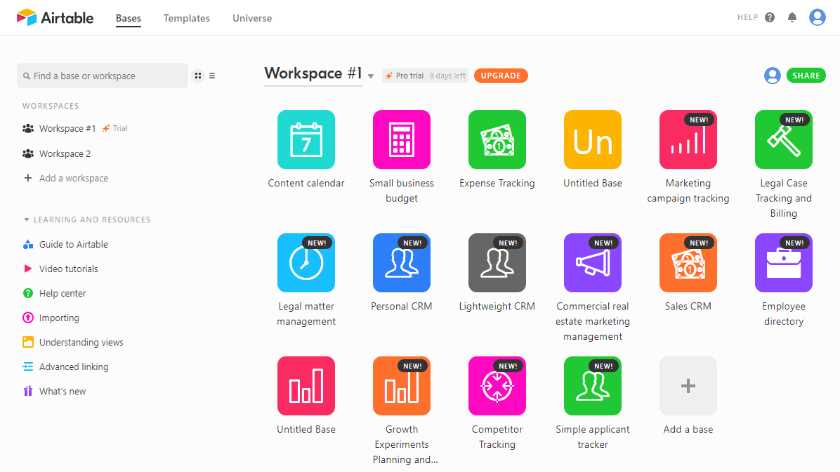

If you need a streamlined way to manage receipts, an Airtable template is your solution. It allows you to track purchases, categorize expenses, and organize your records effortlessly. With a simple setup, you can create a clear structure that aligns with your specific needs.

Start by setting up fields for key details such as date, amount, vendor, and payment method. These basic data points help you stay organized while providing all the necessary information at a glance. You can also add custom fields for categories, tags, or receipt images, making it easy to filter and review your receipts at any time.

By using Airtable’s built-in views, you can quickly switch between different formats like grid, calendar, or kanban, depending on how you prefer to analyze your data. You can also share your Airtable base with others, making it ideal for collaborative teams or shared expenses.

Here’s the improved version with repetitions removed:

To make your Airtable receipt template more streamlined, avoid repeating the same data. Here’s how to do it effectively:

- Consolidate fields that serve the same purpose. For example, if you have both “Item” and “Description” columns that contain similar information, merge them into one.

- Use linked records to connect different parts of the receipt, such as products or customers, instead of duplicating information in multiple places.

- Implement conditional logic to hide or display certain fields based on user input, reducing clutter and repetition in the view.

- Set up calculated fields that automatically calculate totals, reducing the need for manual input and repetition in the rows.

- Utilize Airtable’s “Single Select” or “Multiple Select” options to categorize and reduce redundancy in data entries.

This approach ensures a cleaner, more efficient template without repeating data unnecessarily. With fewer columns and automated fields, you can easily manage receipts without the extra hassle of redundant information.

- Airtable Receipt Template Overview

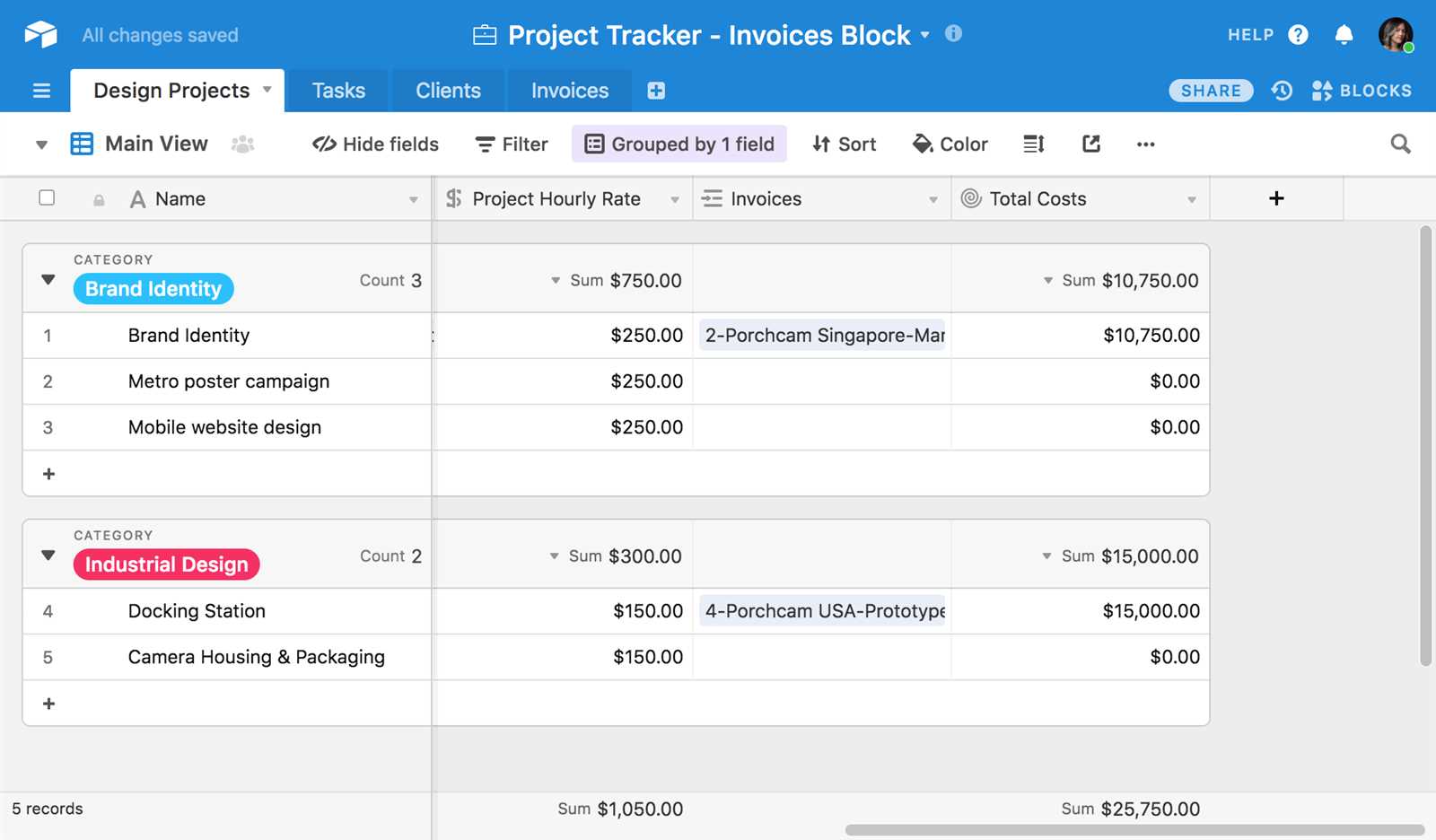

The Airtable receipt template simplifies tracking payments, expenses, and invoices. This template allows you to store and organize transaction data in a clear, accessible format.

- Input key details such as the payer’s name, receipt date, amount, and description of the transaction. Airtable’s custom fields allow you to structure data according to your business needs.

- Use the linked record feature to connect receipts with other related data, such as clients, projects, or invoices. This creates a seamless connection between all your records.

- The template automatically calculates totals and taxes based on the inputted values. This removes the need for manual calculations and helps avoid errors.

For those managing a business or working in finance, this template is a practical solution for keeping receipts organized and easy to access. It can be customized with additional fields, such as payment methods, and adjusted to fit specific business requirements.

- Take advantage of Airtable’s views, which allow you to filter and sort receipts by date, amount, or status, helping you quickly find relevant information.

- Ensure data accuracy by utilizing Airtable’s built-in validation rules to restrict input types, such as currency or dates, for consistency across all records.

By setting up automations, you can trigger email notifications when new receipts are added or when amounts reach a predefined threshold, streamlining your workflow further.

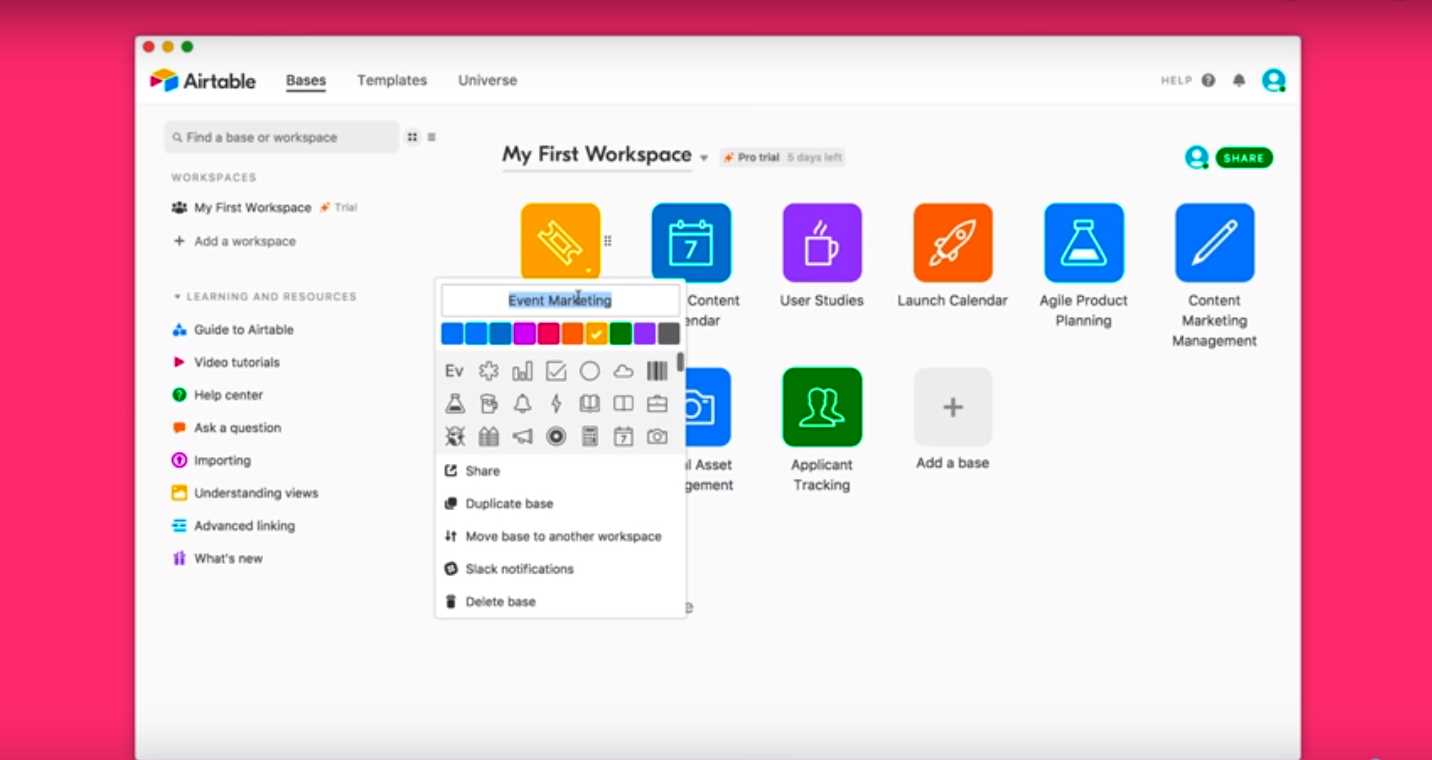

Adjust fields based on the data you need to track. Start by reviewing the default columns and removing or renaming those that aren’t relevant. For example, if you’re creating a receipt tracker, change the “Due Date” field to “Receipt Date” or “Payment Date” depending on your use case.

Adjusting Field Types

Switch between different field types for better organization. For instance, if you’re tracking amounts, use a “Currency” field instead of a plain text field. This ensures calculations and formatting are automatic and reduces errors. Similarly, the “Single Select” field works well for categorizing receipts, such as by “Payment Method” or “Category” (e.g., “Office Supplies,” “Travel,” etc.).

Setting Up Views

Customize views for easy navigation. Create separate views for “Pending Payments,” “Completed Receipts,” or “By Vendor.” This allows for better filtering and faster access to specific data. For each view, ensure the sorting and filtering criteria match your needs, such as by date, amount, or status.

Incorporating these customizations will make your Airtable template better aligned with your workflow, providing more structure and clarity without overwhelming you with unnecessary data.

To track receipts accurately in Airtable, structure your fields to capture all relevant data without overcomplicating the layout. First, include a field for Receipt ID, ensuring each entry has a unique identifier. This helps keep records distinct and searchable. Follow this with a Date field, formatted to reflect the date of the transaction. This will allow you to filter and sort receipts based on time.

Next, create a Vendor Name field, which will help link the receipt to the business or individual from whom the purchase was made. A Category field is also important for classifying receipts by expense type, whether it’s for office supplies, travel, or software. Use a single-select dropdown for consistency in categorization.

For financial tracking, a Amount field in currency format is necessary to capture the total cost. Pair this with a Tax field if you need to track taxes separately. Both should be numeric fields with formatting options to prevent data entry errors.

Consider adding an Attachment field for uploading scanned copies or photos of the receipts. This ensures all documentation is stored directly in Airtable, making it easier to reference in the future. Finally, a Notes field can provide additional context, such as payment methods or receipt discrepancies.

By structuring your Airtable base with these fields, you ensure accurate tracking, efficient sorting, and easy access to important financial records.

To efficiently manage payment and tax information within Airtable receipts, configure dedicated fields that track both payment methods and tax breakdowns. This allows for streamlined record-keeping and reporting. Start by adding fields for the payment type (e.g., credit card, cash, etc.), tax rates, and any adjustments or discounts applied during the transaction.

Payment Method Integration

For payment details, create a dropdown field for payment method selection. This can include predefined options such as “Credit Card,” “Bank Transfer,” or “Cash.” Additionally, use a formula field to calculate the total amount received after applying discounts or adjustments. This makes it easy to reconcile payments against receipts.

Tax Calculation and Breakdown

For tax details, add separate fields for tax rates and taxable amounts. Use Airtable’s formula feature to calculate the applicable tax based on the subtotal or product category. For example, a simple formula can multiply the subtotal by the tax rate to determine the tax amount, which can then be displayed in the receipt.

| Field Name | Description | Example Formula |

|---|---|---|

| Payment Method | Dropdown menu for payment options | N/A |

| Subtotal | Total amount before tax and discounts | N/A |

| Tax Rate | Percentage of tax to be applied | N/A |

| Tax Amount | Calculated tax based on subtotal and rate | Subtotal * Tax Rate |

| Total Amount | Final amount after tax and adjustments | Subtotal + Tax Amount – Discounts |

Once these fields are set up, your Airtable receipt template will automatically compute payment and tax information, providing clear and accurate records for each transaction. This integration simplifies financial tracking and ensures that tax calculations remain consistent across all receipts.

To create a seamless Airtable receipt template, structure your base with these key elements: date, item description, quantity, price per unit, and total cost. Include a formula field for automatic calculation of the total cost by multiplying quantity and price. Ensure all fields are clearly labeled and easily customizable based on your needs.

Use linked records to connect receipt data with customer information or specific projects. This enables dynamic updates and a cleaner workflow across different tables.

For accurate data entry, implement single select or multiple select fields for categories, payment methods, or item types. This prevents inconsistent entries and improves sorting capabilities within your base.

Incorporate conditional formatting or color-coding to visually distinguish different receipt statuses or payment stages, such as “Paid” or “Pending.” This makes it easier to track the progress of transactions at a glance.

Finally, take advantage of Airtable’s view options. Create filtered views to sort receipts by customer or date, ensuring you can quickly access relevant information without cluttering your workspace.