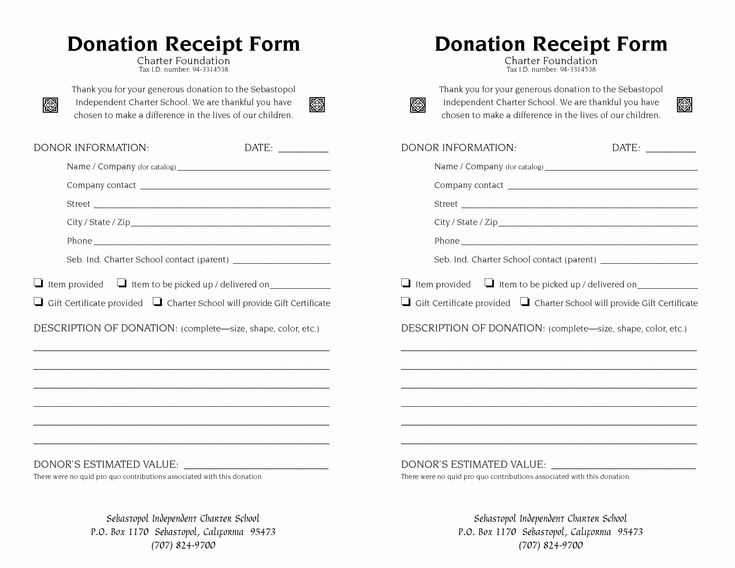

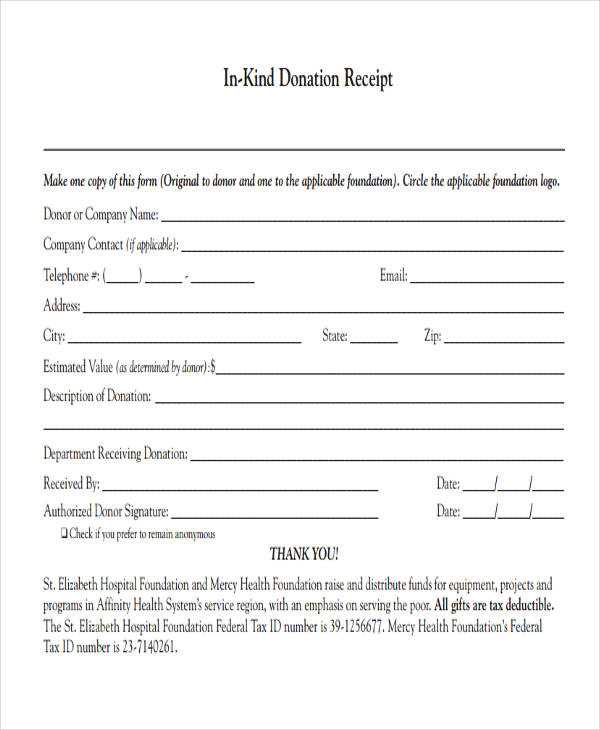

Creating a donation receipt for a school is simple and straightforward with the right template. Make sure it includes the donor’s name, the date of the donation, and the amount contributed. A detailed breakdown of the donation type, whether it’s cash, goods, or services, provides clarity. If your school is a nonprofit organization, include the tax-exempt status and relevant identification number for potential tax deductions.

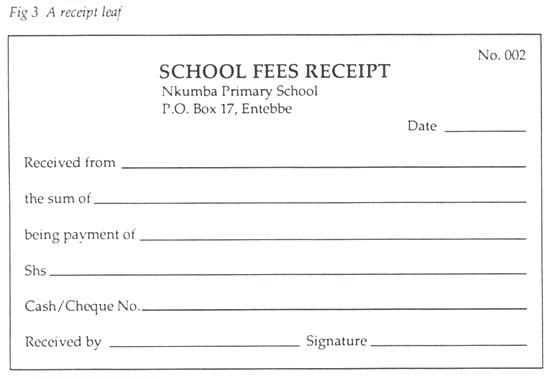

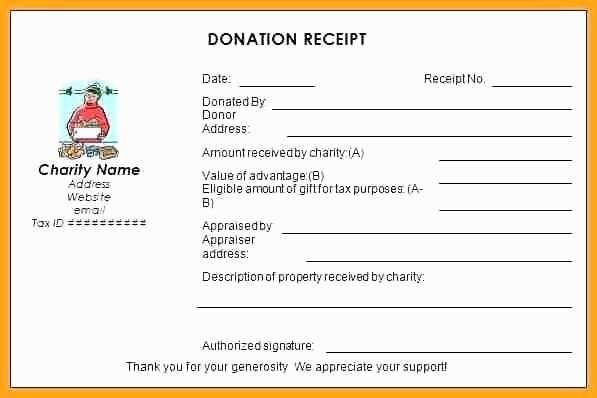

Start by structuring the receipt clearly with a header displaying your school’s name and contact information. Add a unique receipt number for tracking purposes. In the body, mention the donor’s full name, address, and a thank-you note. Be specific about the contribution, including whether it’s a one-time or recurring donation. This ensures both parties know exactly what was donated and how it can be used.

Ensure transparency and accuracy in the donation receipt. If the contribution is in-kind (goods or services), provide a brief description of the items or services donated. While schools don’t need to assign a monetary value to these items, a general description can avoid confusion. For monetary donations, always include the exact amount and specify the payment method–whether cash, check, or online payment.

Conclude with a formal signature from a school representative, such as the principal or financial officer. Include a statement that confirms no goods or services were provided in exchange for the donation, if applicable. This is a requirement for tax-deductible donations.

Here are the revised lines where repeated words are reduced to 2-3 times:

In your donation receipt template, ensure clear and concise wording to avoid repetition and improve readability. Focus on important details, such as the donor’s name, amount donated, and purpose of donation. Avoid unnecessary words that don’t add value to the message.

Example of improved receipt text:

- Donor: John Doe

- Amount: $100

- Purpose: Fundraiser for school activities

- Date of Donation: February 12, 2025

- Receipt ID: 20250212

Revised structure:

- Keep the description of the donation brief and to the point.

- Highlight the key information like donor’s name and the amount clearly.

- Include a thank-you message without repeating similar phrases.

Ensure that the language used is formal and professional, yet easy to understand, with minimal redundancies.

- School Donation Receipt Template

Provide a clear, simple template for donors to receive confirmation of their contributions. This not only serves as proof for tax purposes but also builds trust between your school and supporters. Ensure the receipt includes specific information such as the donation amount, date, and donor details.

Key Components of a School Donation Receipt

The following elements must be included in every donation receipt:

- School Name and Contact Info: Clearly state the name of your school along with the address, phone number, and email address.

- Donor Information: Include the full name and address of the donor for proper acknowledgment.

- Donation Details: Specify the donation amount, whether it is monetary or in-kind (with descriptions of items if applicable).

- Date of Donation: The exact date the donation was received should be included for records.

- Tax-Exempt Status: Include a statement regarding the school’s tax-exempt status if applicable (e.g., “This donation is tax-deductible to the extent allowed by law.”).

- Signature: A signature from a representative of the school or organization adds authenticity and trust.

Formatting Tips

Ensure your donation receipt is neatly formatted. Use bullet points for key details, making it easy for donors to see the information they need. Keep the design simple yet professional, with your school’s branding or logo included at the top.

To create a receipt tailored for your school donations, include key details such as the donor’s name, donation amount, date, and purpose. Make sure to specify if the contribution is tax-deductible. This helps donors track their charitable giving and provides transparency for both parties.

Here are the specific elements to customize:

| Element | Customization Tips |

|---|---|

| Donor Information | Include the donor’s full name, address, and contact information. This is crucial for accurate record-keeping. |

| Donation Amount | Clearly state the exact amount donated, including whether the contribution is in cash, check, or online payment. |

| Date of Donation | List the date of the donation to keep an accurate timeline of contributions. |

| Purpose of Donation | Specify what the donation will be used for (e.g., general funds, scholarship program, equipment). This adds clarity for both parties. |

| Tax Deductibility | If applicable, state that the donation is tax-deductible and include your school’s tax identification number. |

| Thank You Message | Express gratitude for the donation and acknowledge the donor’s contribution to the school’s mission. |

For added personalization, consider including a message specific to the donor’s cause. This makes the receipt feel more meaningful and demonstrates the direct impact of their support.

Ensure the acknowledgment includes the donor’s full name and contact information for clarity. Clearly state the donation amount or item donated. If the contribution is monetary, specify whether it was a cash gift, check, or online payment. For non-monetary donations, describe the items or services provided, including their estimated value if appropriate.

Provide the date the donation was received to help the donor with their tax records. If applicable, include a statement confirming the school did not provide any goods or services in exchange for the donation, which is a requirement for tax deductions.

Include a statement expressing gratitude for the support, reinforcing the positive impact their donation will have on the school and its students. Make sure the tone is personal and appreciative, enhancing the donor’s experience.

Finally, end the acknowledgment with a reminder that the donor can reach out for any additional documentation or information if needed. This makes the process transparent and efficient for both the donor and the institution.

Ensure receipts are sent promptly after a donation is made. A timely response builds trust and shows appreciation for the donor’s generosity.

Be clear and concise in your receipt details. Include the donor’s name, donation amount, date, and any other relevant information such as a breakdown of contributions if multiple items are donated.

Personalize the receipt when possible. A quick message acknowledging the donor’s contribution can make the receipt feel more meaningful. Use the donor’s name and refer to the specific cause they supported.

Provide all necessary tax information. If applicable, make sure the receipt includes your organization’s tax-exempt status and any relevant tax information. This ensures the donor has what they need for their records.

Choose the right delivery method. Email receipts are common, but offering a physical receipt option can appeal to some donors. Ensure the delivery method is simple and convenient for your audience.

Make the process easy for donors. Include clear instructions if donors need to take any additional steps, such as saving or printing the receipt for tax purposes.

Consider offering a thank-you note along with the receipt. This reinforces the positive experience and strengthens the relationship with the donor.

Maintain consistency in your receipt format. Whether digital or physical, the receipt should follow a recognizable structure to help donors easily identify key details and avoid confusion.

Now, each word does not repeat more than the necessary number of times.

To create a clear and concise school donation receipt template, use straightforward language and avoid redundancy. Ensure that the key details are included once without excessive repetition. Start by listing the donor’s name, the amount donated, and the date of the transaction. Then, briefly state the purpose of the donation and thank the donor for their contribution. Keep the format simple, using bullet points or short sentences to convey the information efficiently. The goal is to provide all relevant details in a clear, non-repetitive manner, ensuring the document is both professional and easy to read.