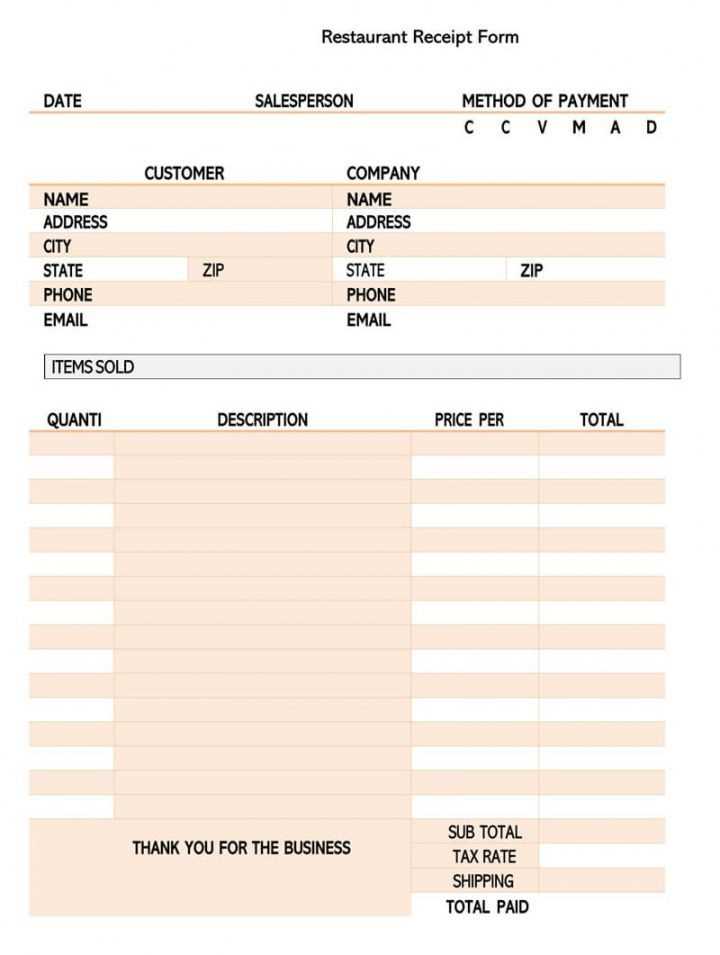

Download a ready-to-use itemized restaurant receipt template to streamline your billing process and ensure clarity for customers. This template allows you to break down each item with precise pricing, taxes, and totals. It’s designed to simplify accounting and help maintain transparency in your transactions.

The template is fully customizable, making it easy to add or remove items, adjust pricing, or modify tax rates. Use it for both dine-in and takeout orders, ensuring that each receipt reflects the services provided accurately. This resource can save valuable time for your staff and eliminate potential errors.

Whether you’re managing a small café or a large restaurant, this tool makes it simple to track sales and keep customers informed about their charges. Download and start using the template today to enhance your service and keep everything organized.

Here’s the revised version with minimal repetition:

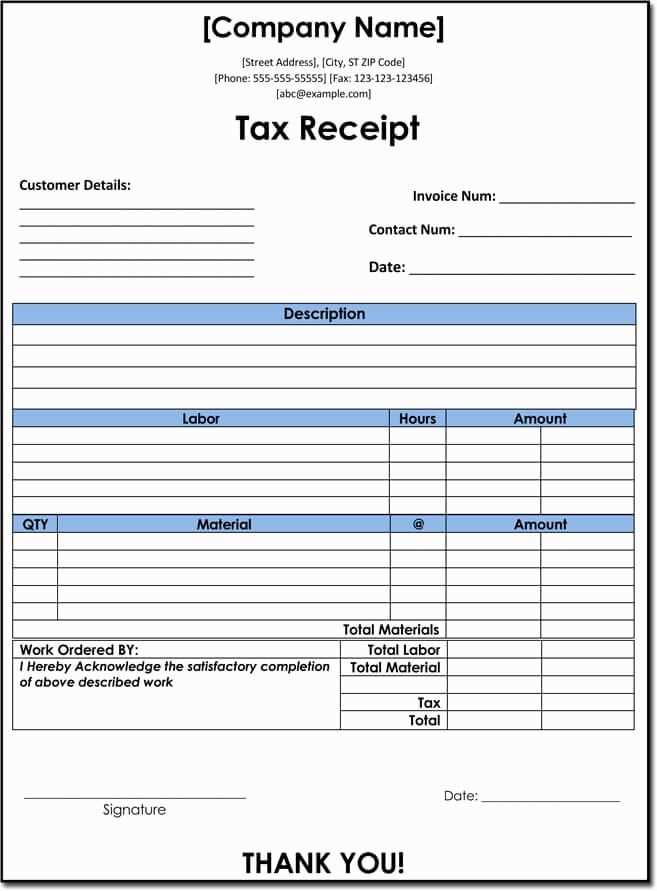

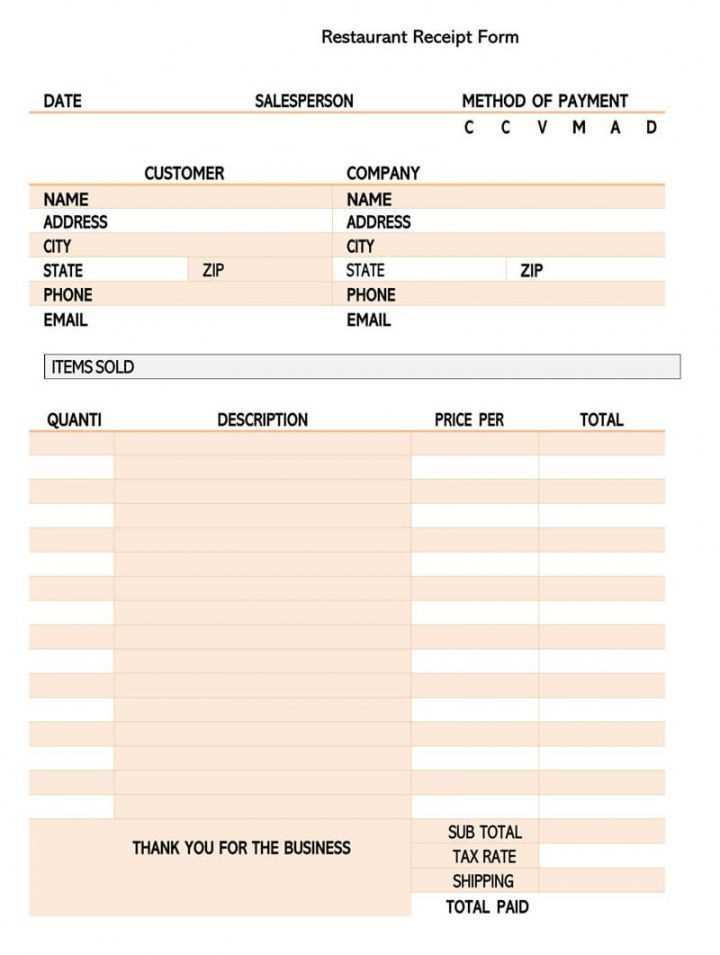

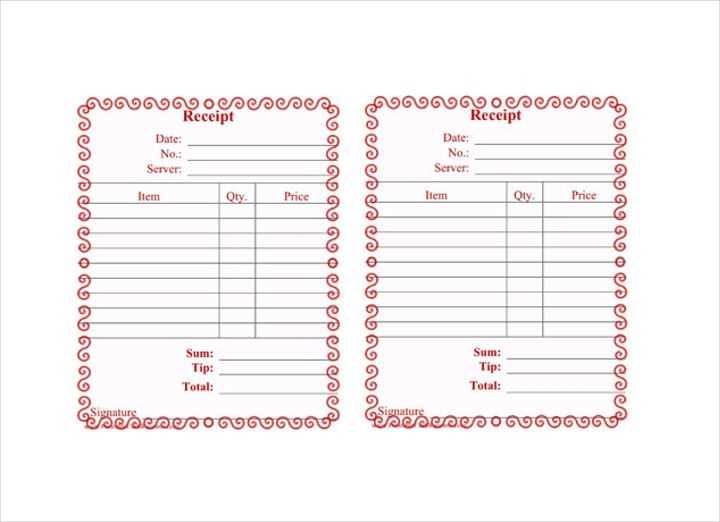

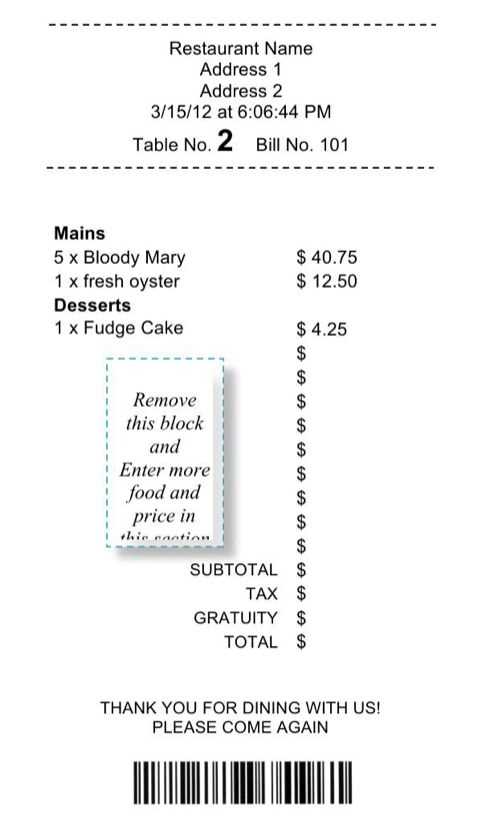

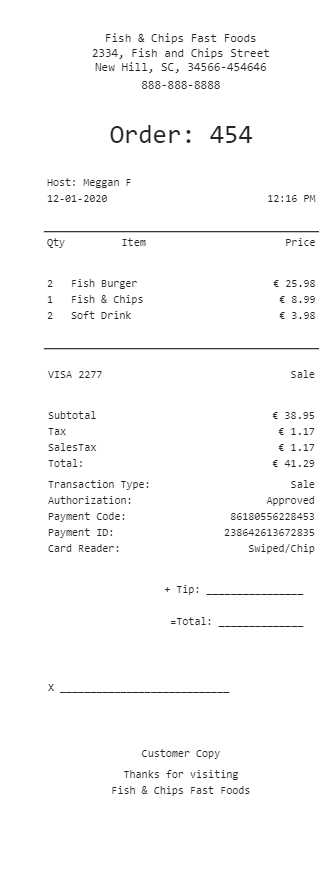

Design your receipt template with clear sections: items, prices, and totals. Keep it neat to prevent confusion. Begin with a header that includes the restaurant name, address, and date. Underneath, list the items ordered, followed by their respective prices. Sum up the total at the bottom, with any taxes or additional fees broken down separately.

| Item | Price |

|---|---|

| Cheeseburger | $8.99 |

| Fries | $3.49 |

| Soft Drink | $2.19 |

| Tax | $1.18 |

| Total | $15.85 |

This layout helps customers quickly identify what they’ve ordered and what they need to pay, making the receipt easy to read and understand.

- Itemized Restaurant Receipt Template Download

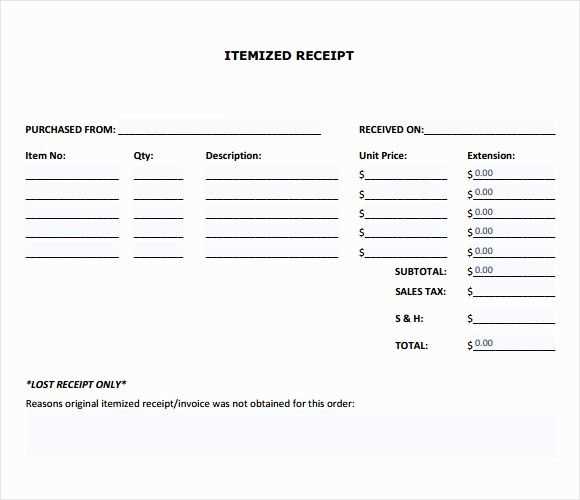

Download an itemized restaurant receipt template to create clear and organized invoices for your customers. It simplifies the process of listing individual items, prices, and totals, ensuring accuracy and transparency in every transaction.

Key Features of the Template

Make sure your template includes these key elements for a professional and detailed receipt:

| Section | Description |

|---|---|

| Item Name | List each dish or beverage ordered by the customer. |

| Quantity | Indicate how many servings or items were purchased. |

| Unit Price | Provide the cost of each individual item. |

| Subtotal | The total price for all items before tax. |

| Tax | Include any applicable tax based on the subtotal. |

| Total Amount | The final amount due after tax has been added. |

Where to Download

You can find customizable itemized receipt templates for free online in various formats like PDF, Excel, or Word. Choose the one that suits your restaurant’s needs and start using it to maintain organized and professional records.

Detailed receipts provide transparency and clarity, benefiting both customers and businesses. They help customers understand exactly what they’re paying for, ensuring no surprises at checkout. Businesses gain valuable insights into transaction history, which is key for record-keeping and taxes.

- Itemized listings break down the cost of each item, service, and tax separately, allowing customers to verify their purchases.

- They provide businesses with an audit trail, helping avoid disputes over charges and simplifying returns or exchanges.

- Clear details on the receipt make tracking expenses easier for customers, especially when submitting reimbursements or managing budgets.

- By including information like discounts, promotions, or tips, a receipt offers a full picture of the transaction, aiding both financial and customer service analysis.

With detailed receipts, businesses create trust with their customers, proving they operate with transparency and attention to detail.

To find reliable dining receipt templates, focus on a few specific sources that consistently provide accurate and professional formats. Many businesses rely on reputable template providers to maintain uniformity and compliance in their receipts. These platforms are often updated with the latest requirements, ensuring the templates stay relevant and user-friendly.

1. Template Websites

Websites dedicated to providing business forms are a prime source. These sites typically offer downloadable receipt templates for various needs, including dining and restaurant scenarios. Look for websites with a reputation for quality templates, like Template.net or Vertex42, which often have user reviews and ratings to guide your choice.

2. Accounting Software Platforms

Many accounting software platforms, such as QuickBooks and Xero, also offer built-in receipt templates. These templates are often tailored to meet the needs of the food service industry and can be customized to match your restaurant’s branding and pricing structure. They also integrate seamlessly with financial records, saving time and reducing errors.

3. Online Marketplaces

Platforms like Etsy or Creative Market offer unique, customizable templates designed by independent creators. These templates can stand out due to their unique styles and ease of customization. However, be sure to check the ratings and reviews for credibility before making a purchase.

4. Google Docs or Microsoft Office Templates

Both Google Docs and Microsoft Office provide free and downloadable receipt templates in their template galleries. These are ideal for small restaurants or casual dining establishments that need quick, no-cost solutions. While they may not be as specialized as other options, they can be easily modified to fit your specific needs.

5. Restaurant-Specific Platforms

Some online services specialize in restaurant-specific forms and templates, providing options optimized for the dining industry. Look for services like RestaurantOwner.com or Toast, which cater specifically to food service businesses and offer receipt templates as part of their broader business toolkits.

Begin by adding your restaurant’s logo and brand colors. This enhances the identity and makes the receipt visually aligned with your business. Incorporate the restaurant name and address at the top to ensure customers know where the receipt came from.

Include a unique identifier for each transaction. This could be a receipt number or a timestamp. It will help you track individual sales and maintain records for future reference. Also, make sure to list the items clearly with their respective prices, taxes, and any discounts applied. Consider organizing the items by category, making it easier for customers to understand the breakdown of their bill.

Adding a personalized thank-you message at the bottom of the receipt can go a long way in building customer loyalty. A simple note like “We appreciate your visit!” or “Hope to see you again soon!” will make your receipt feel more personal and engaging.

Lastly, ensure your payment details and terms are clear. Specify whether tips are included or optional, and provide information about how customers can get in touch with you if needed. This transparency helps avoid confusion and ensures your customers leave satisfied.

To save and print detailed restaurant receipts, begin by choosing the right receipt management software or point-of-sale (POS) system that supports itemized printing. Make sure the system allows you to break down each order, including individual menu items, taxes, tips, and any discounts applied. This helps keep receipts clear and informative for customers.

Saving Receipts in Digital Formats

Use your POS system’s built-in feature to save receipts electronically. This often involves saving them as PDF files, which are easy to store, retrieve, and share. Ensure that the digital format preserves all details, including transaction dates, item names, prices, and totals. You can also implement a cloud-based storage system for easy access and backup purposes.

Printing Receipts Efficiently

For physical copies, choose a reliable thermal printer that can handle detailed receipts. Check that the printer is capable of printing clear text and graphics without cutting off important details. Ensure the layout is organized, with clear sections for each item, taxes, and total amounts. Also, test the printer regularly to prevent issues like misaligned text or paper jams.

Itemized receipts are crucial for both customers and businesses due to their legal and tax-related consequences. These receipts provide clear evidence of purchases, which can be used to claim deductions or verify transactions during audits.

- Tax Deductions: For businesses, itemized receipts serve as proof of business-related expenses, making them necessary for tax reporting. Accurate and detailed records help ensure tax compliance and can aid in maximizing deductions.

- Sales Tax Accuracy: Itemized receipts show the breakdown of sales tax charged, which is essential for businesses to ensure proper tax collection and remittance to local authorities.

- Consumer Protection: Customers benefit from itemized receipts as they offer transparency in pricing. In the event of disputes, these receipts can be used as evidence to support claims about inaccurate charges or overbilling.

- Audit Readiness: For both consumers and businesses, itemized receipts make it easier to prove transaction details during audits. They help avoid complications when verifying income and expenses, ensuring the accuracy of tax returns.

Accurate recordkeeping through itemized receipts ensures legal protection and minimizes tax-related risks for both consumers and businesses.

Best Practices for Organizing and Managing Your Receipts

Sort your receipts by category–food, travel, entertainment, or business expenses. This step saves you time when you need to reference them later. Use folders or envelopes with clear labels to separate each type. If you’re managing multiple receipts daily, consider using a filing system to keep everything in order.

Utilize Digital Tools

Scan or photograph your receipts and store them digitally. There are several apps available that let you upload, tag, and organize your receipts easily. Digital storage is not only eco-friendly but also allows you to quickly search and retrieve receipts whenever necessary. Using a cloud storage service ensures you won’t lose your receipts, even if your device malfunctions.

Regularly Review and Dispose of Unnecessary Receipts

Set a schedule to go through your receipts at least once a month. Eliminate duplicates and receipts that are no longer necessary. Keeping only the ones that are relevant saves space and reduces clutter. For receipts related to warranty claims or tax purposes, keep them for the required time frame, and dispose of others when no longer needed.

To begin, ensure your receipt template includes a clear breakdown of items. List each food and drink separately with corresponding prices. Make it easy for the customer to identify the charges, and include any applicable taxes and tips at the bottom of the document. Place the total amount due clearly at the bottom to avoid confusion. This approach promotes transparency and clarity for both the restaurant and the customer.

Next, consider providing itemized descriptions for each menu entry. This is especially useful for special orders or dishes with multiple ingredients. It allows customers to know exactly what they are paying for, and minimizes disputes over charges. For example, “Cheeseburger with fries” could be broken down as “Beef patty – $5, Fries – $2.”

Finally, integrate sections for payment method and a thank-you message. Acknowledge the payment type, whether cash or card, and leave space for any tips given. A simple “Thank you for dining with us!” adds a personal touch and encourages repeat visits. Make sure your receipt is clear, concise, and customer-friendly for maximum satisfaction.