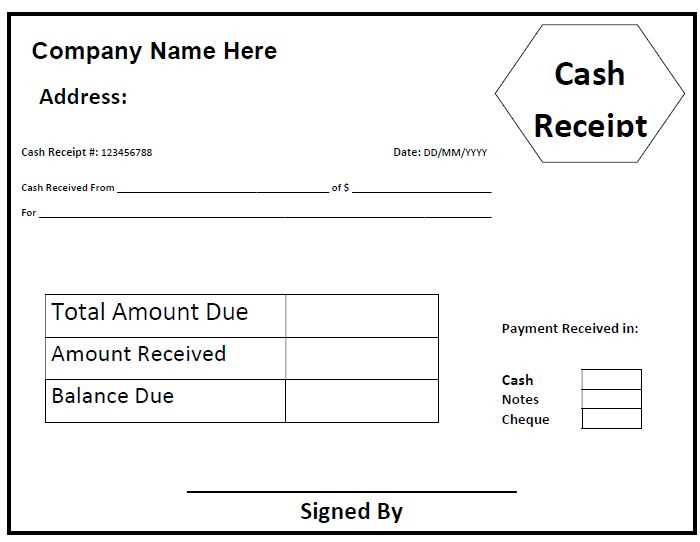

Using a clear and straightforward template for payment receipts can simplify the transaction process for both parties involved. A well-structured receipt includes key details that confirm payment and serve as an official record for future reference. Make sure your template has sections for the date, payment method, total amount paid, and both buyer and seller information.

Ensure you include a unique receipt number for easy tracking. This will help avoid confusion and maintain organization. For example, incorporating a sequential numbering system can make referencing past transactions much simpler.

Customize your template for various payment methods–whether it’s cash, credit card, or bank transfer. This will provide a clear record that reflects the method used and help both parties stay organized. Additionally, including any applicable taxes or discounts is a good practice for maintaining transparency in your transaction records.

Here’s the corrected version, based on your request:

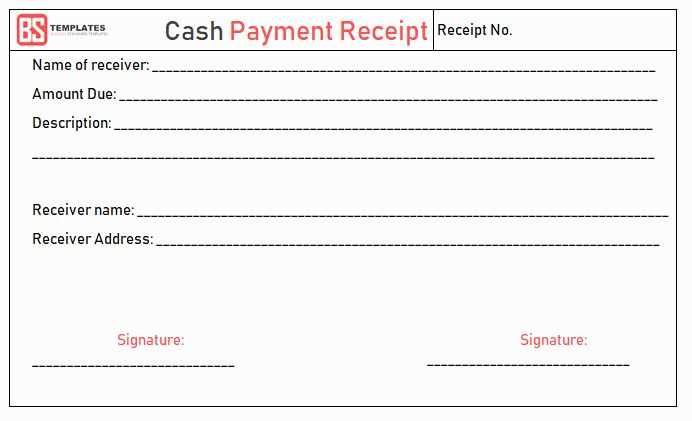

To create a clear and professional receipt payment template, include the following key sections: the date of payment, the amount paid, the payment method, and a brief description of the goods or services provided. Begin with the business name and contact information at the top for easy reference.

Specify the payment details, including the payment method (e.g., credit card, bank transfer, cash) and any relevant transaction number or reference code. Include a breakdown if necessary, such as taxes or discounts, to avoid confusion.

End the receipt with a statement confirming the payment has been received, along with a thank you message or an invitation to contact for further inquiries. A well-structured receipt provides clarity and reinforces trust with your customers.

- Receipt Payment Document Template

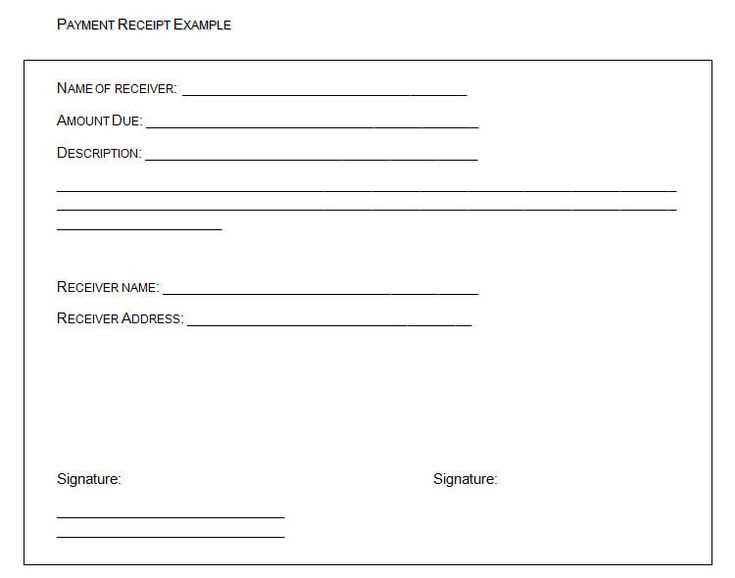

Use this template to create a clear and organized receipt for payment transactions. The key components should include:

- Date of Payment: Specify the exact date the payment was made.

- Receipt Number: Assign a unique number to each receipt for record-keeping and future reference.

- Payment Amount: Clearly list the total amount paid, including any applicable taxes or fees.

- Payment Method: Indicate whether the payment was made via credit card, cash, bank transfer, etc.

- Payee Information: Include the name and contact details of the recipient of the payment.

- Payer Information: Include the name and contact details of the person or entity making the payment.

- Description of Goods/Services: Provide a brief description of what the payment is for.

- Signature: If required, include a space for the signature of both the payer and payee to confirm the transaction.

Ensure all information is accurate and up-to-date to avoid confusion or disputes. Keep a copy for your records and provide a copy to the payer. Adjust the layout and fields based on your specific needs.

Customizing your payment receipt gives it a professional touch and reinforces your brand identity. Begin by incorporating your business logo and contact details at the top of the receipt. This helps clients easily recognize your company and contact you if needed.

Include Essential Payment Information

Ensure that the receipt includes all necessary transaction details. This should cover the date, the amount paid, the method of payment (cash, credit card, etc.), and a unique receipt number. Also, include the name of the goods or services provided, and specify the taxes or discounts applied, if any.

Personalize the Language and Format

Adjust the wording on your receipts to reflect your business style. You can create a friendly, formal, or more creative tone, depending on your brand. Organize the information logically, grouping related details like item description and cost. A well-organized format enhances readability and client satisfaction.

Finally, make sure that your receipt is compatible with your accounting system, ensuring smooth record-keeping and easy reconciliation of payments.

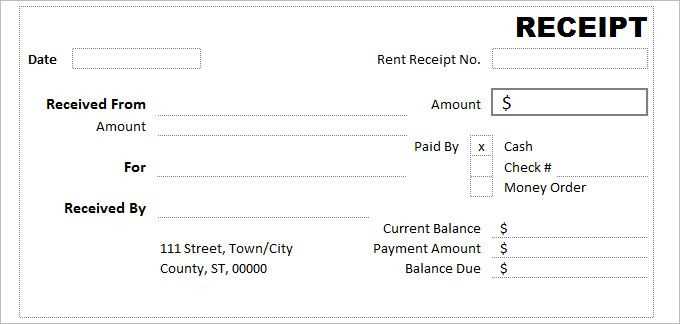

Always include the transaction date. This allows both parties to easily reference when the payment was made. The payer’s and payee’s details are crucial for clarity. Include full names, addresses, and contact information where possible. This ensures both sides can easily follow up if necessary.

The amount paid is one of the most critical details. Make sure it’s written in both numeric and word form for accuracy. If applicable, include any taxes or fees that are part of the payment, so there is no confusion over the final amount.

A unique reference number can help track the transaction, especially for larger businesses with frequent payments. Clearly state the method of payment–whether it was cash, check, or card–to avoid any misunderstandings. If a check was used, including the check number is also helpful.

| Information | Details |

|---|---|

| Transaction Date | Exact date the payment was made |

| Payer’s Information | Name, address, and contact |

| Amount Paid | Both numeric and written |

| Payment Method | Cash, card, or check (with check number) |

| Reference Number | Unique identifier for tracking |

If there are any discounts, refunds, or credits applied, make sure to clearly state those as well. Finally, a signature or an electronic confirmation can serve as proof that both parties agreed to the terms outlined in the document.

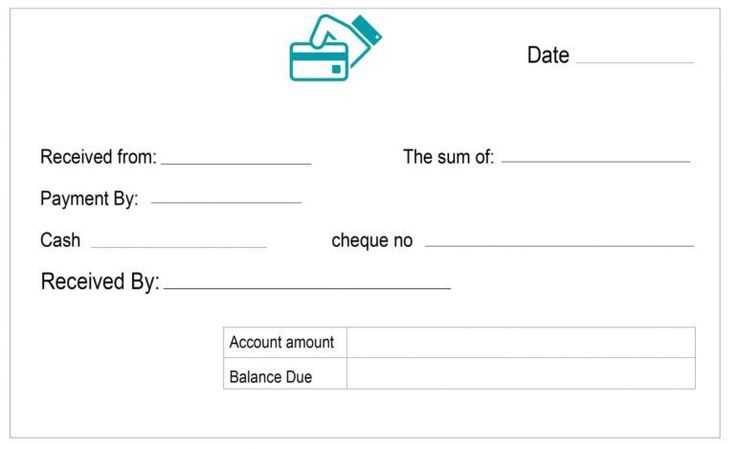

Ensure accuracy in the payment amount. A common mistake is entering the wrong amount, either due to typographical errors or misunderstandings. Double-check the numbers to avoid confusion and potential disputes.

Include all relevant payment details. Missing information like the payment method or transaction ID can cause confusion. Clearly state how the payment was made, whether it was by cash, card, or another method, along with any reference or invoice numbers.

Use clear and readable formatting. Avoid cluttered or hard-to-read receipts. Make sure the text is legible and properly aligned. Important details should stand out, making it easy for the recipient to find key information at a glance.

Do not forget to include the date and time. Omitting this can lead to problems when tracking transactions. Always ensure the payment date is clearly visible on the receipt.

Be careful with tax details. Incorrect or missing tax information can lead to misunderstandings or legal issues. Ensure tax rates are correctly calculated and displayed, along with any applicable discounts or additional fees.

Provide complete contact information. Including your business name, address, and contact details helps the recipient reach out if there are any issues. This builds trust and ensures transparency in your transactions.

Receipt Payment Receipt Template

To create a clear and functional receipt payment template, focus on these key elements: the payer’s details, payment amount, and transaction date. Organize the information logically, using sections that separate payment data, items or services purchased, and any relevant terms. Ensure that each section is labeled correctly for easy identification. Use bold or italic styles sparingly to highlight important information such as the total amount paid or special instructions.

Key Elements to Include

Start with the payer’s name and contact information, followed by the method of payment. This could be cash, credit card, or another option. Indicate the amount paid and include any applicable taxes. Next, break down the purchased items or services, listing their cost and description. At the bottom, leave space for any additional notes or instructions regarding the transaction.

Formatting Tips

Make sure the receipt is easy to read. Use a clean font, and keep margins consistent throughout the document. If the receipt is printed, consider using a simple layout that fits on standard paper sizes. Ensure the template is adjustable, so you can modify it as needed for different transactions.