For a successful nonprofit fundraiser, a clear and organized donation receipt template is a must. This document serves as both a thank-you note and an official record of the donor’s contribution. Having a reliable template ensures you comply with tax regulations while maintaining transparency with your supporters.

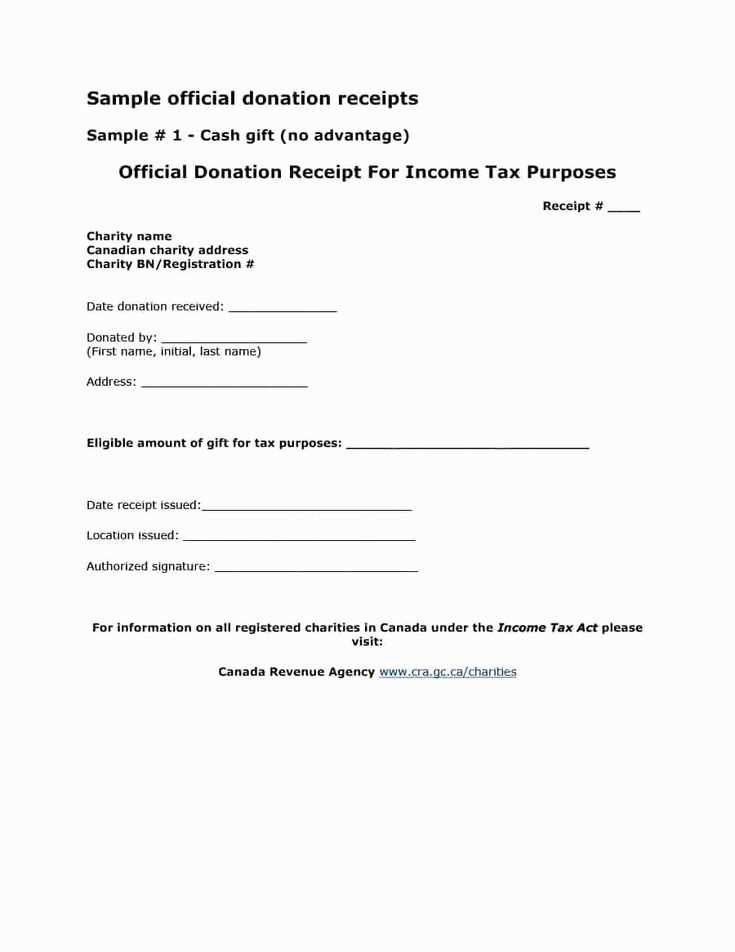

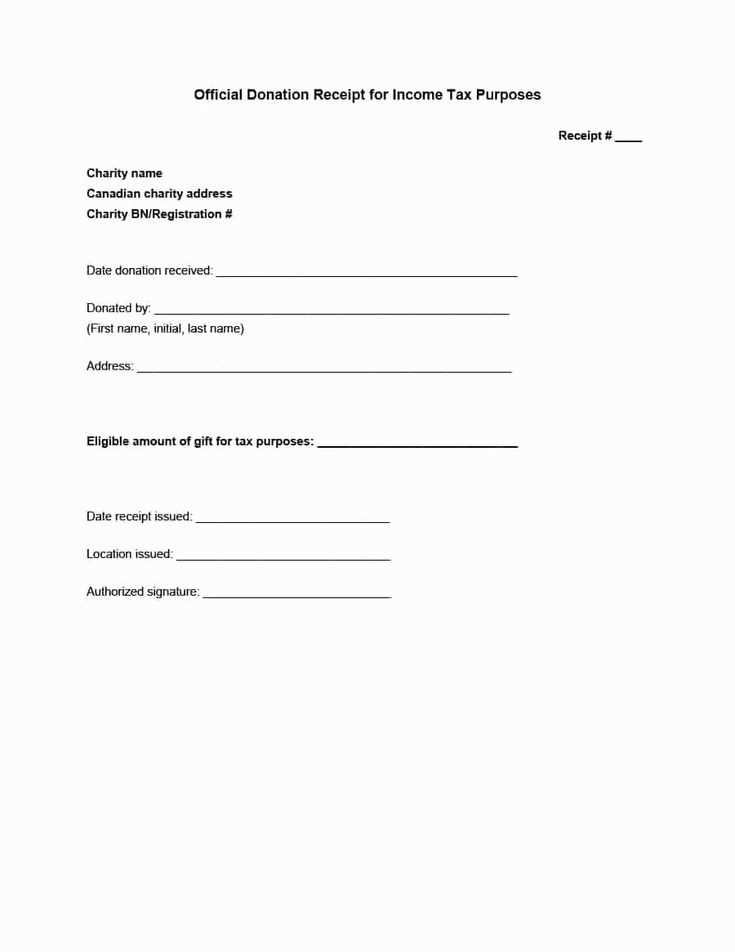

A well-designed donation receipt includes key elements: the donor’s name, the date of the donation, a description of the donated items or services, the fair market value of those items, and the nonprofit’s name along with tax-exempt status. This allows the donor to claim a deduction and assures them their contribution is properly recorded.

Keep the language simple and direct, focusing on the specific donation details. Avoid unnecessary jargon or additional information that doesn’t add value. By keeping the template streamlined, both you and the donor can easily keep track of the donation process and maintain proper records.

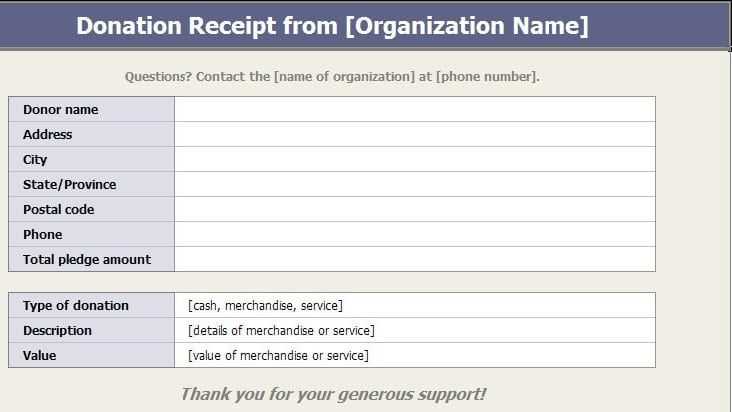

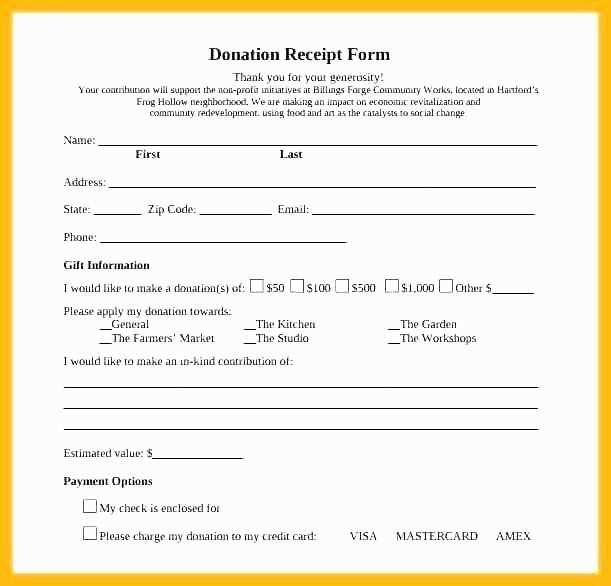

For future donations, customize the template to reflect different types of contributions, such as cash, goods, or services. This flexibility helps accommodate various donation types while ensuring all the necessary information is included. Remember to include a thank-you message at the end to express genuine appreciation for their support.

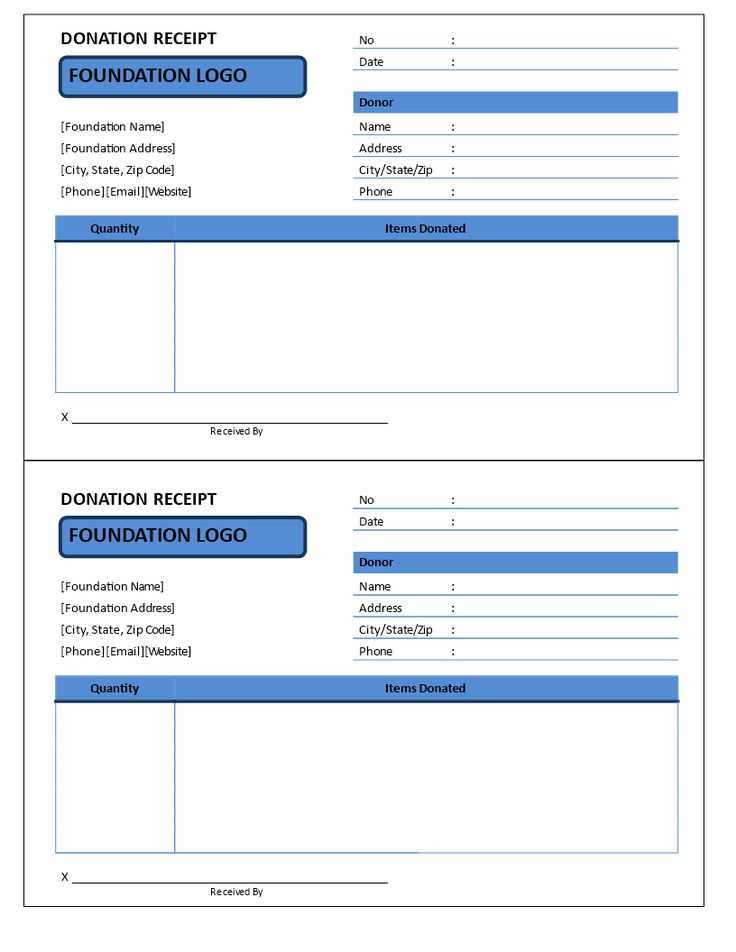

Nonprofit Fundraiser Sale Donation Receipt Template

Provide clear, accurate receipts to donors after their contributions to your nonprofit fundraiser. The donation receipt should list the donor’s name, donation amount, and the date of the donation. Always include a statement confirming that no goods or services were provided in exchange for the contribution, if applicable. This ensures that the donation is tax-deductible.

Key Information to Include

Each donation receipt should include the following details:

- Donor’s full name and address

- Date of the donation

- Amount or description of the donation

- Statement confirming the donation is tax-deductible

- Organization’s name and contact details

- Signature of a representative (optional but recommended)

Formatting Tips

Keep the format simple and clear. Use a straightforward design with the organization’s logo at the top and the receipt information in a readable font. It’s best to include the donation’s purpose or the specific event the funds are supporting. This helps both the donor and your organization track contributions effectively.

How to Structure a Donation Receipt for a Sale Event

Ensure the receipt includes the donor’s name, the date of the transaction, and a brief description of the goods or services provided. Specify the amount of the donation and clarify if any goods or services were received in exchange. This is necessary for tax reporting purposes, as the donor can only claim the donation if the value of the goods is properly listed.

Key Details to Include

List the organization’s name and address, and confirm its nonprofit status. This is important for tax documentation. Include a statement that no goods or services were provided in exchange for the donation, if applicable. If a value was assigned to the goods or services, state that clearly along with the exact amount paid by the donor.

Tax Information

Include a disclaimer about the donor’s responsibility to consult with a tax advisor. For IRS purposes, a statement should mention that the donor did not receive any significant goods or services in exchange for their contribution, if that is the case. Keep the receipt clear and professional, and avoid any unnecessary wording.

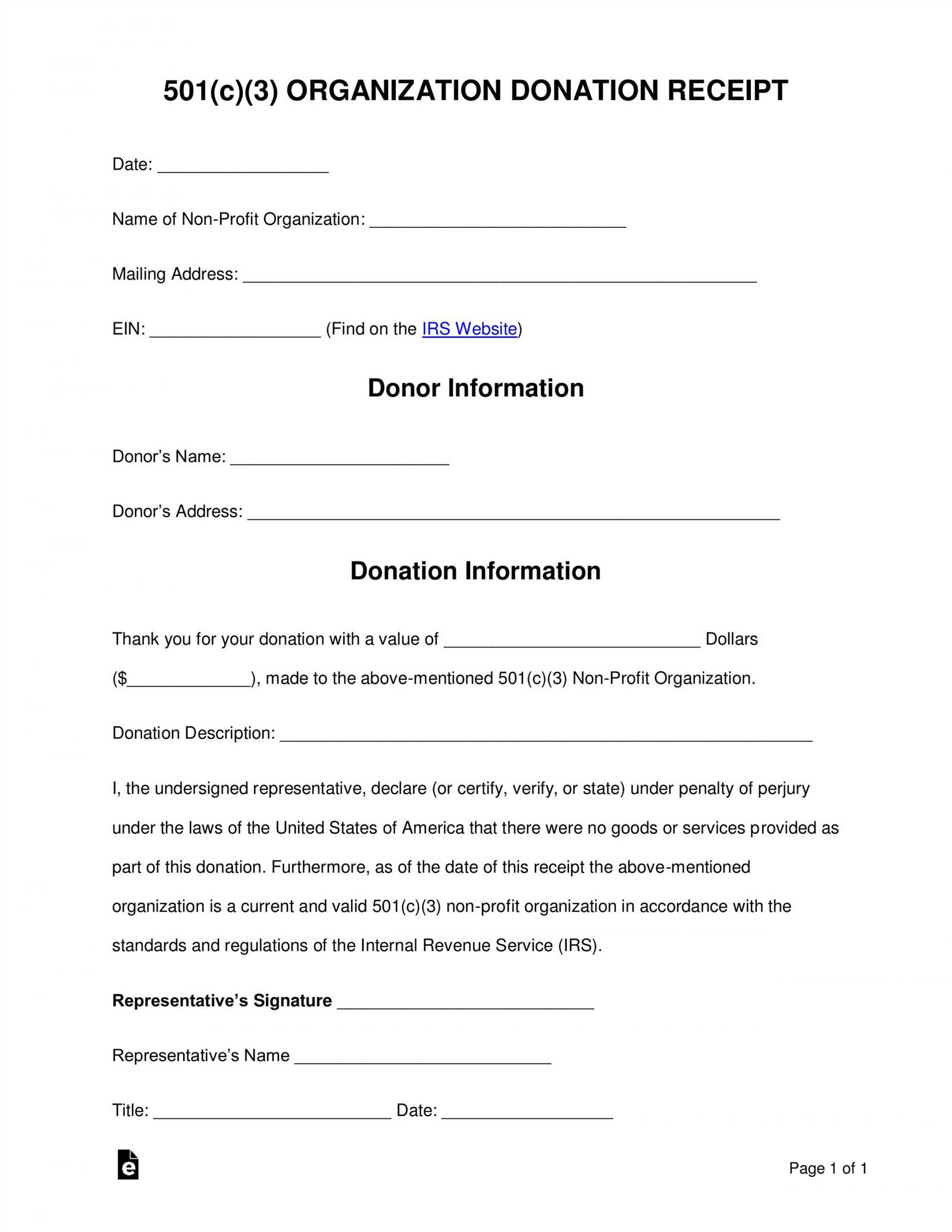

Including Tax-Exempt Details in Your Donation Receipt

For nonprofit organizations, providing accurate tax-exempt details on donation receipts ensures transparency and helps donors claim tax deductions. Ensure your receipts include the following critical information:

- Tax-Exempt Status Statement: Clearly state that the organization is a tax-exempt entity under section 501(c)(3) of the Internal Revenue Code. This lets donors know their contributions are eligible for tax deductions.

- Tax ID Number: Include the organization’s federal tax identification number (EIN). This number verifies the organization’s status with the IRS and supports the donor’s claim when filing taxes.

- Gift Description: Provide a description of the donation, including whether it was monetary or in-kind. If the gift is property, ensure an accurate description is provided to avoid complications for the donor’s tax filing.

- No Goods or Services Statement: If the donation was purely a gift without goods or services exchanged in return, note this on the receipt. This is required by the IRS for donations over $75, and it confirms that the donor can deduct the full amount.

How to Structure the Tax-Exempt Information

Place the tax-exempt details in a visible and consistent location on all donation receipts. This can be at the bottom or in a section marked “Tax Information” for easy reference. Always use clear, simple language to avoid confusion.

Donor’s Role in Tax Deduction

Although the nonprofit includes tax-exempt information on the receipt, it’s the donor’s responsibility to retain the receipt and file it appropriately when submitting tax returns. Advise donors to consult a tax professional if they have questions about how to use the receipt for deductions.

Customizing the Template for Different Fundraising Events

Adjust the template to reflect the specific theme and goals of each fundraising event. For instance, if the event is a silent auction, include sections to list auction items, their starting bids, and final bid amounts. For charity runs or walks, include details such as distance, location, and date. These modifications help create a connection between the donation receipt and the particular event, ensuring it’s relevant and memorable for the donor.

Incorporate branding elements from the event, such as logos, color schemes, and taglines. This reinforces the identity of the event and creates a cohesive experience for the donor. If your event has sponsors, feature their logos prominently in the header or footer of the receipt to acknowledge their contribution.

For recurring events, such as annual galas or benefit dinners, customize the template with placeholders for the event year or season. This keeps receipts fresh and applicable to the specific event while maintaining consistency across multiple years. If the event has different donation tiers, include those categories directly on the receipt to show transparency in how funds are allocated.

Lastly, ensure your receipt includes the appropriate legal language and tax information, adjusting it based on the size and type of the donation. For example, for larger donations, you may need to include the estimated value of goods or services provided in exchange for the donation, if applicable.