acknowledgment of the donation. For example, include a statement like: “This is to confirm that [Donor Name] has donated [Item/Service] to [Organization Name] on [Date].” This statement serves as a formal receipt for the donor’s records.

Consider adding a section for the donor’s tax information, if applicable. Some non-profits offer tax deductions for non-monetary donations, so include a line that confirms whether the contribution is tax-deductible. If you don’t offer this, make it clear to avoid confusion.

Make sure the design is clean and easy to read. Avoid overcrowding the template with unnecessary text or decorative elements. A simple layout with clearly defined sections helps ensure that all relevant information is easy to find and understand.

Finally, include the organization’s contact information at the bottom of the template. This ensures that the donor can easily get in touch if there are any questions or follow-up needed after the donation.