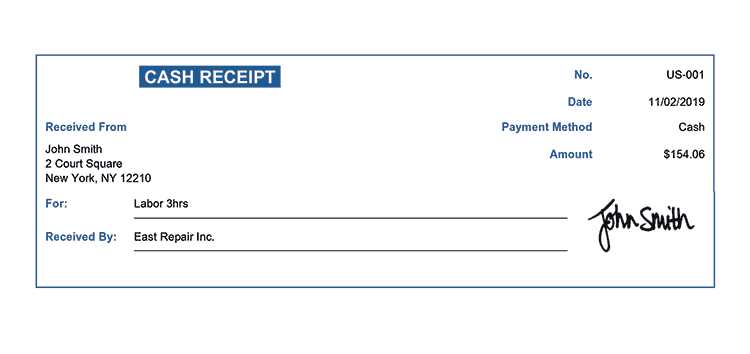

For those needing to create a Fairfield Inn receipt template, it’s helpful to focus on clear and concise details. The template should include fields like guest name, date of stay, room charges, and any additional fees. This information ensures the receipt accurately reflects the transaction.

Start with a header that clearly identifies the receipt as coming from Fairfield Inn. Include a unique invoice number for easy reference. Be sure to list the room rate and any taxes applied. For additional transparency, include a breakdown of charges, such as service fees or parking costs.

Once the main details are included, leave space for the payment method and a section to confirm the total amount paid. A polite thank-you message at the bottom can add a personal touch to the document, reflecting the hotel’s commitment to customer service.

Fairfield Inn Receipt Template

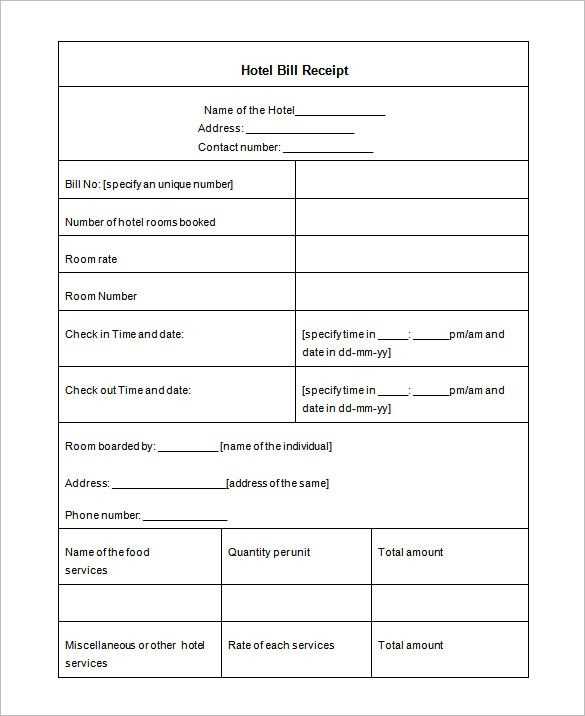

To create a receipt for Fairfield Inn, begin with the hotel’s name, address, and contact information at the top. Include a title like “Receipt” or “Invoice” in bold, followed by the guest’s name and reservation details. List the date of check-in and check-out, the room rate, and any additional charges, such as taxes or services. Be specific with the description of each charge to avoid confusion. Provide the total amount paid, along with the payment method, and include a section for the guest’s signature, if necessary. Make sure to clearly indicate whether the receipt is paid in full or still pending payment.

For clarity, structure the charges in a table format. Include rows for each service or accommodation cost, ensuring the subtotal is clearly marked before taxes. The final section should summarize the total, including any discounts or adjustments applied. If applicable, note the confirmation number or reference code for easy tracking. Double-check for accuracy in the amounts and dates to prevent discrepancies.

Provide a copy of the receipt to the guest immediately upon check-out or via email if requested. The template should be customizable for different room types, special rates, and seasonal promotions. Keep a digital record for future reference and ease of processing returns or disputes.

How to Create a Custom Receipt Template

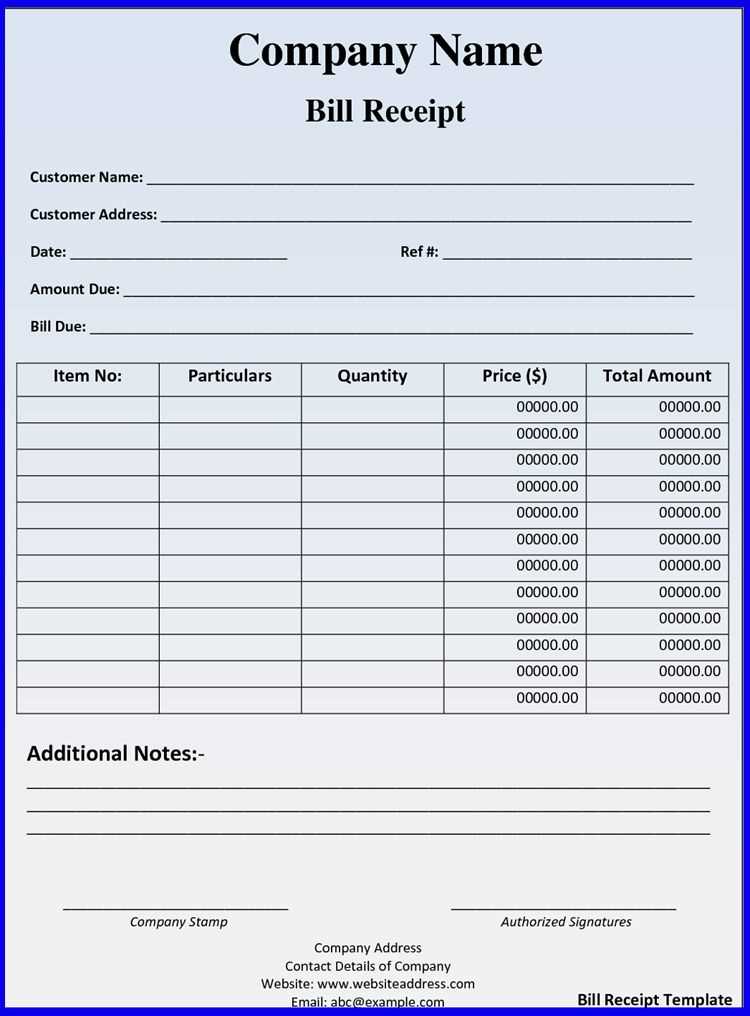

Begin by selecting the software or tool that best suits your needs, such as Microsoft Word, Google Docs, or specialized receipt generators. Make sure the tool allows customization for different fields such as date, company details, and transaction specifics.

Step 1: Set Up Basic Layout

- Choose a clean, professional layout with a clear header and footer.

- Include placeholders for business information, such as company name, address, phone number, and website.

- Make sure to leave space for customer details, purchase items, and total amounts.

Step 2: Customize Key Fields

- Include transaction date, item description, quantity, unit price, and total price for each item.

- Set up the subtotal, taxes, and final amount to appear clearly at the bottom.

- Leave room for any discounts or promotional codes, if applicable.

After customizing the fields, ensure the template is aligned and looks consistent across different receipts. Test it with mock data to verify the layout works well in various situations. Save the template in a format that allows easy updates, such as .docx or .pdf, for future use.

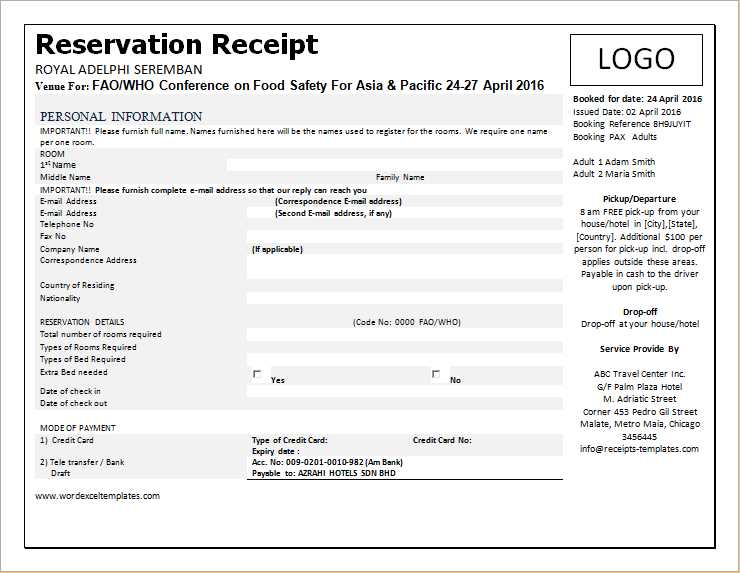

Steps to Add Hotel Information on the Receipt

To ensure the receipt includes necessary hotel details, begin by locating the section for business information. This section should accommodate the hotel’s name, address, phone number, and email. Include the check-in and check-out dates for accurate booking reference.

Next, place the guest’s name and the booking reference number clearly. These help in identifying the specific reservation. Don’t forget to add the room rate and any additional charges, such as taxes or service fees, in separate lines for transparency.

Conclude the receipt by including the hotel’s website and any support contact information. This ensures the guest has access to further communication if needed. Double-check for any mandatory data specific to your region or hotel policies, such as cancellation fees or payment methods.

Including Tax and Additional Charges in Your Template

Clearly outline taxes and extra charges directly on your receipt template. Use distinct line items to display the tax rate and amount separately from the total cost. This helps the customer quickly identify how much tax they are paying. For additional charges, such as service fees or facility charges, create separate lines that show the description and amount for each charge.

Ensure your template accommodates different tax rates for varying locations, as tax laws may differ depending on where the service is provided. Include an option to adjust the tax rate automatically based on the customer’s location, ensuring accuracy without manual intervention. Display the total of all taxes and charges at the end, right before the final total amount due.

If you’re including additional services or upgrades, make sure to break down the costs for clarity. For example, a parking fee or a room upgrade should be listed separately with a brief description of what the charge covers. This transparency helps avoid confusion and maintains trust with your customers.

Lastly, ensure your template allows for the easy updating of rates and fees. Any changes in tax rates or service charges should be quickly reflected on the template without requiring a complete overhaul. This keeps your receipts accurate and up-to-date, providing a smooth experience for both you and your customers.