Creating a cash sale receipt book is a straightforward way to track transactions and ensure both parties are on the same page. A well-organized template can save time and prevent errors in recording sales. When crafting your own receipt book, focus on including all the necessary details such as the date, amount, items sold, and payment method. This ensures clarity for both the buyer and the seller.

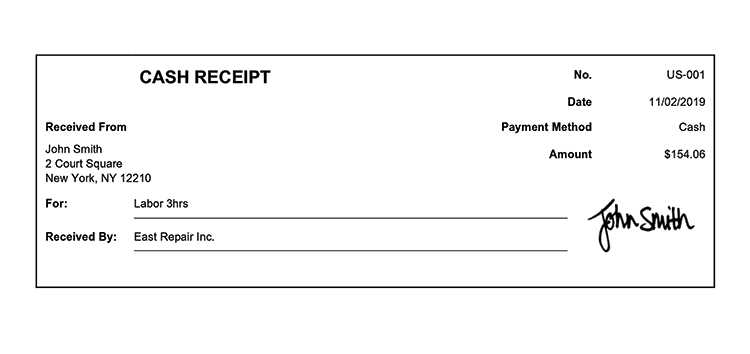

Start with a clear header that states the receipt’s purpose. Include the name of the business, address, and contact information for easy reference. A header sets the tone and provides essential details at a glance, making it easier to identify the source of the transaction when needed.

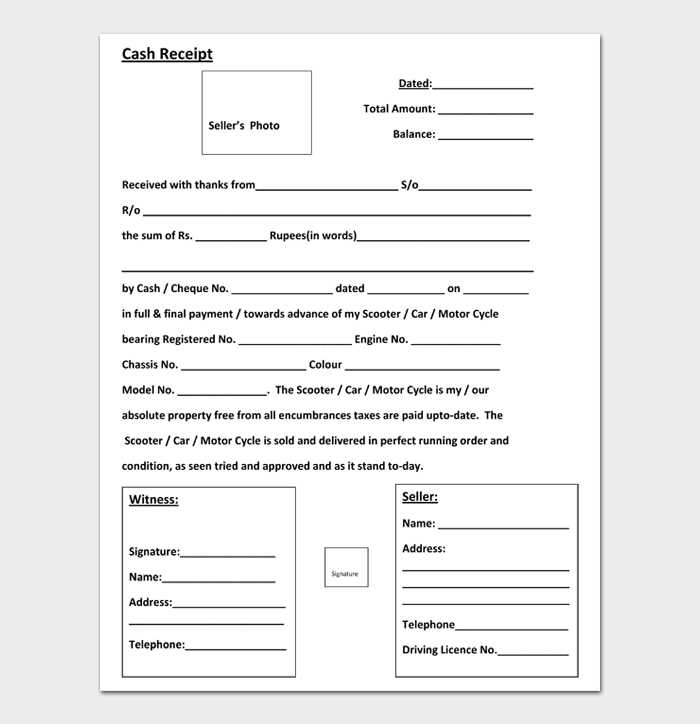

Next, include transaction details like the quantity, description, and price of the items sold. Use clear and concise language to avoid confusion. The total amount paid should be prominently displayed, along with the payment method, whether cash, check, or another form. This is especially helpful for both parties if any disputes arise later on.

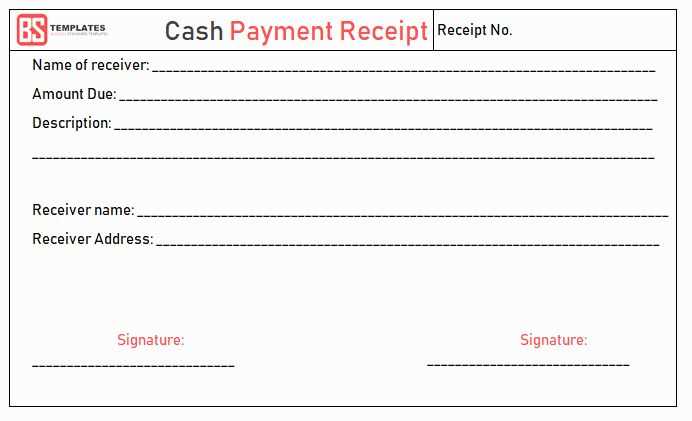

Lastly, don’t forget a space for signatures. A signature section verifies that both the buyer and seller acknowledge the transaction details. This adds a layer of accountability and can be particularly important for larger sales or when returns or refunds are involved.

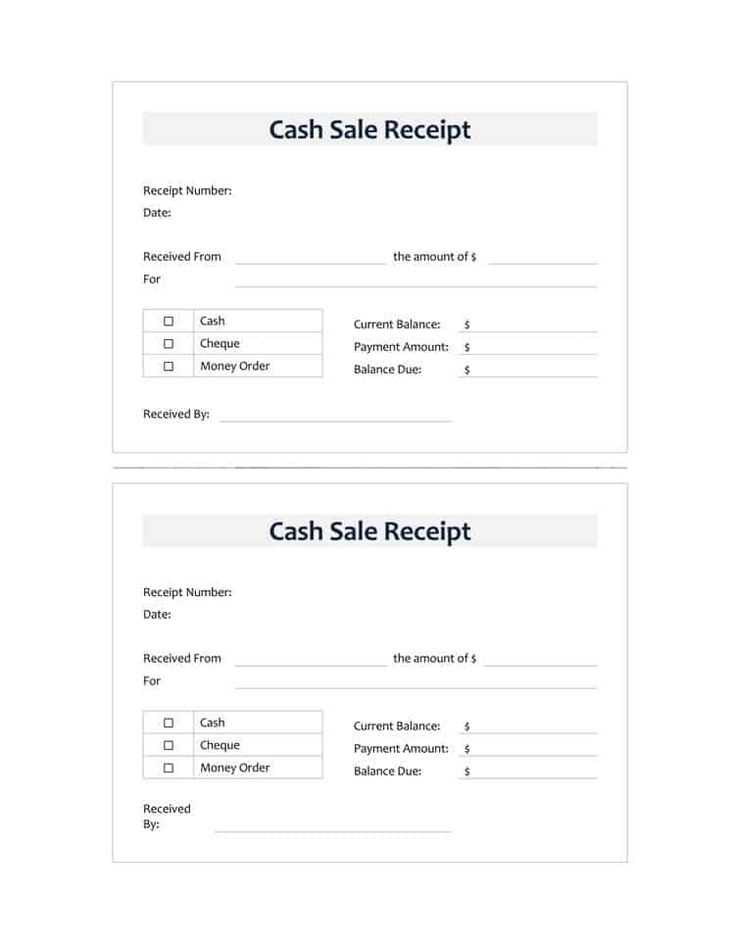

Cash Sale Receipt Book Template

To create a reliable and easy-to-use cash sale receipt book, design a template that captures all key transaction details in a clear and concise manner. Include spaces for the date, receipt number, item description, quantity, price, total amount, and any applicable tax. A well-organized layout enhances readability and ensures nothing is overlooked during transactions.

The receipt should feature a unique number for tracking purposes. Include a section for both the payer’s and seller’s details, such as name and contact information. This can be helpful for future reference or disputes. Make sure there is space for signatures, especially for businesses that require proof of the transaction.

When designing the template, ensure it is formatted to fit within a standard receipt book size. Use clearly defined sections for each piece of information, and consider adding a small footer with your business’s return policy or contact details for customer support. This can further streamline the sales process and build trust with customers.

Consider using a consistent color scheme or company logo for branding purposes. This not only adds professionalism but also helps the receipt stand out, making it easier for both parties to reference in the future.

How to Create a Custom Cash Sale Receipt

To design a custom cash sale receipt, first include basic details like the seller’s name, address, and contact information. Next, add the buyer’s information, including their name and address if necessary. Ensure that the date and receipt number are clear for tracking purposes.

Include Transaction Information

List the products or services sold with clear descriptions. Mention the quantity, unit price, and total amount for each item. Add subtotals for each section of the transaction, followed by taxes (if applicable) and any discounts offered. Summarize the total amount due at the bottom of the list.

Payment Details

Clearly state the payment method (e.g., cash, credit card, bank transfer) and the total amount received. If change is given, note the exact amount returned to the customer. It’s important to provide a detailed breakdown to avoid any confusion later.

Lastly, provide a section for any additional notes or terms related to the transaction, such as return policies or warranty information. This ensures that both parties are clear on the conditions of the sale.

Key Information to Include in Your Template

Include a clear title at the top of the receipt, such as “Cash Sale Receipt.” This ensures the document is easily identifiable. Provide a unique receipt number for each transaction to help with organization and tracking.

Record the date of the transaction. It’s crucial for reference and accounting purposes. Include the seller’s full name or business name, along with their contact details like address, phone number, and email.

List a detailed description of the items or services sold, including quantity, unit price, and total price for each item. This provides transparency and can help resolve any potential disputes later on.

Clearly display the total amount paid, and break down any applicable taxes or fees. If discounts were applied, show those separately to ensure accuracy.

Ensure there’s space for payment method details–whether the transaction was made in cash, via card, or any other method. You might also want to note the amount of change given if the payment was in cash.

Lastly, include a thank you or acknowledgment statement at the bottom to leave a positive impression on your customers.

Best Practices for Printing and Organizing Receipts

Use high-quality paper to ensure durability and readability of receipts. The print should be clear and legible, with sufficient contrast between text and background.

Print receipts in a consistent format. Include essential details like the transaction date, itemized list of products, prices, taxes, and the total amount. This will simplify future reference and minimize errors.

- Label receipts clearly with identifiers such as “Sales Receipt” or “Payment Confirmation”.

- Avoid overcrowding the receipt with unnecessary information; focus on key details that are useful for record-keeping.

- Consider using thermal printing, as it offers a clean, smudge-free finish that lasts longer than ink-based printing.

Organize receipts by category (e.g., purchases, returns, services) and store them in dedicated folders or binders. Using a filing system helps locate specific receipts quickly when needed.

- For easy access, label each folder with a clear title like “2023 Business Expenses” or “Personal Purchases”.

- If you deal with a large volume of receipts, consider separating them by month or quarter to streamline the retrieval process.

- Store receipts in a cool, dry environment to prevent fading or deterioration over time.

For digital organization, scan and save receipts as PDF files with a consistent naming convention (e.g., “2023-02-01_Electronics_Purchase”). Use a cloud storage solution for secure backup and access from multiple devices.

- Include relevant tags in the file name or description to help you filter and search for receipts more easily.

- Set a routine for digitizing receipts immediately after purchase to keep up with the volume.

Finally, review your receipt organization system regularly to ensure it remains effective as your needs change. Simplifying the process now can save time and effort in the future.