Using a well-structured cash receipt template can significantly streamline your accounting process. This simple document serves as a clear record of cash transactions, making it easier to track payments and manage your finances accurately.

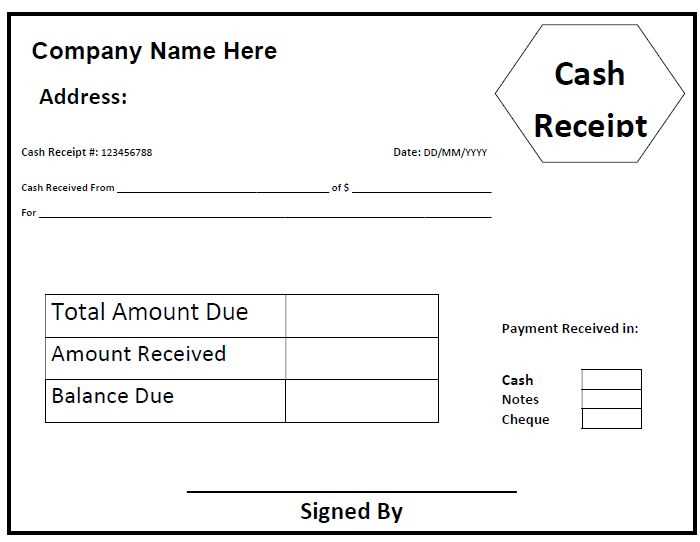

The template should include fields for the company name, date, amount received, payment method, and the name of the person making the payment. It’s also helpful to provide a receipt number to ensure each transaction can be uniquely identified for reference.

By customizing your template to match your company’s needs, you ensure that every receipt is consistent and professional. This will not only simplify your accounting but also build trust with your clients by providing them with clear, organized documentation of their payments.

Integrating a template into your workflow eliminates the need for creating receipts from scratch each time, saving valuable time while maintaining accuracy in financial reporting.

Company Cash Receipt Template

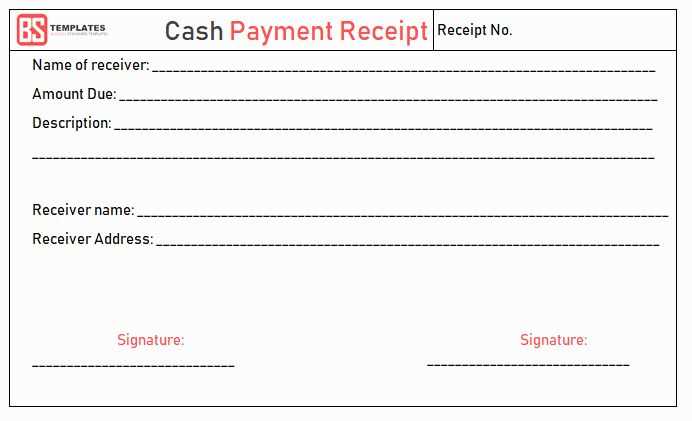

A company cash receipt template is a straightforward tool for recording cash transactions, providing clear documentation for both the payer and the business. This receipt should include the following key elements:

- Receipt Number: Assign a unique number to each receipt for easy tracking.

- Company Details: Include your company name, address, and contact information.

- Date of Payment: Clearly state the exact date of the cash transaction.

- Amount Received: Specify the exact cash amount, ensuring it matches the amount paid.

- Payment Purpose: Include a brief description of the reason for the payment (e.g., invoice number or service rendered).

- Signature: Have the recipient sign to acknowledge receipt of the cash payment.

It’s helpful to keep a record of these receipts in a secure, organized system to streamline financial tracking and audits. Make sure the receipt is printed or saved digitally for both the company and the customer.

How to Create a Simple Cash Receipt Template

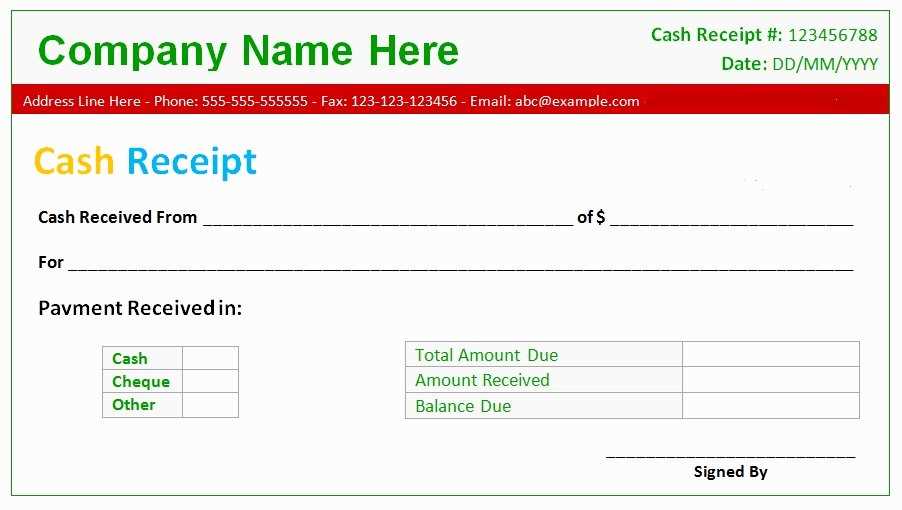

Begin with creating a header that clearly states “Cash Receipt” or “Receipt of Payment.” This helps the document remain professional and easy to identify. Below the title, include space for the company name, address, and contact details, making it easy for clients to reach out if necessary.

Next, set up a section for the receipt number. This ensures each receipt is uniquely identifiable for record-keeping. Keep a consistent numbering system for future reference.

Allocate space for the transaction date. The date should be placed near the top for easy access, as it is a critical reference point for both parties.

Add a section that includes the buyer’s name or company name and their contact information. This is important for identifying who made the payment and facilitates any follow-up if needed.

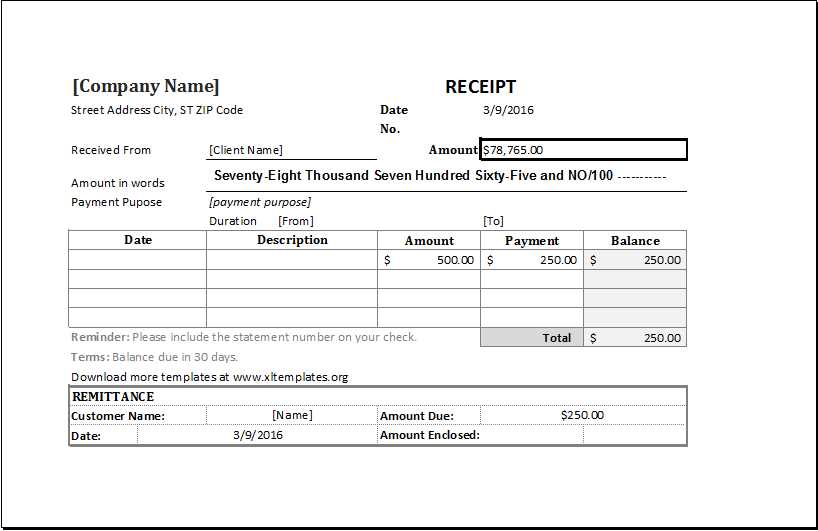

Now, create a table or a section where you list the products or services provided. Include columns for the description, quantity, price, and total for each item. This helps in breaking down the payment clearly and accurately.

Make sure to add a total amount due section, which sums up all the line items. This gives the customer a clear overview of the payment they’ve made.

Include payment details: specify the method of payment (cash, check, or card), as well as any relevant payment reference numbers if applicable.

Finally, leave space for both the company’s representative and the customer to sign. Signatures ensure the authenticity of the receipt and confirm that both parties agree to the transaction details.

Customizing Your Template for Different Transactions

To create a versatile cash receipt template, adjust the layout and fields based on the transaction type. For example, sales receipts require spaces for product descriptions, quantities, and unit prices. Include taxes, discounts, and total amounts clearly. For service transactions, focus on service descriptions, hours worked, and hourly rates. Ensure that payment methods (cash, credit, or check) are clearly indicated.

Adapting for Payments in Installments

If the payment is made in installments, include fields for tracking the payment schedule. Add dates, amounts, and remaining balances to ensure clear documentation of future payments. This will help both you and your client stay organized and avoid confusion.

Handling Refunds and Adjustments

For refunds, clearly mark the amount being refunded, the reason for the refund, and the original payment method. Adjust the total balance accordingly to reflect any changes. If applicable, provide space for transaction references to ensure accurate tracking and accountability.

Ensuring Compliance with Accounting Standards

Ensure your cash receipt template aligns with recognized accounting standards by incorporating clear transaction classifications and proper documentation. Apply the International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP) to ensure transparency and accuracy in financial records.

Maintain a consistent format for all receipts, specifying the date, amount, payment method, and purpose of each transaction. This reduces errors and increases consistency in your financial reporting. Accurate data entry helps avoid discrepancies in financial statements.

Integrate the template with your accounting software for automatic updates, minimizing human error. Audit trails within your software will enhance traceability of each transaction, ensuring compliance with audit standards and reducing the likelihood of financial misreporting.

Regularly review and update the template to accommodate changes in tax laws or accounting regulations. Stay informed about updates to standards such as the Financial Accounting Standards Board (FASB) guidelines to ensure that your records remain compliant and up-to-date.