Download a free donation receipt template that fits your needs. This ready-to-use format allows you to easily create receipts for donations made to your organization, saving you time while keeping your records organized. You can personalize the template to include your organization’s name, donation details, and the donor’s information in a clear and professional manner.

The template ensures compliance with tax regulations by providing the necessary details that a donor might need for tax deductions. It includes fields for the donation amount, date, and the type of donation–whether it’s monetary or in-kind. Additionally, you can add a thank you note to express appreciation for the donor’s contribution.

Once downloaded, the template can be customized to match your branding, making the process of issuing receipts seamless. Keep your records accurate and accessible with this simple yet powerful tool, available for free download now.

Here’s the corrected version with reduced repetitions:

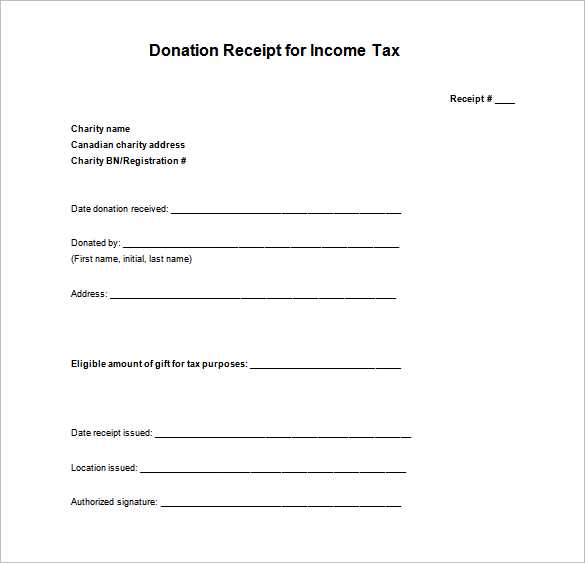

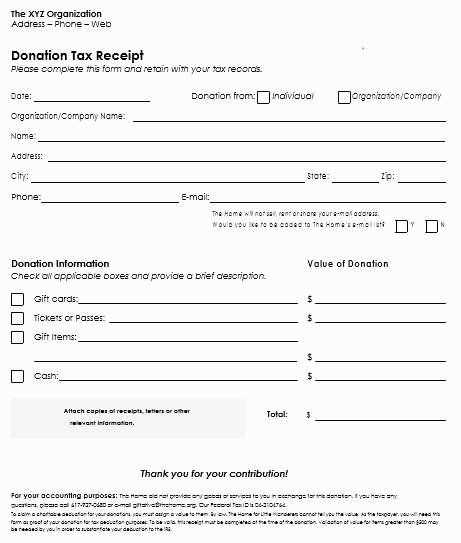

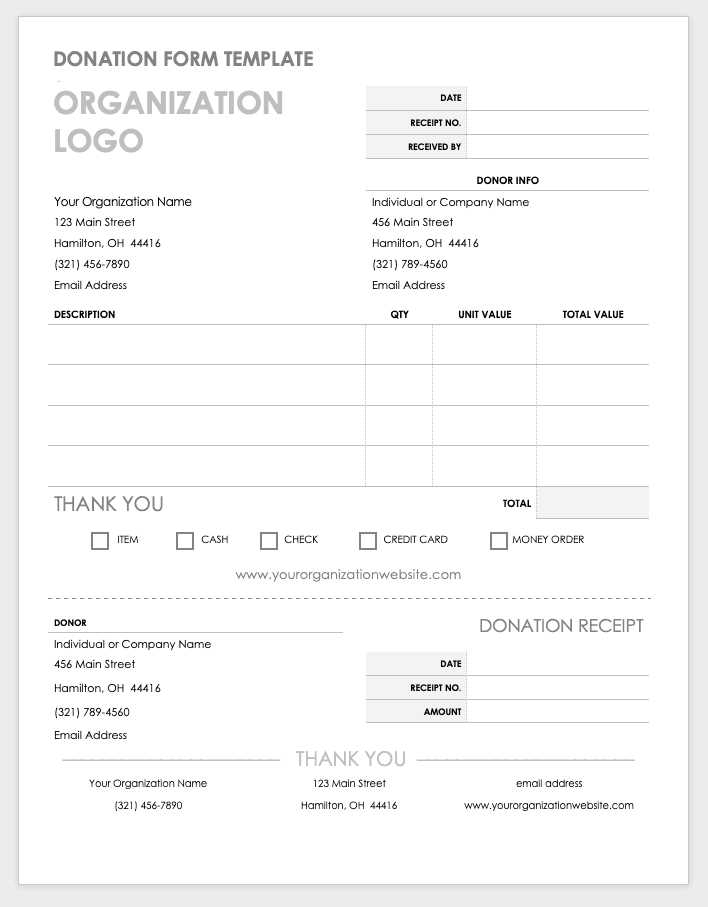

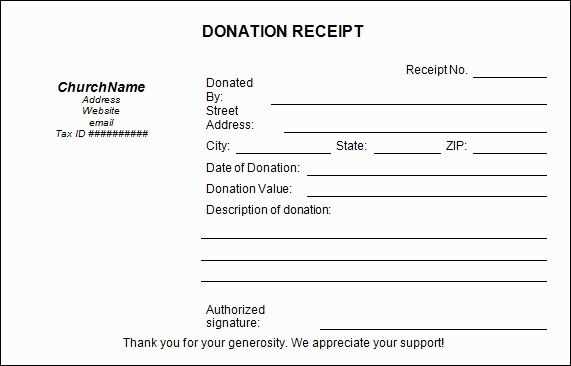

When downloading a donation receipt template for free, make sure it includes the necessary components. A complete receipt should clearly state the donor’s information, the donation amount, and the date of donation. The template should also feature a section for the organization’s name, address, and tax-exempt status. This ensures both the donor and the recipient organization stay compliant with tax regulations.

Key Components of a Donation Receipt

- Donor Information: Full name and address of the donor.

- Donation Details: Amount donated and the donation method (cash, check, etc.).

- Tax-Exempt Status: Include a statement confirming the organization’s tax-exempt status.

- Date: The date when the donation was made.

- Charity’s Contact Info: Ensure the organization’s contact information is listed for future reference.

Free Donation Receipt Templates

Many free templates are available online, allowing quick customization. Look for ones that are easily editable and provide clear, professional formatting. Some popular formats are Word and PDF, offering flexibility in printing and saving. Be sure to check if the template complies with the tax laws of your jurisdiction.

- Donation Receipt Template Free Download

If you need a donation receipt template, you’re in the right place. Downloading a free template can save you time and effort while ensuring accuracy. The receipt should include key details such as the donor’s name, donation amount, and date of donation. Additionally, make sure the template includes a statement about whether the donation is tax-deductible.

Choose a template that is clear and easy to customize. Look for one that allows you to add your organization’s logo, contact information, and a thank-you note. Some templates even allow you to add specific details about the donation, such as whether it was a cash gift or an in-kind contribution. This extra information can be useful for both your records and the donor’s tax filings.

When filling out the receipt, double-check the figures and donor’s details. Accuracy is critical, especially for tax purposes. Keep a record of all receipts issued, as they may be required for your nonprofit’s financial reporting or audits.

Pro tip: Consider using a template that is compatible with your existing accounting software. This can help streamline the process and reduce errors when entering donation data.

Tailor the donation acknowledgment template to reflect your nonprofit’s mission and brand. Adjust the language to align with the tone of your organization–whether it’s formal, casual, or somewhere in between. Ensure your template includes the donor’s full name, donation amount, and the date of the contribution. This creates a clear record for both you and your donor.

Add a personalized thank-you message that shows appreciation. Mention the specific impact their donation will have on your cause. For example, instead of a generic “Thank you for your donation,” use “Your $100 donation will provide five children with school supplies for a month.” This makes the acknowledgment feel more genuine and impactful.

Incorporate your nonprofit’s logo and brand colors into the template. This reinforces your identity and makes the acknowledgment more professional. Make sure the template has a clean, easy-to-read layout–use clear fonts and a well-organized structure that includes the donor’s information, the donation details, and your thank-you message.

For tax purposes, include the necessary legal language, such as a statement that no goods or services were exchanged in return for the donation, if applicable. This is important for the donor’s tax records. Ensure that the language is clear and concise to avoid any confusion.

If you’re managing recurring donations, customize the template to acknowledge the donor’s ongoing support. Include information on how their contributions will continue to support your work over time and highlight any special recognition they may receive for their commitment.

Make it easy to track donations. Include a unique identifier for each donor, such as a donor ID or transaction number. This helps you maintain accurate records for future reference and communications.

Finally, test your template to ensure it looks great on different devices and email platforms. A responsive design ensures the acknowledgment will display correctly regardless of how it’s accessed, whether on desktop, tablet, or mobile.

Charity organizations and donors both benefit from well-structured donation receipts. Here are some websites where you can download free templates tailored for donation receipts:

| Website | Template Type | Features |

|---|---|---|

| Template.net | Customizable | Wide variety of formats (Word, PDF), simple customization options |

| Smartsheet | Donation Acknowledgement | Pre-designed templates for receipts with all required tax information |

| SampleTemplates | Formal | Multiple templates available for free download, clear structure and details |

| WordTemplatesOnline | Word Document | Easy-to-edit Word templates, includes space for donor information and donation amount |

| Canva | Creative Designs | Highly customizable with design tools, suitable for non-profit branding |

These sites offer a wide range of formats, so you can select the one that best suits your needs. Whether you prefer a simple design or a more elaborate receipt, you’ll find templates that help streamline the process of acknowledging donations.

Donor Information: Include the donor’s full name, address, and contact information. Ensure the name is spelled correctly and format the address properly for future correspondence.

Donation Details: Clearly state the donation amount, whether it’s monetary or in-kind. If relevant, mention the purpose of the donation or any specific campaign the contribution supports.

Date of Donation: Specify the exact date the donation was made. This helps both the donor and your organization for record-keeping and tax purposes.

Tax Information: If applicable, provide any necessary tax deduction language. Mention the organization’s tax-exempt status and reference the relevant IRS section if the donation qualifies for tax deductions.

Thank You Message: Personalize the acknowledgment with a sincere thank-you message. Express genuine appreciation for the donor’s generosity, emphasizing the impact of their contribution.

Donor Recognition: If applicable, offer a brief mention of how the donation will be used or highlight how the donor’s support benefits the community or specific projects.

Organization’s Information: Include the organization’s legal name, address, website, and phone number. If necessary, provide a link to your privacy policy to reassure donors of data protection.

Signature: Add a space for a signature from a representative of the organization, such as the executive director or board chair. This adds a personal touch to the acknowledgment.

To create a donation receipt template that suits your needs, focus on including specific details like the donor’s name, donation amount, date, and any relevant tax-exempt status or IRS guidelines. Make sure to present this information in a clear and professional format to ensure it meets legal and record-keeping requirements.

Key Sections of a Donation Receipt Template

- Donor’s full name and contact information

- Donation amount or description of in-kind gifts

- Date of donation

- Nonprofit organization’s name, address, and tax-exempt number

- Statement of whether any goods or services were provided in exchange

- Signature of an authorized representative (optional)

When selecting a free template, ensure it includes all necessary legal information and meets the required standards for tax purposes. You can download these templates from various reputable sources online. Adjust the format as needed to match your organization’s branding or layout preferences.